Byju’s sighs, in relief; Prosus writes off ZestMoney investment; and BGMI’s India return

Also in this letter:

■ NPCI shutters unregulated co-branding deals of PPIs

■ TCS clarifies about jobs scandal

■ Prosus reports 80% jump in Swiggy’s loss

Relief for Byju’s as US court rejects TLB lenders’ plea

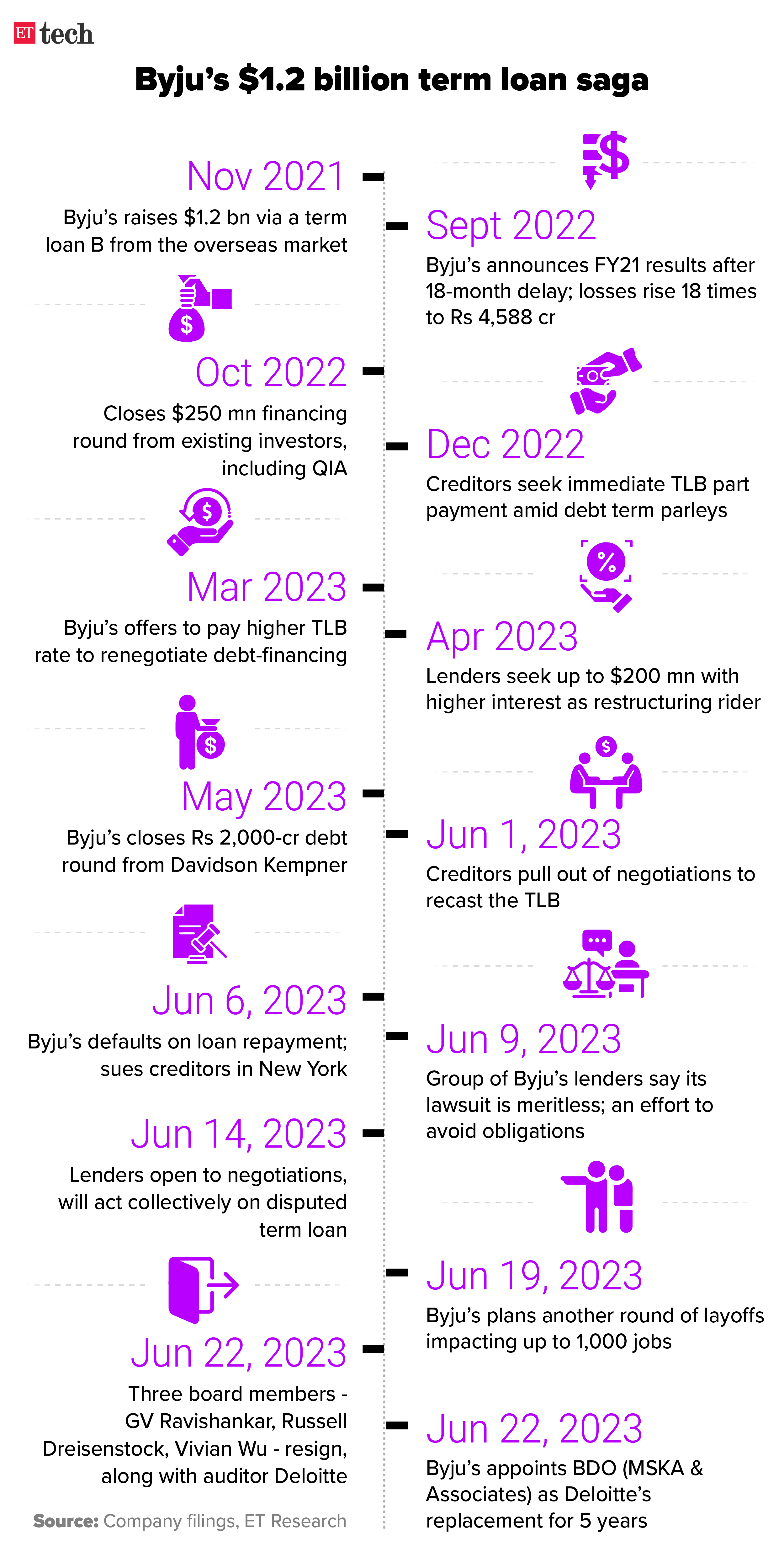

Bringing some relief to beleaguered edtech giant Byju’s, a Delaware court rejected a request by its Term Loan B lenders to investigate a $500-million transfer from US-based Byju’s Alpha to other entities. Byju’s has been trying to assuage investors about its financial situation after a string of high-level exits from the company’s board last week.

