Digital rupee must be anonymous: Nilekani; why Polygon tapped top investors

Also in this letter:

- Why Polygon tapped 40 marquee investors

- FRL asked lenders to take over sale of small stores

- Sachin Bansal’s Navi plans IPO by year-end

Digital rupee should be anonymous to prevent surveillance, says Nilekani

Infosys cofounder and chairman Nandan Nilekani.

India’s proposed digital rupee should be “anonymous” as concerns about surveillance will arise if all payment transactions are recorded and are visible, Infosys cofounder Nandan Nilekani told us.

Significance: The rapid digitalisation of economies worldwide is throwing up major challenges as countries seek to balance the need for regulations with people’s privacy.

What he said: The country will notch up a global first with the launch of its central bank digital currency (CBDC), and existing infrastructure such the Unified Payments Interface and Aadhaar will accelerate its launch, said the 66-year old technocrat.

In her budget speech last week, finance minister Nirmala Sitharaman also proposed that income from virtual digital assets be taxed at 30% from April 1.

Nilekani believes that India is “doing the right things” by “recognising the concept of digital assets” and taxing them at 30%. In a way, India has also recognised that crypto assets are not currencies, he added. “I think the digital rupee should be anonymous because one of the concerns obviously is that if all payment transactions are recorded and visible, it has other issues [such as] surveillance,” Nilekani said.

Stoking innovation: Nilekani, who has championed the creation of several open technology networks that startups and technology firms leverage for innovation, said the digital rupee architecture will lead to similar innovation at the front end.

“It will be very easy to take the digital rupee to consumers who have a UPI application since it will facilitate easy transactions in digital rupees or help convert digital rupees to regular rupees,” he added.

Infosys going strong: Nilekani said with Infosys growing at “market-leading rates” of late, its status as the bellwether of the industry has been restored. Last month, Infosys increased its yearly revenue forecast by 3% and said that its revenue would grow by 19.5-20% in the ongoing fiscal, which ends in March.

Polygon tapped Tiger, SoftBank for ‘institutional legitimacy, firepower’

Polygon founders (from left) Anurag Arjun, Jaynti Kanani and Sandeep Nailwal.

There were two key reasons why Sandeep Nailwal and Polygon’s other cofounders decided to raise $450 million from 40 marquee investors, including Tiger Global and SoftBank Vision Fund II and Sequoia Capital India, by selling them $450 million worth of Polygon’s native token — institutional legitimacy and firepower.

What’s Polygon? Polygon is a secondary scaling solution for the Ethereum blockchain, which has high transaction fees. In just five years, Polygon’s native token, called Matic, has achieved a market capitalisation of nearly $20 billion on a fully diluted basis (that is, if all of its 10 billion tokens were in circulation) according to Coinmarketcap.com.

Tough decision: In an exclusive interview with ET, Nailwal said he contemplated whether or not to accept institutional funding for six months. After all, Polygon’s treasury—funds allocated to grow its ecosystem, which its founders control—prior to the round held almost 20-25% of the total token supply, amounting to roughly $4-5 billion.

But in the past three months, Nailwal changed his mind as he sought to grow the company from a daily transaction volume of four million to 100 million in the next 18 months.

Deal details: The company sold its native token at a 40% discount to the average market price, which is currently about $2. The investors have a three-year lock-in, and 33% of their tokens will vest every year.

Significance: Startups in the Web3 space usually prefer to raise funds from crypto-native VCs as they can also provide technical knowledge and infrastructure. This round signals the growing appetite among traditional funds to invest in crypto and blockchain startups, even if it means accepting non-traditional ways of investing in them.

Tweet of the day

FRL asked lenders to take over sale of small-format stores

Even as Future Retail (FRL) scrambles to service its debt, it has emerged that the company itself had asked its lender consortium, led by Bank of India, to take over the mandate of selling its small-format stores for about Rs 3,500 crore. The move had surprised the lenders as it was communicated on December 31, the last day for FRL to pay the Rs 3,500 crore it owed them by selling its 900 small-format stores.

