Amazon to close seller firm Appario; ‘Chief Twit’ wastes no time in revamping Twitter

Credit: Giphy

Also in this letter:

■ Changes afoot at Twitter days after Musk takeover

■ Best of the best: meet the winners of ETSA 2022

■ Illegal loan apps driving citizens to suicide: home ministry

After Cloudtail, Amazon to close seller firm Appario in a year

After shutting down giant seller Cloudtail, Amazon has now decided to close Appario Retail and delist it as a seller. Appario Retail, one of the largest sellers on the platform, is housed under Frontizo Business Services – a joint venture between Amazon and the Patni group.

Driving the news: In a joint statement, the two parties said the joint venture has been renewed but Appario will cease to be a seller on both Amazon India and Amazon India Business – the wholesale platform – within a year. The Amazon-Patni JV for Frontizo has been renewed for three years, according to people aware of the matter.

“Amazon and India’s Patni group-owned Zodiac Wealth Management LLP have agreed to renew their joint venture, Frontizo Business Services Private Limited. The partners have decided that Appario Retail Private Limited, a wholly owned subsidiary of Frontizo, will cease to be a seller on Amazon.in and Amazon.in/business within the next 12 months. The partners will continue to explore new business opportunities, including helping businesses across India to scale up their online presence,” the joint statement read.

Sources aware of the matter said it is likely to offer seller onboarding services to other businesses and that its parent Frontizo will power Amazon’s customer-service business.

Origins: Amazon set up the Frontizo JV with the Patni group in 2017. While the parent entity provided customer service for Amazon in Indian languages, Appario was scaled as a seller on the Amazon India marketplace. It emerged as one of the largest sellers, dealing in categories such as electronics and accessories and working with brands such as Xiaomi.

Amazon owns 24% in Frontizo while Patni group has a 76% stake, sources briefed on the matter said.

Cloudtail canned: This comes after Amazon was forced to reduce its stake in Cloudtail after the Indian government introduced tighter FDI rules for foreign ecommerce firms. Earlier this year, the company formally shut Cloudtail as a seller firm after acquiring a 100% stake in its parent firm Prione, which was a joint venture with NR Narayana Murthy’s Catamaran Ventures.

Appario Retail clocked revenue of Rs 14,628 crore in FY21 with a profit of Rs 54 crore. Cloudtail clocked a 15% jump in revenue to Rs 19,076 crore in FY22, while losses widened 2.8 times to Rs 522 crore.

Changes afoot at Twitter days after Musk takeover

Elon Musk completed his acquisition of Twitter on October 28, more than five months after he first struck a deal to buy the company for $44 billion in late May.

But after “freeing the bird” – as he put it – the world’s richest man has wasted no time in revamping the social media company.

Raft of changes: The first material alteration he made, less than 24 hours after completing the takeover, was to sack several top executives including CEO Parag Agrawal.

Also Read | Musk denies report he plans to fire Twitter workers to avoid payouts

Next, Musk decided to change Twitter’s default homepage. According to a report by The Verge, Musk requested that users who log out of Twitter.com be redirected to the Explore page, which shows trending tweets and news stories. Previously, visiting Twitter’s homepage while logged out showed users a sign-up form, encouraging them to create an account to view tweets.

Also Read | Musk says he’s the Chief Twit, has ‘no idea’ who Twitter CEO is

Musk has also wasted no time in roping several top tech executives, including Sriram Krishnan of Andreessen Horowitz (aka a16z), to help with the Twitter rejig.

On Monday, India-born Krishnan revealed that he is “temporarily” helping Musk on Twitter. He tweeted, “Now that the word is out: I’m helping outElon Musk with Twitter temporarily with some other great people. I (and a16z) believe this is a hugely important company and can have a great impact on the world and Elon is the person to make it happen.”

Krishnan, a general partner at a16z, invests in early-stage consumer startups and sits on the boards of various firms, including Bitski, Hopin and Polywork.

Also Read | Musk takeover likely to attract GenZ users to Twitter

As part of his Twitter overhaul, Musk is also planning to charge users $20 (about Rs 1,655) a month or $240 a year for a blue tick on their account, according to various reports.