The argument: During the hearing, the counsel representing the defendants submitted that details of three bank accounts that the company uses has already been provided. Meanwhile, the lenders contended that the $500-million transfer was moot in determining whether an “event of default” had occurred.

Catch up quick: The lenders had filed a suit against Byju’s Alpha for moving $500 million out of the company. They said that because Byju’s had defaulted on its loan repayment, they have the right to put their representative, Timothy R Pohl, in charge of Byju’s Alpha. However, the edtech giant refuted the allegations.

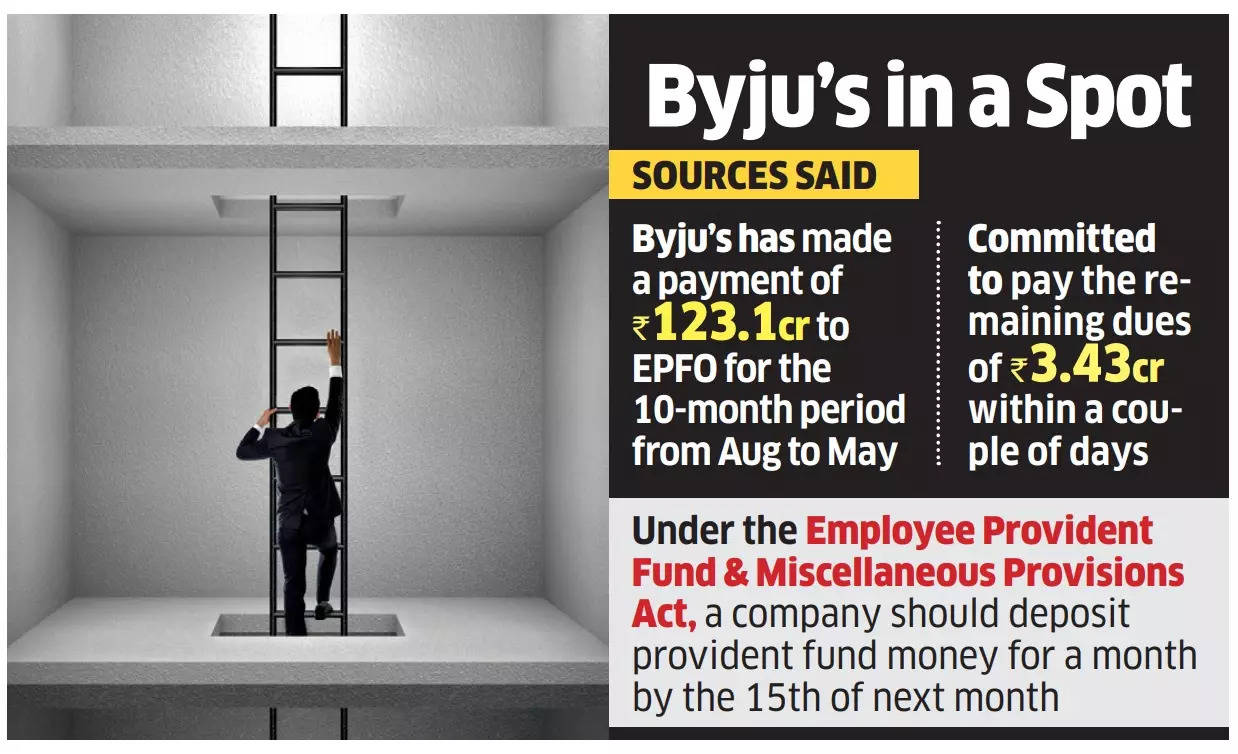

PF dues: Byju’s has remitted unpaid provident fund dues of its employees to the tune of Rs 123 crore to the Employees’ Provident Fund Organisation (EPFO), with some amount yet to be paid, sources told ET.

