Byju’s breaking bad: Will Indian startups feel the aftershocks, and other top stories this week

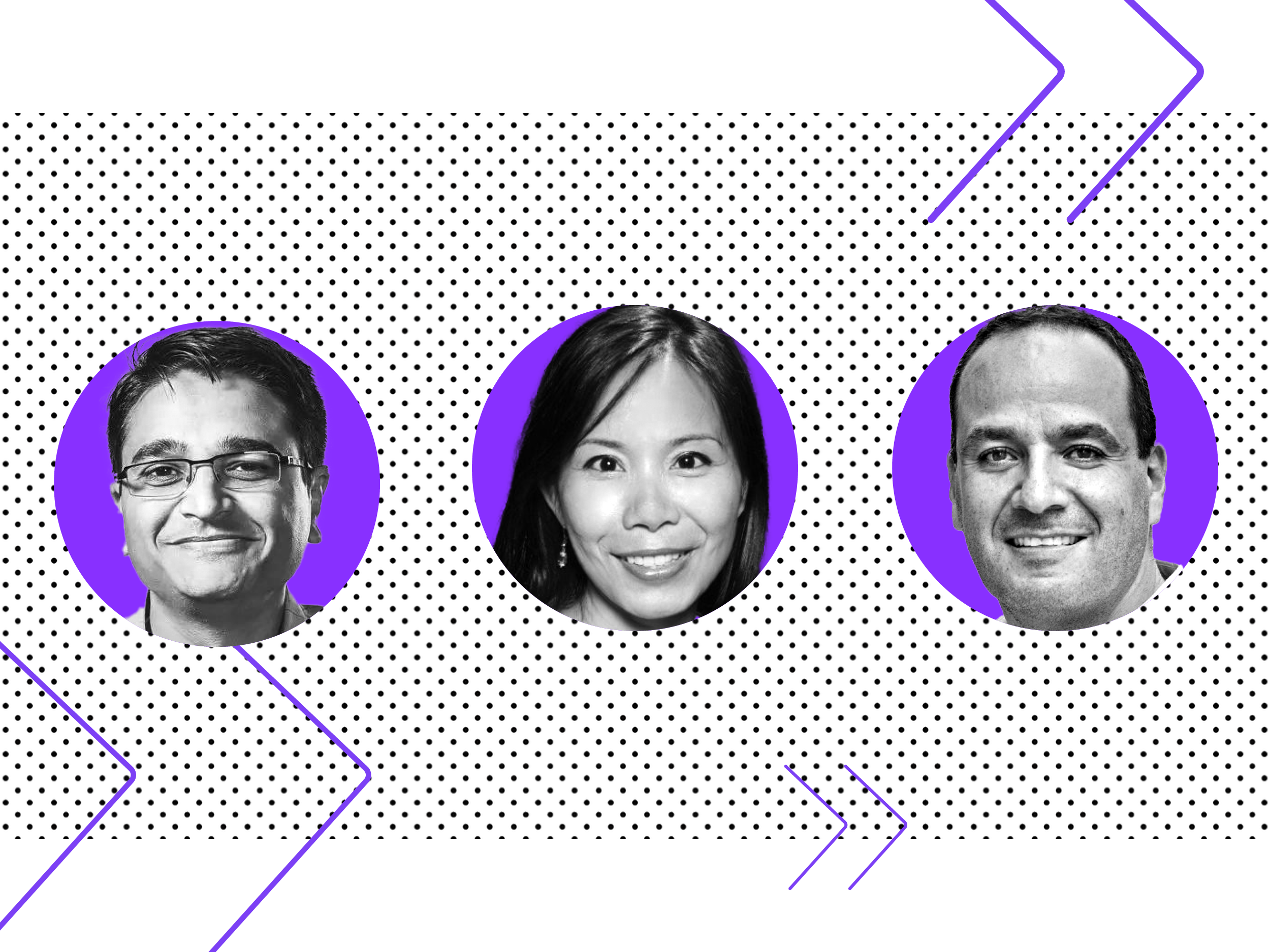

Late on Friday night, all three investors in Byju’s (Peak XV Partners, Prosus, and the Chan Zuckerberg Initiative), confirmed the resignations of their representatives — GV Ravishankar, Russell Dreisenstock, and Vivian Wu — from the Byju’s board, in separate statements.

“Are you really surprised?” an edtech founder said, implying that industry executives have seen this blow-up coming for a while. “This will have an impact on other startups, especially in the current market where money is tight,” the entrepreneur said.

(From left) GV Ravishankar, MD at Peak XV Partners (formerly Sequoia Capital India), Chan Zuckerberg Initiative’s Vivian Wu, and Russell Dreisenstock of Prosus (previously Naspers)

