Delhi HC orders CCI to take up ADIF plaints against Google; Nykaa restructures top deck

Also in this letter:

■ Nykaa restructures senior-level management after executive exodus

■ UIDAI, NPCI to set up eKYC aggregator

■ Big three Indian IT companies to face a tough FY24

Delhi HC asks CCI to look into ADIF plaints against Google’s new billing system

The Delhi High Court on Monday ordered the Competition Commission of India (CCI) to take up complaints filed by Alliance of Digital India Foundation (ADIF), a group representing Indian startups, against Google’s new in-app billing policy, which will become applicable from April 26. The court asked CCI to consider the complaints by April 26.

ET had reported on April 5 that the tech industry body had filed complaints with the antitrust watchdog asking it to review the user choice billing (UCB) policy.

Quorum issue: The arguments by the parties were primarily around whether it was within the ambit of the law for CCI to take the complaints up given that it has only two members, and is therefore lacking a quorum. Following submissions by the parties, the court had reserved its judgment last Wednesday.

ADIF’s complaints: In its petition, the industry body had urged the court to ask the CCI to look into its complaints against Google’s UCB system urgently or put the new policy under abeyance pending a review. ADIF had alleged that Google was engaging in anti-competitive conduct by implementing the UCB policy and that it was taking advantage of the CCI lacking a quorum to look into the industry body’s complaints against the tech giant.

Google’s user choice billing system: Under the system proposed by Google, app developers need to pay a commission of 11-26% to the US-based tech giant. ADIF made a representation to the CCI on this issue, in which it urged the competition regulator to “look into these abusive dominance practices of Google on an urgent basis”.

Nykaa restructures senior-level management after recent executive exodus

FSN E-Commerce Ventures Ltd, the parent firm of Nykaa, on Monday announced the restructuring and appointment of senior executives across technology, finance, business, and marketing teams. This comes after the omnichannel beauty retailer saw several top-level exits in recent weeks.

In a regulatory filing on April 24, the company said the new leaders will join existing leadership, now comprising over 50 leaders, and will be “instrumental in driving the company’s growth agenda forward”.

New recruits: Rajesh Uppalapati has joined as chief technology officer. Abhishek Awasthi, Eswar Perla, Dhruv Mathur and Amit Kulshrestha are among other appointments in the technology leadership team.

P Ganesh took over as Nykaa’s chief financial officer in February. Sujeet Jain has joined as chief legal and regulatory officer, while TV Venkataraman is responsible for the internal audit and risk management charter. Sudhansh Kumar is the new performance marketing head and Priya Bellubbi is customer lifecycle management lead.

Top-level exits: The beauty etailer recently saw multiple exits, including chief commercial operations officer Manoj Gandhi, chief business offer of Nykaa Fashion Gopal Asthana, chief executive of wholesale business Vikas Gupta, Nykaa Fashion’s Owned Brands business vice president Shuchi Pandya, and the fashion unit’s vice president of finance, Lalit Pruthi.

This was after Former CFO Arvind Agarwal quit Nykaa last November to join PayU.

Terming them “mid-level exits”, Nykaa had at the time said that it was part of the standard annual appraisal and transition process, wherein people exit due to performance reviews or to pursue other opportunities.

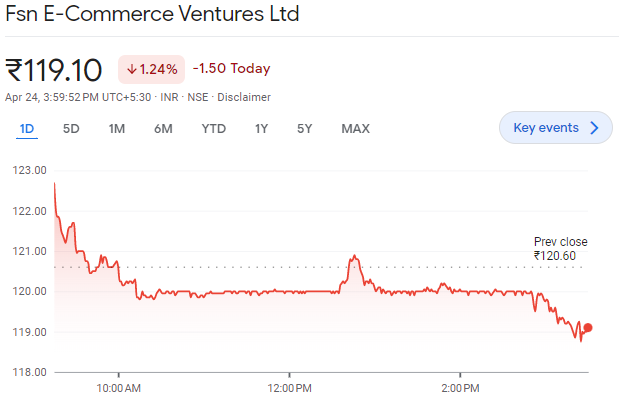

D-street performance: The company’s shares, which listed at a hefty premium of 77.87% in November 2021, have since plunged. On Monday, the Nykaa stock closed at Rs 119 on the exchanges, down 1.24% from its previous close.

Nykaa reported a 71% decline in consolidated net profit to Rs 8.48 crore for the quarter ended December 31. The company’s total expenses surged 36% to Rs 1,455 crore during the third quarter against Rs 1,067 crore in the year-ago period.

UIDAI, NPCI to set up eKYC aggregator

Thousands of regulated entities in the financial sector stand to benefit from a KYC plan that is in the works. The Unique Identification Authority of India (UIDAI) and the National Payments Corporation of India (NPCI) are planning to set up an aggregator platform for eKYC (electronic know-your-customer), according to a report in The Times of India.

Why a new platform? Expected to go online in the coming months, the new platform will enable entities that are regulated by the RBI, Sebi or the insurance and pension regulators to register on it. This will do away with the need for these entities to individually register for eKYC using Aadhaar, while also ensuring that user data is not shared with players using the platform.