However, a legal representative of Byju’s told ET in a statement, “Byju’s has no pending PF dues. The complete amount visible on the PF portal has been paid. Please note that if there is any amount that’s not reflecting on the portal, that’s because of technical or authentication issues (of the portal). That should not be construed as the company’s pending dues.”

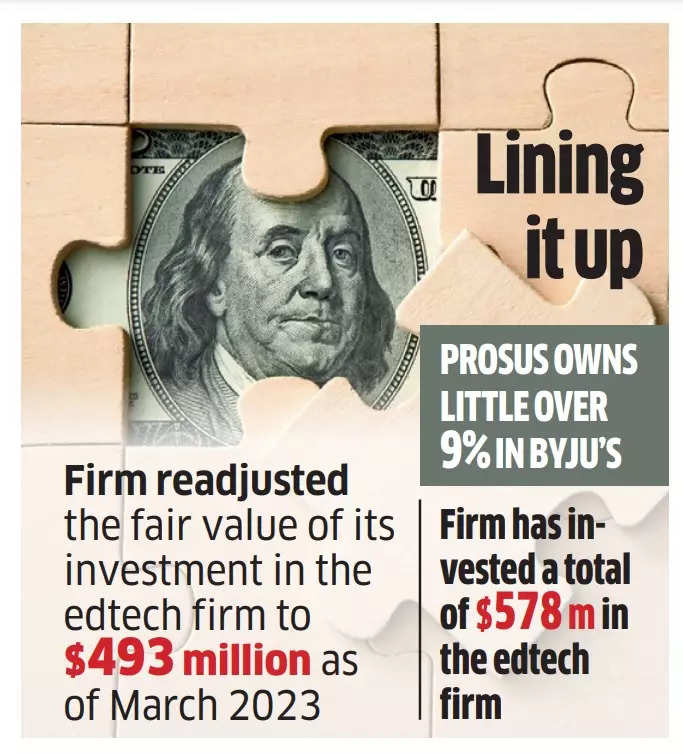

Markdowns continue: Prosus, a prominent technology investor in India, has marked down the fair market value (FMV) of its stake in the company. The latest adjustment would trim Byju’s valuation to about $5.1 billion.