According to one such report, verified users on the platform would have 90 days to sign up to the premium service Twitter Blue or lose their ‘verified’ check mark.

Also Read | Twitter verification should be free, says AirBnB CEO

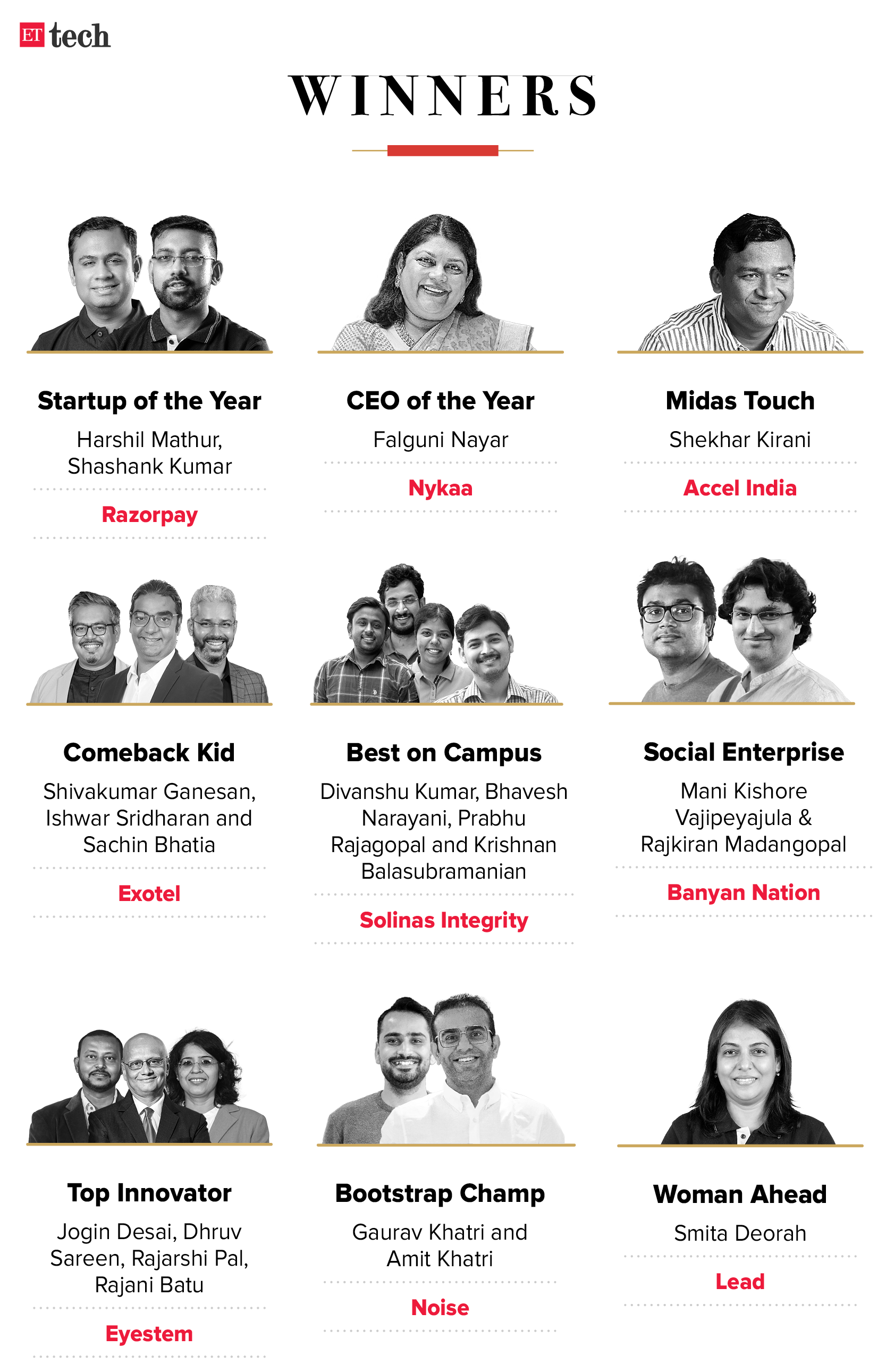

Best of the best: meet the winners of ETSA 2022

On October 28, a stellar line up of corporate leaders, startup founders and global investors came together in a virtual meeting to pick the winners of The Economic Times Startup Awards (ETSA) 2022.