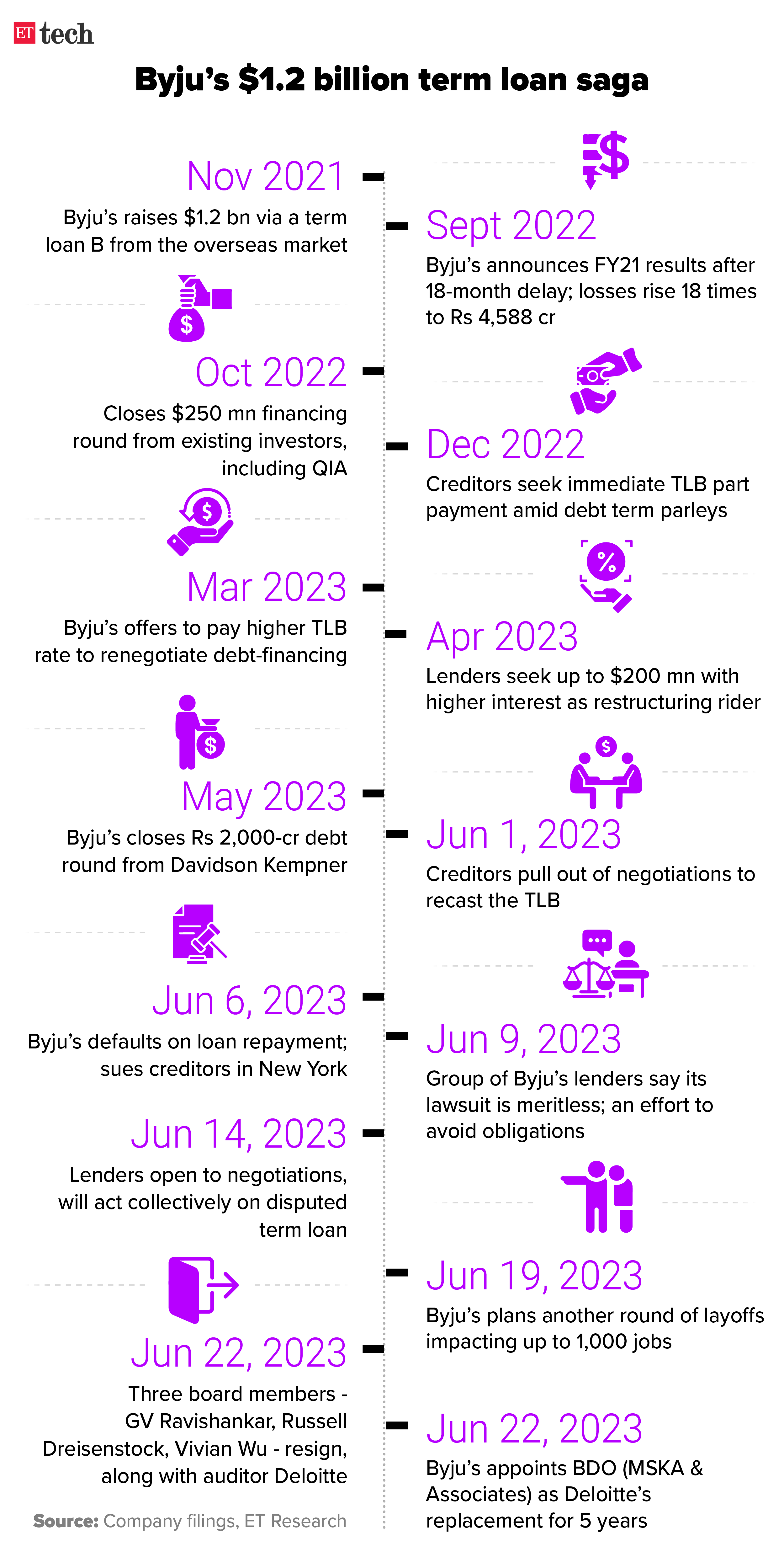

Byju’s has been hogging the headlines — for the wrong reasons — over the last one year. Much of this pertained to announcing its FY20-21 results after an 18-month delay, in September 2022.

Since then, Byju’s has been hit by a string of issues — a fight with its $1.2 billion term loan B (TLB) lenders, raids by the Enforcement Directorate (ED), the lack of a timeline for FY21-22 results, job cuts, verticals like coding unit Whitehat Jr. gasping for funds… the list goes on.

Byju’s is not just another well-funded startup known among investors, founders, and ‘power users’ of the Indian internet economy. The edtech firm is a household name — albeit one that’s much unloved due to alleged mis-selling of courses. ETtech had reported last July that the government had flagged a rising number of complaints against the edtech major at an industry meeting.

Hence, what happens to Byju’s hereon would be significant for the startup ecosystem, which is at a critical point right now with the ongoing liquidity squeeze and investors demanding profitable growth along with sound corporate governance.

Also read | ETtech Deep Dive: inside the changing VC deal terms as easy startup funding era ends

“It is bound to make big-ticket global investors wary of India. If the most-valued startup doesn’t come clean on financials, funding, debt agreements — it raises a red flag for anyone who may be considering investing here. Given the fact that an auditor like Deloitte has resigned and there is no clarity on when the FY21-22 financial statements will be audited, marquee investors will go slow in backing new assets — even if they don’t have any corporate governance issues. Everything will be scrutinised with an additional layer of checks,” said an entrepreneur who runs a unicorn, a privately-held startup valued at $1 billion or more.

One of Byju’s’ competitors had told ETtech that he is worried that the government will start regulating the edtech sector after the serial shenanigans at Byju’s.

Also read | Byju’s and the debt trap haunting Indian tech startups

The Bengaluru-headquartered firm has always maintained that since it is the largest online education player in the country it will have more irate customers than others. “But that’s not how the government, the policymakers think. They see the biggest player and form an opinion about the rest as well. You don’t want this to become heavily regulated as in China, do you?” the competitor explained.

Several investors — who have previously explored investing in Byju’s — have flagged Byju Raveendran’s resistance to open the company’s books to investors before a potential deal. “That leaves little room for a new investor to see what’s happening in the firm before writing a cheque. Even existing investors have faced this issue,” one of the VCs told ETtech.

We had asked Raveendran about this last year. In an interview, he said at the time, “If somebody wants to put $10-20 million, we can’t let them do full due diligence and open all our books. All the investors who have led big rounds have done deep diligence — commercial, legal, and financial — multiple times. We don’t give such access to all investors as the same set of investors have backed five other similar companies.”

Investors continue to disagree with Raveendran on this.

Byju’s is at a pivotal point in its journey. Even as it continues to hold discussions with lenders to finalise the terms for its $1.2 billion TLB, or ink a potentially new funding deal which has been in the works for months — everyone will be watching with bated breath what happens to the most valued* startup of the country in the coming months. Or weeks. Or days.

*It was last valued at $22 billion when it raised $250 million from Qatar Investment Authority (QIA) last October.

Read our in-depth coverage of Byju’s week of woes

■ Peak XV, Prosus and Chan Zuckerberg confirm exit from Byju’s board

■ More trouble for Byju’s as three board members, auditor Deloitte resign

■ Byju appoints BDO (MSKA & Associates) as auditor after Deloitte Haskins resigns

■ Corporate affairs ministry ordered inspection of Byju’s last week

■ Byju’s and the debt trap haunting Indian tech startups

■ Byju’s begins another round of layoffs; to impact 500-1,000 employees

ETtech Exclusives

Tata Digital to rejig top deck, hires new CEO to steer Cliq: A reshuffle in the top ranks at Tata Digital, which runs Tata Group’s superapp Neu, is underway, multiple people aware of the development said.

Shivcharan Pulugurtha, chief strategy and business officer of Tata Neu, has left just a year after joining the firm, even as the Mumbai-based conglomerate has hired Gopal Asthana as chief executive of its fashion business Tata Cliq.

Read the exclusive story in full here

Squaring Off | Banks want their QR codes at merchant outlets: Quick response codes, or QR codes, have become an integral part of the Indian digital payments story mostly because of the push from non-banking apps like Paytm, PhonePe, and Google Pay. Now, a clutch of large banks are staking a claim to this space by deploying their own QR codes at merchant locations.

Read the exclusive story in full here

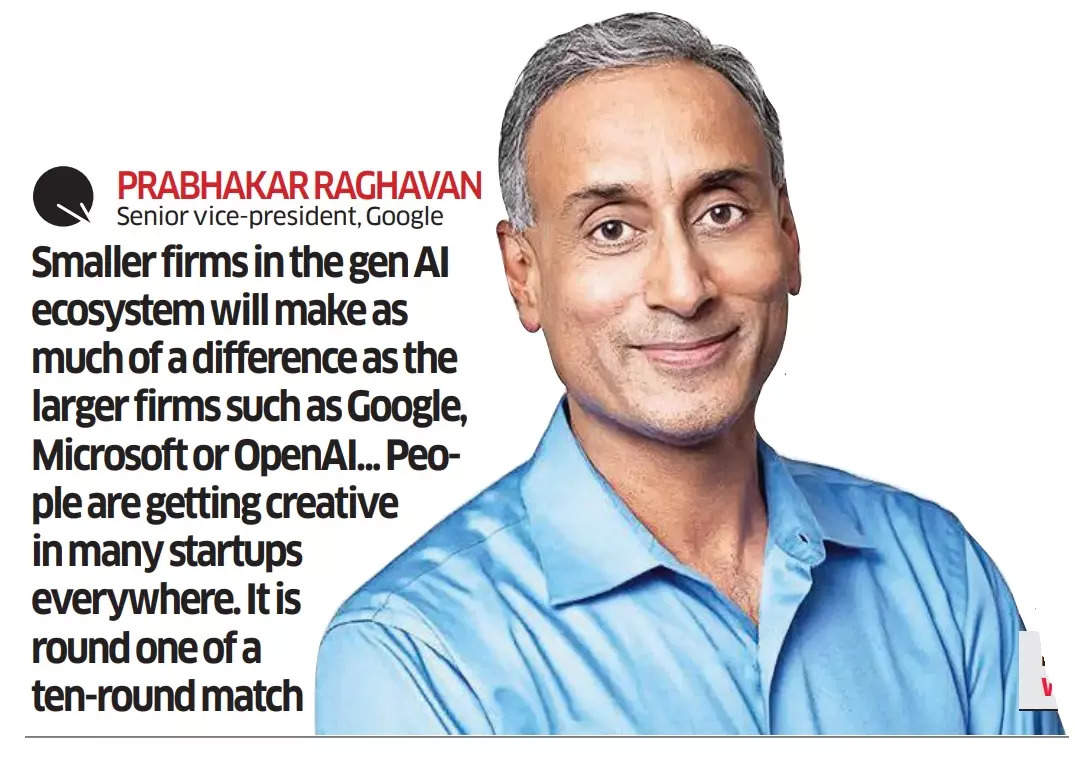

India’s a priority market for Google, excited by tech innovation here, says senior VP: Terming the demands for a “pause” in AI development as “uncalled for, as of now”, senior vice president of Google Prabhakar Raghavan said rules to govern AI should be “based on science and a deep understanding of the subject”.

