Amazon gets social (again); Razorpay’s $80-100 million secondary share sale

Also in this letter:

■ Lightspeed may invest in Razorpay’s $80-100M secondary share sale

■ Coming soon: the first high-volume chip made in India

■ Foreign investors cut Paytm stake to 4.42%

Amazon acquires Glowroad to boost social commerce ambitions

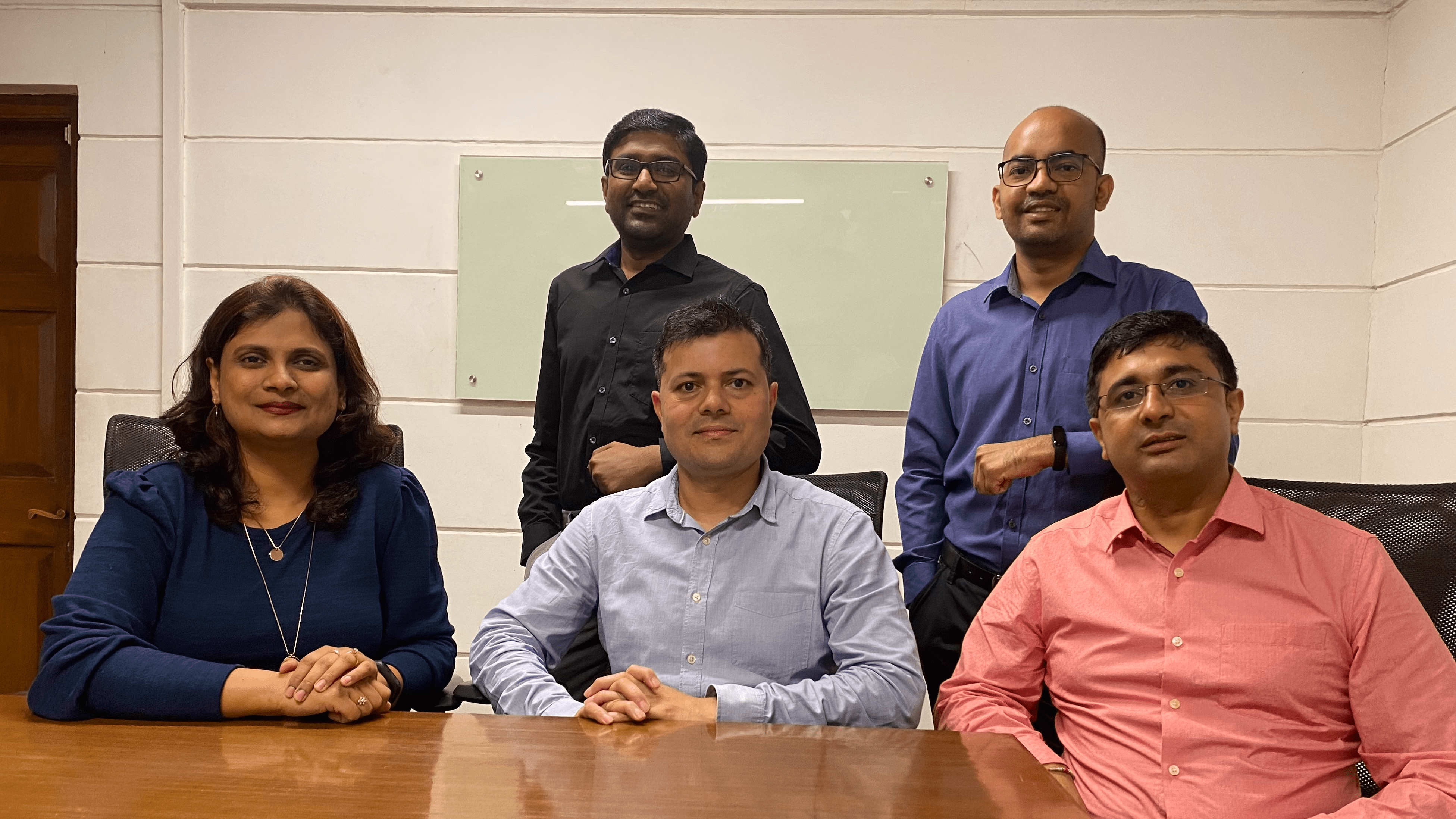

From left (sitting): Sonal Verma, Kunal Sinha, Nitesh Pant; (standing): Nilesh Padariya, Shekhar Sahu

Amazon India has acquired women-focussed social commerce startup Glowroad in an all-cash deal, sources told us.

