Cognizant CEO Ravi Kumar on earnings, company’s vision & ChatGPT; Visa launches CVV-free online transactions

Also in this letter:

■ Space industry regulator flags spectrum concerns

■ Tech firms’ mcap slip post IPOs

■ ETtech Done Deals

“Seeing a historic quarter as deal bookings up 28%”: Cognizant CEO

Ravi Kumar S, who took over as the chief of US-headquartered IT firm Cognizant four months ago, has termed the last quarter “historic” amid a cautious macro environment. In his first exclusive interview since joining from Infosys, Kumar talks about his vision for the firm, lessons from his previous stint and ChatGPT.

Key takeaways:

On job cuts & office space: “(Employee impact) will be across corporate functions and overheads of the non-billable workforce. Similarly, real estate will be a structural shift in our costs.”

What lessons from Infy: “Cognizant is a unique company. I don’t need to bring anything else from outside. Cognizant, on its own, with its unique value proposition, can thrive. I am focused on igniting the soul and heart of the company which is in India.”

ChatGPT a threat? “If enterprise software reengineered corporations 30 years ago, the next generation of reengineering will be powered by AI, and those who use this effectively will win. ChatGPT is powerful. One needs to be cautious with the ethical and responsible use of AI.”

Read the full interview here

Q1 results: Cognizant’s net profit increased 3% in the first quarter to $580 million on lower administration costs and a bump in other income. Its revenue declined 0.3% year on year (YoY) to $4.81 billion, beating Street estimates of $4.74 billion.

