A week of crypto chaos

Panic selling. Worried investors. Professionals considering moving bases.

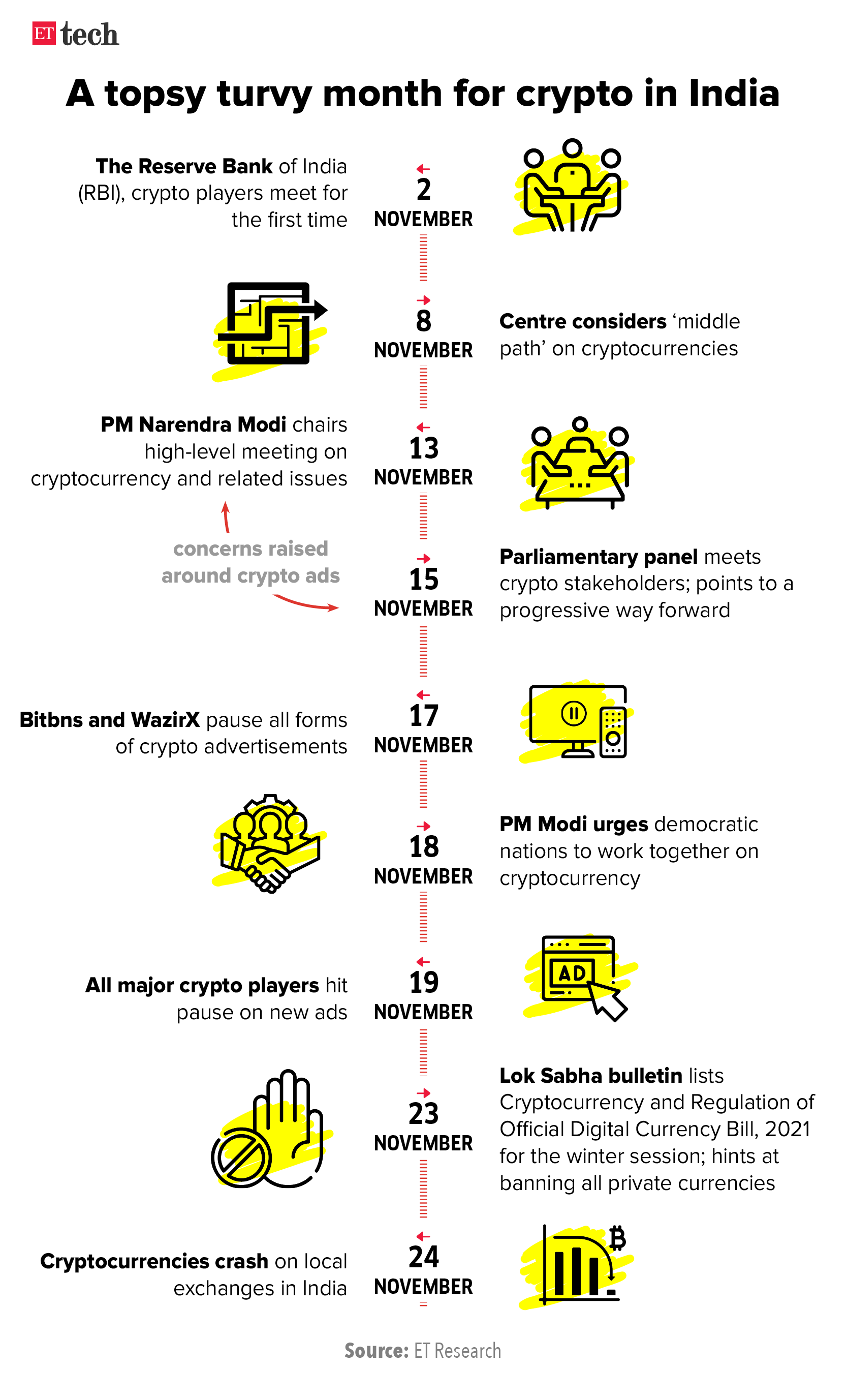

But the crypto sector today is nothing like what it was then. When it became clear earlier this year that the Cryptocurrency Bill won’t be tabled during the budget session of the parliament, retail participation in this asset class skyrocketed—thanks, in part, to Elon Musk—and exchanges flourished.

Up until this month, the prospects of the industry looked rosy from a regulatory point of view as Union Finance Minister Nirmala Sitharaman promised a “calibrated” approach to cryptocurrency. But, Tuesday night flipped the seemingly positive narrative in seconds.

This week, a bulletin published by the Lok Sabha for the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, spooked the nascent industry. To be tabled during the upcoming winter session of the parliament, the bulletin ominously said, the bill aims to “…prohibit all private cryptocurrencies in India…”

The declaration was enough to send thousands of retail investors, who have jumped on the crypto bandwagon, into a panic-selling mode. India has about 15-20 million retail investors who hold about Rs 6 lakh crore in crypto assets, according to the Blockchain and Crypto Assets Council (BACC), part of the Internet and Mobile Association of India (IAMAI).

“Retail investors are scared, I get 50-60 messages a day just talking about the market and a possible ban,” said a founder of a DeFi project who has been trading for over five years, requesting anonymity. Bitcoin, Ethereum fell by as much as 15% on local exchanges and Tether (USDT), the world’s largest stablecoin by market value crashed and hit Rs 60 on WazirX exchange while maintaining the 1:1 peg with the dollar on international exchanges. The market was ripe for arbitrage, and sophisticated investors bought the dip.