This is the first inorganic bet that Amazon is taking on the social commerce space where sellers use platforms like Whatsapp and Facebook to sell their wares. The acquisition is Amazon’s attempt at getting a foothold in this buzzy segment, where many new players have emerged over the past few years, two people aware of the matter told us.

False start: In 2019, Amazon Spark, which was the ecommerce firm’s social shopping experiment in the US, was shut down two years after its launch. Similarly, in India, Amazon decided to phase out Spark after launching it here in December 2018.

Glowroad’s team of around 170 employees will join Amazon and the entity will continue to be run as an independent unit for now.

Backed by venture capital fund Accel and Vertex Ventures, among others, it is said to have been last valued at around $75 million.

According to data from Tracxn, the company has raised a little over $31 million since its inception in 2017.

Amazon’s interest in social commerce and Glowroad comes at a time when etailers are looking to widen their customer base outside of the top 10-12 cities.

Besides Meesho and Flipkart’s Shopsy, the social commerce segment saw the entry of foreign ecommerce ventures like Shopee last year. After six months of frenetic growth, the Singapore-based company abruptly decided to exit India, as we reported first on March 28.

Lightspeed may invest in Razorpay’s $80-100 million secondary share sale

Digital payments major Razorpay is stitching together an $80-100 million secondary share sale, which will see new investors including Lightspeed Venture Partners join its cap table, sources briefed on the matter told us.

The Bengaluru firm, valued at $7.5 billion after a $375 million funding round last December, is likely to close the deal in the coming weeks.

Who’s selling? The startup’s angel investors, employees and some other investors are offloading shares in what could be one of the company’s largest secondary sale deals since it was founded. In a secondary share sale, new investors buy shares from existing investors; the money doesn’t go to the company.

Razorpay founders may also offload a small part of their holding in the company but that hasn’t been finalised yet, sources added.

Sources said the final size of the transaction will depend on how much Razorpay employees are willing to divest. The secondary sale could lead to a windfall for existing investors as Razorpay’s valuation jumped two-and-a-half times in eight months when it closed its previous funding round in December.

Razorpay clocked an annual total payment volume (TPV) of $60 billion last calendar year and is aiming to hit the $90 billion mark by the end of 2022.

Coming soon: the first high-volume made-in-India chip

India has homed in on what would be its first indigenous semiconductor product.

One small step: The Indian Semiconductor Mission under the Ministry of Electronics and IT has identified a tiny but extensively used semiconductor chip used in LED bulbs, for manufacture within the country.

An estimated 700 million chips are used in LED bulbs in a year, and this number is set to touch one billion in two years.

Industry veterans, silicon wafer startups and academics are accelerating the plan to indigenise the supply chain for this chip, the first step in a larger plan to cut into a market dominated by Chinese imports.

Non-profit EPIC Foundation – set up by HCL cofounders Ajai Chowdhry and Arjun Malhotra and other technocrats – is working on a proposal to localise the design, manufacture, and packaging of these chips. It has chosen Bengaluru-based Qwikchip to design it.