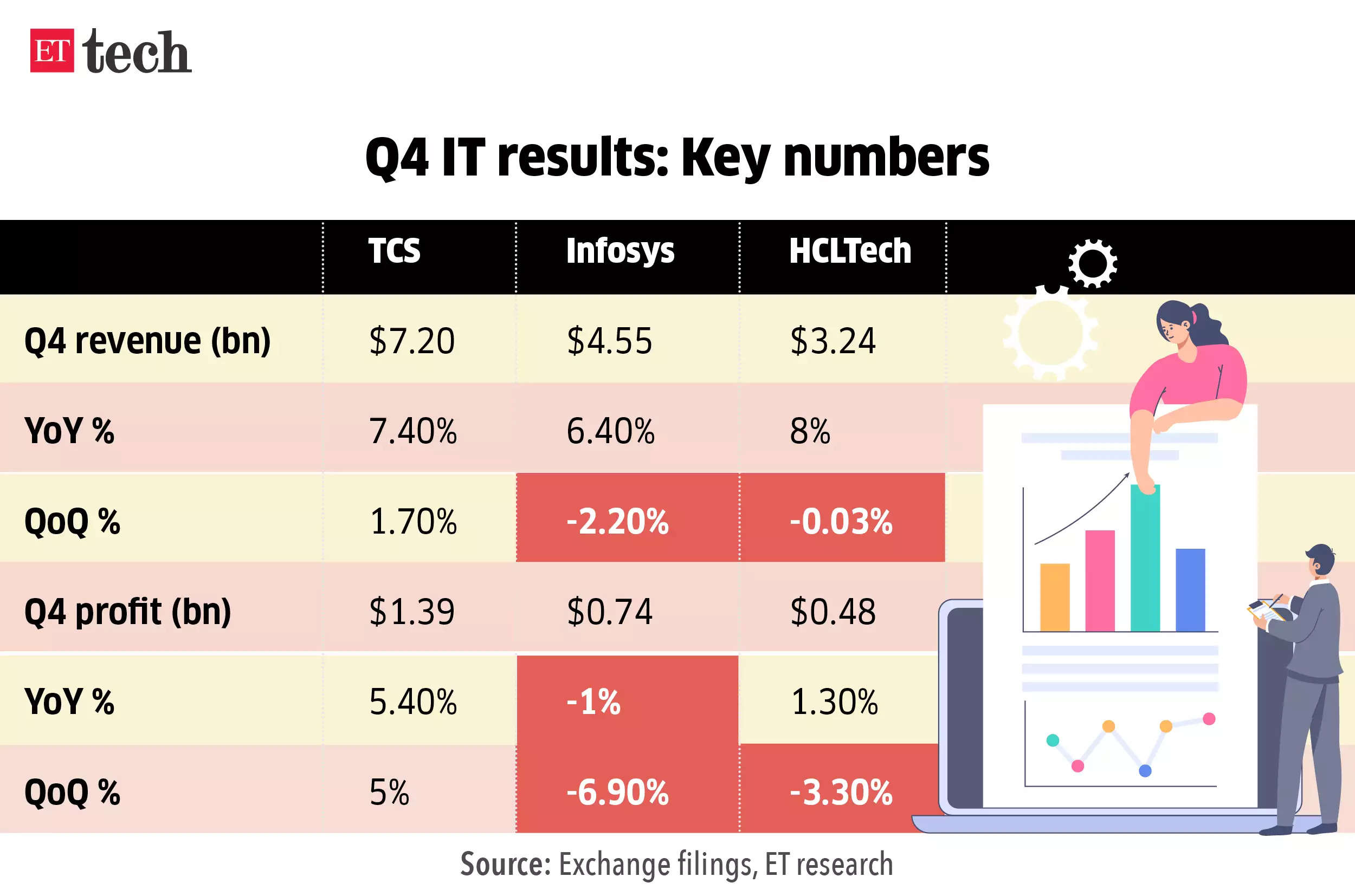

Muted IT earnings: After IT bellwethers TCS, Infosys and HCLTech posted subdued results in the fourth quarter of FY23 and struck a note of caution with their FY24 guidance, Wipro and Tech Mahindra, too, followed suit, rounding off a weak earnings season for the country’s IT pack.

Visa launches CVV-free online transactions for tokenised cards in India

To smoothen transaction processes, card payments giant Visa has launched cardholder verification value (CVV)-free online transactions for tokenised cards in India. The development comes on the back of Visa pausing it’s single-click checkout service for Indian ecommerce transactions, as reported first by ETtech on April 24.

Driving the news: Merchants adopting this will not have to ask for customers’ CVV every time as the value will be verified only once at the time of tokenising the card.

Jargon buster: Tokenisation masks the card details with a unique code, making transactions more secure. Tokenised transactions are two-factor authenticated, one at the time of tokenisation and later at the time of putting the OTP.

Also read | ETtech Unwrapped: Fintech sector grapples with heightened scrutiny

Quote, unquote: “Tokenisation is being adopted in the mainstream ecommerce space well. We want to make the payment experience faster and friction-free by removing the CVV. What we are saying is that in a tokenised card transaction, the role of a CVV is limited, and are working with the industry to remove it,” Ramakrishnan Gopalan, head, products, India and South Asia, Visa told us.

