Amazon to deliver third-party ecomm orders; ETSA winners to receive awards on Nov 19

Also in this letter:

■ ETSA winners to receive their awards in Bengaluru on Nov 19

■ Paytm’s net loss widens to Rs 571 crore in Q2; revenue up 76%

■ Unacademy cuts another 350 jobs in second round of layoffs

Amazon India set to deliver third-party ecommerce orders

Ecommerce major Amazon is set to open its logistics infrastructure in India to orders from other online businesses, multiple sources briefed on the matter told us.

This will make the US ecommerce major a direct rival to new-age logistics firm Delhivery, Xpressbees, Ecom Express and Flipkart’s Ekart, which recently started onboarding external merchants to ship non-Flipkart orders.

We reported in April that Flipkart’s Ekart was onboarding platforms like Nykaa, FirstCry and others to service their deliveries.

Details: Amazon has tapped direct-to-consumer (D2C) brands, logistics aggregators and other businesses that take direct orders from consumers to start the new vertical, called Amazon Shipping.

A pilot is underway, and Amazon is expected to make a formal announcement over the next couple of months.

“…Now you may ship orders received by you via your own website or via social media or any other means,” an email sent by a senior Amazon executive read.

For now, it seems Amazon is focussed on individual brands and select logistics aggregators. It has already launched the service in the UK and has tested it quietly in the US.

One of the customers using the beta service said they are being billed for it by Amazon Seller Services, which runs the India marketplace unit.

Amazon Transportation Services (ATS) is one of the key India entities of Amazon, which houses the logistics business. The local shipping services arm of the US ecommerce giant reported revenues of Rs 4,581 crore in FY22, a 12.6% increase from the previous year. Its losses increased by 38% to Rs 95 crore in FY22.

