Ecommerce sales tepid; upstarts seek to disrupt Ola, Uber

Also in this letter:

■ New mobility companies seek to disrupt Ola, Uber

■ Infosys Q1 results: profit up 3.2% YoY to Rs 5,360 crore

■ Demand for techies with metarverse skills on the rise

Ecommerce sales tepid as consumption growth slows

After experiencing several highs and lows since the start of the pandemic, ecommerce companies are seeing consumption growth moderating across categories, especially segments considered to be discretionary, senior executives and analysts told us.

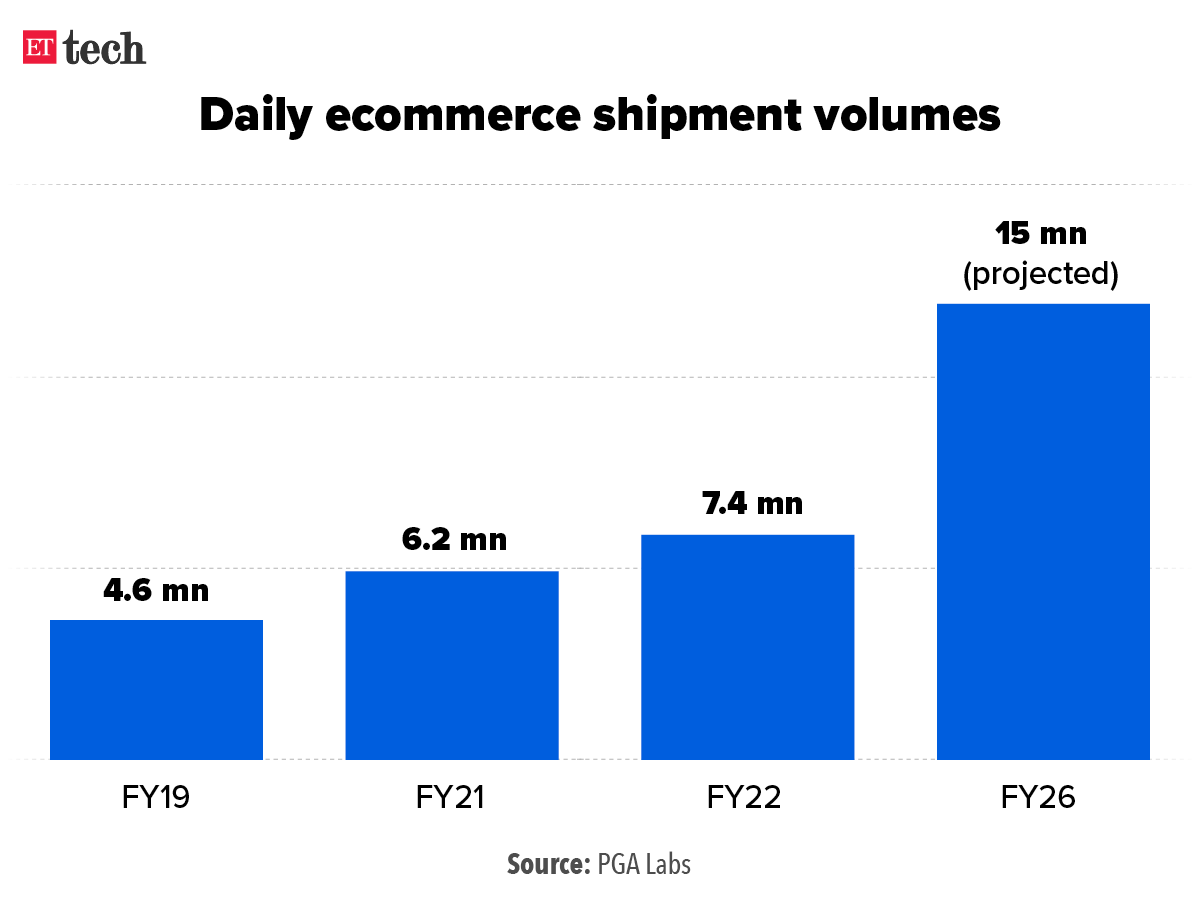

By the numbers: According to estimates from data platform PGA Labs, ecommerce daily shipments are expected to grow 20% in the ongoing financial year – slower than in the past two years, when they recorded at least 25-30% annual growth thanks to virus-induced lockdowns.

According to sellers, ecommerce and logistics executives, the ongoing Prime Day sale event on Amazon India and similar sales on Flipkart haven’t seen a significant uptick over last year even though discounts are higher than on non-sale days this year.

These trends are emerging at a time when large fast-moving consumer goods (FMCG) companies have expressed concern over falling volumes. Last week, Hindustan Unilever Ltd (HUL) managing director Sanjiv Mehta told us the company has seen volumes decline, and that inflation has worsened the issue.

