Coinbase criticizes Singapore’s crypto regulations, urges city-state to embrace retail trading

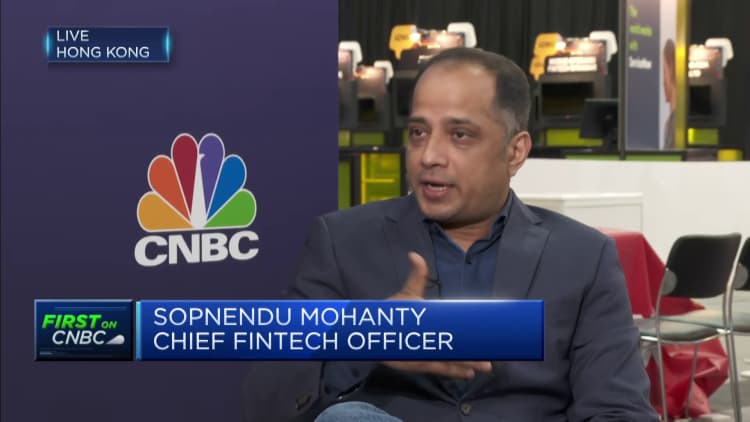

Brian Armstrong, co-founder and CEO of Coinbase chats with Sopnendu Mohanty, chief fintech officer of the Monetary Authority of Singapore (MAS) during the Singapore Fintech Festival, in Singapore, on Friday, Nov. 4, 2022.

Bloomberg | Bloomberg | Getty Images

SINGAPORE – Co-founder and CEO of U.S.-based crypto exchange platform Coinbase, Brian Armstrong, said that Singapore wants to be a forward-looking regulator, but is not welcoming toward crypto trading.

The city-state has repeatedly warned that cryptocurrencies are highly speculative and volatile after many retail investors lost large chunks of their savings. It has also banned crypto advertising in public areas and on social media.

“Singapore wants to be a Web3 hub, and then simultaneously say: ‘Oh, we’re not really going to allow retail trading or self-hosted wallets to be available,” said Armstrong at the Singapore FinTech Festival 2022. He was speaking alongside Sopnendu Mohanty, chief fintech officer of the Monetary Authority of Singapore.

“Those two things are incompatible in my mind, and I would like to see Singapore embrace retail trading and self-hosted wallets,” Armstrong added.

It comes after Coinbase received in-principle approval from MAS to offer digital payment token services in the city-state.

So far, Singapore has only handed out 17 in-principle approvals and licenses after a strict selection process following 180 applications. Binance reportedly withdrew its application to operate in the city-state earlier this year after being in regulatory limbo for months.

In response, the Monetary Authority of Singapore’s Mohanty said that retail investors today were “exposed to risks they do not understand they are taking.”

“We believe that Web 3.0 is the future and what we want to do is to ensure that the money which can transact on this ecosystem is considered a safe asset, safe currency. As long as that is the direction, we are OK,” added Mohanty.

Mohanty went on to challenge Armstrong to name regulations he felt should be reviewed.

“For centralized exchanges and custodians [like Coinbase], I think they should be treated just like other financial service businesses. There should be anti-money-laundering protections. There should be audits that they need to complete, no commingling of funds, appropriate disclosures to customers,” said Armstrong.

“Crypto should not be treated at a disadvantage; they should be treated equally with other financial service regulations.”

In response, Mohanty gave an analogy of a customer using a banking app.

“We, as the regulator, don’t worry about internet protocols. We only care about the customers who went to the bank. The bank is responsible to ensure that they protect their customers,” he added.

CNBC has reached out to MAS and Coinbase for further comment.

For all the latest World News Click Here

For the latest news and updates, follow us on Google News.