Byju’s defers payments for Aakash deal; Zomato sheds $1B market cap in two days

Credit: Giphy

Also in this letter:

■ Zomato market cap down nearly $1B in two days after Blinkit deal

■ Cert-in defers new cybersecurity rules by three months

■ Bertelsmann India raises $500 million for early-stage bets

Byju’s pushes back payments for billion-dollar Aakash deal

Byju’s sought a two-month extension from Blackstone and other shareholders of test-preparation provider Aakash Educational Services on payments that were due this week, Bloomberg reported on Tuesday, citing anonymous sources.

Blackstone and Aakash’s other shareholders agreed to the extension, the sources said.

‘No cash shortage’: Byju’s asked to push back the Aakash deal payments until late August because regulators are yet to clear the acquisition, said one of the sources, adding that it had nothing to do with cash shortages.

A Byju’s spokeswoman said the Aakash acquisition is “fully on track and all payments are expected to be completed by the agreed upon date i.e. August 2022”.

Yes, but: WhiteHat Jr, which Byju’s acquired in August 2020, has laid off around 300 employees in its latest attempt to cut costs. The majority of the sacked employees were in the code-teaching and sales teams.

“To realign with our business priorities, we are optimising our team to accelerate results and best position the business for long-term growth,” a spokesperson said.

WhiteHat Jr posted a total loss of Rs 1,690 crore for FY21, according to regulatory filings.

In May, 220 WhiteHat Jr employees had resigned as they were asked to join the office after two years of working from home.

Catch up quick: The edtech giant announced it had bought Aakash Educational Services for $950 million in April 2021. This made it Byju’s biggest acquisition ever, outstripping the $300 million it paid for WhiteHatJr ~the previous year. ~

Some sellers received partial payment in 2021, the people said. Blackstone, which owned 38% of Aakash, opted to defer payments due until this year, one of the people said. The shareholders were to be paid partly in cash and partly in Byju’s stock.

Voracious appetite: One of the world’s most valuable startups, Byju’s has expanded its business globally through acquisitions.

But the tech investing climate has changed radically in recent months as company valuations have plummeted. The number of startup deals and total funding raised have dropped to their lowest level since late 2020.