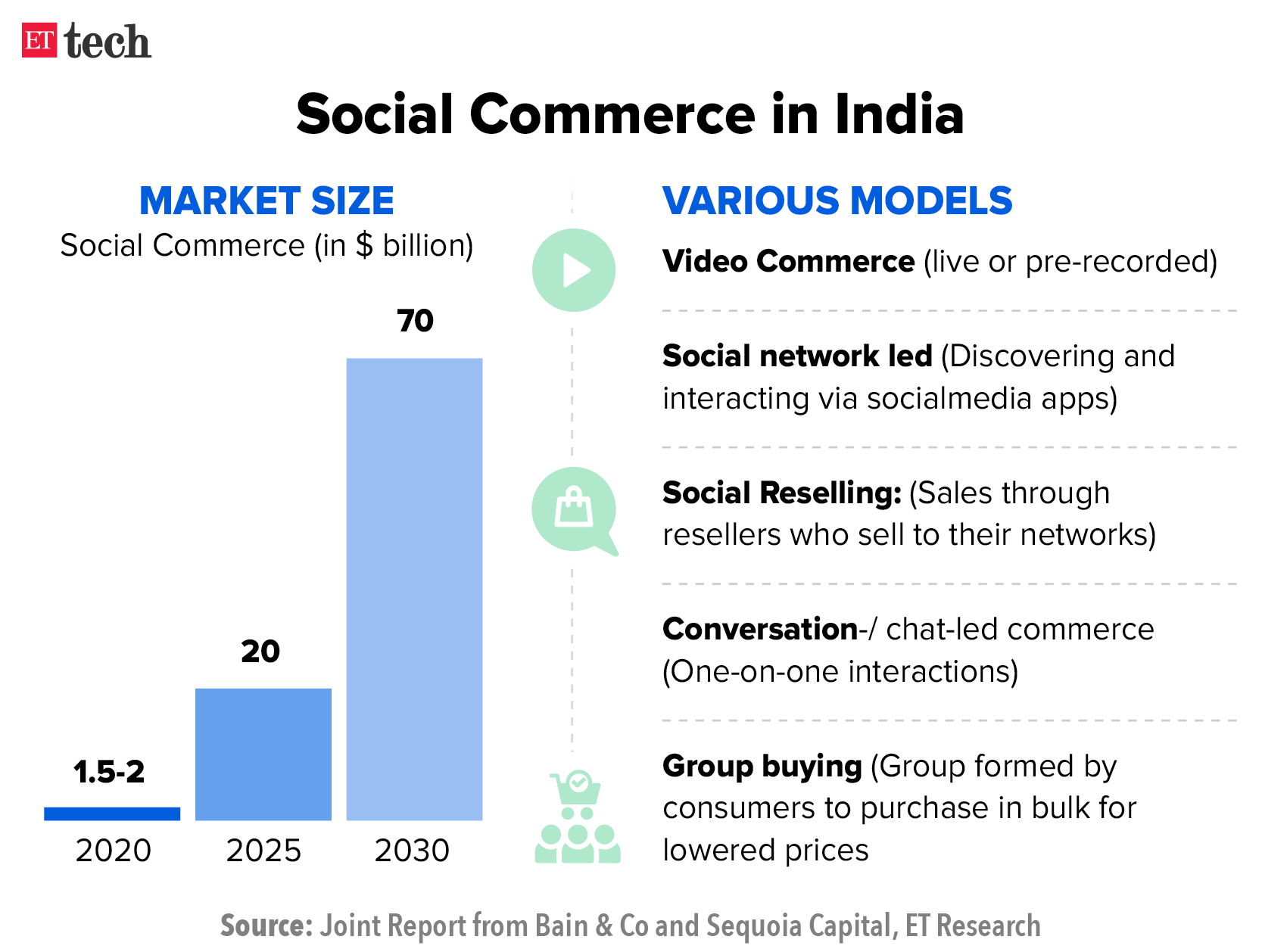

Infographic Insight

The collapse of Netflix’s stock on Wednesday, after the company reported its first loss of customers in a decade is the latest drastic sign that Wall Street is abandoning streaming services and other pandemic winners and questioning whether they still merit growth stock valuations, Reuters reported.

Foreign investors reduced Paytm stake to 4.42%, filing shows

.jpg)

One97 Communications, the parent company of Paytm, filed an updated shareholding with Indian stock exchanges on April 21.

It showed foreign portfolio investors reducing their stake to 4.42% as of March 31, from 9.36% in the quarter ended December 31.

Retail investors increased their stake to 7.72% from 3.49% in the same period, while Canada Pension Plan Investment Board (CPPIB) increased its stake from 1.57% to 1.71%.

CPPIB along with BlackRock were the anchor investors in Paytm’s initial public offering (IPO). They had bought more shares in November, right after its listing.

