Darling Darktrace is back: Shares climb 20 per cent following revenue boom

Darktrace shares surged as high as 20.8 per cent this morning after it raised its full-year outlook for revenue and earnings margin following strong customer growth and retention in the first half of the year.

In its announcement, the tech darling said that it had a 39.6 per cent growth in its number of customers, with up to 6,531 customers, and at least a 45 per cent boost in annual recurring revenue (ARR) to at least $426m (£314m).

Foreign exchange headwinds also continued to be less than previously forecasted, accelerating the conversion of constant currency ARR to US dollar denominated revenue.

Based on this, the FTSE 250 firm is now expecting year-over-year revenue growth of between 42 per cent and 44 per cent (previously 37 per cent to 39 per cent), hitting a revenue of at least $190m (£140m) for the coming year.

Cathy Graham, chief finance officer at Darktrace, said she was “very pleased” with the results and added: “We also achieved our aim of driving improvement in churn and net ARR retention rates over the past six months by leveraging our customer success team and focusing on upsell programmes.”

Gordon Hurst, Chairman of Darktrace, has already described 2021 as a “pivotal” year for the firm, back in November.

The confident announcement comes against a backdrop of the ongoing fraud case against founding investor Mike Lynch, and the market repercussions of the bearish note issued last year by analysts Peel Hunt, which saw shares plummet by almost 50 per cent.

This morning, Peel Hunt moved Darktrace to a Hold recommendation, given the immediate share movement.

However, research analyst Oyvind Bjerke warned that the announcement should not be overstated. He said: “Although we see these upgrades as positive, as flagged earlier, many investors were already expecting a beat and raise strategy. Given the share price has now approached our target price, we pause for breath and move from Sell to Hold.”

Meanwhile, analysts at Berenberg and Jefferies reiterated their Buy recommendation, with a target prices of 1000p and 800p respectively.

Paolo Pescatore, tech analyst at PP Foresight, said that the results and outlook suggest a rosy future for Darktrace, but warned: “Given the clear opportunity for cybersecurity products, it must seek to generate a profit to satisfy all key stakeholders. Impressive client roster underlines its appeal and credibility to compete with established solution providers. With any subscription business, focus must be on retention as well as luring new customers.”

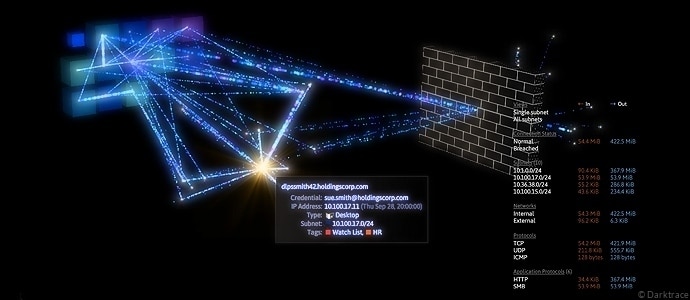

He added: “Its unique AI powered self learning technology gives the company a clear differentiator over rivals.”

Darktrace shares were up over ten per cent this afternoon to 434.48p.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.