The founder of a leading electronics accessories brands said while preparations for festive sales have started, the outlook for growth is muted compared to last year. Mobile phones, which comprise a large part of sales for ecommerce companies, have been affected the most, dragging overall growth down, said a top executive at an online retail firm.

Slow on financing? Ecommerce firms, over the years, have focused on offering financing options for large purchases, especially high-end smartphones and large appliances.

But as we previously reported, card-based fintech firms have run into rough weather after the Reserve Bank of India barred non-banks from loading credit lines onto online wallets and other prepaid payment instruments in June. Card-based fintech Slide recently changed its business model because of the new rule.

New mobility companies seek to disrupt Ola, Uber

India’s two dominant ride hailing platforms – Ola and Uber – are facing competition from several upstarts, category-specific business models, and traditional players looking to break their duopoly.

In with the new: Ride hailing in the days before the pandemic, especially in cabs, was ruled by Ola and Uber, but as the economy opened up, a bunch of companies feel the sector is ripe for disruption.

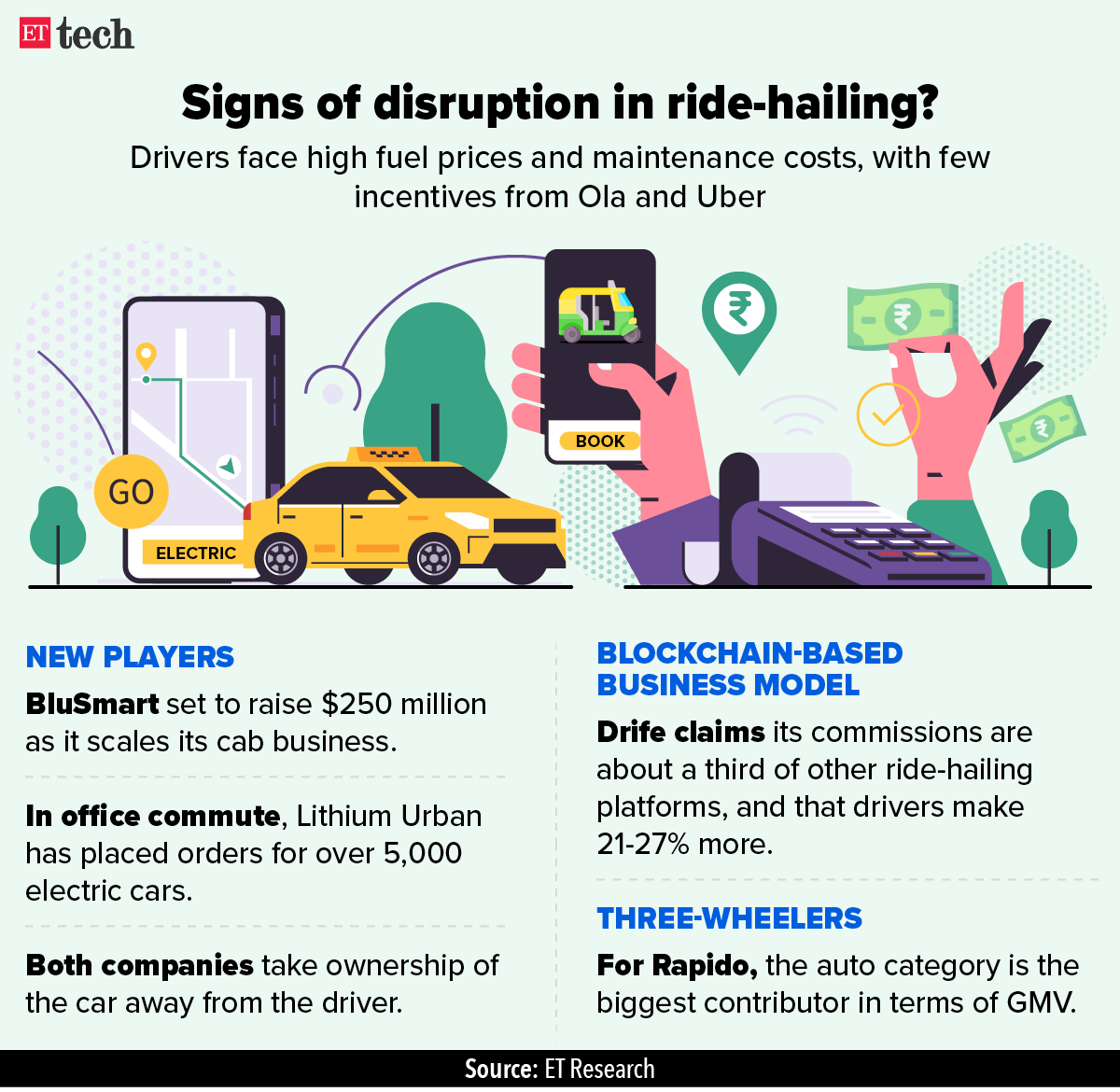

BluSmart, a Bengaluru-based all-electric cab company, is close to raising $250 million from investors including BP’s venture capital division, according to people in the know. Cofounder Tushar Garg told ET that it has 1,800 cabs running in Delhi-NCR and is adding 500-700 cabs every month.