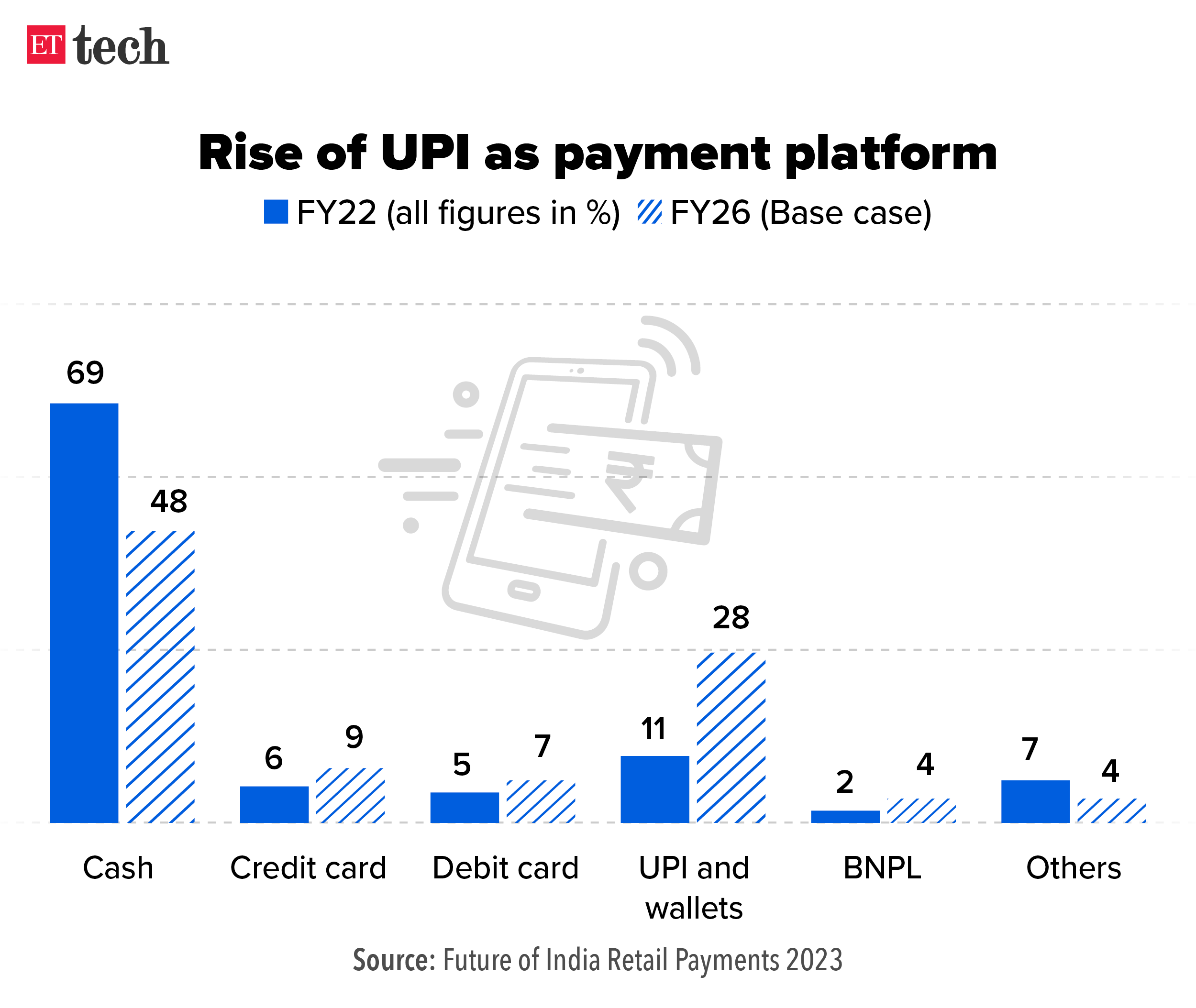

UPI competition: With such checkout options, Visa wants to stay ahead of competitor Unified Payments Interface (UPI) for ecommerce payments, given the ease the latter brings through a pin.

Also read | UPI merchant payments to reach $1 trillion by FY26: Report

Satcom spectrum not auctioned anywhere: IN-SPACe chief Pawan Goenka

Pawan Goenka, chairman of India’s space industry regulator, has agreed to the concerns raised by the satcoms industry. He said that for now though, no country has allocated spectrum resources for space-based communications through the auction route.

Spectrum concerns: Goenka’s comments come after the Satcom Industry Association (SIA India) recently sought his intervention in the telecom regulator’s ongoing consultation process on the spectrum allocation mode for space services. It warned that the underlying intent of the latter’s discussion paper seemed to be forcing an auction of satellite spectrum in India, contrary to global practices.

Contrary views: Allocation mode of satcom airwaves remains a vexed issue with satellite players, including Bharti Group-backed OneWeb and US-based Hughes, categorically saying satellite spectrum must be given administratively as has been the global practice. Reliance Jio and Vodafone Idea have been opposing this.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

ETtech Done Deals

Anmol Singh Jaggi, cofounder & CEO, BluSmart

EV cab startup BluSmart raises $42 million in funding: Electric vehicle (EV) ride-hailing startup BluSmart has raised about $42 million from BP Ventures and several other existing investors. The latest round includes an equity component of $37 million and venture debt of $5 million.

EduFund raises $3.5 million in funding: EduFund, an India-based edu-fintech company, has raised $3.5 million in a funding round led by global venture capital firm MassMutual Ventures (MMV). The fundraise also saw participation from investors DSP Investment Managers, Anchorage Capital Partners, and Kunal Shah.

Groww completes Rs 175 crore acquisition of Indiabulls’ mutual fund business: Nextbillion Technology, which runs investment platform Groww, has completed the acquisition of the mutual fund business of Indiabulls Housing Finance (IBHFL) for Rs 175.6 crore after receiving the necessary approvals, IBHFL said in a filing with exchanges.

