AMD to invest $400 million in India; Reliance’s Milkbasket to see layoffs, redundancies

Also in this letter:

■ Ola Electric FY23 losses at $136 mn

■ Swiggy integrates InsanelyGood with main app

■ ETtech Deals Digest

US chipmaker AMD to invest $400 million in India by 2028

Advanced Micro Devices is planning to invest $400 million in India over the next five years, with its biggest design centre slated to come up in Bengaluru, chief technology officer Mark Papermaster said.

Tech city centre: The US chipmaker plans to open its Bengaluru design centre by the end of this year, while creating 3,000 engineering jobs over the next five years. With the new 55,000 sq. ft. campus, the company will significantly increase its footprint in India to 10 locations.

The Santa Clara, California-based company is also working to take on rival Nvidia with an artificial intelligence chip.

Prime Minister’s invitation: From his home turf of Gujarat, Prime Minister Narendra Modi on Friday invited global semiconductor companies to invest in India. Whoever comes in will have a “first mover’s advantage,” the PM said, in a bid to woo semiconductor majors.

“It is not just India’s needs, the world now needs a trusted and reliable chip supply chain. Who can be that trusted partner if not the largest democracy?” Modi said.

In 2021, India introduced a $10 billion incentive programme aimed at bolstering the chip sector. However, the plan has encountered setbacks, as no company has received approval to establish a fabrication plant, which is the centrepiece of the PM’s ambitions for the sector.

Reliance steps up Milkbasket integration; layoffs, redundancies imminent

Milkbasket, the subscription-based grocery delivery firm owned by Reliance Retail, is facing a slew of layoffs and redundancies as its integration with its parent is at an advanced stage.

Layoffs loom: About a quarter of Milkbasket’s 600-strong workforce is likely to be affected by the layoffs, according to a report by news portal Entracker. The redundancies will be across sales, delivery operations, marketing, and other verticals, a person in the know of the matter told ET.

Rebranding on the cards: Reliance is also considering rebranding Milkbasket and is also contemplating having a single brand entity for its overall grocery service. Although a final decision is yet to be made, the Milkbasket brand is likely to continue to exist.

Recent exits: Milkbasket has been hit by several leadership exits – chief executive Yatish Talvadia, chief operating officer Abhinav Imandi and chief financial officer Gaurav Srivastava left recently. Talvadia was the last remaining co-founder at Milkbasket, as per recent reports, after other co-founders like Ashish Goel, Anurag Jain and Anant Goel left in 2021.

Also read | Dunzo’s downfall: from startup star to sinking ship? and other top tech stories this week

Ola Electric posts $136 million loss in FY23

Missing its publicly disclosed revenue goal, Ola Electric recorded an operating loss of $136 million on a revenue of $335 million in the last financial year, news agency Reuters reported, citing sources in the know.

‘Missed projections’: The loss figure for FY23 shows that the SoftBank-backed e-bike maker missed its revenue projections. In June last year, Ola had issued a statement saying it was “on track to surpass $1 billion run rate by the end of this year” and “the future forecast looks even stronger”.

As per the Reuters report, Ola’s first full year of operations saw it record a revenue of $335 million with over 150,000 unit sales, and an operating loss of $136 million.

Jargon buster: Run rate is a financial indicator calculated by taking one month of Ola’s revenues and multiplying it by 12.

Catch up quick: Since it began sales in late 2021, Ola has become India’s e-scooter market leader with a 32% share, competing with Ather Energy as well as TVS Motor and Hero Electric.

It was valued at $5 billion last year, and has raised nearly $800 million from investors since 2019.

Swiggy integrates grocery delivery service InsanelyGood with main app

Food delivery startup Swiggy has integrated its morning grocery delivery service InsanelyGood with its main app, people in the know told ETtech.

Restructuring biz: InsanelyGood is currently operational only in Bengaluru, after the company exited six cities to conserve cash. The service, which was earlier known as SuprDaily, was rebranded as InsanelyGood in March. Orders placed on the service before 11 pm usually get fulfilled by 7 am the following day.