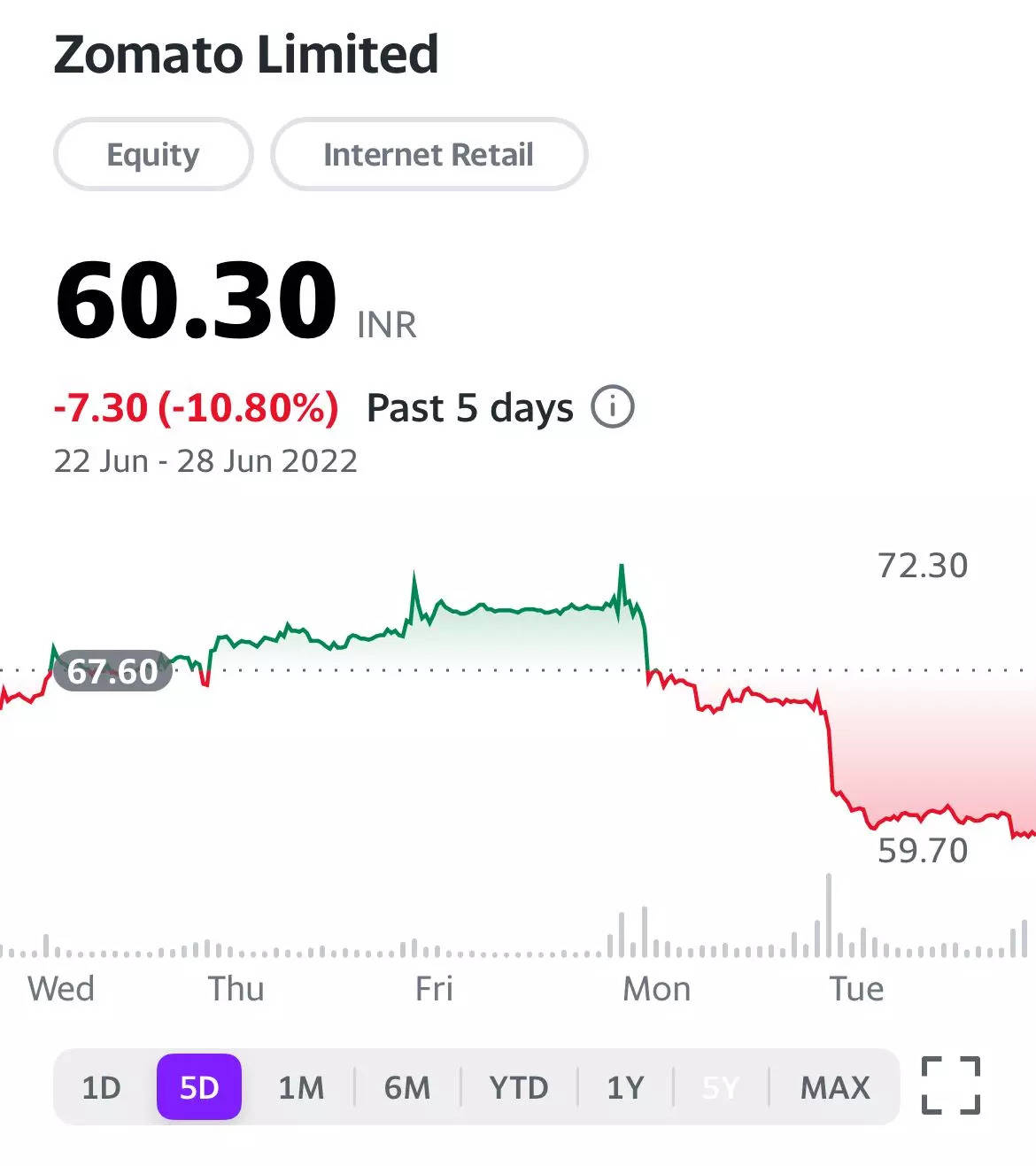

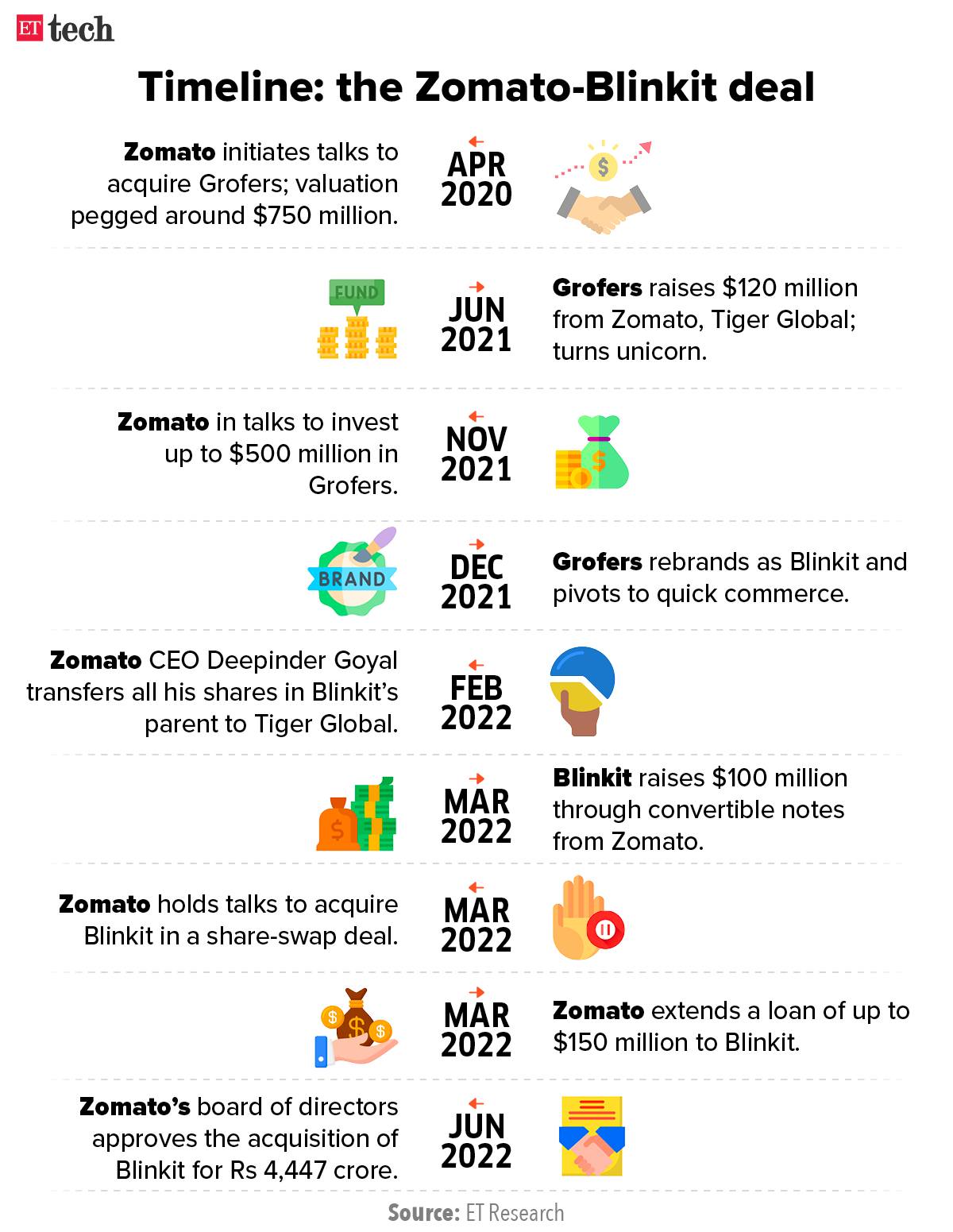

Zomato market cap down nearly $1 billion in two days after Blinkit deal

Shares of Zomato fell as much as 8.2% on Tuesday, extending losses for a second straight day as investors questioned its purchase of quick commerce startup Blinkit.

Zomato said on Friday it would acquire Blinkit for Rs 4,447 crore ($568.16 million) in stock as it tries to gain a foothold in the fiercely competitive quick delivery market.

Credit: Yahoo Finance

The company’s shares have fallen as much as 14% since then, shedding nearly $1 billion in market capitalisation. They are also down nearly 48% since going public last July.

The Blinkit deal came after Zomato bought a more than 9% stake in the SoftBank-backed firm for nearly Rs 518 crore in August 2021, and promised to invest as much as $400 million in the Indian quick-commerce market over the next two years.

Analysts weigh in: “We believe Blinkit will require investments beyond the $400 million envisaged by Zomato, given rising competitive intensity,” analysts at Kotak Institutional Equities wrote in a note.

Issuance of new shares by Zomato to Blinkit, including employee stock option pool, would amount to dilution of about 7.25% of total outstanding shares post acquisition basis, according to a Morgan Stanley client note.

“E-grocery economics have been tough to crack given price competition, relatively lower margin nature of the category, high number of products per order which need efficient fulfilment, and very high competition,” Kotak analysts said.

Stiff competition: India’s quick-commerce sector is growing at a rapid clip, with rivals Swiggy, Reliance-backed Dunzo, Tata-backed BigBasket and Zepto making big investments. The industry was worth $300 million last year and is expected to grow 10-15 times to $5 billion by 2025, according to research firm RedSeer.

Cert-in gives a three-month breather to VPN providers, small businesses

The Indian Computer Emergency Response Team (CERT-in) has given a three-month extension to VPN providers, small and medium businesses, and data centres to comply with its cybersecurity rules.

Issued on April 28, the rules were to come into effect today (June 28). They will now come into force on September 25.

Brief relief: Cert-In’s extension will come as a relief to small businesses, which had asked the government for more time to comply with the rules, which require them to report any data breach within six hours.