We reported on April 15 that Indian mutual funds had been lapping up beaten-down shares of new-age businesses and recently listed startups.

SBI Mutual Fund, ICICI Prudential, Nippon India and UTI bought shares of One97 in March, as Paytm shares have been under selling pressure since its market debut.

The stock fell as low as Rs 520 on March 23, almost 76% below its listing price of Rs 2,150.

Govt asks EV firms to voluntarily recall defective vehicles

The centre has asked electric vehicle manufacturers to voluntarily recall defective two-wheelers.

In a series of tweets, Road Transport Minister Nitin Gadkari said, “Companies may take advance action to Recall all defective batches of vehicles immediately.” He said that an expert committee was constituted to enquire into these incidents and make recommendations on remedial steps.

Okinawa Autotech will recall 3,215 Praise Pro electric scooters, the first instance of an Indian manufacturer doing so after the spate of recent fires, we reported on April 16.

Three scooters made by Okinawa have caught fire since October, resulting in two injuries.

Man dies as EV battery explodes: The battery of a Pure EV electric scooter burst in a home in Nizamabad town on Tuesday night, killing an 80-year-old man and injuring his wife and grandson. A case has been registered against Pure EV. The report suggested that the battery burst into flames after the owner put the vehicle on charge.

This is the third recent incident in which a Pure EV scooter caught fire or exploded.

Ola Electric and Jitendra EV are other companies that have seen their electric scooters catch fire in the past fewweeks.

Also Read: Okinawa clarifies that fire at dealership was due to an electric short-circuit

Ola Electric posts Rs 200 crore loss: Ola Electric posted a loss of almost Rs 200 crore in for the financial year that ended March 2021 (FY21), according to regulatory filings.

The company clocked operational revenue of just Rs 86 lakh as it didn’t sell a single product during this period. Its biggest expense was employee benefits, which made up close to 70% of total expenses.

TWEET OF THE DAY

HCL Tech Q4 results: profit jumps 226% yoy to Rs 3,593 crore

HCL Technologies on Thursday said its consolidated net profits for the quarter ending March stood at Rs 3,593 crore, up 226% from Rs 1,102 crore in the same quarter last year.

The company said its revenue from operations for the quarter came in at Rs 22,597 crore, up 15.05% from Rs 19,641 crore in the year-ago quarter.

The company’s Ebitda (earnings before interest, tax, depreciation and amortisation) fell 4.2% to Rs 5,053 crore in the quarter, from Rs 5,276 crore a year ago.

The board of the company has also declared an interim dividend of Rs 18 per equity share for fiscal 2022-23.

In its FY23 guidance, HCL said it expects revenue to grow between 12% and 14% in constant currency terms.

‘Tis the season: On April 11, TCS announced an increase of 7.4% in net profit for the March quarter. Consolidated net profit for the January-March quarter came in at Rs 9,926 crore, on revenue at Rs 50,591 crore, up 15.8% on-year.

Two days later, Infosys said its consolidated net profit rose 12% year-on-year to Rs 5,686 crore in the March quarter. The company reported a 29.8% on-year rise in consolidated revenues at Rs 32,276 crore.

Other Top Stories By Our Reporters

HealthifyMe cofounder and CEO Tushar Vashisht

HealthifyMe mulls IPO: Health and wellness platform HealthifyMe is mulling an initial public offering (IPO) in the next 24 months. The company said it plans to clock an annualised revenue run rate (ARR) of $200 million by then. The company clocked revenue of $13 million in FY20, $23 million in FY21, and around $50 million in FY22.

Indian smartphone market grows just 2%: India’s smartphone market grew only 2% in the first quarter of 2022 from the same period last year, according to a report by Canalys. This comes as the Indian smartphone industry, like others around the world, has been facing a severe supply crunch.

Global Picks We Are Reading

■ Netflix’s Password Crackdown Is Coming. Here’s What That Means for Account Sharers (WSJ)

■ China’s most chaotic social network survived Beijing’s censors — until now (Rest of World)

■ Actors launch campaign against AI ‘show stealers’ (BBC)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.