BharatPe drags Ashneer Grover to arbitration; Snapdeal halts $152 million IPO

Also in this letter:

■ Snapdeal halts $152 million IPO amid tech rout

■ Twitter Files part II reveals secret blacklists, shadowbans

■ WhatsApp emerging as direct marketing channel for brands: report

Fintech unicorn BharatPe has filed for arbitration under the Singapore International Arbitration Centre’s (SIAC) rules as it looks to claw back the restricted shares of its former managing director Ashneer Grover and his ‘cofounder’ title, PTI reported on Friday, citing sources with direct knowledge of the matter.

Grover, whom BharatPe has accused of cheating and embezzlement, holds about 8.5% in the company, and 1.4% of his shares are not vested.

The arbitration proceedings were initiated after Grover refused to comply with the shareholders’ agreement, the sources said.

Legal hat-trick: This is BharatPe’s third legal action against Grover. It previously filed a civil suit in the Delhi High Court and a criminal complaint with the Economic Offences Wing.

On Thursday we reported that the Delhi High Court summoned Grover and his wife Madhuri Jain, the company’s former head of controls, in connection with the civil case, and gave them two weeks to file a reply. The case is expected to be heard starting January.

In its 2,800-page lawsuit, BharatPe alleges that Grover, Jain and other family members created fake bills, enlisted fictitious vendors to provide services to the company, and overcharged the firm for recruitment. It seeks up to Rs 88.67 crore in damages.

Catch up quick: BharatPe has been under intense scrutiny since Grover sought damages from Kotak Mahindra Bank managing director Uday Kotak in January, claiming the bank refused him financing for a personal investment in Nykaa’s IPO last November.

Soon after, BharatPe’s board hired A&M and PricewaterhouseCoopers to audit the firm after receiving complaints from a whistleblower on alleged financial malpractice and corporate misgovernance.

This led to the ouster of Jain in late February. Grover resigned from the company and its board at the end of March.

Snapdeal halts $152 million IPO amid tech rout

SoftBank-backed ecommerce firm Snapdeal has decided to pull the plug on its $152 million IPO, the company told Reuters, making it the latest casualty of the tech meltdown this year.

Driving the news: The company filed a request this week with the country’s markets regulator to withdraw its IPO prospectus, said one source with direct knowledge of the matter.

In a statement to Reuters, Snapdeal said it has decided to withdraw its IPO prospectus “considering the prevailing market conditions” but did not elaborate. The company added that it may reconsider an IPO in future depending on its need for capital and market conditions.

Catch up quick: Snapdeal filed its IPO papers in December 2021, after a number of high-profile startups – including Zomato, Paytm and Nykaa – went public. But this year, many companies are delaying their offerings amid the stock market rout.

In August, TPG and Prosus-funded PharmEasy withdrew papers for its $760 million IPO, while Warburg Pincus-backed boAT Lifestyle withdrew its papers in October.

Dodged a bullet? Indian tech startups that went public last year have since faced the wrath of investors.

Shares in Paytm, which raised $2.5 billion one of India’s biggest ever IPOs in November 2021, have plunged 76% since their debut, while Zomato’s shares have halved from their all-time highs after listing in July 2021.

Twitter Files part II reveals secret blacklists, shadowbans

The second installment of the Twitter Files – a series of documents exposing the inner workings at Twitter around issues of free speech – was released by Bari Weiss, founder of the independent news publication The Free Press, on Friday.

Weiss, echoing Matt Taibbi — the independent journalist who released the first installment — said Twitter set out with the goal of giving people the power to create ideas without barriers, but ultimately failed to do so.

Latest revelations: The new leaks revealed that “teams of Twitter employees build blacklists, prevent disfavored tweets from trending, and actively limit the visibility of entire accounts or even trending topics — all in secret, without informing users”.

Weiss wrote, “Take, for example, Stanford’s Dr. Jay Bhattacharya who argued that Covid lockdowns would harm children. Twitter secretly placed him on a ‘Trends Blacklist’, which prevented his tweets from trending.”

India’s response: The Twitter Files saga has reaffirmed India’s stance on making social media platforms accountable for their role in political influencing, and shown how the unfettered power of internet platforms might lead to “abuse of power with no accountability,” minister of state for electronics & technology Rajeev Chandrasekhar tweeted on Friday.

Chandrasekhar added that the Twitter Files have shown “it is very obvious that safe harbours for Internet Intermediaries must be conditional on them following [a] set of rules as #India has done”.

Twitter to delete 1.5B accounts: Meanwhile, new Twitter chief Elon Musk said on Friday that the platform will delete 1.5 billion accounts that have not tweeted or logged for years to free up ‘name space’.