He was voicing his opposition to calls for a blanket ban on the technology, which is taking the world by storm. He said the way ahead to develop artificial intelligence (AI) systems is to “engage with scientists and technologists who understand” the technology behind it.

Read the exclusive interview here

Startups oppose IAMAI submission on Digital Competition Bill: Over half a dozen companies including Paytm, Bharat Matrimony, Shaadi.com, Match Group (which owns Tinder), ShareChat, and Spotify have written to the Committee on Digital Competition Law (CDCL), saying they don’t agree with the apex internet industry association’s submission on the digital competition bill.

The Internet and Mobile Association of India (IAMAI) had submitted its views to the CDCL opposing the prescription of ex-ante regulations for digital companies, saying that they “may limit growth not only of the market in question but of the digital economy altogether”.

Read the exclusive story in full here

Also read | IAMAI members flag concerns surrounding ex-ante regulations

Mojocare Mess

Mojocare founders Rajat Gupta (Left) and Ashwin Swaminathan

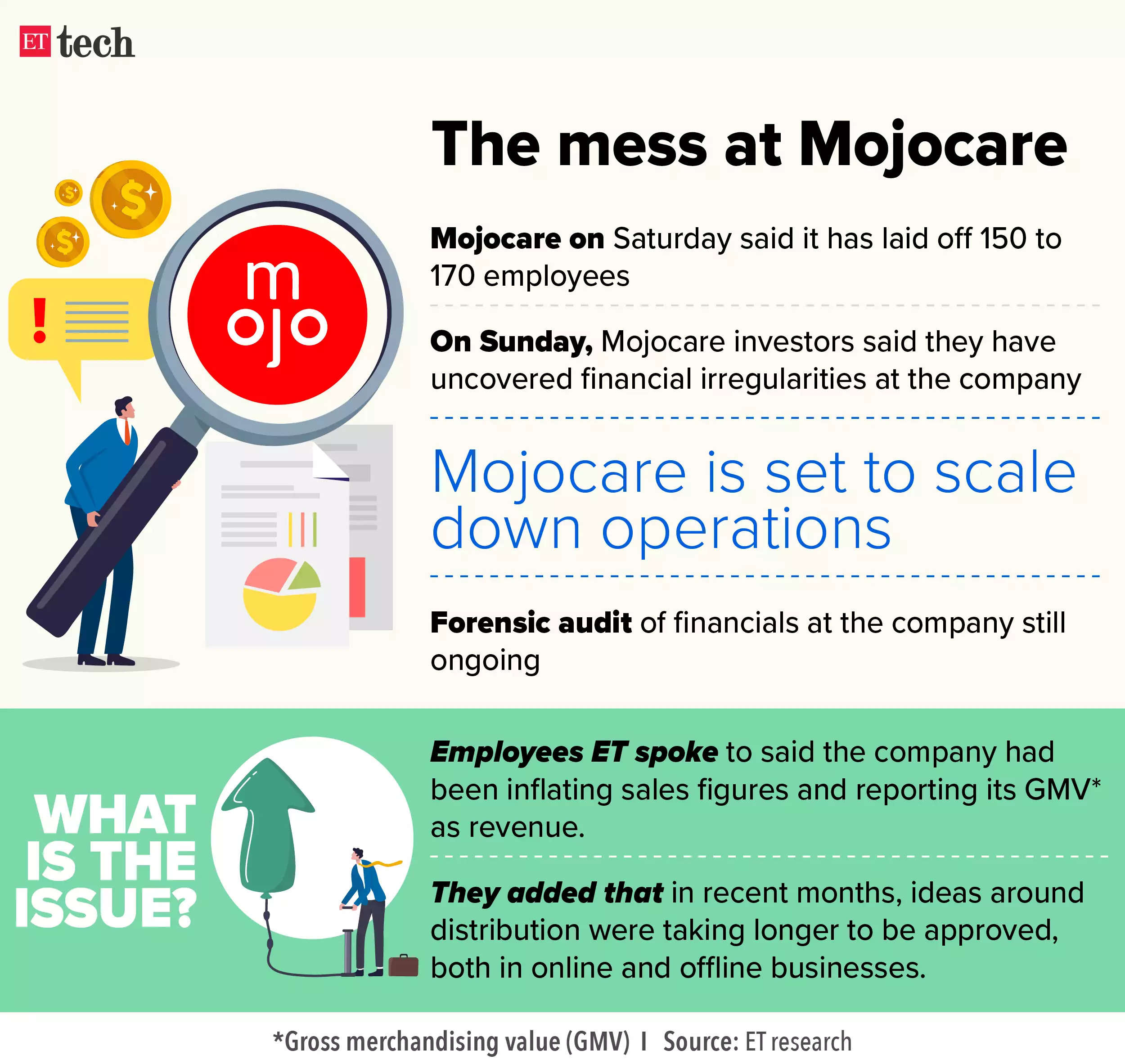

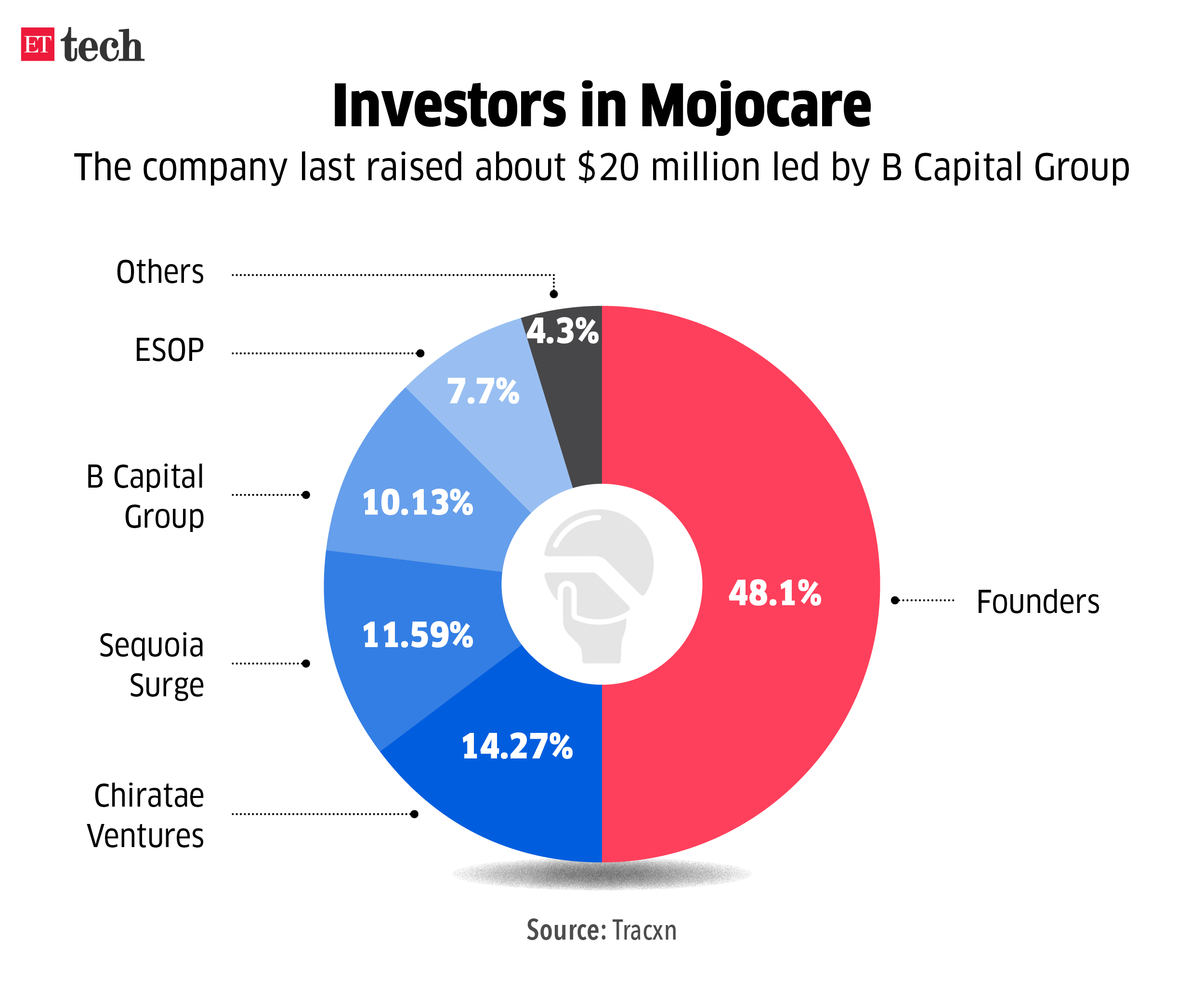

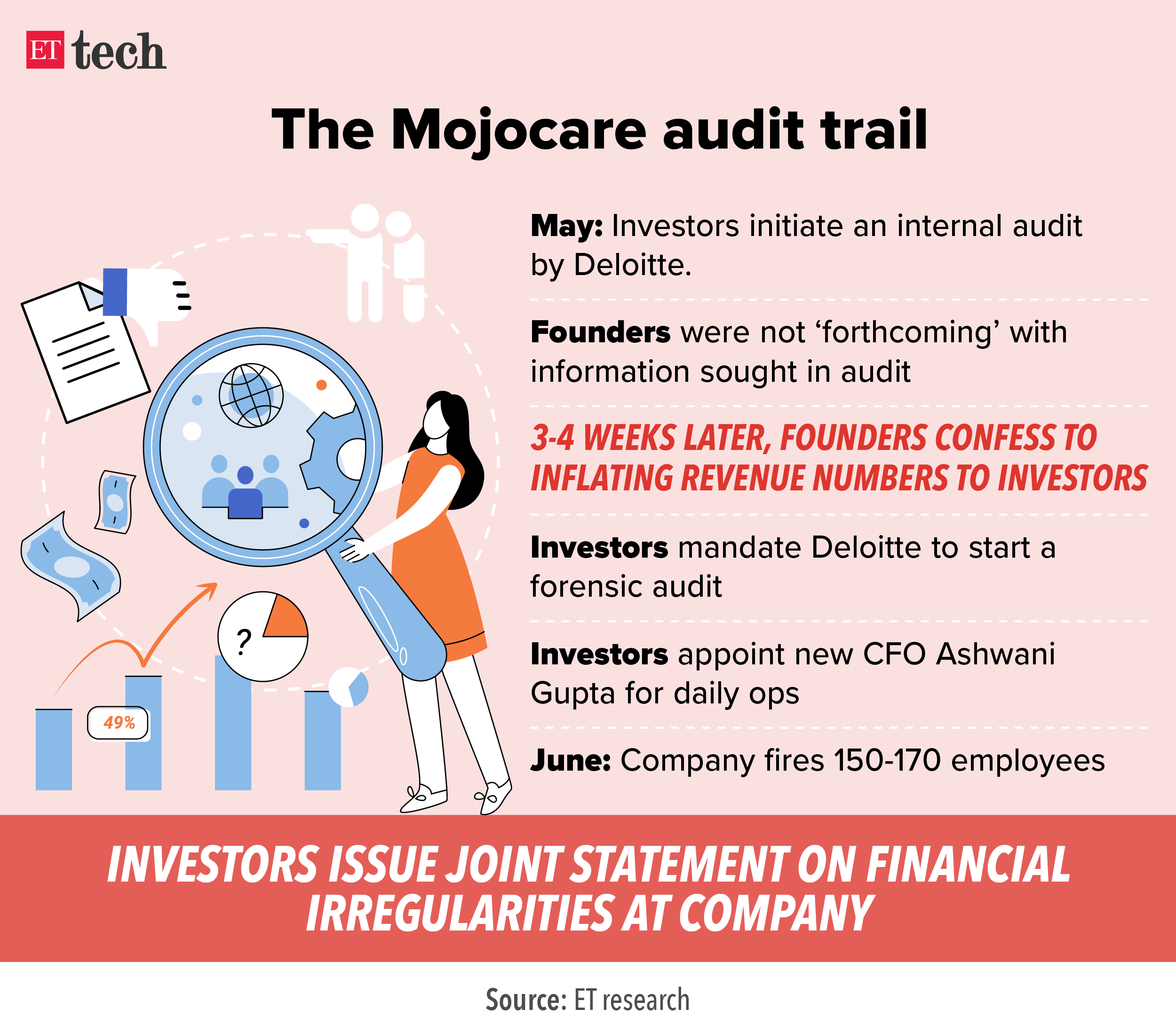

Financial irregularities found at healthcare startup Mojocare: Investors in Mojocare said a review of its financial statements has revealed irregularities and that the startup is scaling down operations and revisiting its business model.

In a joint statement, investors including Chiratae Ventures, B Capital, and Peak XV Partners (erstwhile Sequoia India), said they had initiated a forensic audit of the company’s financial statements.

Mojocare shareholders mull legal action against founders: A few shareholders of Mojocare are considering legal action against the healthcare and wellness startup’s founders, people aware of the discussions said.

Startup Corner

Startup audits in focus amid financial irregularities: Frequent corporate governance issues at Indian startups has led some of the leading accounting firms to initiate discussions with venture funds to audit their portfolio companies.