Meanwhile, VPN providers ExpressVPN, Surf Shark and NordVPN have already shut down their servers in India, refusing to comply with the new rules, which require them to store customer data for five years and hand it over to the government when asked to.

This marks the first time the government has made a concession on the issue, having said earlier that companies unwilling to adhere to the guidelines were free to leave India.

Tweet of the day

Bertelsmann India raises $500 million to make early-stage bets

Pankaj Makkar, managing director, Beretelsmann India Investments

Bertelsmann India Investments, the VC arm of the German media giant, Bertelsmann, has raised $500 million to back more early-stage Indian startups, its managing director, Pankaj Makkar, told us

Quote: “We will be writing larger cheques owing to the increased entry level-valuations. The larger pool gives us the ability to back portfolio firms longer,” Makkar said.

The company, which has invested in over 16 Indian startups, including unicorns Licious and Eruditius, plans to make six to eight additional investments each year.

Early-stage buzz: Amid a drop in large funding rounds, early-stage funding has become the flavour of the season among venture capital firms. We reported earlier that Seed and Series A investments had risen 88% and 22% year-on-year in this year’s January-March quarter. A few days ago, Sequoia’s accelerator programme Surge announced it’s raising the ceiling for its investments in seed-stage Indian startups.

Almost half of 5,532 ads ASCI reviewed in 2021-23 were digital

Digital ads comprised 48% the 5,532 ads processed by the Advertising Standards Council of India (ASCI) processed across print, digital, and television in 2021-22, according to its latest report, titled Complaints Insights 2021-22. In total ASCI processed 62% more ads than in the previous year, the report said.

Trouble spots: The report said 33% of the ads ASCI processed had to do with the education sector, followed by healthcare (16%), personal care (11%), crypto, gaming, and food & beverage (8% each). Of the total complaints processed, 1,593 were against influencers, mainly in categories such as crypto, personal care and fashion.

Risky apps: Meanwhile, a separate report from the security testing platform Appknox revealed that about 75 of India’s top 100 Android apps contain security risks. While about 79% were affected by network security misconfiguration, 78% lacked sufficient code obfuscation, it said.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.