Aditya Birla Group bags eight D2C brands; India may have 500 more GCCs by 2026: Nasscom

.jpg)

Credit: Giphy

Also in this letter:

■ MNCs to add 500 tech, services centres in India by 2026: Nasscom

■ Now, Amazon to shut its wholesale distribution business in India

■ Next year will be worse than 2022 for tech firms: Gaurav Munjal

Aditya Birla Group’s TMRW to invest in eight D2C brands

TMRW, the Aditya Birla Group’s online ‘house of brands’ business, said it is investing in eight digital-first lifestyle brands.

With these brands on board, TMRW has achieved a revenue run-rate of Rs 700 crore and is on track to cross an annual revenue rate of Rs 1,500 crore in the next 12 months, the company said.

Catch up quick: On Friday we reported that the Aditya Birla Group was in the final stages of acquiring a controlling stake in one of these brands, apparel and accessories firm Bewakoof, for about Rs 100 crore, marking its entry in the direct-to-consumer (D2C) segment. Mumbai-based Bewakoof has been out to raise fresh capital from financial investors but those discussions did not fructify into a deal amidst a funding winter, said people in the know of the matter.

The seven other brands TMRW has acquired are Berrylush (women’s western wear), Juneberry (casual wear), Natilene (teen’s occasion wear), Nauti Nati (kid’s wear), Nobero (athleisure), and Urbano and Veirdo (casual and denim wear).

Some of these transactions are subject to customary closing conditions and signing of definitive documents, TMRW said in a statement.

Digital foray: The Aditya Birla Group set TMRW in June and said it would acquire and incubate 30 brands in the next three years. The new firm is part of the group’s strategy to build a portfolio of new-age, digital brands across categories in fashion, beauty and lifestyle.

“With our investment and deep value-addition, we are confident in scaling existing leading brands to become category leaders as well as be the category creators in several emerging categories,” said Prashanth Aluru, CEO and cofounder, TMRW.

Covvalent raises $4.3M: Meanwhile, Gurugram-based startup Covvalent has raised $4.3 million in a seed funding round led by Nexus Venture Partners. The startup, founded this year by IIT Kharagpur alumni Sandeep Singh and Arush Dhawan, operates as a tech-enabled, managed marketplace for specialty chemicals.

MNCs to add 500 tech, services centres in India by 2026: Nasscom

Over 500 global capability centres (GCCs) are expected to be added to India’s existing tally of 1,500 GCCs by 2026, the Times of India reported, citing IT industry body Nasscom.

What’s a GCC? GCCs are the tech and shared services centres of MNCs in India. They are growing rapidly as global companies look for talent to help them go digital.