In all, the jury chose nine winners from a shortlist of 45 nominees across the nine categories. Here are this year’s winners of India’s most prestigious awards for entrepreneurship.

Startup of the Year: Razorpay won top honours at ETSA 2022, in what was arguably the most closely contested category, narrowly edging out software testing startup BrowserStack.

CEO of the Year: This award went to Nykaa’s Falguni Nayar, who has broken all the conventions associated with the typical new-age entrepreneur, from gender to age to the category she chose for her startup.

Midas Touch: The jury gave this award – for the best investor of the year – to Accel partner Shekhar Kirani for being the first to write a cheque to Freshworks, the Indian SaaS poster child that went public on Nasdaq last year.

Woman Ahead: There was a two-way fight in this category between Lead’s Smita Deorah and Melorra’s Saroja Yeramilli. The award finally went to Deorah for her ambition to make quality education available to the masses through edtech.

Top Innovator: This prestigious award went to Bengaluru-based Eyestem for its mission to democratise access to cell therapy treatment by substantially bringing down the cost.

Bootstrap Champ: With more than Rs 800 crore in revenue and Rs 40 crore in profits, the jury could not ignore Noise’s outstanding financials despite challenges around China manufacturing and the low defensibility of the business.

Comeback Kid: From the word go, the jury praised the grit that Exotel founders Shivakumar Ganesan, Ishwar Sridharan and Sachin Bhatia have displayed against many odds to build an Indian software play in cloud telephony for the world.

Social Enterprise: It was Banyan Nation’s simple approach to a problem as complex as plastic waste reduction that helped the nine-year-old startup clinch the coveted Social Enterprise award.

Best on Campus: The jury had a detailed discussion before picking Solinas Integrity, whose robotics solutions help eliminate manual scavenging, as the winner of this year’s Best on Campus award.

Also Read | How we arrived at the winners

Illegal loan apps driving citizens to suicide, says Ministry of Home Affairs

Following the arrest of Chinese nationals allegedly involved in the digital loan apps scam, the Ministry of Home Affairs has in a letter to states and Union Territories highlighted the “illegal lending” practices of digital applications.

Death by loan: The letter says, “Illegal digital lending apps are driving citizens to suicide due to harassment, blackmail and harsh recovery practices by the loan firms”.

It said, “[The] borrower has to provide mandatory access to contacts, location, phone storage in order to avail loan. This data is misused to harass and blackmail citizens using morphed images and other abusive practices by recovery agents located in India as well as overseas, violating RBl’s Fair Practices Code.”

RBI’s lending rules: In August, the RBI said that disbursal of loans and collection of repayments must be executed only between borrowers and entities regulated by it, and that no third party should be involved in the process.