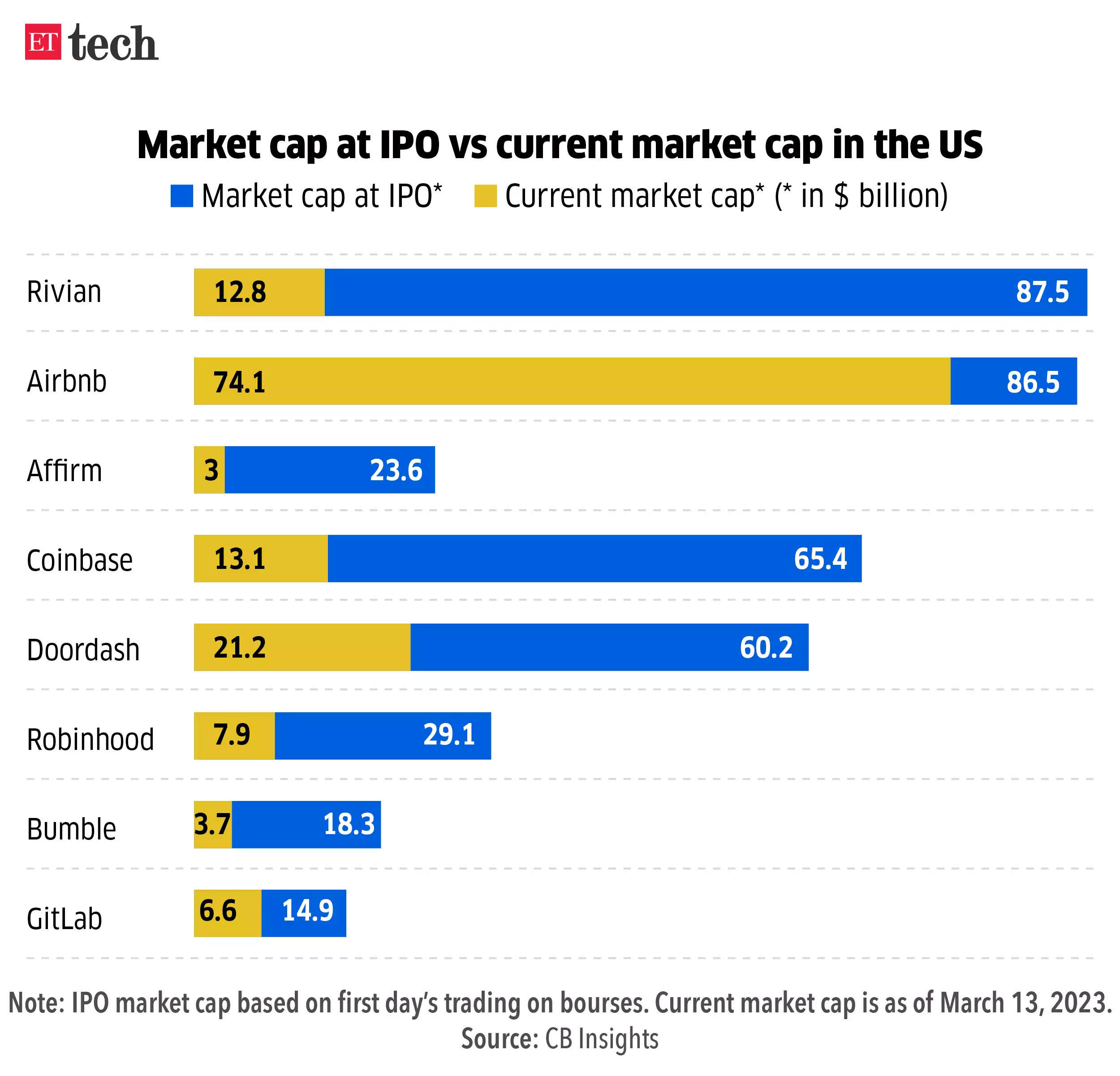

Market cap of tech companies sees steep fall since listing

The combined market cap of the 50 largest US tech company IPOs since 2020 has dropped 59% since the day they were listed, per data from market research firm CB Insights.

Big picture: This trend is not driven by a handful of companies. According to data, 18 of the top 20 tech companies that were listed in 2020, currently trade lower than their IPO price by a significant margin. That means 90% of the tech IPOs in 2020 are below their offer price.