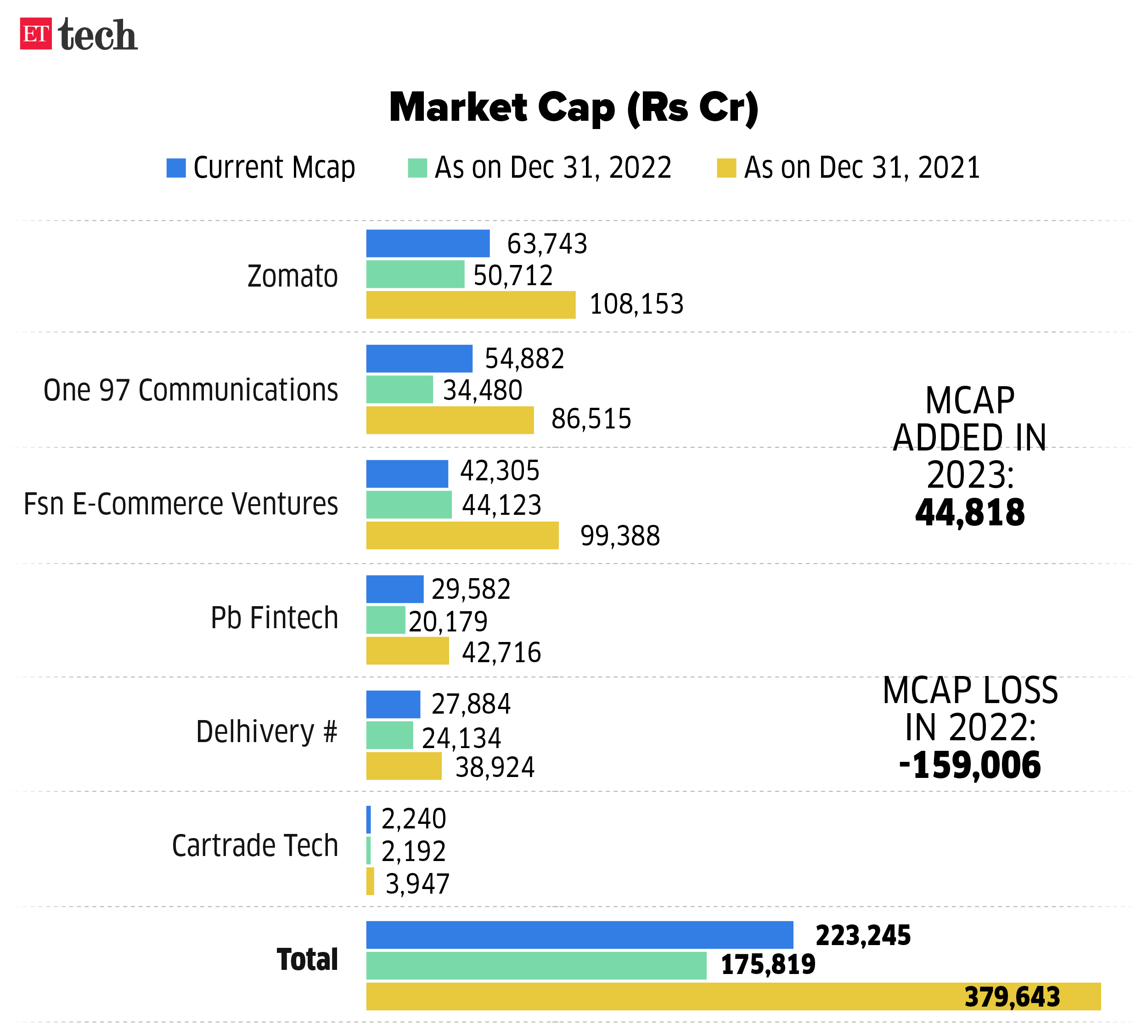

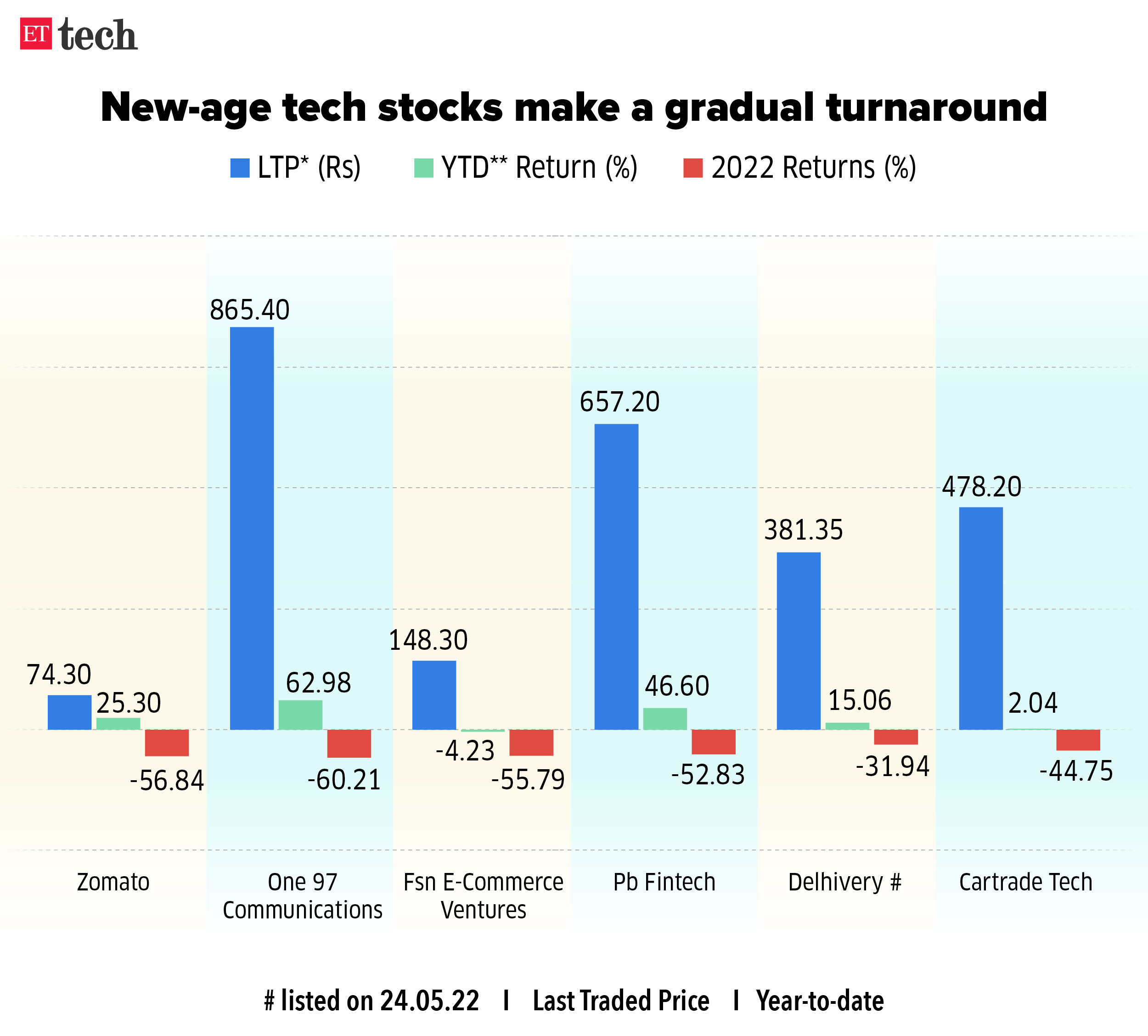

New-age tech stocks claw back a third of lost wealth: New-age tech companies Nykaa, Paytm, Zomato, Policybazaar, CarTrade and Delhivery have together regained nearly a third of the wealth investors in their shares had lost last year, thanks to their efforts towards profitability, reducing overheads, and rationalising the acquisition strategy.

These half a dozen stocks have gained almost Rs 45,000 crore in market value in 2023, after losing nearly Rs 1.59 lakh crore in 2022.

