Crisis deepens at Dunzo as it further delays June, July salaries; Indian investors double down on Big Tech stocks

Also in the letter:

■ Order to remove Disney+ Hotstar only interim: Google

■ Ecomm share in warehousing falls to 3%

■ ONDC to have 2 lakh daily transactions by year-end: report

Cash-strapped Dunzo further delays payment of June, July salaries

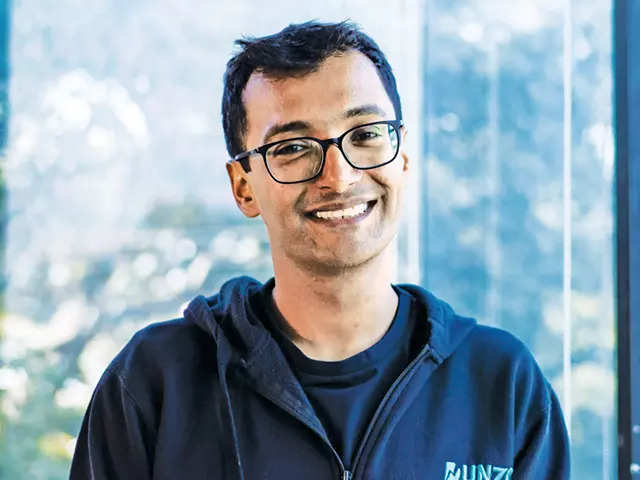

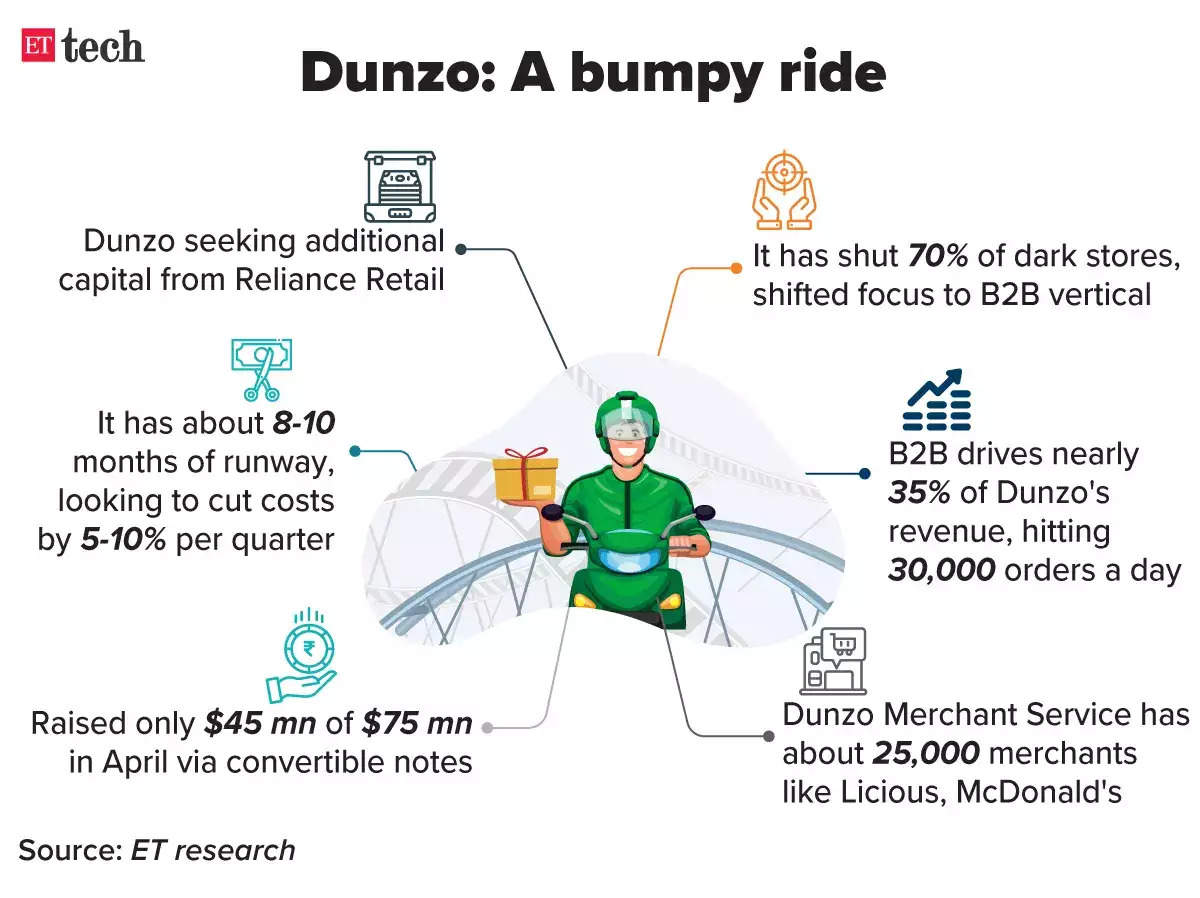

Kabeer Biswas, CEO, DunzoDeeper cuts: Quick commerce platform Dunzo, which is backed by Reliance Retail, has mandated cutting costs by around 30-40% internally, sources told ETtech. This will involve cutting more roles, they said, adding such a drastic cut can’t be done with the same headcount and corporate costs.

Head of product leaves: As Dunzo goes through a series of changes aimed at saving capital, its head of product Akansha Kumari has resigned from the startup, which is backed by the likes of Blume Ventures and Lightbox.

Funding efforts by Biswas: Meanwhile, Biswas was in Mumbai meeting a set of investors to stitch up a new financing arrangement even as the firm told staff that it has further delayed the payment of salaries to its employees for the months of June and July.

Note to staff: “For those team members who were expecting the balance payouts of their June salary during this week, we regret to inform you that this has been delayed. The pending salaries for June will now be paid on September 4th, 2023. Additionally, the July salary for all team members will be paid only on September 4th along with the August salary,” the company said in an internal note that was seen by ET.

Cash flow in focus: Dunzo told employees that it understands the delay in salaries is ‘very difficult’ and that the firm appreciates their patience. “At this stage, we need to focus on streamlining our cash flow so we can build a more sustainable business for the future. We need your support as we work through this,” the note added.

