Delhivery stock tanks on muted outlook; forensics firms put moonlighters under the microscope

Credit: Giphy

Also in this letter:

■ Forensics companies put moonlighters under the scanner

■ By the Numbers: Hybrid mode most preferred by India Inc

■ Rishad Premji says top Wipro executive was fired for ethics violations

Delhivery stock tanks over 15% after company tempers expectations

The market’s reaction to Delhivery’s muted guidance is perhaps not surprising. The company is the largest third-party logistics player in the ecommerce space and is viewed as a proxy for online consumption and demand trends.

What does the filing say? “While the festive season sale surge in shipment volumes will spill over to the third quarter as well, we anticipate moderate growth in shipment volumes through the rest of the financial year,” said the note to exchanges.

Why is the outlook modest? According to Delhivery, while shipments rose thanks to festive sales in the latter part of the second quarter, market sentiment continued to remain “broadly unchanged” from Q1. It cited muted consumer discretionary spending and high levels of inflation for the tepid sentiment. “While the festive season sale surge in shipment volumes will spill over to Q3FY22 as well, we anticipate moderate growth in shipment volumes through the rest of the financial year,” it said in the exchange filing.

Integration pangs: Delhivery, which went public in May, reported a net loss of Rs 399 crore for the quarter that ended June 30, a more than threefold increase over the previous year.

This was partly due to challenges in integrating the partial truckload business with its acquisition of Spoton and the exit of Singapore-based ecommerce company Shopee, which created excess capacity, thereby leading to higher costs.

Also read | Lacklustre market debut for Tracxn, lists at 6% premium

Wary companies chasing forensic firms to nab moonlighters

Moonlighting employees now have more than just their employers and bosses to worry about. With many companies deciding to crack down on the practice, forensic and employment verification companies have recorded a jump in the number of cases being referred to them,

What is happening? Organisations are hiring forensics firms to weed out moonlighters and also help them review compliance and control frameworks as concerns around moonlighting grow, and the true extent of the problem emerges.

During Covid-19, as work-from-home became prevalent, some employees started taking up freelance jobs or working for competitors, while others reportedly got experienced professionals to impersonate them during online recruitment interviews.

People-centric businesses such as IT services, ITES, media, and consulting were among those particularly affected.

From the horse’s mouth: “We are definitely getting more calls from concerned clients and the mandates range from pre-screening to investigations,” said Nikhil Bedi, head, Deloitte Forensic practice.

“We have signed on at least 15 new large clients, including top-tier IT-related companies. The surge in moonlighting incidentally coincided with the Great Resignation,” said Maneesha Garg, partner and head, Forensics Managed Services, KPMG India. “And it caught companies’ attention about 6-9 months after the Great Resignation.”

Operation Moonlighting: Forensics experts have been using software that helps identify moonlighting by looking at public-source databases and social media analytics.

The provident fund Universal Account Number (UAN) is also becoming a popular way to find out if an employee is getting money from two sources. But if an employee has two UANs, he cannot be caught.

In some cases, forensics experts also use software that analyses voice samples to single out employees who get other people to take their Zoom interviews. Increasingly, companies are also using PC tools to check on employees’ work patterns.

Also read | IT firms reach out for legal help to address moonlighting among staff

TWEET OF THE DAY

Global framework will not grant legitimacy to digital currencies: official

The proposed global information-sharing framework for crypto assets, which the Organisation for Economic Co-operation and Development (OECD) presented to G-20 finance ministers in Washington last week, doesn’t provide legitimacy to digital currencies and does not take away sovereign freedom to impose bans, an OECD official told ET.

The plan: The push for a global information-sharing arrangement follows growing concerns worldwide over opacity in transactions in crypto assets and a lack of regulatory oversight over the intermediaries dealing in them.

“The CARF [Crypto Asset Reporting Framework] is designed to be implemented by jurisdictions to deliver tax transparency in the crypto-asset market and therefore does not prejudice the decision of jurisdictions to put in place bans or other limits on (transacting in) crypto-assets,” Phillip Kerfs, head, International Cooperation Unit, Centre for Tax Policy and Administration, OECD, told us.

Decoding CARF: CARF envisages an automatic exchange of tax information relating to transactions in crypto assets in a standardised manner.

It details rules and commentary that can be transposed into domestic laws to collect information from a Reporting Crypto-Asset Service provider envisaged in the framework.

The framework also defines relevant crypto assets in scope, transactions, and the intermediaries and other service providers that will be subject to reporting.