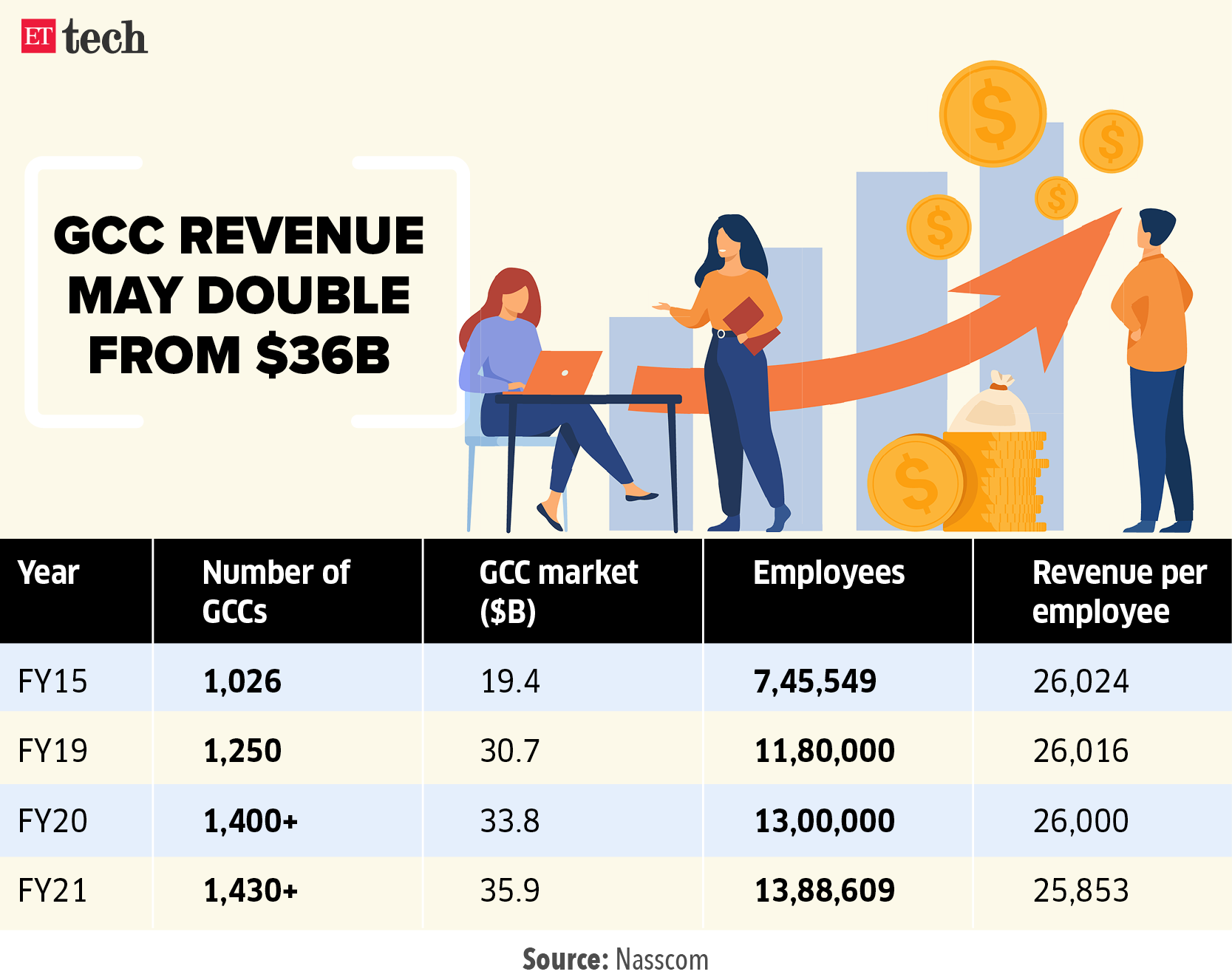

Infographic insight: The 1,500 GCCs in India employ 1.3 million people. GCC revenue could increase to $60-$85 billion by 2026 from $33.8 billion in 2019-20, according to the Nasscom report. A revenue of $33.8 billion is equivalent to about 1% of India’s GDP. GCC revenue was $19.4 billion in 2015, indicating a compound annual growth rate (CAGR) of 11% between then and the 2020 fiscal.

Who’s doing what: Companies that recently established GCCs in India include auto component major Marelli, which has set up a technical R&D centre in Bengaluru and plans to employ 600 people in two years.

- Rakuten India, the global product and innovation centre for the Japanese e-commerce firm Rakuten Group, plans to hire over 1,000 people over the next 12-18 months, which will take its overall workforce to over 3,000.

- GE Healthcare has launched its first made-in-India, AI-powered cath lab to advance cardiac care in India.

- Deutsche Bank uses a low-code/no-code platform to eliminate manual work and delays in processing transfer pricing invoices. Its technology unit in India has about 5,000 employees across Pune and Bengaluru.

Now, Amazon to shut its wholesale distribution business in India

Ecommerce giant Amazon said it is shutting down its wholesale distribution business in India. Called Amazon Distribution, the business operates in Bengaluru, Hubli and Mysore. This is the third business Amazon has shut in India in the past week. Reports emerged earlier this month that it plans to lay off thousands of employees around the world.

Not that one: Amazon Distribution is different from its business-to-business (B2B) ecommerce marketplace Amazon Business, which operates on a marketplace model with third-party sellers.

“As part of our annual operating planning review process, we have made the decision to discontinue Amazon Distribution, our wholesale ecommerce website for small neighborhood stores around Bengaluru, Mysore & Hubli,” read a statement by the company.

Hat-trick of closures: We reported on November 26 that Amazon India has decided to shut its food delivery business by the end of the year. It is also shutting down its edtech business Amazon Academy.

While the Amazon India marketplace, Amazon Seller Services, was able to cut losses by almost 23% to Rs 3,649 crore in FY22, losses at its other two businesses – payments and logistics – have widened.

Also Read | Zoomcar onboards Cars24’s Naveen Gupta as country head for India

Next year will be worse than 2022 for tech firms: Gaurav Munjal

Unacademy Group cofounder and CEO Gaurav Munjal has said that next year will be worse for tech companies than 2022, which has been marked by a prolonged funding winter and widespread layoffs. He tweeted, “2023 will be worse than 2022 for Tech. This is what I keep hearing.”

Grim year: The tweet comes at a time when thousands of tech workers across the world have lost their jobs in cost-cutting measures by US tech giants. Layoffs across the tech industry, including at startups and Big Tech companies such as Meta, Google, Microsoft and Amazon, have affected hundreds of Indians.

Several new-age companies in India, including edtech firms such as Byju’s and Vedantu, have also fired employees amid a severe slowdown in big funding deals. Unacademy recently sacked as many as 350 employees. Earlier this year, it fired around 1,000 contract and full-time workers.

ETSA discussion: The tech turmoil was one of the biggest talking points at The Economic Times Startup Awards 2022.

- Kalyan Krishnamurthy, CEO, Flipkart Group, said during a panel discussion, “The next 12 to 18 months is where we will see a lot of turmoil and volatility.”

- Harsh Jain, cofounder and CEO, Dream Sports, said such problems occur when startups “try to hyper-grow when [their] unit economics are not in place”.

FTX remains focus of active probe: Bahamas attorney general

Collapsed cryptocurrency FTX, which collapsed this month, remains the subject of “an active and ongoing investigation” by Bahamian authorities, the country’s attorney general Ryan Pinder said, praising the Bahamas’ regulatory regime and swiftness with which it responded to the crisis.

Catch up quick: FTX, once among the world’s largest crypto exchanges, is headquartered in the Bahamas. Since declaring bankruptcy on November 11, it has become the subject of investigations by Bahamian and US authorities. In mid-November, the Royal Bahamas Police said that government investigators in the Bahamas were looking at whether any “criminal misconduct occurred”.

Also Read | WazirX says it received 828 info requests from law enforcement in six months

Singapore govt faces tough questions: Meanwhile, Singapore’s government faces increased scrutiny over the fallout from the collapse of FTX. Prime Minister Lee Hsien Loong and Deputy Prime Minster Lawrence Wong face a raft of parliamentary questions this week over the losses incurred by retail investors and the due diligence undertaken by state-owned investor Temasek, which wrote down its entire $275 million investment in FTX.

Also Read | How did FTX fleece the world’s shrewdest investors?

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Siddharth Sharma in Bengaluru. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.