Details: According to minutes of meetings between the lenders and FRL, which ET has reviewed, the lender consortium had first expressed displeasure and were surprised with FRL informing them at the last minute that it was unable to sell the stores.

The minutes of the December 15 meeting showed the lenders were in favour of such a sale and were following up with FRL on its status. The lenders expressed their disappointment at the meeting as the company had previously told them that the process of selling the stores was underway and would be completed by December 31, 2021. “But now the company’s statement that they will not be able to sell on time has come as a surprise to the lenders,” the minutes read.

Following this, it was FRL that, in a note to lenders, suggested on December 31 that they take over the process of selling the stores, saying FRL would offer its “support”.

We reported last month that the lenders were likely to seek buyers for the small-format stores to recover the dues.

Battle for Indian retail: FRL and Amazon have been battling in courts over FRL’s Rs 25,000-crore deal with Reliance Retail, announced in August 2020. Amazon has long argued that Future violated the terms of their 2019 deal in deciding to sell retail assets to Reliance.

We reported last week that lenders told the Supreme Court that both Amazon and Reliance Retail should be allowed to bid for FRL’s assets. Meanwhile, Delhi High Court is expected to hear a set of cases between Amazon and FRL related to the Reliance Retail deal on Friday.

Sachin Bansal’s Navi Technologies plans IPO by year-end

Navi founder Sachin Bansal.

Sachin Bansal’s financial services company Navi Technologies is gearing up to list on the Indian exchanges, having converted itself into a public company, according to regulatory filings shared by business intelligence platform Tofler.

According to the filings, the board approved the change on February 2. “The authorised share capital of the company is Rs 75,00,00,00,000 divided into Rs 75,00,00,000 equity shares of Rs 100 each,” read the company’s updated filings.

Key developments:

- Navi Technologies now has appointed bankers—including ICICI Securities, BofA Securities and Axis Capital—to help float its IPO, sources said.

- While it is still in discussions on the final IPO size, the company may look to file its draft IPO near the end of this fiscal, sources said.

Quote: “The company is gearing up for a public listing by the end of 2022. The profit and scale the company has achieved in a short time has given it the necessary confidence to go ahead with a listing,” said sources.

Navi Technologies declined to comment on ET’s queries in the matter.