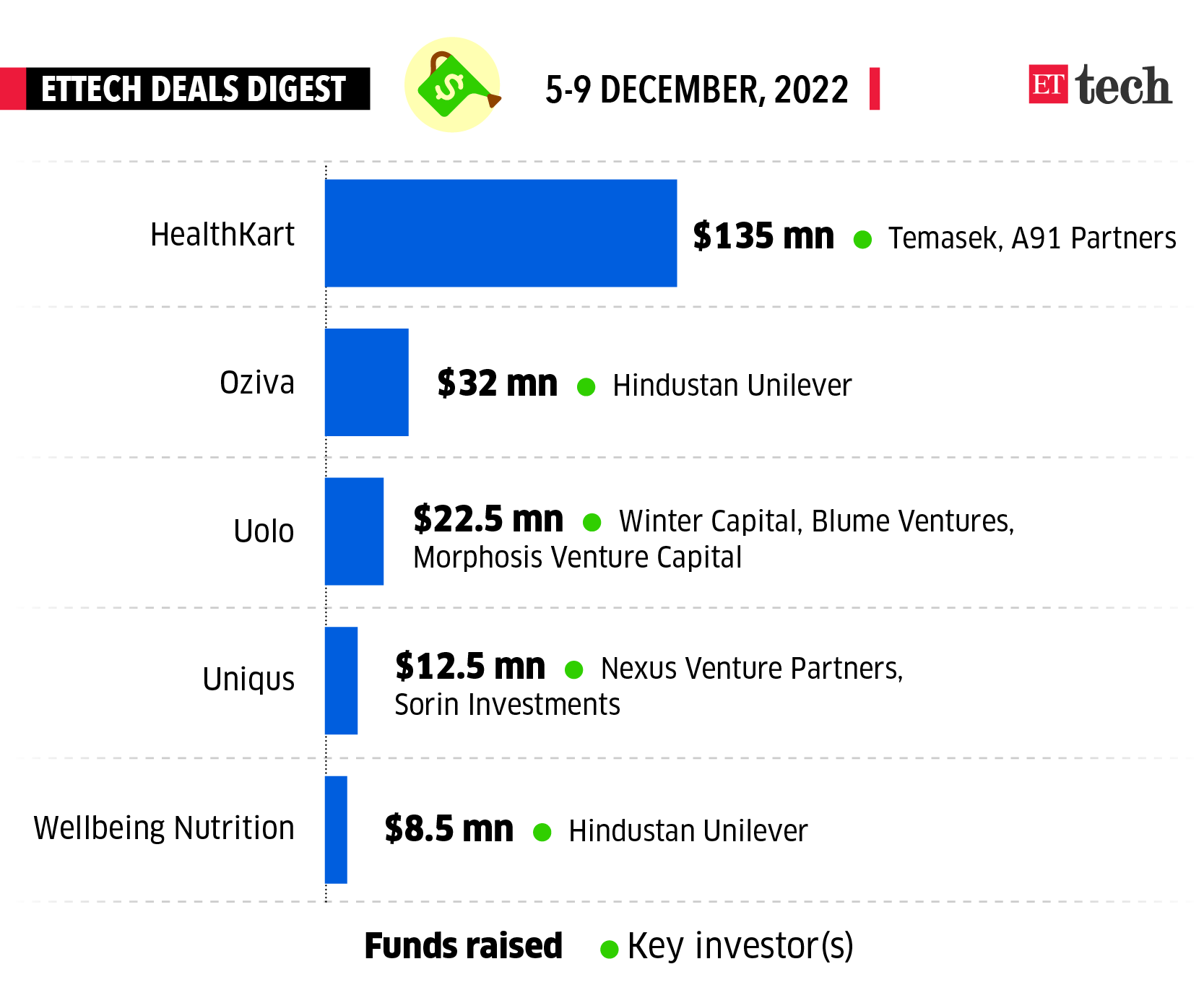

ETtech Deals Digest: startup funding down 35% in 2022 despite Nov blip

Funding for Indian startups has been scarce for some time now, but according to a report by Venture Intelligence, November was the best month for fundraising since June, with startups raising $1.27 billion.

The increase in funding last month was mostly driven by early- and growth-stage rounds, which crossed $1 billion in a month after more than five months.

According to another report by Tracxn, startup funding fell 35% year-on-year this year (as of December 5). Investments in the retail and fintech sectors fell 57% and 41%, respectively, according to Tracxn’s India Tech 2022 annual report. Yet, these two sectors and enterprise applications remained top fundraisers during the year.

Here is a list of all startups that raised funds this week.