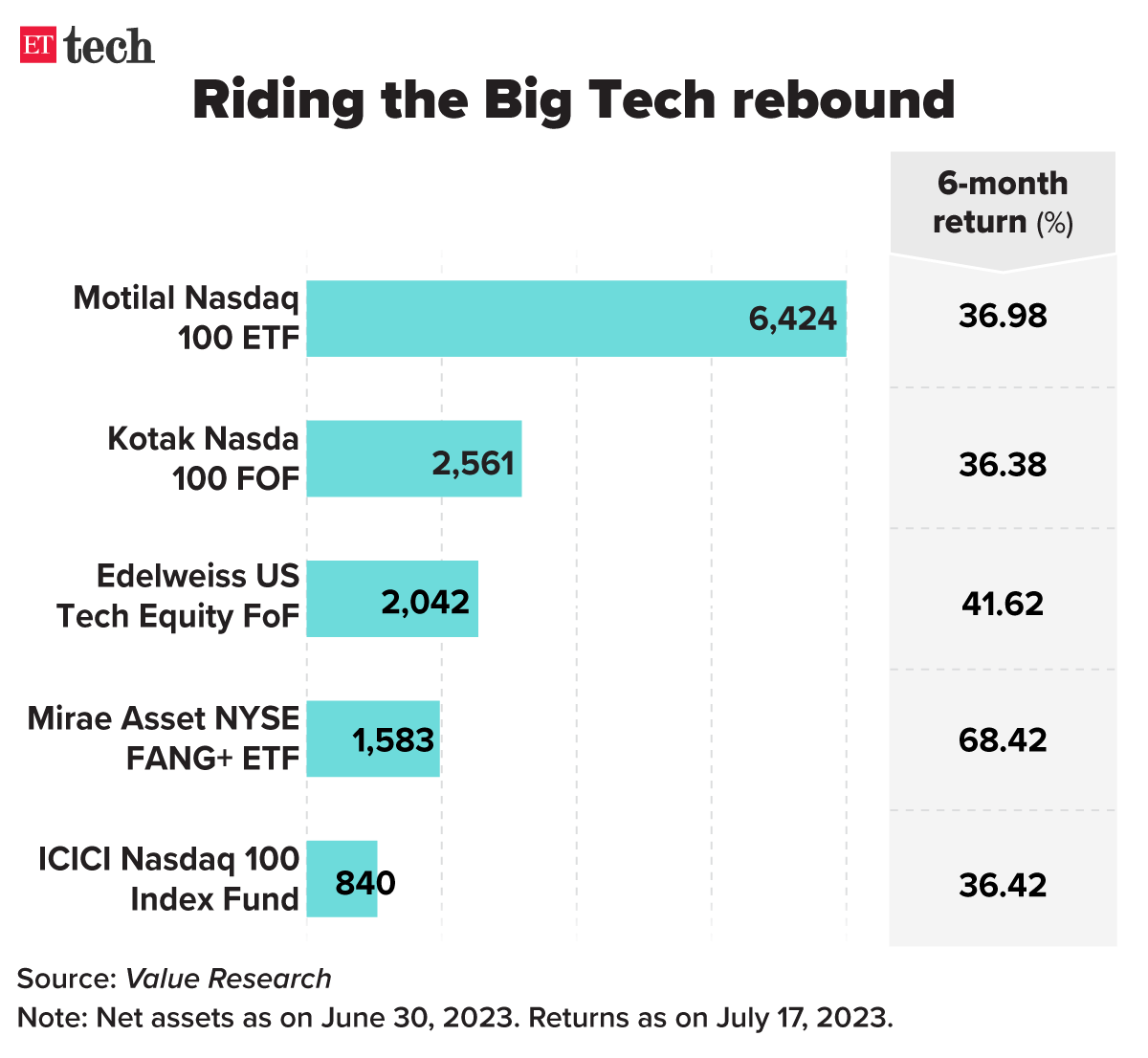

Indian investors double down on Big Tech stocks

Indian investors have joined the US tech stock party, more than doubling their allocations to global tech leaders in the past six months on online platforms that enable Indians to invest in the US markets. These platforms saw trading volumes rise by about 40% in the first half of 2023 from the second half of 2022, said brokers.

Quote unquote: “Tesla, Amazon, Apple, Microsoft, Google, Facebook and Nvidia were the top stocks traded on our platform, which saw trading volumes grow by 37% in H1 2023 compared to H2 2022, while buy transactions went up by 41%,” said Viram Shah, CEO and cofounder, Vested Finance, an online investment platform that deals with US stocks.

Numbers game: The tech-heavy Nasdaq 100 has climbed 43% since January 1. Among the seven top tech companies, Nvidia has surged 218% since January 1, while Meta and Tesla rose 158% and 136%, respectively. Apple, Microsoft, Google and Amazon have gained 40-60% this year.

Google says court order not to remove Disney+ Hotstar app is interim

Tech giant Google on Wednesday said the Madras High Court’s order stopping the company from removing Disney’s streaming app from its app store is only interim in nature. Disney’s lawsuit is the latest and most high-profile challenge to Google’s policy of imposing a ‘service fee’ of 11-26% on in-app payments in India.

What the court said: The Madras High court, in an interim order on Tuesday, said that Google cannot remove the Disney+ Hotstar app — Disney’s streaming service app in India — from its app store, Google Play. The Court also ordered Novi Digital, parent entity of Hotstar, to pay Google 4% commission on downloads through the Play Store.

