Difficult decision to come from Sunak and Hunt on bank surcharge

The government has not ruled out reversing a tax cut on the UK’s biggest banks as it scrambles to overfill a huge hole in the public finances.

Asked today by City A.M. if chancellor Jeremy Hunt and prime minister Rishi Sunak would commit to cutting the bank surcharge, an effective windfall tax, the Treasury said it does “not comment on speculation around changes to tax policy outside of fiscal events”.

The pair have made clear difficult decisions are needed to put the public finances on a sustainable path. Last week, Treasury sources told City A.M. nothing was off the table on the direction of fiscal policy.

In March 2021, then chancellor Sunak said the bank surcharge, an additional levy on top of the sector’s corporation tax bill, would be cut to three per cent from eight per cent to account for a six percentage point corporation tax rise.

If kept to, that promise would send banks’ headline tax rate to 28 per cent when corporation tax rises to 25 per cent in April.

However, if Hunt and Sunak renge on the pledge, then the likes of NatWest, Barclays and Lloyds will be paying a headline tax rate of 33 per cent.

The duo are expected to launch £50bn worth of tax rises and spending cuts at the delayed fiscal statement on 17 November to tip the public finances into surplus.

Treasury sources told The Sunday Times Sunak’s bank surcharge cut will be maintained.

Last week, UK banks’ earnings season was mixed, with some of the sector’s biggest players notching a big jump in profits over the last year.

Lenders’ finances have been dragged down by building up reserves to cope with a jump in loan defaults caused by the cost of living crunch squeezing finances.

Lloyds posted a 26 per cent fall in profits, driven by a more than £650m build up of loan loss reserves.

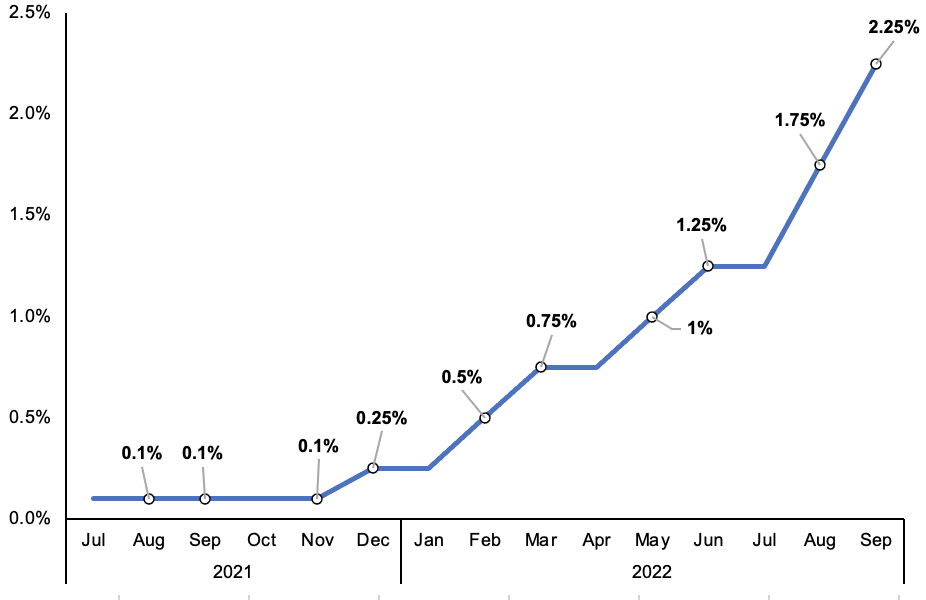

However, NatWest and Barclays’ earnings were bounced by a series of rate hikes by the Bank of England allowing them to charge more for loans.

UK banks have benefited from rising interest rates

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.