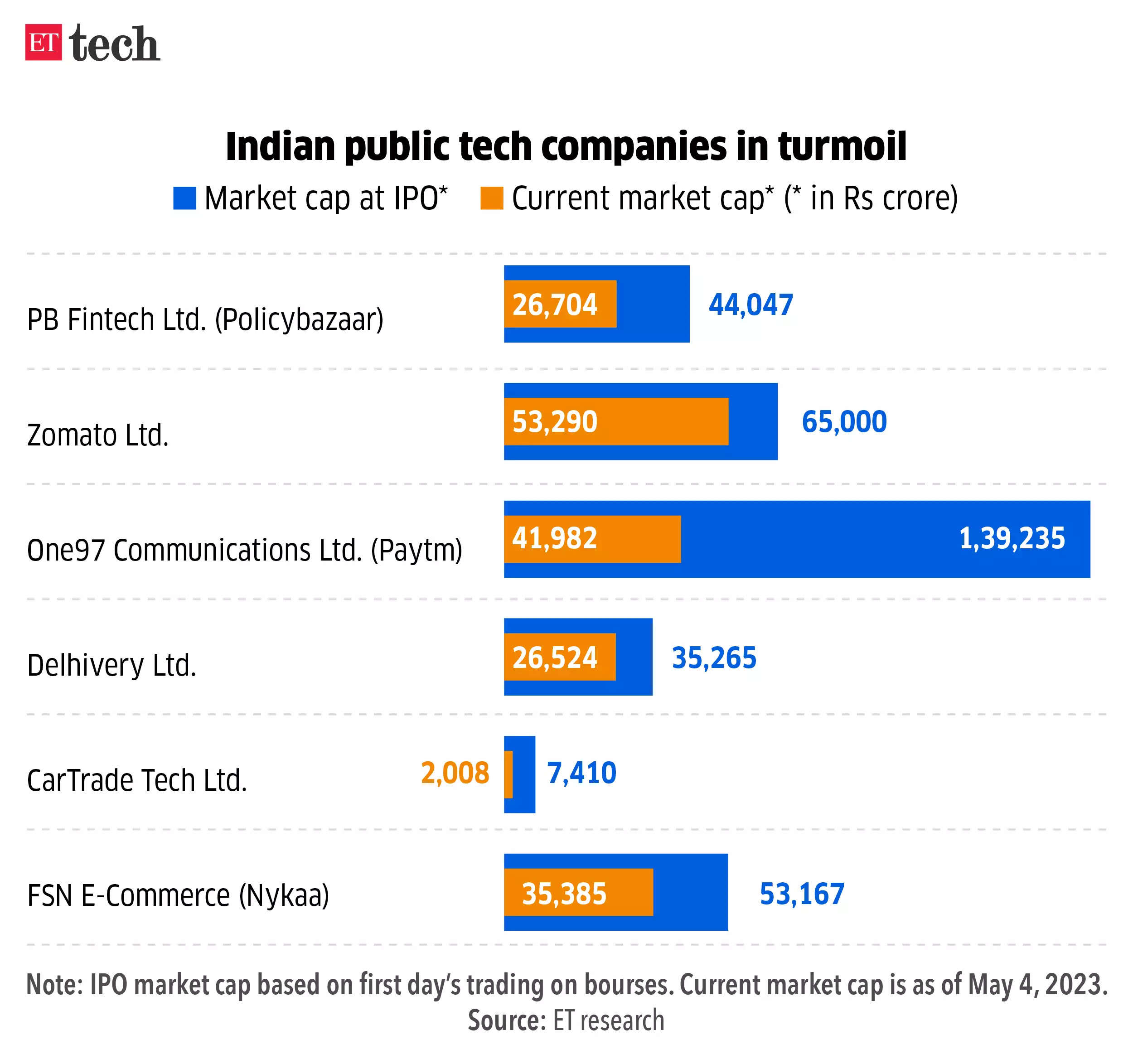

Indian public tech: Indian new-age tech startups, too, saw significant erosion in their market capitalisation since going public over the last two years. Paytm-parent One 97 Communications has seen the biggest drop, as its mcap has fallen nearly 70% from Rs 1.4 lakh crore to Rs 41,982 crore. Zomato and Nykaa saw their mcap plummet to Rs 35,385 crore and Rs 53,290 crore, respectively.

