“Doesn’t make sense”: SSE slam Government’s lack of incentives for renewable energy

SSE has urged the Government to include investment incentives in the new levy on electricity generators to avoid deterring investment in renewable energy.

The renewable energy specialist told City A.M. it was important Downing Street addressed the disparity between the investment climate for North Sea oil and gas producers and operators of renewable electricity across the UK.

This was especially aggravating due to the UK’s continued shift to renewable energy and ambitious plans to boost domestic energy generation following Russia’s invasion of Ukraine.

A spokesperson said: “Investing in low carbon infrastructure is crucial to building a cheaper, cleaner and more secure homegrown energy system here in the UK. The fact that oil and gas companies have incentives that are not available to renewable producers simply doesn’t make sense.

“We all know the way to solve the energy crisis is to encourage investment in low carbon energy sources and the electricity infrastructure that supports them.”

The energy firm has welcomed the latest report from Westminster body the Environmental Audit Committee, has also backed the idea of a low-carbon investment allowance to work alongside the levy.

In its report round-up, the committee said: “We recommend that the Treasury examine how a low-carbon investment allowance could be introduced for electricity producers paying the new temporary tax of 45 per cent, similar to the one that applies to oil and gas producers.”

Producers of renewables grapple with new levy

At the fiscal event in November, the Chancellor Jeremy Hunt unveiled the Electricity Generator Levy is a temporary 45 per cent tax on extraordinary returns made by older UK electricity generators from January 2023.

It is expected to raise £14bn over the six year duration of the levy.

The tax will not apply to newer renewable generation supported through the Government’s contracts for difference scheme.

However, legacy generators on current renewable obligation contracts resemble 40 per cent of the market.

To the consternation of renewable and nuclear producers, it does not include the 91p in the pound investment relief included in the Energy Profits Levy for North Sea oil and gas producers.

Following the levy, Keith Anderson, chief executive of Scottish Power, warned the new Electricity Generator Levy will create a “five-year long corridor of uncertainty for investors” which risks undermining the UK’s green ambitions.

| Energy Source | Generation Capacity | Generation Target | Date |

| Offshore Wind | 11 GW | 50GW | 2030 |

| Solar | 14GW | 70GW | 2035 |

| Nuclear | 7GW | 24GW | 2050 |

| Hydrogen | <1GW | 10GW | 2030 |

He told City A.M. in November: “In times of national crisis everyone should be playing their part. I’m deeply disappointed that renewables have been singled out – it seems it’s a recession made by gas, but a recovery to be paid for by renewables.”

The energy boss feared the new tax risked hampering clean energy projects that were essential for reducing the country’s “gas dependency” and for reaching its net zero ambitions.

Anderson also raised concerns over the continued investment relief in the Energy Profits Levy for oil and gas companies, with no equivalent support for green energy projects.

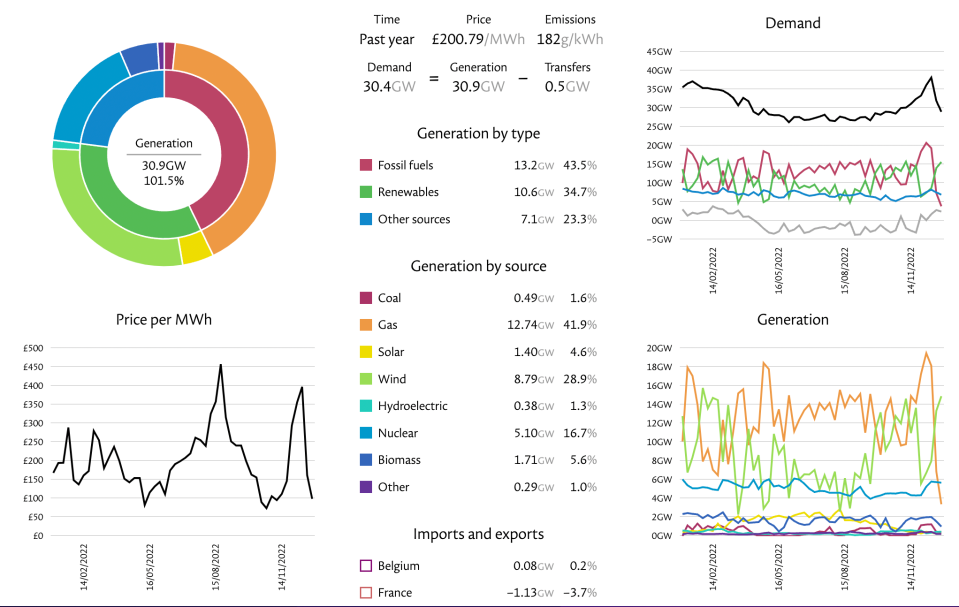

The UK is targeting a vast ramp up in renewables following Russia’s invasion of Ukraine, including boosting offshore wind from 11GW to 50GW by the end of the decade, alongside targets to push solar power from 14GW to 70GW and to generate 10GW of hydrogen.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.