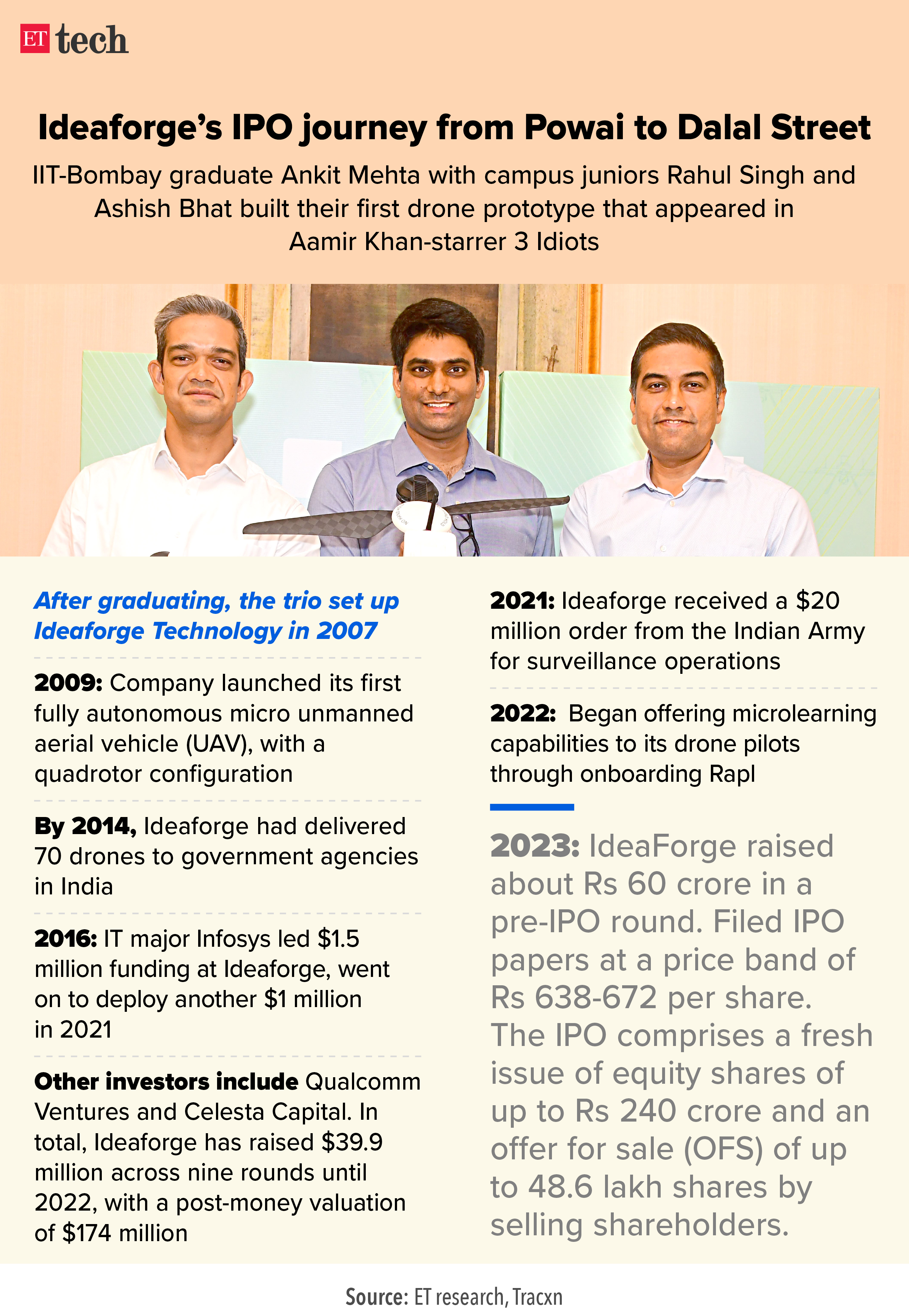

Ideaforge IPO expected to fuel drone startup’s flight: Drone manufacturer Ideaforge Technology Ltd on Wednesday fixed the price band for its initial public offering at Rs 638 to Rs 672 per share, aiming to raise between Rs 550.69 crore and Rs 567.24 crore.

PhonePe taps merchants in big lending push: Digital payments major PhonePe has jumped on the credit bandwagon with a foray into merchant lending. This comes on the heels of its aborted acquisition of fintech lending platform ZestMoney, which it had hoped to build up as a consumer lending vertical.

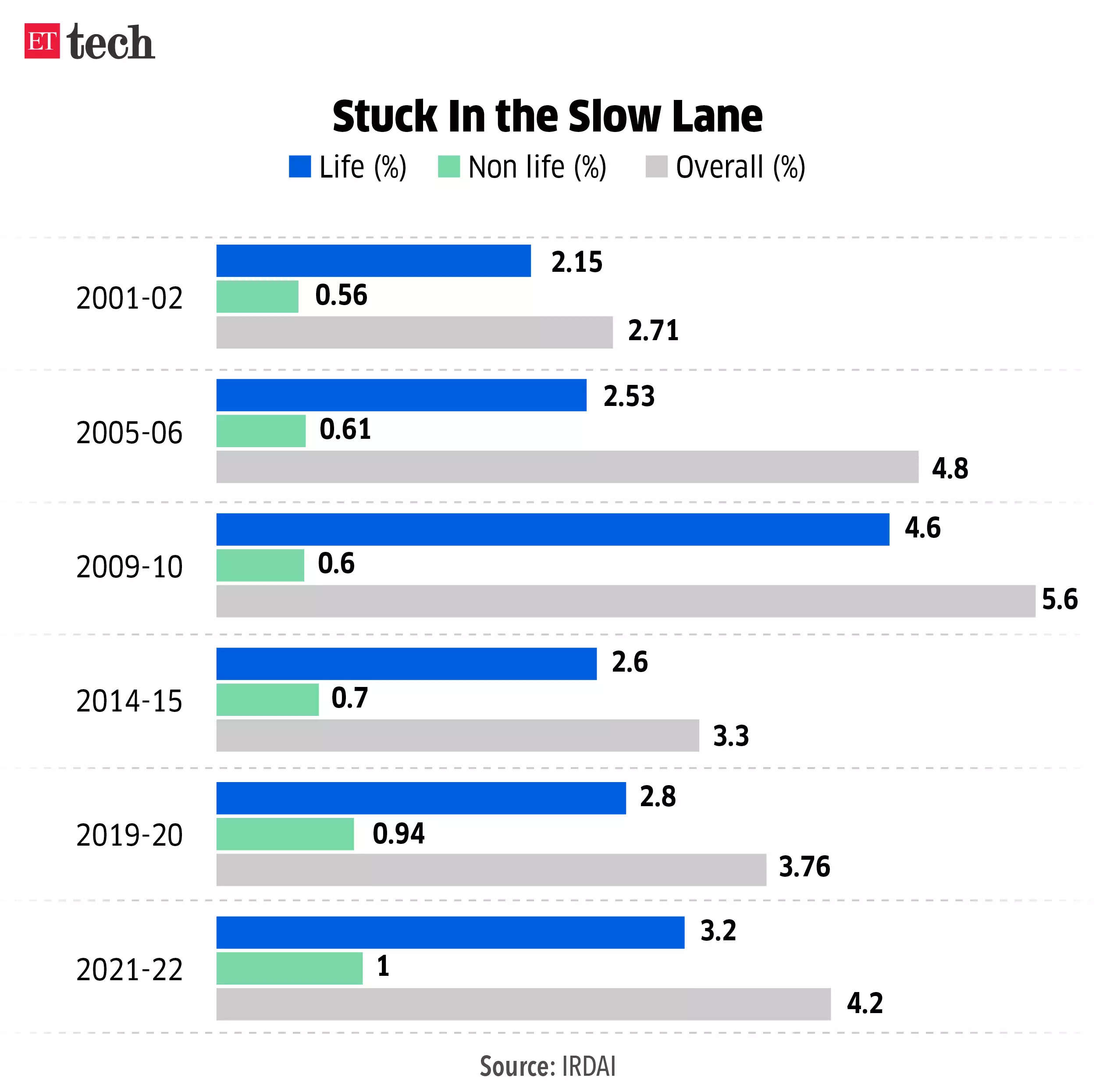

IRDA considering Managed General Agencies in insurance: The country’s insurance regulator is considering the feasibility of allowing managed general agencies, or MGAs, in the domestic market.