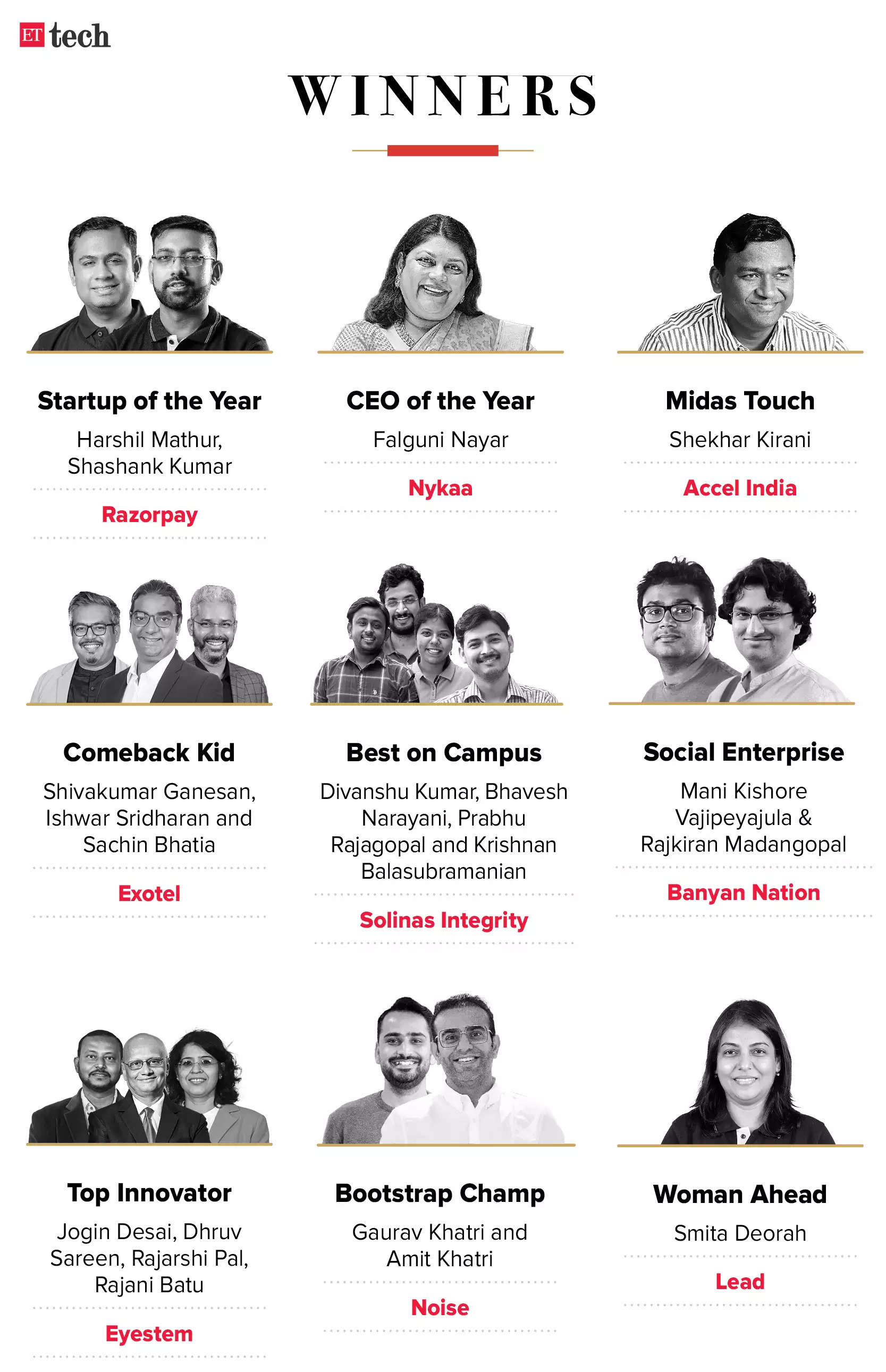

ETSA 2022 winners to receive their awards in Bengaluru on Nov 19

The eighth edition of The Economic Times Startup Awards (ETSA) will be held on Saturday, November 19, in Bengaluru to honour this year’s winners across nine categories in what will be a star-studded gathering of the who’s who of India’s new economy.

The most coveted recognition for the country’s entrepreneurial talent, ETSA will host top policymakers, unicorn founders and tech investors in a by-invite gathering of 350 guests.

Winners: At a virtual meeting that lasted for more than two hours on October 28, a high-powered jury led by Infosys CEO and MD Salil Parekh picked the winners in nine categories from a shortlist of 45 contenders.

- Razorpay, the Bengaluru-based online payments solutions company, won top honours as the Startup of the Year, while Falguni Nayar, founder and CEO of Nykaa, bagged the newly launched CEO of the Year award.

- Shekhar Kirani, partner, Accel, won the Midas Touch Award for Best Investor.

- The award for the Bootstrap Champ went to Noise, a smart wearables brand with sizable revenue and profits while the prize for Top Innovator went to Eyestem, a Bengaluru-based cell therapy company.

- Cloud telephony platform Exotel was chosen as the winner of the Comeback Kid category while Solinas Integrity, a deep-tech firm founded at IIT Madras that develops robotic solutions for the pipeline and sanitation industry was adjudged as the Best on Campus.

- Smita Deorah, co-CEO, Lead, an edtech company, was the winner in the Woman Ahead category and plastic recycling startup Banyan Nation was the Social Enterprise winner.

Paytm’s net loss widens to Rs 571 crore in Q2; revenue up 76%

Digital payments firm Paytm reported a 76% jump in second-quarter revenue, driven by a surge in loan growth.

Paytm’s parent One 97 Communications said revenue rose to Rs 1,914 crore ($233.81 million) in the July-September quarter, from Rs 1,086 crore a year earlier.

Consolidated net loss widened to Rs 571 crore from a loss of Rs 473 crore a year earlier, the company said in an exchange filing.

PB Fintech’s losses narrow: Meanwhile, PB Fintech, the parent entity of insurance platform Policybazaar and credit marketplace Paisabazaar, reported consolidated losses of Rs 186.6 crore in the July-September quarter, narrowing from a loss of Rs 204.3 crore in the previous quarter.

Total revenue for the group grew to Rs 633.8 crore in the period, from Rs 552.6 crore in the quarter ended June 30. Operating revenue grew to Rs 573 crore.

