Arm revenues jump to £620m as Softbank gears up to float UK chipmaker

British chipmaker Arm said revenues had surged 28 per cent in the past quarter as its parent company Softbank gears up for a much anticipated float at the end of this year.

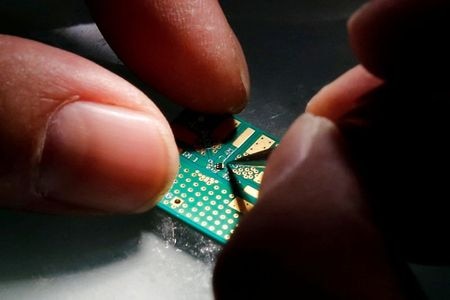

In a trading update on its third quarter trading the Cambridge-headquartered firm said revenues had topped $746m (£620) after its partner firms shipped a record eight billion Arm-based chips.

Licensing revenues at the chipmaker jumped 65 per cent to $300m on the back of “strategic long-term agreements with four key customers”, Arm chiefs said, while royalty revenues jumped 12 per cent after a boost in demand for its server technology and auto chips.

The revenue growth provides a boost to the firm as it prepares to shift on to the public markets this year in a much anticipated IPO.

Arm’s parent company, the Japanese investment giant Softbank, has been angling to float the firm since early last year after a blockbuster merger deal with rival Nvidia fell apart after intense scrutiny from regulators.

Softbank’s billionaire boss Masayoshi Son called in chief Rene Haas to oversee the firm’s shift on to the public markets last year after the breakdown of the deal. Haas said today the results showed the firm was now poised to make an “even greater impact and change the world again”.

“The world’s data centres, IoT systems, automobiles and next-generation consumer devices all need more and more power efficient computing capabilities, fuelling the long-term demand for Arm technology and innovation,” he said in a statement.

“These strong results are a testament to the hard work of every team across the business and their continued dedication to building the future on Arm.”

Ministers and regulators in the UK have launched a charm offensive on the firm in the last 12 months in a bid to woo it into a London listing. However, Son has long publicly favoured New York’s Nasdaq where tech firms are expected to tap into a deeper pool of investors and fetch higher valuations.

Son said last year he was now focusing all his intention on the chipmaker’s float after a torrid period for Softbank that has seen its tech heavy portfolio of investments plunge in value. Softbank today slumped to another loss after its flagship Vision Fund posted a £4.6bn loss in the months between October and December.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.