Apple Pay Later is unveiled; borrowers can repay loans up to $1,000 with four equal payments

The borrower will have a soft pull of his credit report done to check his/her financial position

The user will then be asked how much he/she wants to borrow and must agree to the Apple Pay Later terms. A soft credit pull will be done during the application process. This means that the user’s credit report will be pulled to determine whether the borrower is in a good financial position before having the funds lent to him/her. As a soft credit pull, the inquiry will show up on a credit report but will not lower the user’s credit score.

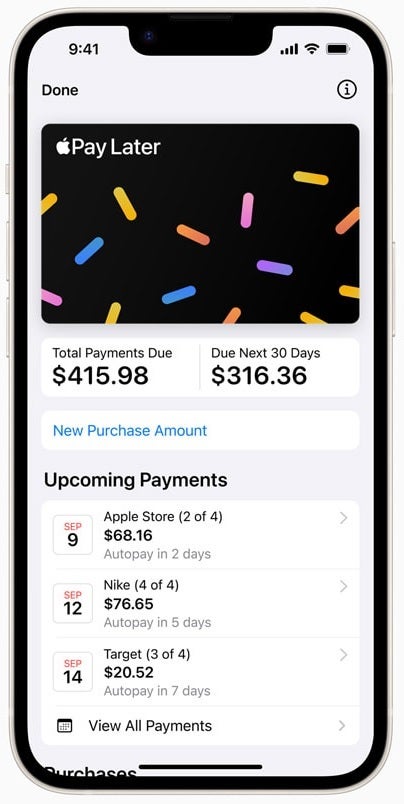

Loans made using Apple Pay Later will be paid back with four equal repayments over a six-week time frame

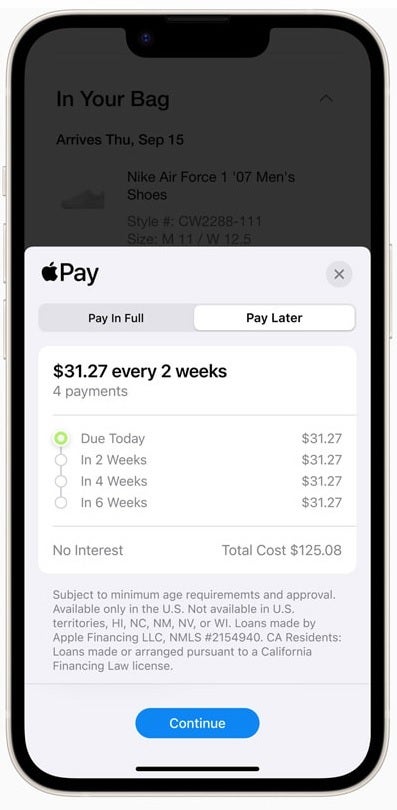

If a user is approved for a loan, when they checkout for a purchase made online, they will see the Pay Later option when they select Apple Pay at checkout, and in apps on the iPhone and iPad when making a purchase. Apple notes that “Once Apple Pay Later is set up, users can also apply for a loan directly in the checkout flow when making a purchase.” Merchants who accept Apple Pay will automatically accept Apple Pay Later

All repayments must be done through a debit card

Now here is an important part of Apple Pay Later; all subscribers to the program will be required to link their account to a debit card from Apple Wallet; the debit card will be used for loan repayments. Those with a loan will not be able to make a repayment using a credit card since that would be akin to borrowing more money to pay off a debt, a move that is considered fiscally irresponsible.

Repayment schedules are easy to understand

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said, “There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later. Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Apple Pay Later is offered by Apple Financing LLC, which is a subsidiary of Apple Inc. and is responsible for credit assessment and lending. Starting this fall, Apple Financing plans to report Apple Pay Later loans to U.S. credit bureaus so they will show up in users’ overall financial profiles. Apple says that this can help promote responsible lending by the borrower.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.