Losses on a half-yearly basis, however, widened to Rs 391 crore, more than 24% higher than the Rs 315.2 crore loss in the first half of the previous fiscal year.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Unacademy cuts another 350 jobs in second round of layoffs

Edtech startup Unacademy has undertaken another round of layoffs, cutting as many as 350 jobs amid a push to reduce costs and turn a profit, according to an internal memo sent by Gaurav Munjal, cofounder and CEO of Unacademy group.

Munjal said the restructuring exercise would affect about 10% of employees across the group.

Cost-cutting: On November 4, Munjal tweeted that Unacademy had brought down its monthly cash burn from $20 million to $7 million.

The company previously fired around 1,000 contractual and full-time employees, as we reported in April. In July, Munjal told employees that Unacademy would not lay off any other workers and try to reduce other expenses.

Sacked Twitter employees up for grabs: Meanwhile, laid-off Twitter employees in India are up for grabs, according to half a dozen recruitment services firms and executive search firms. Executives at these firms told us that despite a slowdown in hiring, the talent from Twitter will not have trouble getting jobs.

Consortium restructures terms of Oyo founder’s 2019 loan

A Mizuho-Nomura-led consortium has restructured the terms of the financing arrangement worth about $2.2 billion through which Oyo founder Ritesh Agarwal bought back a 23% stake in his company in 2019, said people with knowledge of the matter.

Catch up quick: In May 2019, Agarwal bought back a 23% stake in his company for $2.2 billion from Oyo’s early backers Lightspeed and Sequoia through RA Hospitality, a holding company created for the purpose. This made Agarwal the second-largest shareholder in Oyo holding 33%, with 46% owned by SoftBank, valuing the company at $9.6 billion.

Details: The revised conditions include a reduced quasi-equity component of $950 million, down from $1.8 billion previously, due to an $850 million write-off, said the people cited above.

This $950 million component is linked to the valuation of the company and has a 10-year repayment time frame. Under the new terms, the loan component of $383 million is now payable by 2027 instead of 2025.

The markdown signals a more sober approach by financial groups to startup investments, experts said.

TWEET OF THE DAY

Reliance, HCL may enter semiconductor race; explore stake in ISMC

Reliance Industries and software major HCL are independently evaluating deals to buy a 30% equity stake each in the semiconductor wafer fab applicant ISMC Analog, multiple people aware of developments told us, signalling heightened interest in India’s ambitious move to seed a semiconductor manufacturing ecosystem in the country.

Details: The oil-to-telecom conglomerate and the Shiv Nadar-founded software group are likely to invest through subsidiaries, said the sources who estimate the “total investment from both parties may be over Rs 4,000 crore ($500-600 million)”.

ISMC Analog, a consortium of Mumbai-based Next Orbit Ventures and Israeli tech company Tower Semiconductor, is one among three applicants vying for subsidies under the Centre’s Rs 76,000-crore SemiconIndia programme. It has chosen an electronics cluster near Mysuru in Karnataka, to build its $3-billion fab.

Term sheets for both proposed deals have been signed recently, according to the people cited above. We were not able to independently verify when the parties signed term sheets.

Other Top Stories By Our Reporters

Chiratae launches growth fund: Homegrown tech-focused venture capital firm Chiratae Ventures has launched its first growth fund and marked its first close at Rs 759 crore ($92.6 million), with an option to raise another Rs 750 crore. It is aiming to make the final close of the fund by December.

Zomato Pay goes live in some cities, replacing Pro: Foodtech platform Zomato has rolled out Zomato Pay — the third iteration of its dining out programme — in several cities, including Delhi, Mumbai, Bengaluru, Ahmedabad and Kolkata. In August, the company said it was recalibrating its loyalty programmes, and that it had closed new signups and renewals for its flagship programme Zomato Pro.

Amazon India launches mobile-only Prime Video plan: Amazon is launching a single-user, mobile-only version of its Prime Video streaming service in India for Rs 599 a year. The company launched the mobile-only plan last year with telecom service provider Airtel and is now expanding the service to all users. Customers can subscribe to the service through the Android app or on the Prime Video website.

Global Picks We Are Reading

■ Elon Musk is overloaded (Wired)

■ Startups look to scoop up laid-off tech workers (WSJ)

■ With Apple and Microsoft moving in, Vietnam bets on tech migration from China (Rest of World)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.