Also read | BlackRock marks down Byju’s valuation again to $8.2 billion

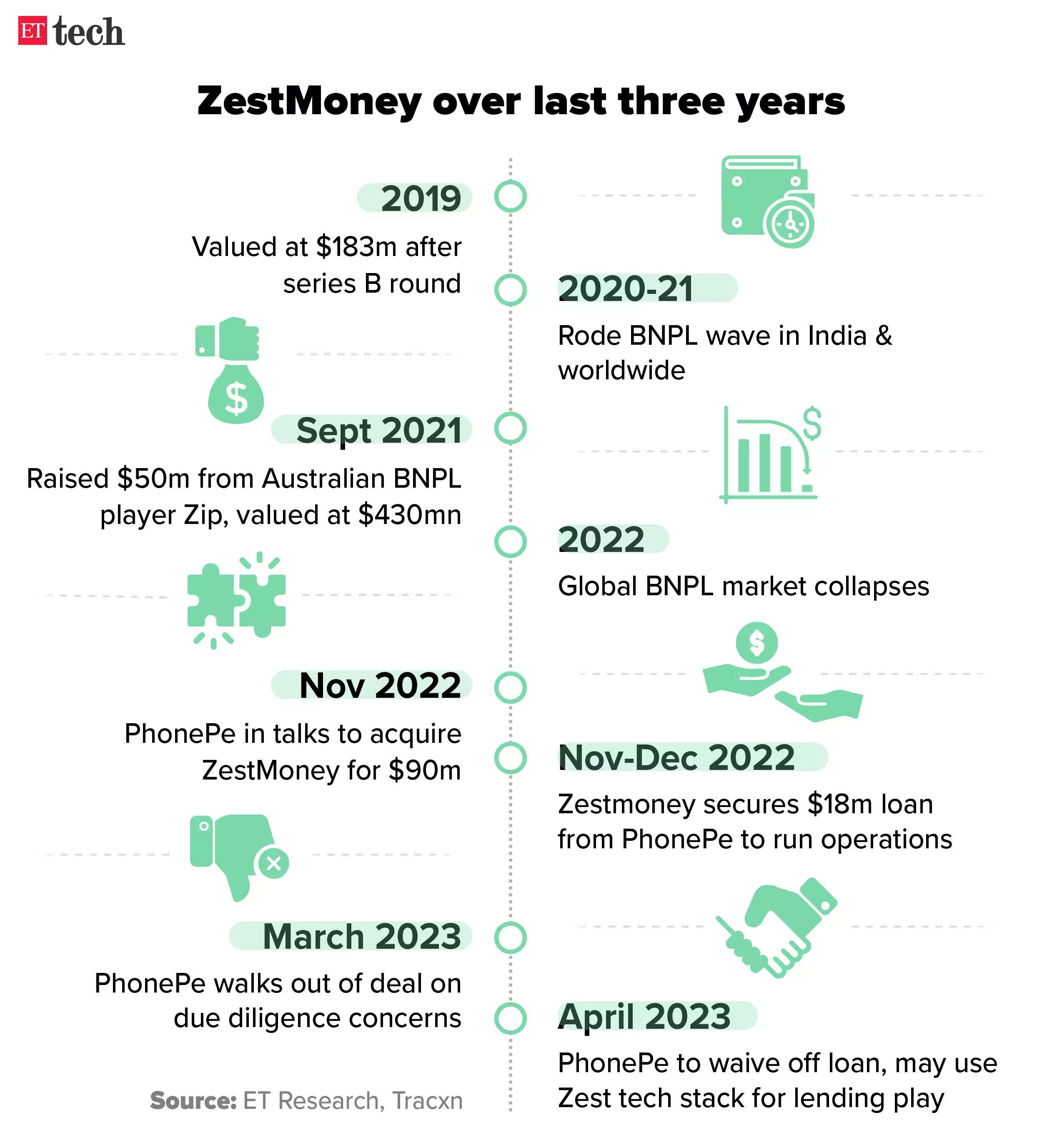

Prosus writes off ZestMoney investment

ZestMoney founders Priya Sharma, Ashish Anantharaman and Lizzie Chapman

Prosus has marked its investment in troubled buy-now-pay-later startup ZestMoney to zero as against $38 million FY22, disclosures made in the Netherlands-based technology investor’s annual report show.

Quote unquote: When contacted, Mandar Satpute, chief banking officer of ZestMoney, said, “Our shareholders and investors continue to remain positive about the business and fund us to profitability and onward. We continue to work with PayU (owned by Prosus) on multiple fronts… We cannot comment on their reasons. It is their prerogative.”

Satpute was one of the leaders appointed to take charge of ZestMoney after the founders stepped back from their operating roles.

Catch up quick: ZestMoney was in talks with PhonePe for an acquisition, but the deal fell through due to concerns over diligence, as reported first by ET. After the deal fell through, PhonePe decided to forgo an $18 million loan it had handed out to the cash-strapped ZestMoney in lieu of a commercial agreement with the lending firm.

Game on: Krafton’s BGMI return revs up Indian esports

The return of the popular online game Battlegrounds Mobile India has boosted optimism in the Indian esports sector, as tournament organisers and streaming platforms look to reap benefits.

Long wait: The government unblocked the game at the end of a 10-month block under section 69A of the IT Act. Though neither the government nor Krafton revealed the exact reasons behind the move, minister of state for information technology Rajeev Chandrasekhar, in a tweet about the game’s return, said that it had “complied with issues of server locations and data security”.

High on hope: The lifting of the block on a three-month trial basis in May has streaming platforms and tournament organisers alike projecting a bump in viewership and revenues. At the same time, professional BGMI teams are seeing their calendars fill up with tournaments and the opportunity to represent India abroad.

Boomtime blues: Industry executives, however, say the boost in viewership from the return of the game also points to the esports segment’s over-reliance on it. Firms in the ecosystem say they are trying to encourage diversification into other games like CounterStrike and Pokemon Unite, but it remains difficult.

TCS clarifies to the board about jobs scandal

Amid allegations of a recruitment scandal at TCS, the country’s largest software services company has written to its board members clarifying details about the issue, one of the directors told ET.

From the horse’s maw: “This is not an issue related to hiring of employees, it pertains to contractors of TCS. There are claims that the amount involved is Rs 100 crore, it is not even remotely close to it,” said the board member speaking off the record. “The company has written to all the directors and explained what is happening,” the person said.

