Binance hooks Indian crypto traders; Meity gets three SRO proposals for online gaming

Also in the letter:

■ Acko readies life insurance product

■ Green shoots appear in IT hiring

■ Micropayments: Internet’s ‘sachet’ moment

Indian crypto punters flock to Binance to trade using rupees

Binance, the world’s largest cryptocurrency exchange, is allowing users in India to trade using rupees — either by online fund transfers from domestic bank accounts, or using services like GPay, or even the physical delivery of cash.

Driving the news: Here’s a case where an overseas exchange is virtually matching local and offshore traders, though the payment is settled here in rupees. Binance is simply acting as a neutral third party, providing a kind of an ‘escrow’ facility for the transfer of crypto assets.

Binance holds the user’s cryptocurrency, and when the buyer and seller agree on a trade, the latter is given some time to move the money. Once the seller confirms, the assets are released.

Breaching rules? The transactions are learnt to have attracted the attention of regulators in India. Technically, though Binance may not be strictly breaking any Indian law, chances are that the local traders may be breaching rules on foreign exchange and money laundering.

Deeper details: A fortnight ago, the local cryptocurrency and digital assets industry shared a video with the Reserve Bank of India (RBI), demonstrating a crypto trade on Binance using an Indian digital wallet to make the payment in rupees.

The local crypto industry — stifled by high taxes and the absence of banking services fearing backlash from the RBI — hopes that the video would draw the regulator’s and the government’s attention to trades that mock the rules imposed by New Delhi and the central bank.

Also read | The unbooming of crypto boom

The video of the Binance trade was shared with RBI officials soon after the industry body Bharat Web3 Association requested the central bank to permit the resumption of UPI/payment services for the VDA (virtual digital asset) sector.

Quote, unquote: “Someone can sell crypto from a wallet opened with Binance. No one gets to know. No tax is paid, but trading goes on. Some of the trades are quite large’’, a trader told us.

Gamespotting: MeitY receives three applications for forming SROs

The ministry of electronics and information technology (MeitY) has received at least three proposals for the formation of independent self-regulatory organisations (SRO) for online gaming. The last of these was filed just before the July 6 deadline whooshed by.

Who’s who? The latest proposal to set up an SRO is from the Esports Players Welfare Association (EPWA), a non-profit organisation. It follows two others already submitted to the MeitY, one of which is by a grouping backed by two gaming industry associations, the E Gaming Federation (EGF) and the Federation of Indian Fantasy Sports (FIFS). The other submission was made by a self-regulator backed by the All India Gaming Federation (AIGF).

The guardians: Per the online gaming rules, the SRO will have to be set up as a legal entity under Section 8 of the Companies Act. Its members will include an individual with online gaming industry experience; another with experience in promoting the interests of gamers; an educationist; a mental health expert; an information and communication technology expert; a current or former member of an organisation dealing with child rights; a public policy, law enforcement, or public finance expert; and any other individual approved by the government.

The way ahead: An IT ministry official, who spoke on condition of anonymity, confirmed receiving the applications, and said that the government will soon take a call on whether these are in line with the new rules. “If an SRO is not notified in time, the rules provide for MeitY to step in and certify games as either permissible or non-permissible,” the official said.

In April, minister of state for electronics and information technology Rajeev Chandrasekhar had said that the government initially plans to notify only three SROs, and depending on their workload, it will consider notifying more at a later point.

Life insurance up for disruption as Acko readies product

Varun Dua, founder and CEO, Acko

India’s life insurance space is ready for a new player after nearly a decade as the startup Acko is preparing to launch its first product in the next two months. The last time a new life insurance company was licensed was in 2011.

New kid on the block: Bengaluru-based insurance startup Acko is in the final stages of launching its first life product in August or September. “It will be a pure term life product, aimed at customers comfortable buying products online,” said a person in the know. Acko has hired Amit Tiwari, an ex-Amazon India executive, to lead its life insurance business.

Easy peasy: Acko could be looking at a simple and easy-to-understand term insurance product where there is no money-back, just the sum assured in the event of an untimely death.

“The thinking at the company is simple: the future is online, the next generation of consumers will look for products online, and that is where Acko wants to be. Even if that means growth is slow, the management team at Acko is comfortable with a steady yet slower growth curve. But it intends to build a direct relationship with the customer’’, sources said.

