Credit cards on UPI soon, says RBI; two senior execs quit BharatPe in post-audit churn

Also in this letter:

■ Two senior executives quit BharatPe

■ WazirX and Unocoin to slow down hiring

■ CEO’s Esops cost Zomato Rs 387 crore in second half of FY22

RBI allows credit cards to be linked with UPI, starting with RuPay

The Reserve Bank on Wednesday allowed credit cards – starting with RuPay cards – to be linked with the Unified Payments Interface (UPI).

This is expected to bring more people onto the popular platform, which currently facilitates transactions by linking savings or current accounts through users’ debit cards.

Not just yet: The central bank said the facility would be available after a required system development was complete. It said the National Payments Council of India, which runs UPI, would issue instructions separately.

How it will work: By adding your credit or debit card to a UPI app, you will be able to pay with cards without the need for a point-of-sale (POS) machine. When you initiate a UPI payment through a debit or credit card, a one-time password (OTP) will be sent to your registered mobile number to complete the payment.

Recurring payments limit raised: The RBI also announced that automatic transactions up to Rs 15,000 would no longer require manual authentication with a one-time password (OTP). The earlier limit was Rs 5,000 and the regulator had received requests from several stakeholders to increase this.

Crypto and digital rupee: RBI governor Shaktikanta Das said, “There is constant engagement between the government and the RBI on all issues related to cryptocurrency. We have given our views to the government. Let’s wait for the government’s discussion paper.”

RBI deputy governor T Rabi Sankar said that India’s central bank digital currency (CBDC) would be rolled out gradually, starting this year, to ensure the financial system is not disrupted.

Lending apps: Das said most digital lending apps operating in India are not registered with the RBI. “When we get complaints about these unregistered apps, we advise people to file a complaint with the police. Customers should ensure the digital lending app they are using is registered with the RBI,” he said.

Two senior executives quit BharatPe in post-audit churn

Two senior executives have quit fintech firm BharatPe, which has been embroiled in controversy since the start of the year.

Details: In the past few weeks, chief revenue officer Nishit Sharma and head of institutional debt Chandrima Dhar have left the company, citing personal reasons, multiple sources told us.

One of the sources said, “It is still not known whether the company will look to replace these individuals or club some of their functions under the incoming chief financial officer.”

