As bank crisis spreads, Cramer says the Fed may need to take drastic measures

With all eyes on the banking sector, CNBC’s Jim Cramer on Wednesday said the Federal Reserve may need to take “desperate measures” at next week’s meeting — which could be “fantastic” for your portfolio.

“This is going to be the most momentous Fed meeting in recent memory because the next move is so significant, and we don’t know what it’s going to be,” he said.

However, it’s too early to say if the Fed’s moves will outweigh the negative effects of the growing banking crisis, Cramer said.

“We’re close to the point where the Fed may feel the need to take desperate measures that could be fantastic for your stocks for your portfolio,” Cramer said. “We just don’t know if it’s enough to outweigh the bad from the snowballing banking crisis.”

Over the past few days, a financial sector crisis has unfolded following the collapse of Silicon Valley Bank and Signature Bank in New York, both of which failed to manage a series of interest rate hikes from the Federal Reserve over the past year.

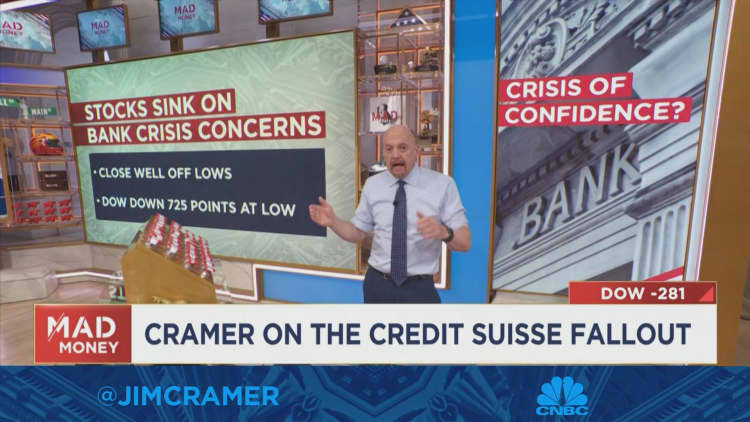

Stocks dropped on Wednesday over fears of the banking crisis spreading into Europe, with investors mulling over the future of global bank Credit Suisse. The major averages recovered some ground in the afternoon after a Swiss regulator announced the country’s central bank would provide Credit Suisse with liquidity if needed.

For all the latest World News Click Here

For the latest news and updates, follow us on Google News.