What’s the matter? TCS was alerted about senior executives at the company’s RMG (Resource Management Group) division giving preferential treatment to some hiring firms.

The incident was discovered following a whistle-blower complaint towards the end of April or the first week of May, and the investigation is nearly complete, said another official aware of the development.

Deeper scrutiny: ET had reported on Monday that the number of firms under scrutiny could be higher, as the investigation is currently ongoing. The incident may also spark greater oversight of hiring processes at other IT firms.

Experts said corruption in recruitment could have gone up during 2021-22, when attrition rates hit record highs and there was accelerated demand for tech talent.

NPCI pulls up PPIs, shuts down unregulated co-branded wallets

The National Payments Corporation of India (NPCI) has asked all pre-paid payment instrument (PPI) issuers to stop allowing their wallets to be used on unregulated partner applications for Unified Payments Interface (UPI)-based transactions.

Driving the news: Per guidelines, PPI issuers are supposed to link only the wallets of their customers to their UPI handles. The users of other apps’ cannot be offered such services. However, some entities were taking a roundabout way to work with a partner (with a PPI licence) and offer UPI services to their customers, in some cases without undertaking a full KYC or obtaining a certificate from NPCI.

Halt!: NPCI, which runs the UPI platform, has directed PPI issuers to stop offering such services with immediate effect and close down such wallets by June 30, 2023.

Who will be hit? Dream11, Akudo, and Muvin were using PPI licences of other fintechs to launch UPI services, giving the sense of a ‘co-branding’ arrangement. Dream11’s case launched its mobile payments app DreamX in March this year in partnership with Pine Labs.