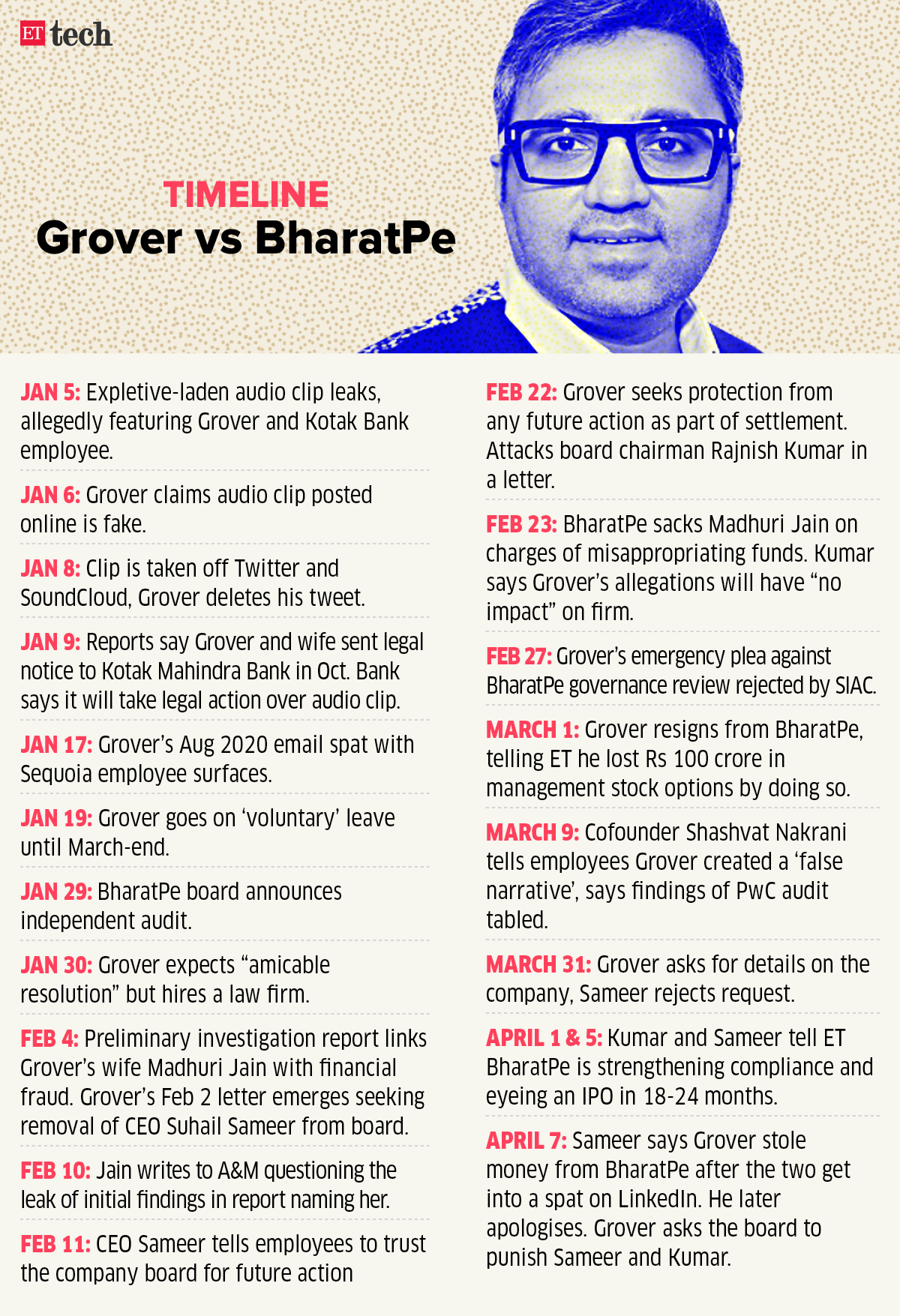

Controversy: The company has seen intense investor and media scrutiny this year, after cofounder Ashneer Grover sought damages from Uday Kotak, head of Kotak Mahindra Bank, alleging that the bank refused him financing for a personal investment in Nykaa’s IPO last November.

At the end of January, BharatPe’s board hired independent auditors A&M and PricewaterhouseCoopers after receiving complaints from an internal whistleblower on alleged financial malpractices and corporate misgovernance at the firm.

This led to the ouster of the company’s head of controls, Madhuri Jain, who is also Grover’s wife. Grover himself resigned from the company and its board in March.

WazirX and Unocoin to slow down hiring, following Coinbase

Indian crypto exchanges WazirX and Unocoin are slowing down their hiring amid a global cool-off in the crypto market, senior executives told us.

WazirX and Unocoin: Nischal Shetty, cofounder of WazirX, confirmed to us that the company has slowed down hiring for the time being.

“The top reasons for the slowdown are bearish markets, regulatory uncertainty, and the current banking issues. We are working on solving for regulatory uncertainty and banking issues as we speak. But until then the Indian crypto industry will continue to see downward pressure in terms of business growth. This has led to a slowdown in hiring,” Shetty said.

Sathvik Vishwanath, cofounder and CEO of Unocoin, said the company decided to change its hiring plans in the past couple of weeks.

“Like other tech-based companies, we have also become cautious with our hiring. We are concentrating on filling up crucial roles in the organisation as oppossed to those meant to build in redundancies. No layoffs are planned in the foreseeable future,” Vishwanath said.

Coinbase’s worldwide freeze: The developments come soon after Coinbase, the largest US crypto exchange, announced a hiring freeze and even rescinded accepted offers across its global offices. In April, Coinbase’s CEO Brian Armstrong had announced the company planned to triple its workforce to 1,000 in India.

In response to our query on whether it would pause its hiring efforts in India, the company said, “this applies globally.”

Deepinder Goyal’s Esops cost Zomato Rs 387 crore in second half of FY22

Zomato incurred Rs 778 crore in expenses on salaries and other benefits such as employee stock options (Esops) for the half-year ending March 31, 2022, according to a regulatory filing with BSE on June 7.

Esops allocated to cofounder and chief executive Deepinder Goyal cost the company Rs 387 crore over this period, according to the filing.

The company’s other key executive, chief financial officer Akshant Goyal, earned Rs 50 lakh in salary and had stock options worth Rs 3 crore. The company’s independent board directors Kaushik Dutta and Namita Gupta earned a sitting fee and Rs 30 lakh each.

Esop donation: Back in May, Goyal revealed that he would donate Esops worth Rs 700 crore to the Zomato Future Foundation, which works for the welfare of delivery partners and their children. He also waived his salary for the year ended March 31, 2022.

Tweet of the day

Mobikwik in talks to scoop up $100 million after delaying IPO

Upasana Taku, cofounder, Mobikwik

Fintech startup Mobikwik is in talks with investors to raise $100 million to expand its business after delaying its initial public offering (IPO) plans, Upasana Taku, its cofounder, told Bloomberg.

IPO shelved: The company had filed draft papers for a Rs 1,900-crore IPO in July 2021, seeking a valuation of $1 billion.

However, after the failure of Paytm’s IPO dampened investor interest in startup IPOs, the company decided to halt its listing plans. According to data from investment platforms that allow trading in private companies, its unlisted shares had also taken a hit at the time.

For now, Taku says the company plans to use the fresh funding for marketing, hiring and making acquisitions.

ETtech Done Deals

Alternative investment management platform Jiraaf has raised $7.5 million from Accel Partners, Mankekar Family Office, and Aspire Family Office. Founded in 2021 by finance professionals Saurav Ghosh and Vineet Agarwal, Jiraaf aims to help individual investors earn better returns by participating in high-quality opportunities beyond equities, fixed deposits, real estate and gold.

Web3 startup Samudai has closed a $2.5 million pre-seed round from well-known investors such as FTX Ventures, Sino Global Capital and Coinbase Ventures. Based in Singapore, Samudai plans to launch a full productivity suite for DAOs, a project management network, and other tools to facilitate collaboration among Web3 users.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.