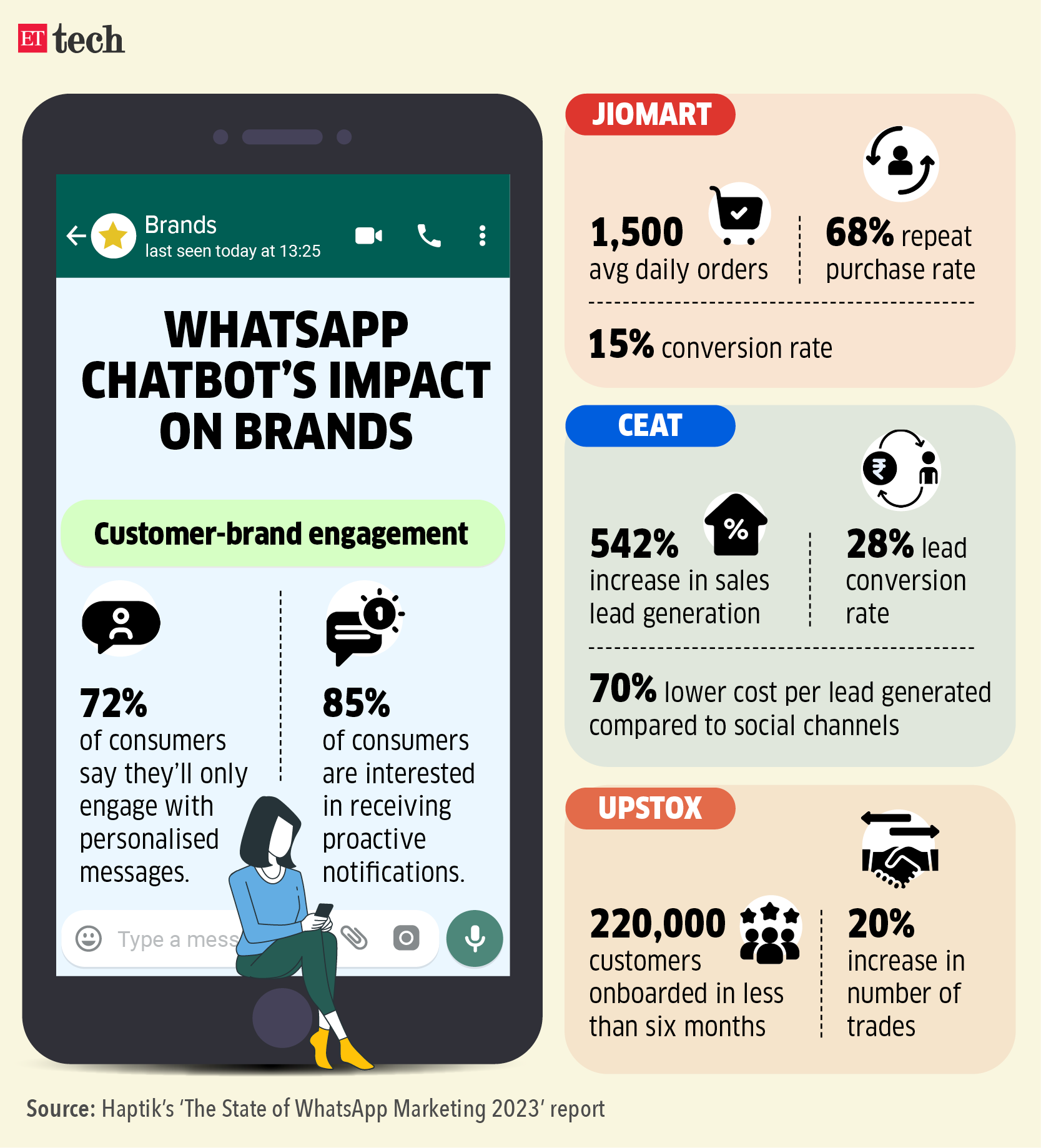

WhatsApp emerging as direct marketing channel for brands: report

As consumers increasingly seek more personalised engagement with brands, Meta-owned messaging platform WhatsApp is emerging as a direct marketing channel for brands looking to reach out to customers, said a report by Haptik, a Reliance-backed AI-based customer engagement platform.

Details: It said 72% of the consumers surveyed only engage with brands through personalised messaging.

And 85% said they were interested in receiving proactive notifications such as product recommendations, back-in-stock alerts, pricing updates, etc.

The report said WhatsApp messages have an open rate of 98% and a clickthrough rate of 45%.

Win-win: The report said that since its launch in November 2021, JioMart has seen a 68% repeat purchase rate through WhatsApp, clocking 1,500 daily orders on average.

Tyre manufacturer Ceat, which has tied up with Haptik to build a WhatsApp chatbot to generate sales leads, has clocked a six-fold increase in lead generation, though its lead-to-conversion rate is just 28%.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Gaurab Dasgupta in Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.