TWEET OF THE DAY

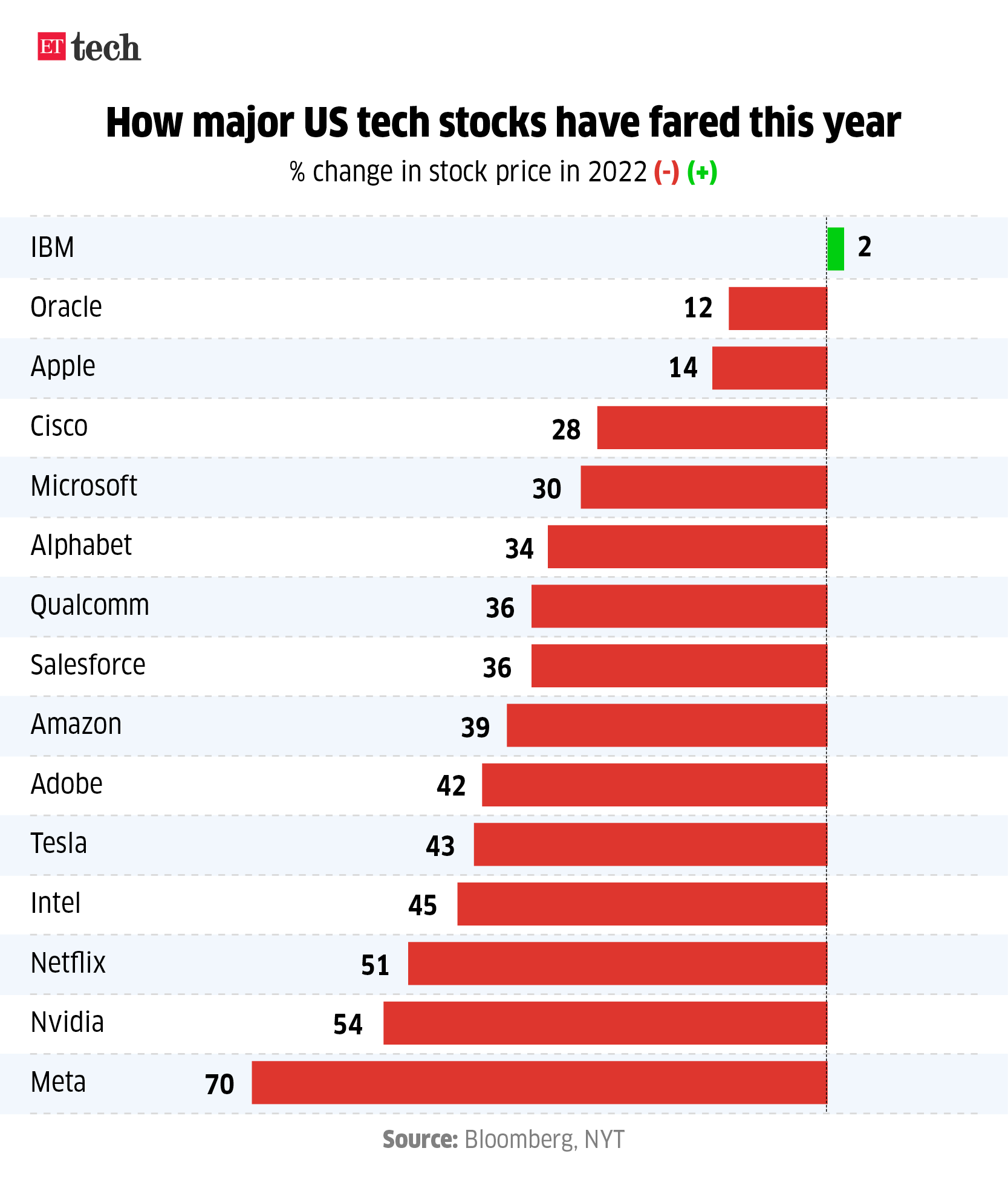

US tech stocks take a hammering in 2022; Indian IT firms suffer too

US tech stocks, the go-to place for global investors during the pandemic, have been among the market’s biggest losers this year as weak economic growth, rising inflation, rapid rate hikes and a strong dollar have taken a toll on these companies.

Sea of red: Meta, which has been using its cash cow Facebook to fund its ambitious and expensive bet on the metaverse – the so-called ‘future of the internet’ – is the biggest loser in 2022. The company’s stock is down an incredible 70% since the start of the year.

Nvidia and Netflix are next in line, having shed 54% and 51% of their value, respectively.

Amazon’s stock is down 39% since the start of the year, while Alphabet’s has shed 34% and Microsoft 30%. The Big Tech firm that has held up the best amid the turmoil is Apple, which is down “only” 12% since January 1.

Indian IT suffers: The global slowdown has also impacted Indian IT companies’ stocks. Wipro’s is down 47%, TechMahindra’s 41% and Infosys’s 20%. TCS, India’s largest IT firm, has fared the best – its stock is down 17%.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Siddharth Sharma in Bengaluru. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.