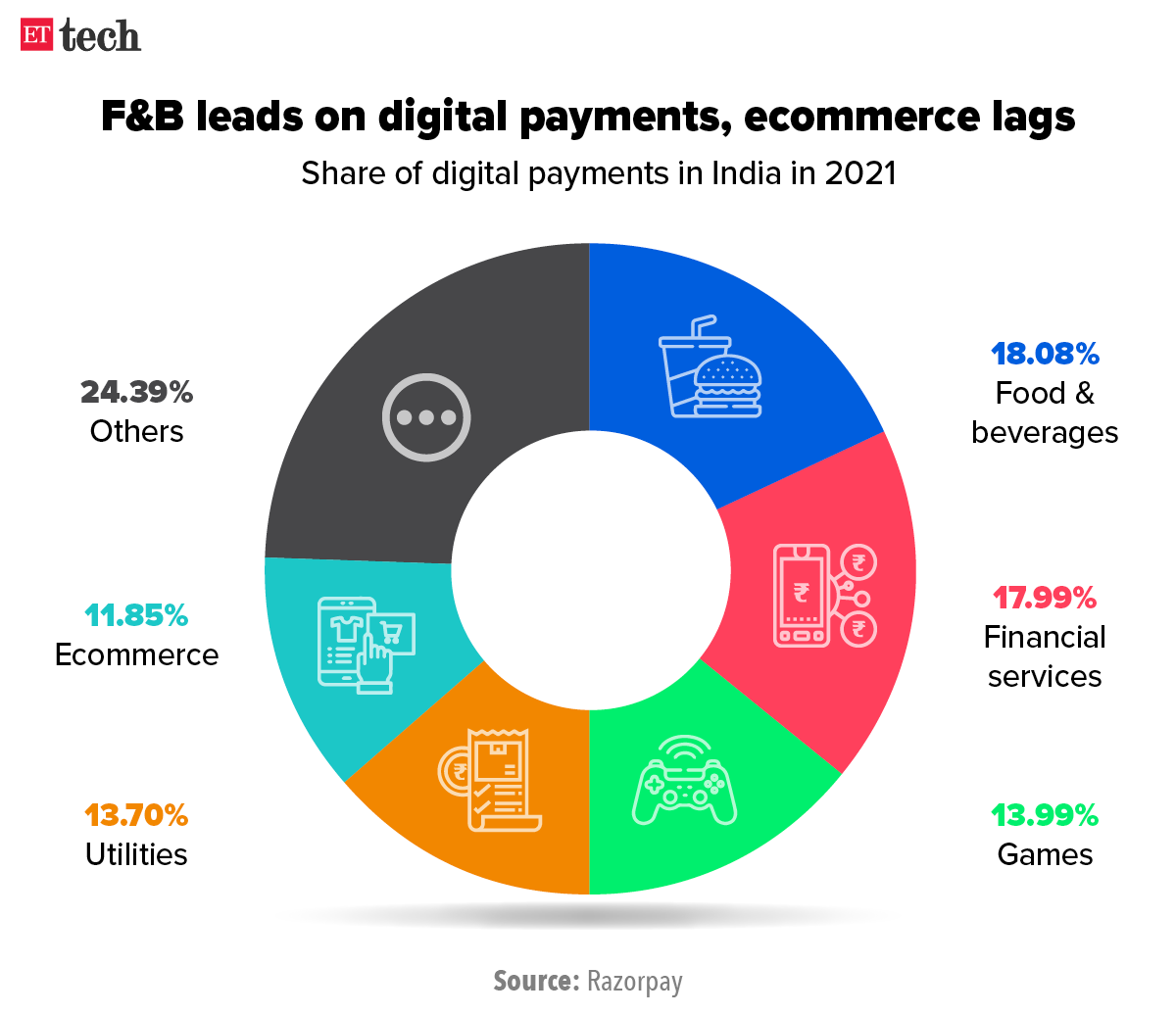

INFOGRAPHIC INSIGHT

Investor’s lawyer joins BharatPe board

John Weinstein, deputy general counsel at US-based venture capital firm Insight Partners, has joined the board of Resilient Innovations, which is doing business as BharatPe, amid controversies linked to its cofounder and managing director Ashneer Grover.

- Weinstein joined the board as an additional director on February 1, according to regulatory filings sourced from Tofler.

- Insight Partners, which first invested in BharatPe in 2019, holds close to 10% stake in the Delhi-based fintech startup.

Weinstein’s appointment comes at a time when the company seems to be distancing itself from Grover amid allegations of fraud and when the cofounder has held preliminary talks to sell his 9.5% stake in the firm, as ET reported on Tuesday.