Ease for users: Sources said that the idea is to ensure that at best the last four digits are available to the financial services players and even the masked data of the consumers is not shared. Users will not have to share physical copies of their documents, which often results in misuse and data theft.

Big three Indian IT companies to face a tough FY24

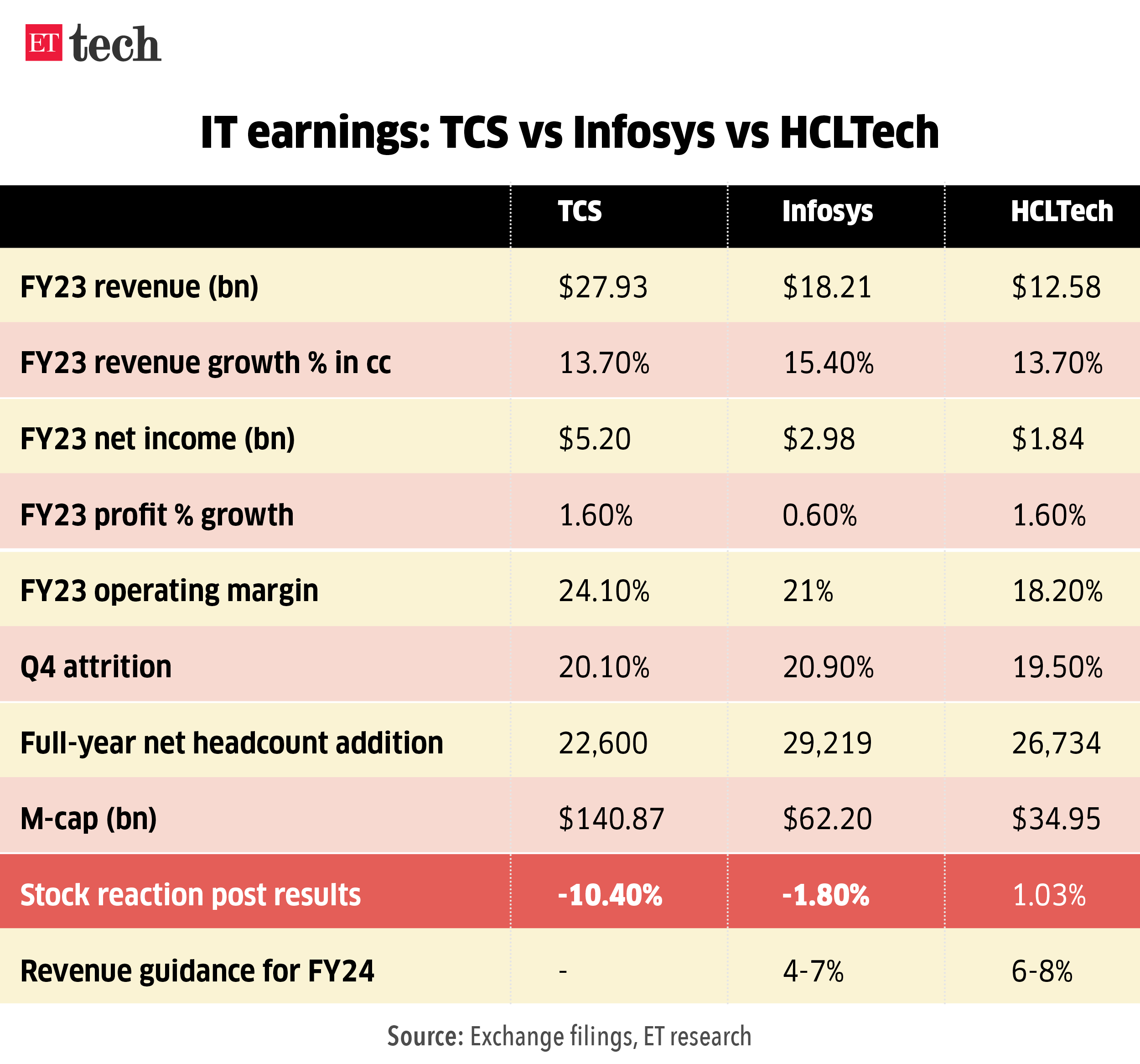

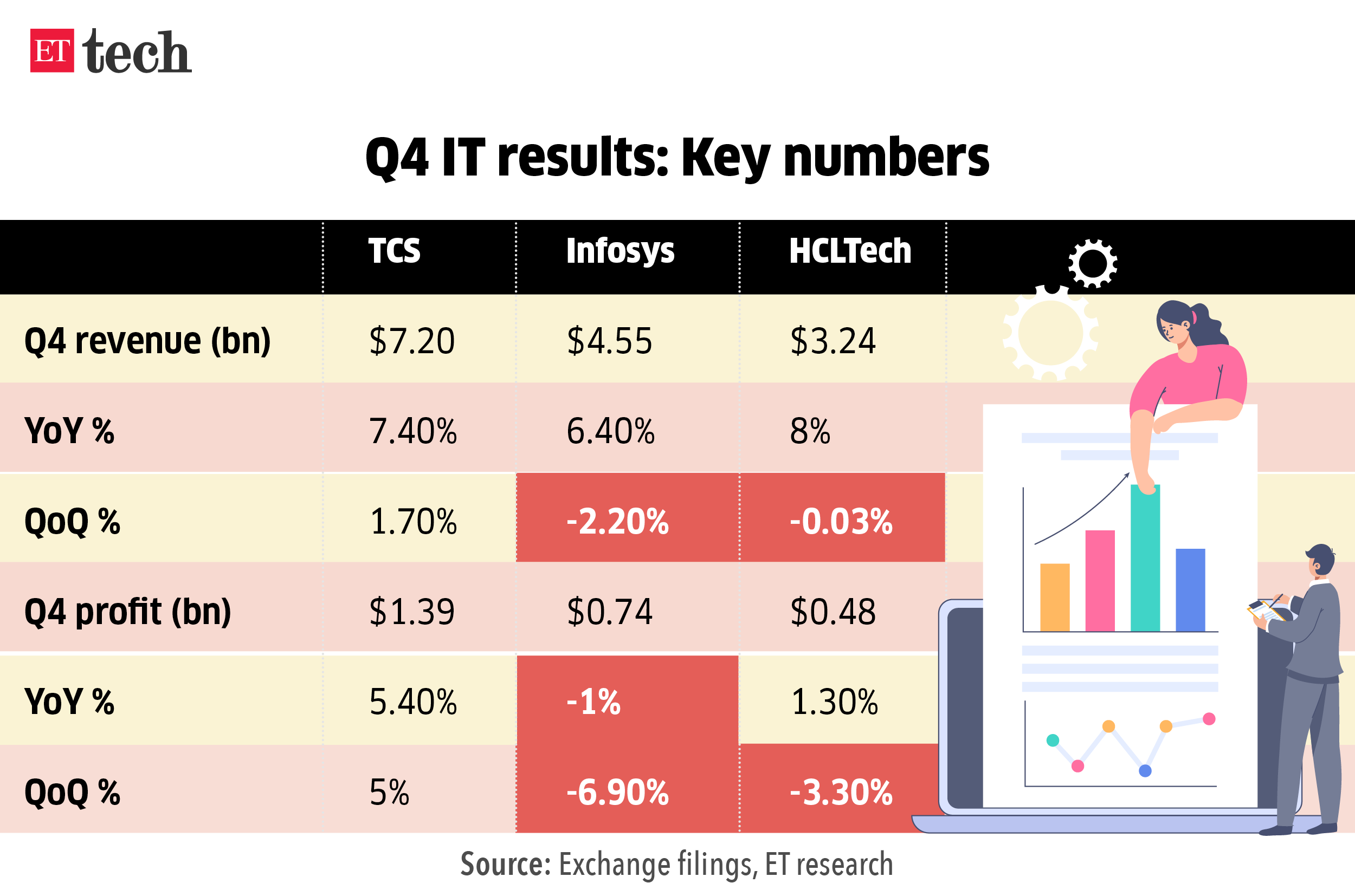

India’s top three IT firms — Tata Consultancy Services, Infosys and HCLTech — spoke of demand uncertainty, delays in decision making and even some project rampdowns as they announced their FY23 and fourth-quarter results earlier this month.

Muted guidance: While TCS doesn’t provide revenue guidance, Infosys’ FY24 revenue growth forecast of 4-7% meant the company will expand at its slowest pace in six years.

The company also missed its revenue growth guidance of 15.4%. These two factors mainly contributed to its stock falling the most in three years. HCLTech’s revenue growth, too, was near the lower end of its guided range of 13.5-14.5%.

Tweet of the day

‘Give it to charity’: Stephen King ticks off Musk over Twitter badge payment

A war of words broke out between Twitter CEO Elon Musk and popular author Stephen King just three days after the microblogging platform removed the legacy blue verification tick from accounts not subscribed to Twitter Blue.

‘Personally paying’: King had tweeted on Friday that he hadn’t subscribed to Twitter Blue but still had the blue tick. Musk replied, stating that he had paid for King’s verification. He revealed that he was “personally paying” for Twitter Blue for some prominent users, including King, actor William Shatner and basketball star LeBron James.

‘Give it to charity’: A day later, the author asked Musk to give his blue tick verification badge to charity. In his tweet, King also suggested Musk donate the money to a foundation providing services in war-hit Ukraine. Musk replied detailing his company’s donations for war-torn Ukraine. “I’ve donated $100M to Ukraine, how much have you donated? (We turned down the DoD money btw),” he replied.

Blue tick back again: Twitter has restored verification badges on several accounts. In most cases, the accounts have more than a million followers. Several prominent celebrities, politicians and sportspersons lost their verification ticks on Thursday.

A ‘serious danger’ for traditional media: Musk on Monday said that his micro-blogging platform has become a “serious danger” to traditional media outlets’ ability to control narratives, as he restored legacy Blue check marks for influential users and celebrities.

Today’s ETtech Top 5 newsletter was curated by Erick Massey in New Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.