Flashback: Swiggy acquired the firm in 2018 and integrated it into a unit under the parent entity in 2021.

Swiggy’s key investor Prosus, the Dutch-listed arm of South African technology investor Naspers, had reported in June that the firm’s losses had ballooned 80% year on year in the January-December 2022 period, though food-delivery GMV had also grown 26%.

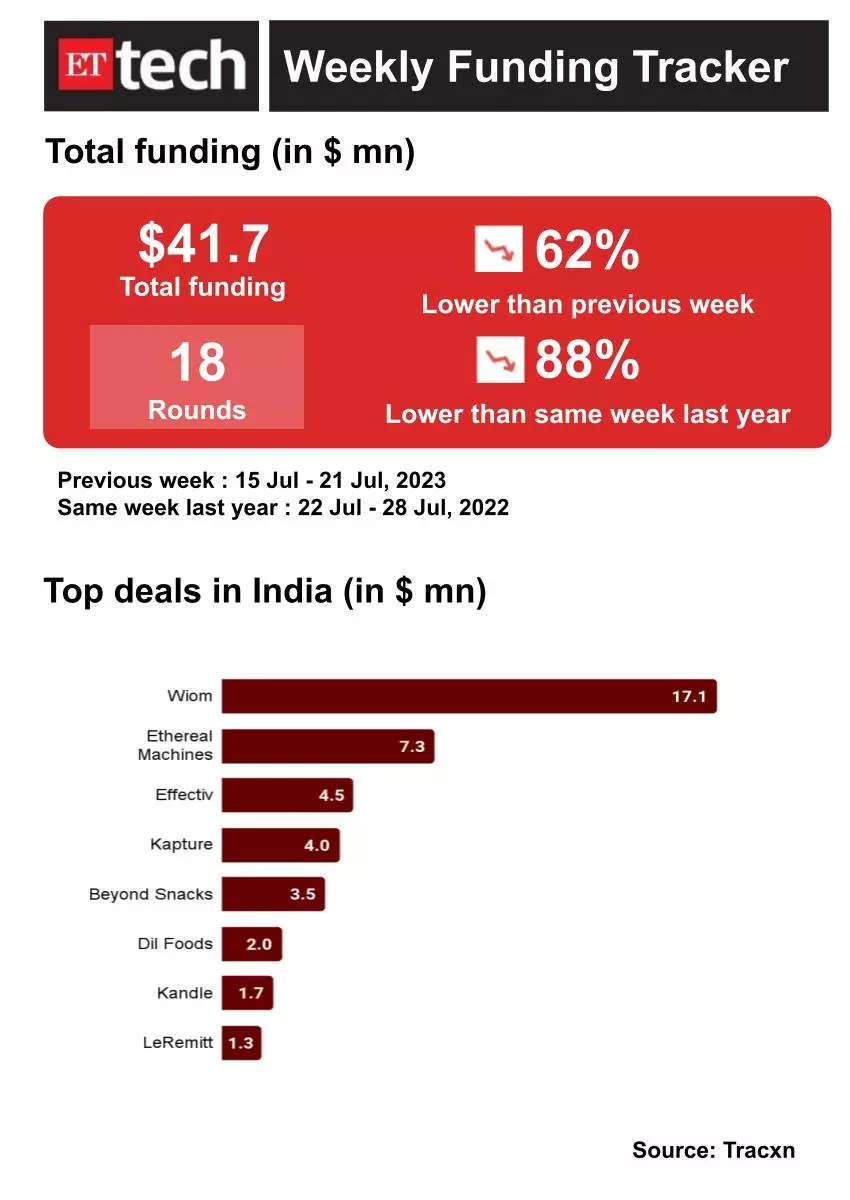

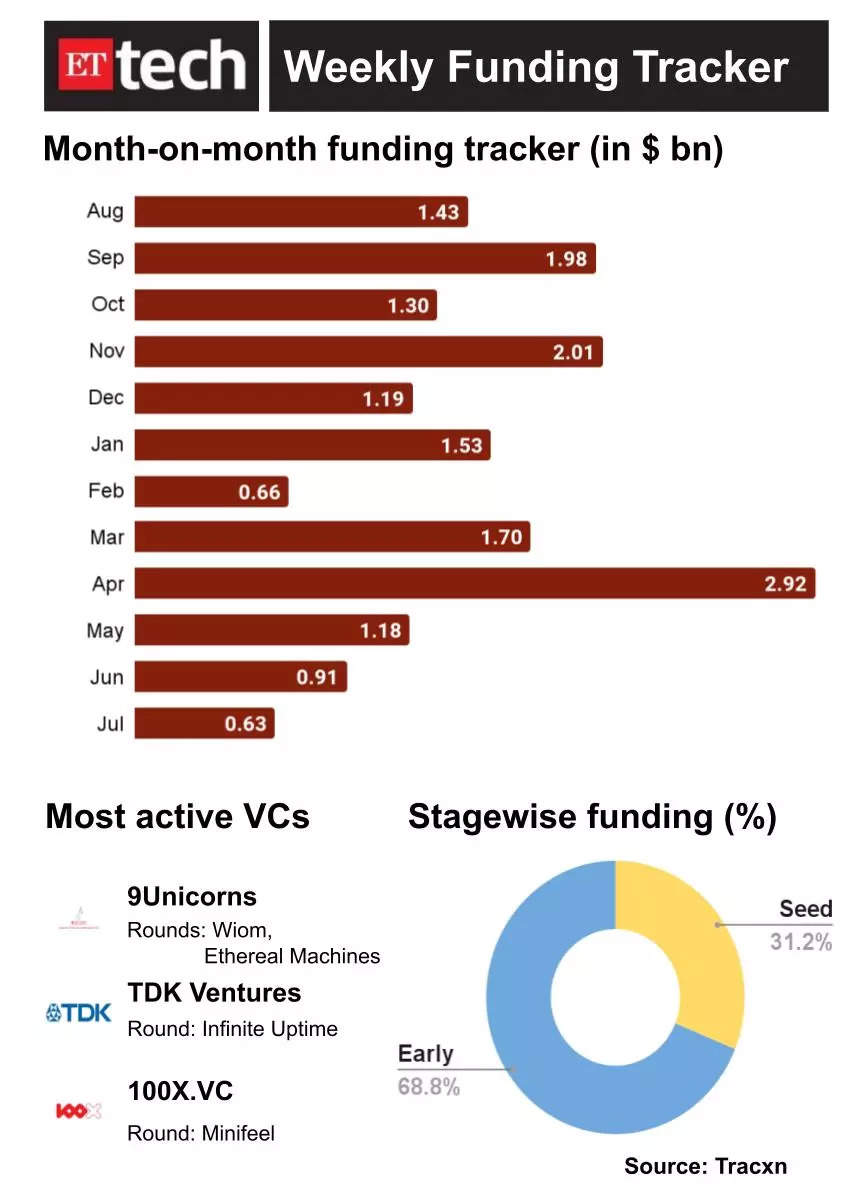

ETtech Deals Digest: Weekly funding crashes to $41.5 million

The funding drought for Indian startups sent growth- and late-stage rounds to zero with venture capital funds specialising in these stages continuing to remain cautious this week.

Early stage funds, on the other hand, made small deployments accounting for the bulk of funding activity in the week of July 22-28.

Funding in the penultimate week of July plunged by 88% to $41.5 million, with just one of the total 18 rounds managing a double-digit-million ticket size. This compares with $109 million coming in from 18 rounds during the previous week.

The largest deal during the week was New Delhi-based telecom and technology startup Wiom’s $17 million round led by RTP Global.

Rutvik Doshi, managing director, Athera Venture Partners, told ET that early-stage funds continue to deploy money with a focus on 6-7 year horizons for exits, typical of most funds operating at the seed and early stages.

Here are the startups that got funded this week

Today’s ETtech Top 5 newsletter was curated by Siddharth Sharma in Bengaluru and Megha Mishra in Mumbai.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.