Venture Capital News

(From left) Lumikai’s founding general partners Justin Shriram Keeling and Salone Sehgal

Gaming-focused VC Lumikai unveils Fund II, eyes $50 million corpus: Indian gaming-focused venture capital fund Lumikai has launched its second fund targeting $50 million, for investments in pre-seed to Series A firms in the gaming and media sectors.

(From left) Karthik Reddy, cofounder and partner; Ashish Fafadia, partner; Sanjay Nath, co-founder and partner

Blume Ventures makes first close of $25 million for new opportunity fund: Early-stage venture capital firm Blume Ventures has made the first close of its new opportunity fund at Rs 200 crore (around $25 million), about half the final target that it expects to achieve by August.

Avaana Capital secures $70 million in first close for climate fund: Avaana Capital, a climate-focused venture capital firm, has secured commitments of $70 million for the first close of its Avaana Climate and Sustainability Fund.

ETtech Deals Digest

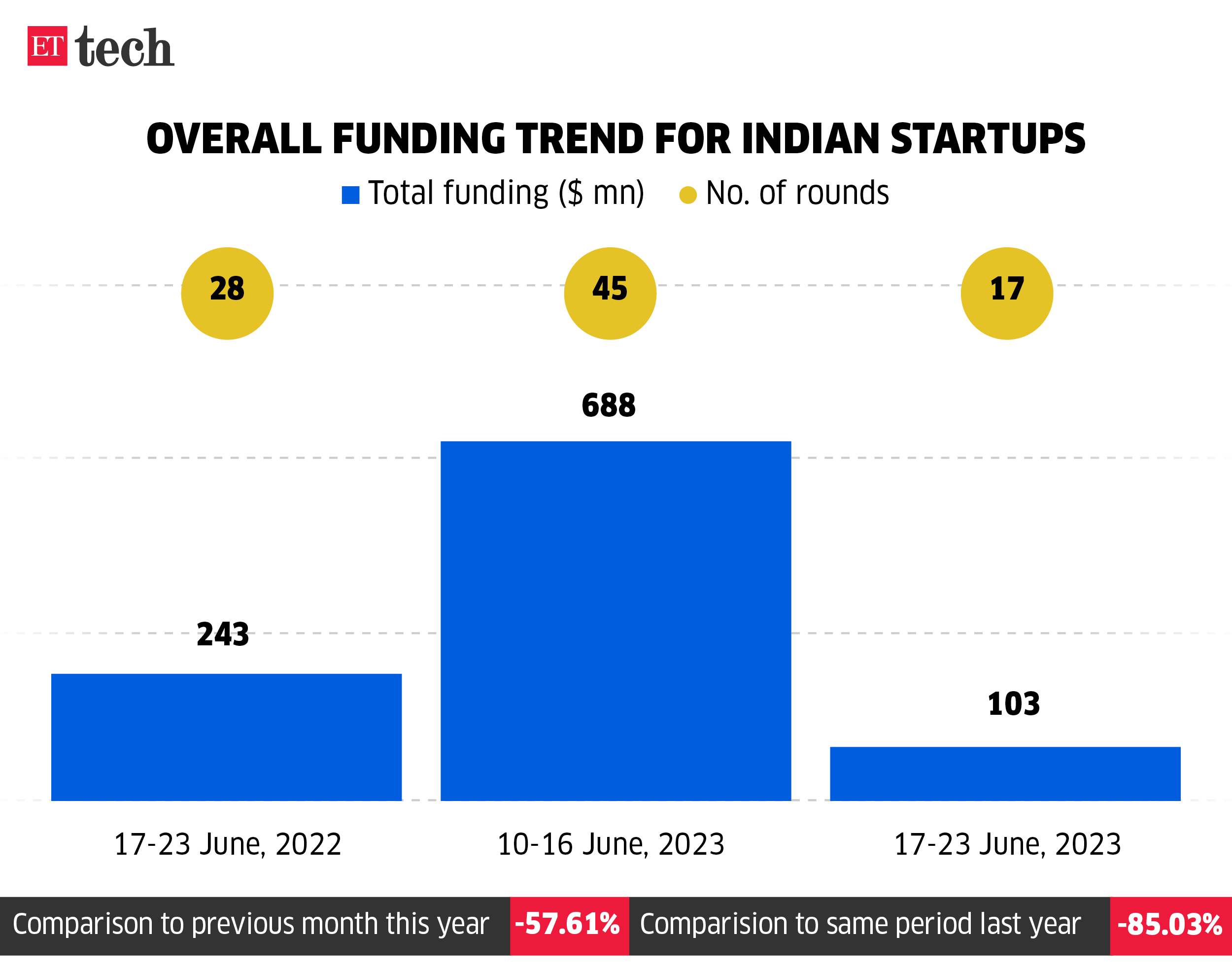

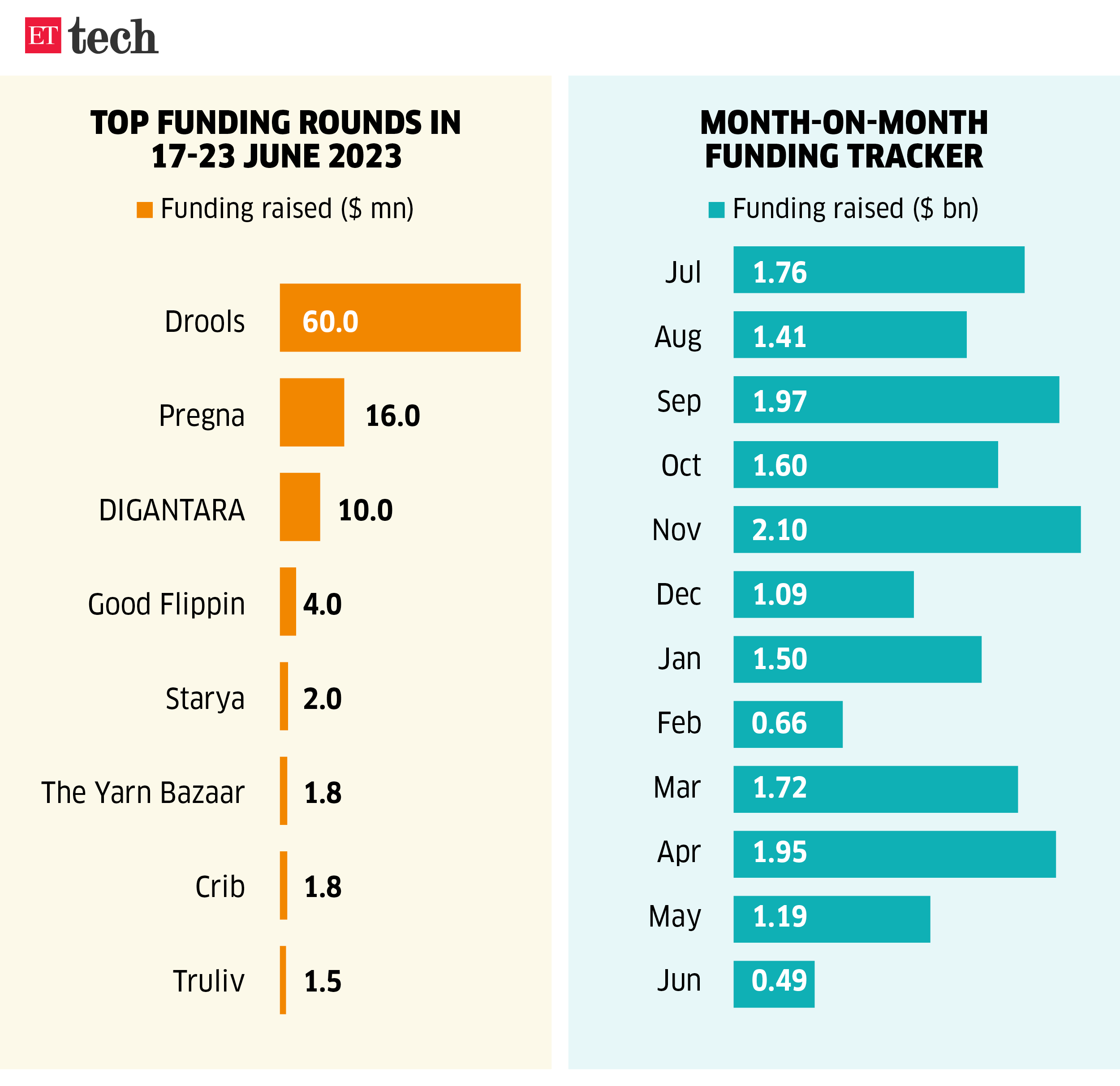

Startups raise $103 million this week as funding drought persists: Another week has gone by, and the funding drought persists across the Indian startup landscape, with new-age companies mopping up just $103 million across 17 rounds in the last seven days.

Sequentially, funding activity for Indian startups plunged 58%, against $243 million raised across 28 rounds last week.

