Bank of England to launch gentler but still record rate rise after mini budget U-turns

The Bank of England can marginally take its foot off the accelerator after prime minister Liz Truss U-turned on key aspects of her tax cutting mini budget, but will still launch the biggest move in its 25 years of independence, City economists are betting.

The monetary policy committee (MPC) is set to lift borrowing costs by 75 basis points to three per cent at its next meeting on 3 November, according to Wall Street investment bank Goldman Sachs.

Goldman previously thought the Bank was on course to lift rates a whole percentage point next month.

The gentler rate rise would still be the biggest since the Bank was given control of monetary policy in the 1990s.

Goldman also thinks the Bank will keep raising rates steeply, lifting them by 75 basis points in December, 50 basis points in February and 25 basis points in March and May, taking them to a peak of five per cent.

Deutsche Bank has also downgraded its expectations for the severity of the coming rate rise to 100 basis points from 125 basis points.

Governor of the Bank Andrew Bailey said over the weekend said the MPC has adjusted upwards its expectations of how high rates will have to rise in November after the government froze typical household energy bills at £2,500 for two years.

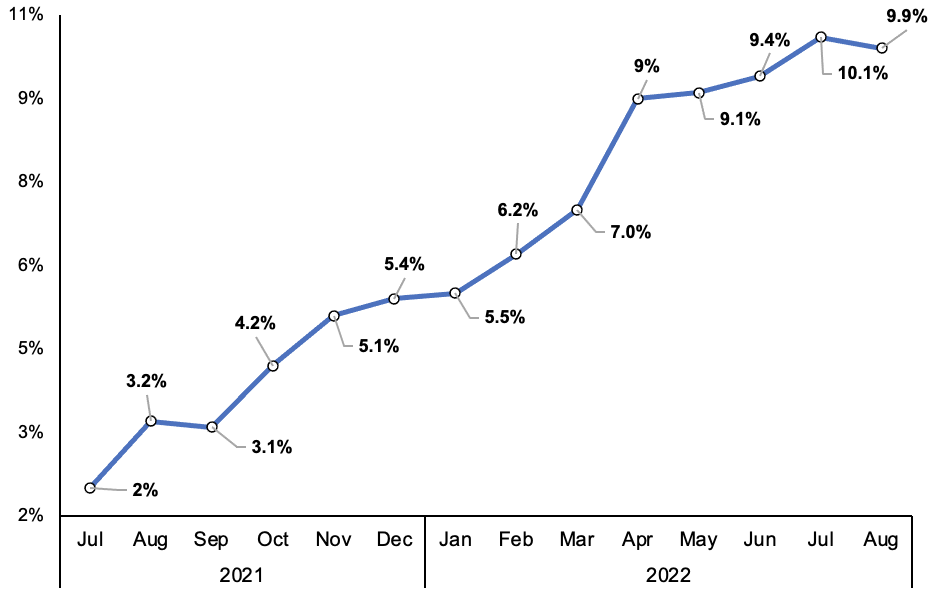

Inflation has surged to a 40-year high of 9.9 per cent, forcing governor Andrew Bailey and co to tighten borrowing costs seven times in a row.

Annual UK CPI inflation

New inflation figures out on Wednesday are expected to hit 10 per cent, five times the Bank’s two per cent target.

However, Truss’s decision to try to ease investor fears over the UK’s finances by scrapping plans to ditch the six percentage point corporation tax hike will lead to “a more significant recession in the UK,” Goldman said.

The firm also slashed their GDP projections off the back of last week’s U-turn.

The prime minister’s mini budget last month launched a sweeping set of tax cuts and was characterised by Truss and her former chancellor Kwasi Kwarteng as their blueprint for lifting UK economic growth out of the gutter.

However, she was forced into a series of embarrassing U-turns after financial markets took flight over her £45bn worth of unfunded tax cuts.

“Could we see other U-turns? Almost certainly,” Sanjay Raja, senior UK economist at Deutsche Bank, said.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.