Between $1 billion to $2 billion of FTX customer funds have disappeared, SBF had a secret ‘back door’ to transfer billions: Report

Sam Bankman-Fried, co-founder and chief executive officer of FTX, in Hong Kong, China, on Tuesday, May 11, 2021.

Lam Yik | Bloomberg | Getty Images

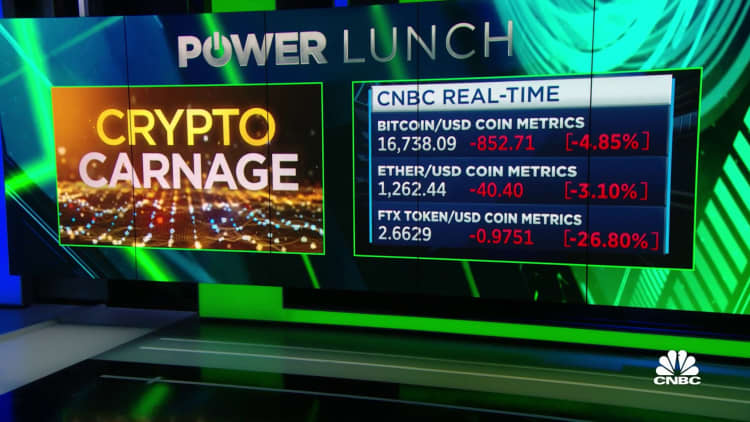

As Sam Bankman-Fried’s FTX enters bankruptcy protection, Reuters reports that between $1 billion to $2 billion of customer funds have vanished from the failed crypto exchange.

Both Reuters and The Wall Street Journal found that Bankman-Fried, now the ex-CEO of FTX, transferred $10 billion of customer funds from his crypto exchange to the digital asset trading house, Alameda Research.

related investing news

Alameda, also founded by Bankman-Fried, was considered to be a sister company to FTX. Those cozy ties are now under investigation by multiple regulators, including the Department of Justice, as well as the Securities and Exchange Commission, which is probing how FTX handled customer funds, according to multiple reports.

Much of the $10 billion sent to Alameda “has since disappeared,” according to two people speaking with Reuters.

Reuters disclosed that both sources “held senior FTX positions until this week” and added that “they were briefed on the company’s finances by top staff.”

One source estimated the gap to be $1.7 billion. The other put it at something in the range of $1 billion to $2 billion.

It appears that Reuters reached Bankman-Fried by text message. The former FTX chief wrote that he “disagreed with the characterization” of the $10 billion transfer, adding that, “We didn’t secretly transfer.”

“We had confusing internal labeling and misread it,” the text message read, and when asked specifically about the funds that are allegedly missing, Bankman-Fried wrote, “???”

Emergency meeting in the Bahamas

Last Sunday, Bankman-Fried convened a meeting with executives in Nassau to look at FTX’s books and figure out just how much cash the company needed to cover the hole in its balance sheet. (Bankman-Fried confirmed to Reuters that the meeting happened.)

It had been a rough few days of trade for FTX after Binance CEO Changpeng Zhao tweeted that his company was selling the last of its FTT tokens, the native currency of FTX. That followed an article on CoinDesk, pointing out that Alameda Research, Bankman-Fried’s hedge fund, held an outsized amount of FTT on its balance sheet.

Not only did Zhao’s public pronouncement cause a plunge in the price of FTT, it led FTX customers to hit the exits. Bankman-Fried said in a tweet that FTX clients on Sunday demanded roughly $5 billion of withdrawals, which he called “the largest by a huge margin.” That was the day of SBF’s emergency meeting in the Bahamian capital.

The heads of FTX’s regulatory and legal teams were reportedly in the room, as Bankman-Fried revealed multiple spreadsheets detailing how much cash FTX had loaned to Alameda and for what purpose, according to Reuters.

Those documents, which apparently reflected the most recent financial state of the company, showed a $10 billion transfer of customer deposits from FTX to Alameda. They also revealed that some of these funds — somewhere in the range of $1 billion to $2 billion — could not be accounted for among Alameda’s assets.

The financial discovery process also unearthed a “back door” in FTX’s books that was created with “bespoke software.”

The two sources speaking to Reuters described it as a way that ex-CEO Bankman-Fried could make changes to the company’s financial record without flagging the transaction either internally or externally. That mechanism theoretically could have, for example, prevented the $10 billion transfer to Alameda from being flagged to either his internal compliance team or to external auditors.

Reuters says that Bankman-Fried issued an outright denial of implementing a so-called back door.

Both FTX and Alameda Research did not immediately respond to CNBC’s request for comment.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.