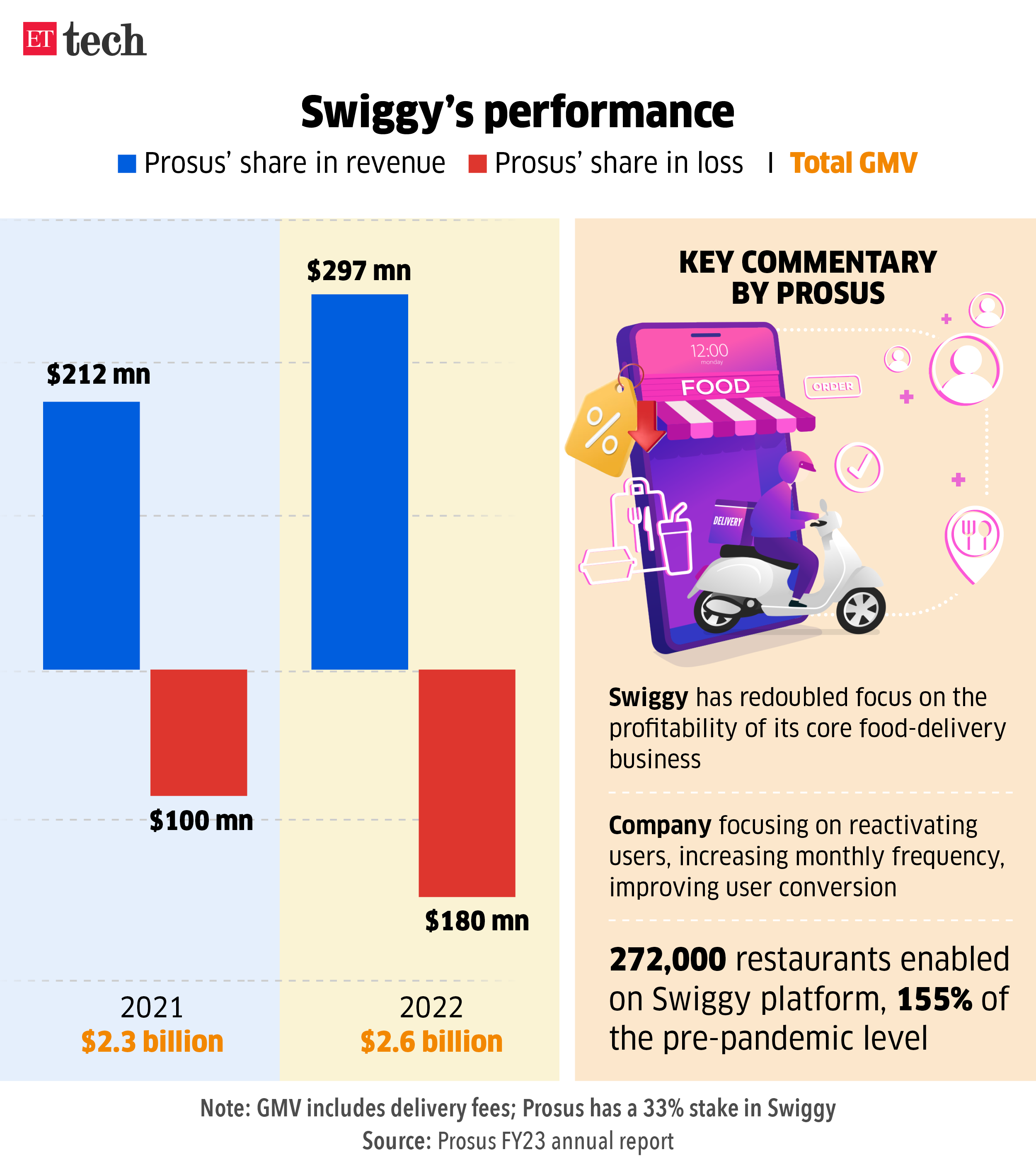

Prosus reports 80% jump in Swiggy’s loss, 26% growth in GMV

In the calendar year 2022, the expansion in Swiggy’s losses outpaced its topline growth. South African investor Prosus reported an 80% year-on-year (YoY) jump in the food delivery platform’s operating losses, while revenue grew 40%.

The numbers: Prosus’ share in Swiggy’s losses for the January-December 2022 period was $180 million, which translates to an overall loss of $540 million for the startup — Prosus owns 33% of the Bengaluru-based company. Similarly, the investor’s share in Swiggy’s topline was at $297 million. The incremental losses were mainly due to investments in the quick-commerce vertical Instamart.

Also read | Baron Capital slashes Swiggy’s valuation yet again to $6.38 billion

Slowing growth: As Swiggy took steps towards profitability, its growth slowed. Over the whole of 2022, Prosus reported YoY growth of 26% in gross merchandise value (GMV) for Swiggy’s food-delivery business, and a 5.5X jump in GMV for Instamart. The GMV growth recorded in the first six months of 2022 was 40% and 15X for food delivery and quick commerce, respectively.

Also read | Invesco slashes Swiggy’s valuation by 33% to $5.5 billion

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

ER&D demand keeps hiring robust despite larger tech slowdown

Demand from manufacturing and automotive industries for engineering research & development (ER&D) services is driving hiring within the technology sector, at a time when recruitment in the rest of the industry is subdued.

Data decoded: According to data from staffing services firm TeamLease, ER&D-related hiring has gone up by almost 60% over last year with strong demand from the global capability centres (GCC) of multinationals and the service providers here. The ER&D sector employs around 2 million people in India, suggest industry estimates.

India in focus: Snehil Gambhir, partner director — transformation, BCG India, said, “For a variety of reasons, companies are looking at India to build an alternative supply chain and delivery pool. There is an increasing desire to look at product design, including 3D modelling and advanced embedded software systems, to power electronics and imaging.”

Other Top Stories By Our Reporters

Kunal Shah’s NBFC ends 1st year with a small profit: Kunal Shah’s nonbanking finance company Newtap Finance has reported a small profit of Rs 5.6 crore in the first year of its operations, regulatory filings with the corporate affairs ministry show.

Pacts signed with US during PM’s visit to shape the future of tech, says MoS IT: The agreements signed between India and the US during Prime Minister Narendra Modi’s visit will shape the future of technologies such as OpenRAN wireless systems, semiconductors, and AI, MoS IT Rajeev Chandrasekhar said.

Salesforce India has grown in double digits’: US-headquartered CRM firm Salesforce has seen its India business grow in double digits, aid Salesforce India CEO Arundhati Bhattacharya.

Global Picks We Are Reading

■ Meet the Humans Trying to Keep Us Safe From AI (Wired)

■ Nigeria’s dating app for people who want to stop dating and get hitched already (Rest of World)

■ AI Promised to Make Jobs Easier. Workers Weren’t So Sure. (WSJ)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.