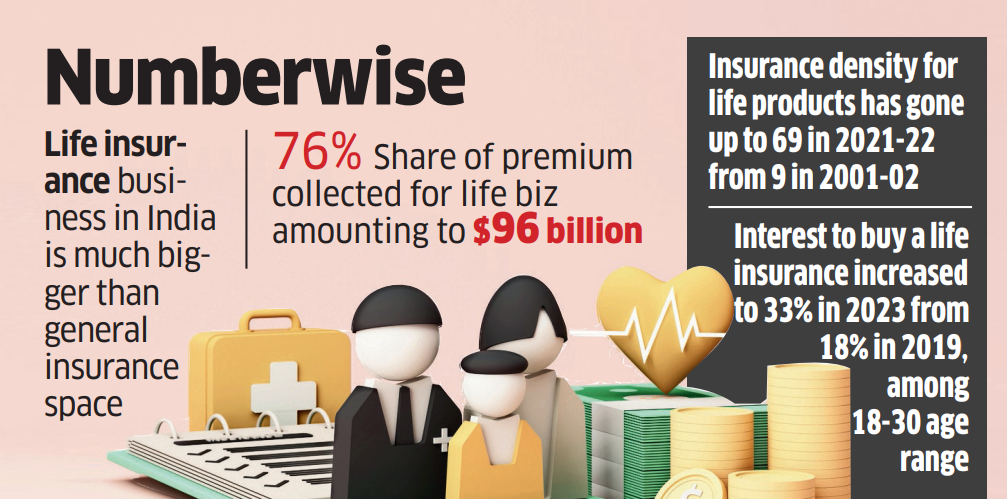

Waiting to be disrupted: The share of the life insurance business in India (76%) is much bigger than the general insurance space. With $96 billion in premium collected for the life business, this is indeed a large market, which has only grown since Covid. There is also greater awareness about term insurance products.

Green shoots appear in IT hiring, mandates up 10% in July

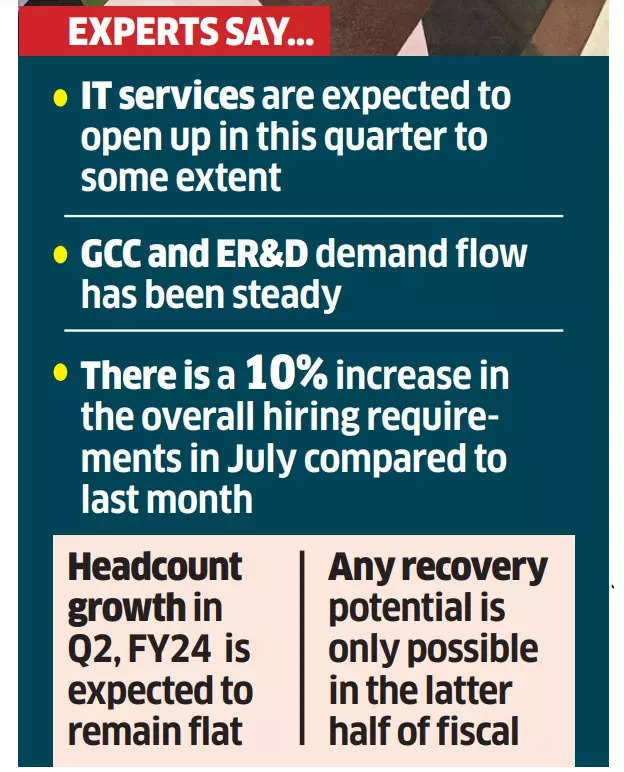

After months of slowdown in tech hiring, the IT sector has started seeing some green shoots indicating a pick-up in demand in the coming quarter.

What’s happening? Staffing firms have signalled good news for the sector as data shows that there has been a 10% increase in hiring requirements in July compared to last month.

Expert take: “IT services are expected to open up this quarter to some extent. This is as hiring has been on the back burner for quite some time and utilisation levels have peaked to over 80-85%’’, said Sunil C, chief executive at TeamLease Digital.

Saravanan Balasundaram, chief executive of staffing firm Handigital, said that the current uptick in demand has only started in the past two-three weeks and will likely result in offers only in the October-December quarter.

Why it matters? The increased demand is led by companies with better visibility of demand. Despite the uptick, the rate of recovery is still slower than anticipated.

Micropayments: Internet’s ‘sachet’ moment

Be it shelling out 10 bucks for an online tarot card reading, or 50 for an online game, or offering Rs 30 at a temple website, micropayments, enabled by UPI, are driving new-age users to consume a variety of services on the internet. This route can lead to big business.

Micro what? Micropayments are small-ticket transactions that can be as low as Rs 10. This way, applications can offer users exclusive features or access to specific content at an affordable rate. Platforms also leverage micropayments to establish trust by allowing users to taste the product before committing to a larger transaction.

Micro-money: Apps like Pocket FM and Astrotalk rely heavily on micropayments. But it isn’t just apps that provide content and services that are cashing in on the micropayments boom. Micro-investing platforms like Deciml and Jar are also riding the micropayment wave.

Beyond ads: Developers view micropayments as a revenue-generating opportunity outside of subscriptions and advertisements. They feel that having flexible payment options gives them the freedom to test out unique options and whether those are in line with audience preferences.

Other Top Stories By Our Reporters

Microsoft India president Anant Maheshwari resigns: Microsoft India president Anant Maheshwari has resigned from his post and will move out of the company to pursue other interests. The company confirmed Maheshwari’s exit in a statement. This comes amid a rejig among top-tier executives at the software firm.

Glance at lock screen content in regional languages: A higher number of users of lock screen platform Glance are consuming content in regional languages, and their share is growing quarter on quarter, a top official of mobile advertising giant InMobi told ET.

Global Picks We Are Reading

■ Threads isn’t for news and politics, says Instagram’s boss (The Verge)

■ Old Memories Can Prime Brains to Make New Ones (Wired)

■ Tesla’s new Mexico factory divides a city (Rest of World)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.