Bengaluru-based pet food-maker Drools led the funding activity this week, scooping up $60 million from L Catterton, a private equity (PE) firm backed by Paris-based luxury products giant Moët Hennessy Louis Vuitton (LVMH) group.

Here’s a list of all startups that raised funds this week

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

IT & ITes

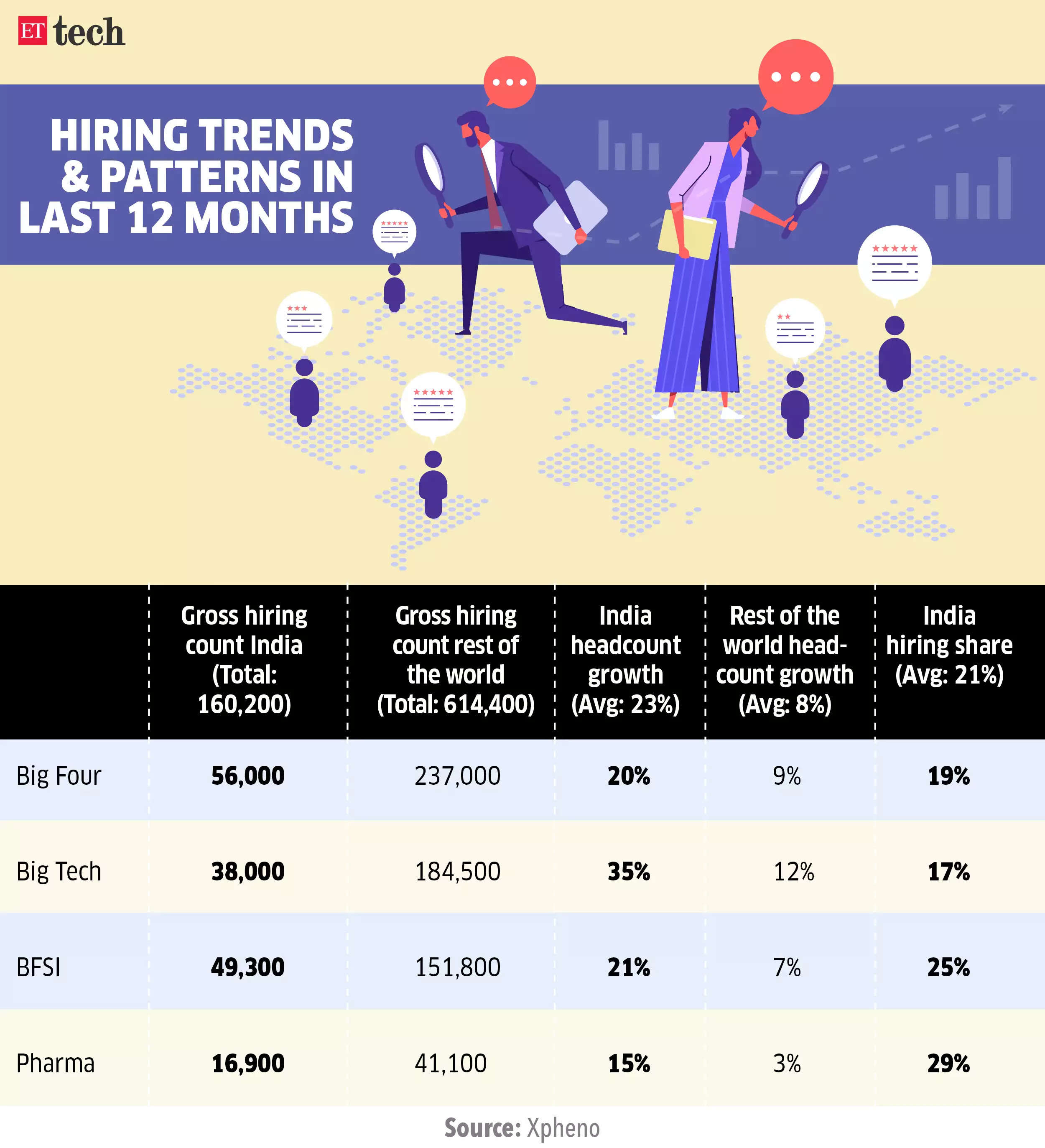

Outsourcing hubs like India to bag 40% of jobs lost to layoffs: Experts say that 30-40% of the more than 3,00,000 technology jobs lost to layoffs globally could move to outsourcing hubs like India in the coming months.

60,000 IT employees may be ‘impacted’ by generative AI: The use cases of generative artificial intelligence may impact the scope of work of close to 1% of India’s 5.4-million IT workforce, spread across sales and support employees, and create an additional revenue potential of $2-$3 billion for the industry, a new study has said.

Tech Policy

Govt weighs measures to penalise erring two-wheeler EV companies: The government is contemplating penalties for several electric scooter manufacturers found guilty of falsely claiming subsidies from the FAME II scheme.

CCI reviewing probe report on Apple’s App Store payments policy: The Competition Commission of India (CCI), led by its new chairperson, is currently examining the report of an investigation into Apple’s app store billing policies.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.