Arm deals blow to LSE by rejecting London listing for a US-only flotation

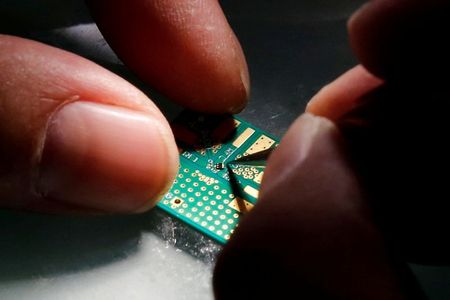

Cambridge-based technology firm Arm said it will pursue a US-only stock market listing this year, dealing a blow to the UK markets.

The plans from the company, owned by Japanese investment giant SoftBank, come despite heavy lobbying by successive prime ministers and cabinet members.

In January, Rishi Sunak reportedly restarted talks with SoftBank to persuade it to list the computer chip maker in London.

Arm indicated it could still look at an additional UK listing in the future but provided no further details.

On Friday, bosses at Arm, which designs chips used in almost every smartphone, stressed that it will continue to expand and invest in the UK.

Chief executive Rene Haas said: “After engagement with the British government and the Financial Conduct Authority over several months, SoftBank and Arm have determined that pursuing a US-only listing of Arm in 2023 is the best path forward for the company and its stakeholders.”

The move is the latest blow to London, where Arm was listed until it was snapped up by SoftBank for £24.6 billion in 2016.

SoftBank last year decided it would seek to float the business back on the stock market after a 40 billion dollar (£33.4 billion) takeover by US firm Nvidia was blocked over competition concerns.

The listing plans come a day after building materials giant CRH revealed it is planning to shift its main stock market listing from London to New York.

CRH, which is headquartered in Dublin and valued at more than £30 billion, said: “We have now come to the conclusion that a US primary listing would bring increased commercial, operational and acquisition opportunities for CRH.”

Press Association

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.