Catch up quick: Novi Digital, the fifteenth company to challenge Google Play Store’s new billing system, filed a motion in the High Court on Monday. Previously, Matrimony.com, People Interactive, Info Edge India, Arha Media and Broadcasting, Primetrace Technologies, Cold Brew Tech, Mebigo Labs, Crescere Technologies, Verve Mobile, Catchup Technologies, Sorting Hat Technologies, Alt Digital Media Entertainment, Nasadiya Technologies, and Ananda Vikatan Digital had also challenged the policy.

Ecommerce share in warehouse leasing falls to 3% on declining demand

As ecommerce companies continue to struggle with faltering demand since the Covid-19 pandemic began easing, their share in warehousing space has fallen to a mere 3% from more than 20% during the pandemic, according to data by Savills India.

Dwindling demand: In 2020, ecommerce companies occupied more than 20% of warehousing space while physical stores had a 9% share. During the January-June period, physical retailers occupied 14% of the total space, while ecommerce companies only needed 3%. Overall leasing activity in India continued to grow, with a total space uptake of 22.4 million square feet in the first six months of 2023, up from 20.9 million sq ft a year ago.

Also read | Ecommerce logs 24% Q2 growth as premium products click; slowdown hits low-priced items

Behind the fall: According to industry experts, ecommerce companies have increased investment in their warehousing operations and footprint optimisation through automation and improved shelving and racking systems, enabling them to use their own space more efficiently and rely less on warehouses. Experts said the companies are also looking to outsource the space they had taken during the pandemic.

