Apple goes solo for buy-now pay-later snubbing Goldman

Apple has snubbed banking partners Goldman Sachs for its new buy-now pay-later offering, instead opting for its own in-house team to manage the service.

The iPhone maker’s new Apple Pay Later service will be made through a wholly owned subsidiary, Apple Financing LLC, defying previous reports from Bloomberg which suggested the US mega bank would be playing a key role in the BNPL service.

The tech giant has worked with the likes of Goldman and Barclays in the past for financing options, and the move may raise alarm bells for core banking providers, who may fear the domineering force of Apple in their previously untouched space, as reported by the FT.

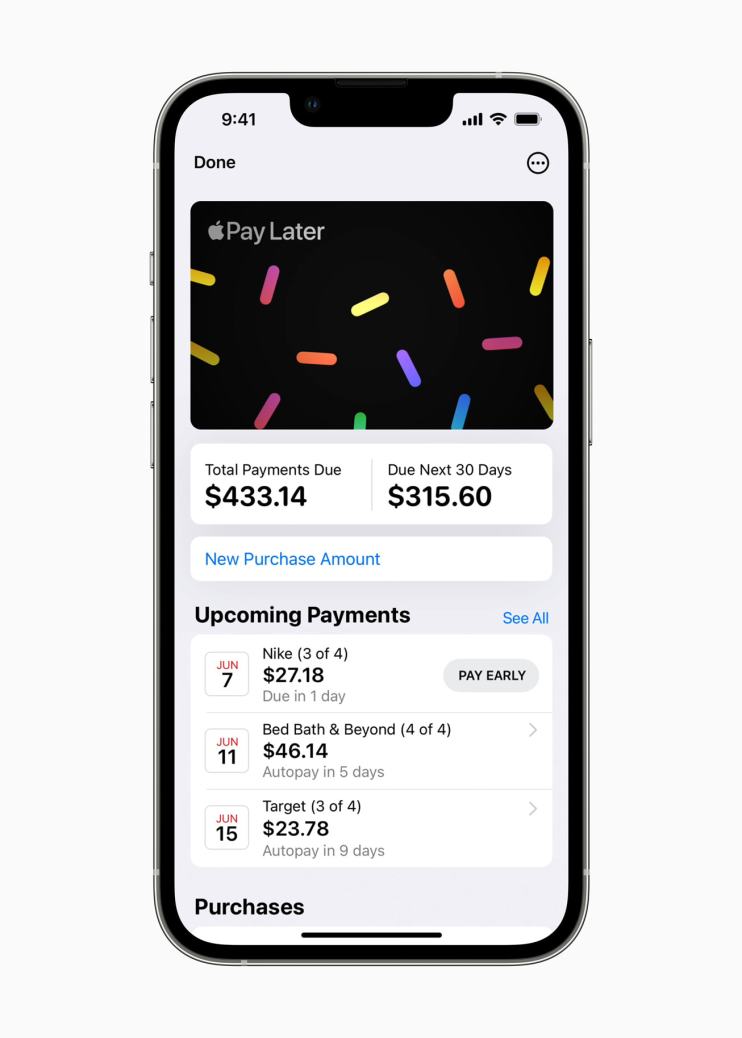

Announcing its step into the highly competitive sector at its developer conference on Monday, the new feature will allow Apple customers to pay for items in four equal payments over six weeks with no additional interest or fees.

The feature is available everywhere Apple Pay is available, starting with US retailers, both in apps and online, with payments being managed through the Apple Wallet app using the Mastercard network. Purchase pages will detail how much exact payments are, as well as the due dates.

The new feature requires no extra work from the developer or the merchants involved, but undoubtedly puts the Silicon Valley firm at odds with popular services like PayPal and Klarna.

Reacting to the announcement, Chief Analyst at CCS Insight Ben Wood said Apple’s new update looks a lot like Klarna’s service, but added: “Apple’s challenge will be to ensure it does not generate negative optics if users get into extra debt by using the service.”

Indeed, as the cost of living crisis crunch sinks in, the Big Tech firm will need to balance promoting its new offering alongside the harsh reality of shrinking household budgets.

Head of TMT Research at Mirabaud Neil Campling told City A.M. that the idea behind the launch was the “the age-old Apple mantra of ‘ease of use’”, as well as enticing users to use Apple based service offerings.

“The bigger picture, for Apple, is to drive more and more service-based revenues that has become meaningful (over $50bn annually) and high margin”, Campling said.

“It’s all part of the ever growing Apple ecosystem: bring technology, semiconductors, services, infrastructure, advertising, hardware and software inside this gigantic ‘technology walled garden’”, he said.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.