In charts | More Indians willing to spend on online gaming: EY survey

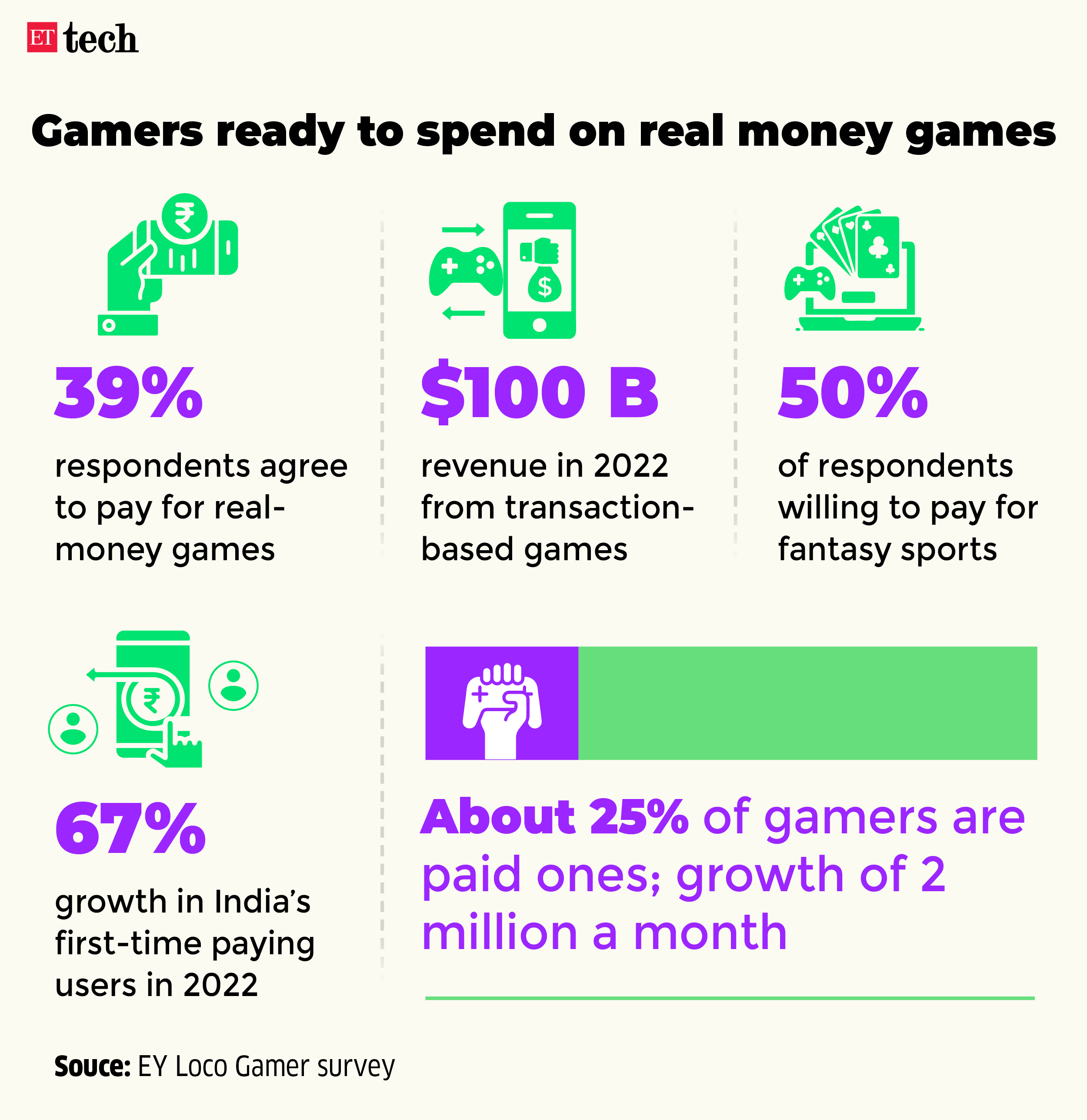

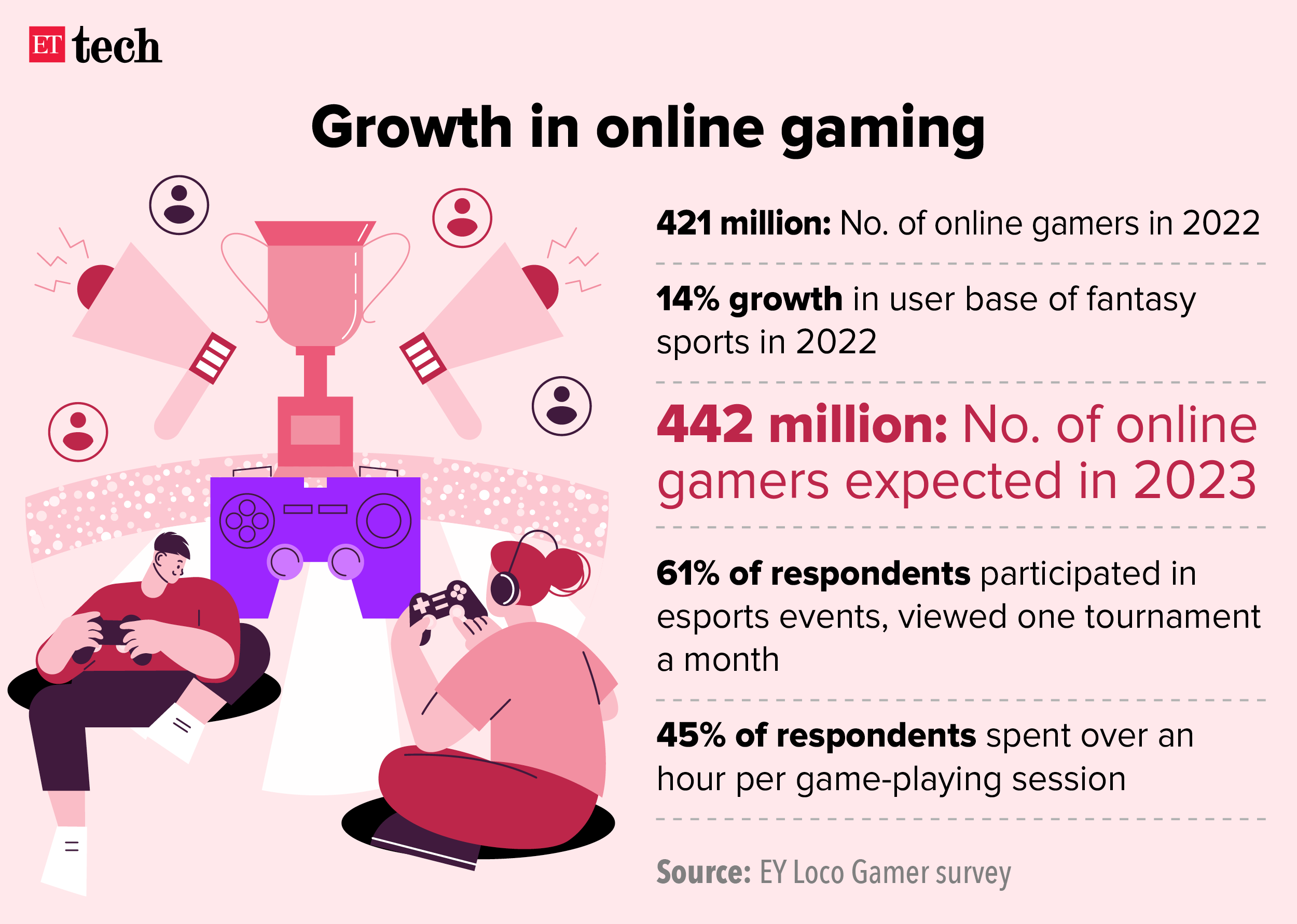

As a testament to the changing attitude of Indians towards gaming, two-thirds of the 13,000 respondents of the EY Loco Gamer survey said they were willing to pay for a gaming subscription. Half of the respondents said they were okay with paying for in-app purchases.

Real money, real winner: As many as 39% of those surveyed said they were willing to pay for real money games, while half of them were okay paying for fantasy games. Transaction-based game revenues increased by 39% in 2022, crossing Rs 10,000-crore mark, from 2021, when they had grown 27%.

Other Top Stories by Our Reporters

Delhivery chief compliance officer resigns: Ecommerce-focussed logistics company Delhivery’s chief compliance officer and company secretary Sunil Kumar Bansal has resigned, the company said in a stock exchange filing.

Ola Electric, Ather say they will reimburse charger amount to all eligible customers: Electric vehicle maker Ola Electric said that it will reimburse the amount it had collected from customers for chargers.

Global Picks We are Reading

■ Africa’s role in the global AI race is more prominent than you know (Rest of World)

■ LinkedIn Turns 20. Its Next Career Move: A Big AI Push (Wired)

■ Social-Media Shopping Scams Are Growing. Young Adults Are the Targets (WSJ)

Graphics & illustrations by Rahul Awasthi

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.