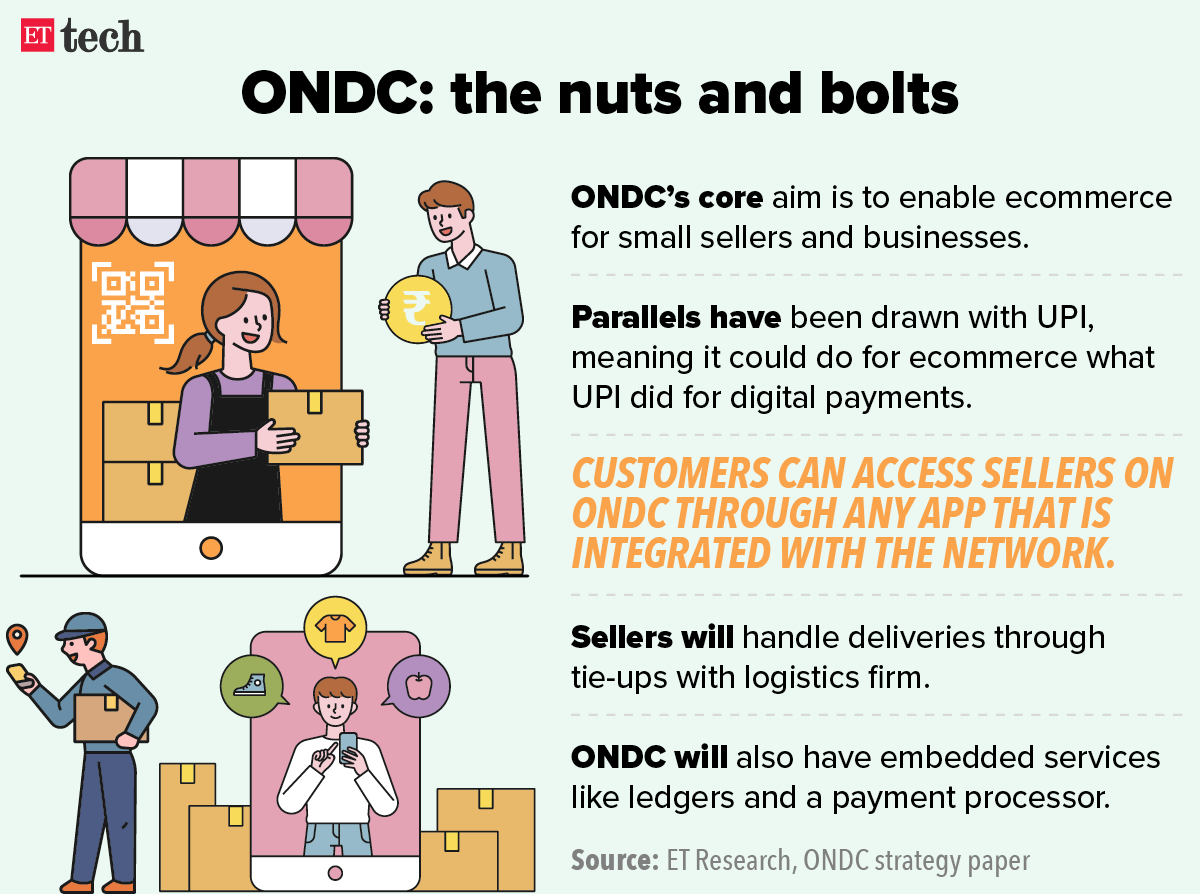

ONDC may have 200,000 daily transactions by December 31: report

Government-backed ecommerce marketplace ONDC may record 200,000 transactions daily by the end of 2023, according to a report from ICICI Securities, citing ONDC CEO Thampy Koshy and Senior VP Rahul Handa.

More from the report: The marketplace hopes to reach 2 lakh transactions a day from its current daily numbers of 75,000 to 80,000 transactions, Koshy and Handa told ICICI Securities. The platform has over 100,000 merchants currently, with about 60,000 of those in the mobility space. The government-backed network “will not go public and will not pay dividends but hopes to create a self-sustaining financial mode,” the report said.

Rating system coming up: ONDC is trying to develop a network-wide scoring system for rating purposes. Within the B2C segment, every seller will receive a network-wide score, independent of the platform they operate on. In the B2B segment, both buyers and sellers will be rated. This feature is currently under development and will be rolled out in stages, encompassing three key components: rating, scoring, and badging.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai & Siddharth Sharma in Bengaluru.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.