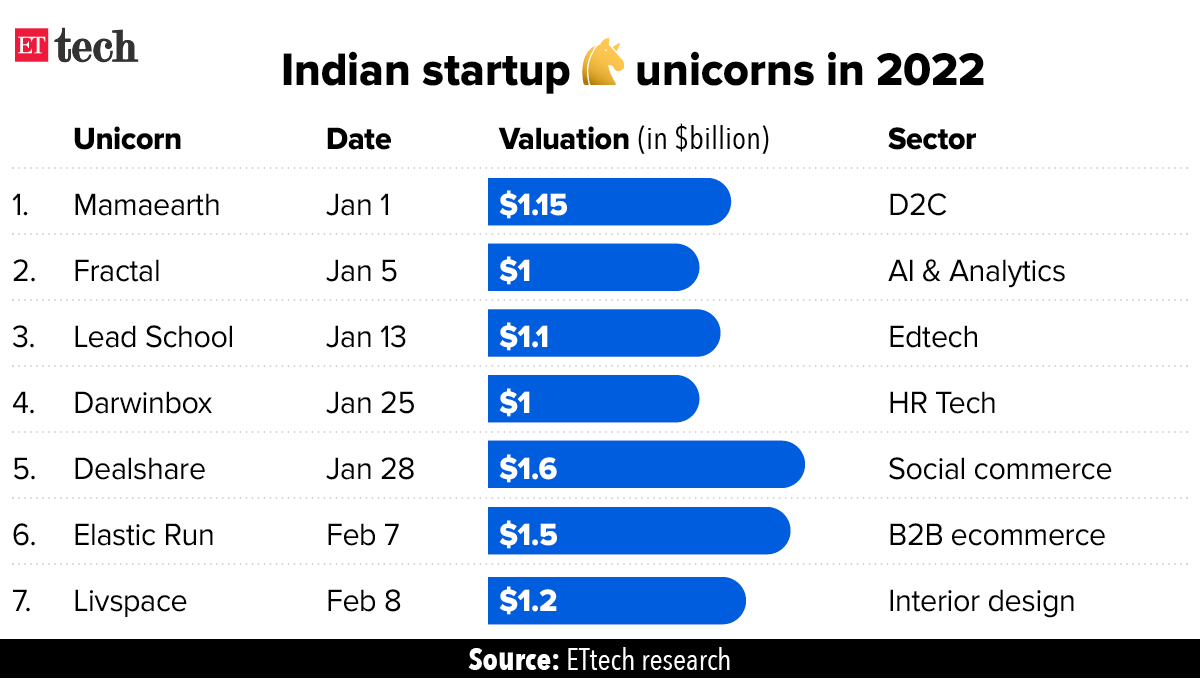

Livspace turns unicorn after $180-million funding round

Livspace crossed a valuation of $1 billion after raising $180 million in a late-stage funding round led by KKR & Co.

Seventh heaven: The home renovation platform is the 86th Indian startup unicorn, according to Venture Intelligence Unicorn Tracker.

It is also the seventh startup of 2022, and the second in two days. We reported yesterday that ElasticRun, a kirana-focused business-to-business ecommerce firm, had joined the club after raising $300 million in a round led by SoftBank Vision Fund II. A record-breaking 2021 saw 43 new firms join the club.

Swedish retailer Ikea, and other early backers Jungle Ventures, Venturi Partners and Peugeot Investments, also participated in the fundraising.

The deal is the latest in a series of investments in the consumer internet space for private equity firm KKR & Co., which has previously bet on Indian eyewear retailer Lenskart, China’s digitised dairy startup Adopt A Cow, and small enterprises-focused platforms GrowSari and KiotViet in South East Asia.

In other deals news,

- Pine Labs, a digital payments and financial services provider has agreed to acquire Mumbai-based online payments startup Qfix Infocomm for an undisclosed amount.

- Mintifi, a digital lending platform for distributors and retailers, has raised $40 million in a fresh funding round led by Norwest Venture Partners and Elevation Capital.

- Bugworks Research, a clinical stage multi-indication therapeutics firm, has raised $18 million to support the development of a novel broad spectrum antibiotic.

- Virtual events platform Airmeet has raised $35 million in a Series B funding round led by Prosus Ventures and Sistema Asia Fund.

- Mangopoint, a company that focuses on preserving and promoting high-quality mangoes and mango products from India, has raised Rs 1.82 crore in a funding round led by The Chennai Angels.

Other Top Stories By Our Reporters

Razorpay founders Harshil Mathur (left) and Shashank Kumar.

Razorpay makes international foray with Curlec deal: With the acquisition, Razorpay is looking to expand its core payments services to Southeast Asian customers and launch recurring payments in new geographies. (read more)

Mindtree expects digital to drive growth in FY23: The mid-tier IT firm reported a growth of more than 40% in its top 20 clients in the past year, and CEO Debashis Chatterjee sees potential to extend this strategy to the next set of 20 clients. (read more)

Oversight Board wants Meta Platforms to look into ‘doxing’ issues: The Oversight Board, an independent body dealing with content moderation issues on Facebook and Instagram, is calling on Meta Platforms to review its policies on how Facebook and Instagram govern the sharing of people’s private residential information. (read more)

Global Picks We Are Reading

- Ferrari partners with Qualcomm to upgrade car dashboards (Bloomberg)

- SoftBank returns to profitability, barely (NYT)

- In India, online groceries come with a human cost (The Verge)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.