Blockchain-based mobility startup Drife said on instant messaging Telegram that it had deployed about 10,000 cabs in Bengaluru as part of a pilot. The platform allows users to determine their own fares and drivers to receive payouts daily.

Rapido cofounder Aravind Sanka told us that after launching its auto rickshaw service during the pandemic, it has equaled Uber’s market share in Bengaluru and Hyderabad.

Disruptors disrupted: According to Tanveer Pasha, president of Ola-Uber cab drivers’ association, there are about 45,000 Ola and Uber drivers in the city, down from over 100,000 pre-pandemic.

We reported on May 22 that drivers were logging out of Ola and Uber over rising fuel prices and low incentives. Those drivers that managed to survive were faced with higher fuel prices, maintenance costs, fewer riders and no option for shared riders.

Many of the new players are trying to solve these very problems.

Infosys Q1 results: profit up 3.2% YoY to Rs 5,360 crore

Infosys on Sunday reported a consolidated net profit of Rs 5,360 crore for the first quarter, which ended June 2022, up 3.2% year-on-year from Rs 5,195 crore in the same quarter last year. Sequentially, profit fell 5.7% in the first quarter from Rs 5,686 crore in the fourth quarter of FY22.

The company’s revenue jumped 23.6% to Rs 34,470 crore from Rs 27,896 crore in the June 2021 quarter. Sequentially, revenue rose 6.8% from Rs 32,276 crore in the previous quarter.

Total operating expenses in April-June 2022 increased 14.4% to Rs 3,187 crore from Rs 2,787 crore a year ago.

Infosys CEO and MD Salil Parekh said in a statement, “Our strong overall performance in Q1 amidst an uncertain economic environment is a testament to our innate resilience as an organisation, our industry-leading digital capabilities and continued client-relevance. We continue to gain market share and see a significant pipeline driven by our Cobalt cloud capabilities and differentiated digital value proposition.”

Demand for techies with metarverse skills on the rise

Demand is on the up for tech professionals with niche skills who can help IT services companies and metaverse startups expand their practice in the nascent sector.

There were an estimated 55,000 job openings related to the metaverse ecosystem at the beginning of this month in India, according to specialist staffing firm Xpheno.

These were across functions like AI/ML programming, AR/VR, gaming, UI/UX, blockchain and crypto, and security skill sets.

Most services companies are in the process of building out a metaverse practice to develop solutions for customers.

Aan Chauhan, chief technology officer of mid-tier IT services company Mindtree, said it was investing in metaverse solutions and capabilities, hiring for skills across the platform ecosystem.

These include designers, 3D artists, blockchain specialists, channel, game and voice-based cognitive developers, and solution, integration, data, AI, IoT and geospatial architects.

Xponentia raises Rs 365 crore towards first close of second fund

Homegrown mid-market-focused private equity fund Xponentia Capital Partners has raised Rs 365 crore towards the first close of its second fund, Xponentia Opportunities Fund 2.

The PE firm is looking to mop up Rs 750 crore towards the final close of the fund.

The capital has come from Indian corporates, family offices and High Net-worth Individuals with most investors in its first fund doubling down. The fund is expected to achieve a final close before December.

Founded by PR Srinivasan and Devinjit Singh, Xponentia raised its first fund of Rs 351 crore in 2019. Along with its Limited Partners, or sponsors, who co-invested in deals, the firm has invested a total of Rs 450 crore from its first fund.

Its portfolio includes Flight Simulation Technique Centre or FSTC, Barbeque Nation, R4Rabbit, Easy Home Finance, Medsource and Altigreen.

Other Top Stories By Our Reporters

■ Swiggy workers call off strike:

Delivery workers with Swiggy went on strike on July 21 across Bengaluru to protest poor pay, reduced incentives, and safety concerns, the Indian Federation of App-based Transport Workers (IFAT) said. The strike, in which about 3,000 workers participated, was called off on Sunday afternoon after Swiggy sought a week to address the workers’ grievances, an IFAT spokesperson said.■ No margin for error for Indian IT firms: Indian IT service providers seem to be checking all the right boxes, except one. Revenue growth, new client wins, fresher intake, headcount additions, share of Digital in deals – they are scoring big on all these – but one factor is playing spoilsport — operating margin.

■ Apple’s M1 chip is iconic, says iPod designer: Tony Fadell, who designed Apple’s iconic IPod in the early 2000s, told ET in an interview that Apple’s “ground-breaking release” of the M1 processor last year was an inflection point equivalent to previous iPod and iPhone releases.

Global Picks We Are Reading

■ Tesla looks to open Its EV-charging network (WSJ)

■ How China threatens to splinter the metaverse (Wired)

■ For creators, community is the new follower count (The Washington Post)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.