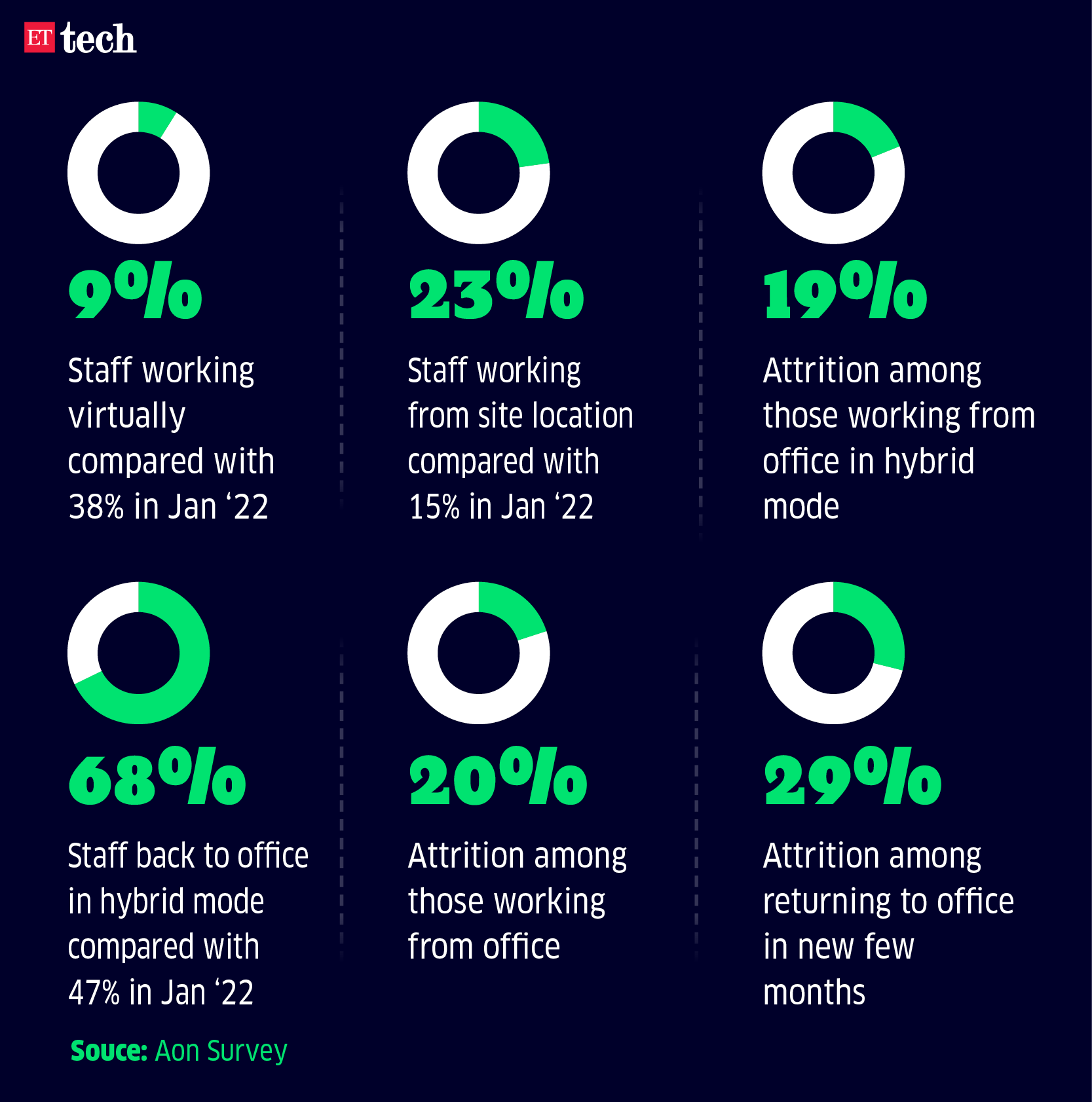

By The Numbers

Nearly 70% of India Inc prefers home-office hybrid work, up from 47% in January

Click here to read the full story

Wipro sacked a top executive for an ethics violation, says Chairman

Wipro Chairman Rishad Premji said the company had fired one of its seniormost executives for a “huge integrity violation”, and that the decision was made in 10 minutes. Speaking at the Nasscom Product Conclave – 2022, Premji stressed the importance of integrity.

Premji’s take: “You take the tough calls when things are not easy. There was a very senior person…we let a top-20 person in the organisation go because there was a huge integrity violation. We made that decision in 10 minutes,” Premji said.

No-nonsense mode: The IT industry as a whole has taken a dim view of moonlighting. Wipro was the first major Indian IT company to take concrete steps to tackle the issue when it fired 300 employees found moonlighting for competitors.

In a recent interview with ET, N Ganapathy Subramaniam, COO of TCS, India’s largest IT services firm, said moonlighting was unethical and unacceptable and that the whole industry could fall apart because of it.

His sentiments were echoed by Infosys CEO Salil Parekh, who spoke out against moonlighting and said he did not support dual employment.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.