If you have been keeping tabs on the sector, the broader sentiment felt like an outright ban was unlikely in India, and some form of regulations will be reached, barring the multiple reiterations by the country’s central bank. The Reserve Bank of India (RBI) Governor Shaktikanta Das had earlier said that cryptocurrency is a “major concern”.

Some prominent investors say that flashy, unbridled ads by exchanges are to blame for the current mess. So much so that the Indian Prime Minister Narendra Modi said “Ads should not mislead the youth”.

“The exchanges brought this upon themselves,” said one of the investors.

CEOs of top exchanges, crypto commentators, policy figures tapped all possible channels — Twitter diplomacy, good old broadcast television, Twitter Spaces, you name it—to calm retail investors’ nerves.

Along with unprecedented retail participation, the last eight months in the crypto markets had also coincided with a boom in the developer community and blockchain and crypto projects. Investors from outside India began to feel the potential of the market—thanks to the success of Polygon and Instadapp and others—and the numbers showed it. Over $500 million in risk capital has been invested in the sector as of October.

We wrote about how the uncertain environment is leading some funds to pause investments or rethink strategies, while other international venture capitalists are hinging their hopes on innovation-friendly regulations.

When hints of a possible crypto ban emerge, developers and founders instantly start thinking about moving bases to friendlier locations like Singapore, Dubai or Abu Dhabi. Several large investors and project developers have already done so, and many others could follow suit.

Another founder said the uncertain environment felt too risky to be in.

What’s next? An outright crypto ban in India is unlikely, as is its recognition as legal tender, ET reported earlier this month. India is considering a middle path on cryptocurrencies. And we will be here to report how things play out for this nascent yet booming industry.

Stay tuned to ETtech for more on this developing story next week.

OTHER BIG STORIES BY OUR REPORTERS

Mobikwik founders Bipin Preet Singh (left) and Upasana Taku

Mobikwik defers IPO amid fintech scrutiny: MobiKwik, has decided to delay its Rs 1,900 crore initial public offering (IPO), draft papers of which were filed in July, in the aftermath of Paytm’s disappointing market debut.

“We have a one-year window from October to list and obviously we‘ll do it when we feel that we are going to have a successful IPO,” cofounder Bipin Preet Singh told Reuters. “We don’t do it (IPO) based on bravado, based on being aggressive and hopeful. You create maximum opportunity for success because you do this one time in the history of the company so you want it to be successful.”

After Paytm lists, SoftBank sets eyes on Juspay: SoftBank, one of the largest investors in Paytm, is looking to diversify its holdings in India’s fast-growing fintech industry now that the company has gone public.

SoftBank Vision Fund is close to leading a $100-120 million funding round at Juspay, which would value the fintech company at $400-500 million, sources told us. “SoftBank may put in around $50 million with some other investors still to finalise their participation,” said one person aware of the development.

- If it goes through, it will be the largest-ever fundraise for the nearly decade-old Juspay, which counts Accel and Wellington Management as investors.

The Japanese conglomerate had until now stayed away from backing financial services companies in India due to its $1.6-billion exposure to Paytm, in which it holds a 16% stake.

D2C brands settle down in small town India: Small towns now account for 40-50% of sales of several premium direct-to-consumer (D2C) brands across grooming and beauty, wellness foods, wearables, cookware and appliances with heightened digital adoption and online shopping amid the pandemic.

- Brands such as boAt, Bombay Shaving Company, Wonderchef, Kapiva, mCaffeine and Mamaearth expect further increase in demand from small towns, driven by affordability and first-time consumers.

D2C—where many brands are online only—is one of the select sectors that have grown significantly since the outbreak of Covid-19 as the pandemic forced people across the country to shop online.

Udaan cofounders (from left) Amod Malviya, Vaibhav Gupta and Sujeet Kumar.

Udaan to take on Meesho, DealShare in grocery business: Udaan, a B2B ecommerce firm, is entering the consumer-focused grocery business through the group-buying or community model, similar to China’s Pinduoduo.

- While small retailers in Tier II-IV towns will be its “community leaders” delivering the orders, an individual consumer can also place an order for fresh supplies and FMCG products, people briefed on the matter said.

This will put Udaan in direct competition with SoftBank-backed Meesho as well as Tiger Global-supported DealShare, which are increasingly focusing on selling groceries in non-metro markets. Udaan has entered the space through a new platform called Price Company, the people said.

BigBasket jumps into buzzy quick delivery segment: BigBasket will launch its express delivery service, BB Now, next month, offering 10-20-minute grocery delivery, joining the quick commerce rush with platforms like Grofers, Swiggy’s Instamart, Dunzo and Zepto.

- The company will also be bringing all its grocery offerings in its main BigBasket app, which is being referred to internally as the ‘BB Super App’, CEO Hari Menon told ET.

BB Now, expected to be launched around the middle of December, will be part of BigBasket and the company has also started work to bring its subscription-based essentials delivery service, BB Daily, on to the main app, he said.

ETtech Opinion

Startups, stay sharp, but grow up: What founders need to do is strike a balance between staying agile and being ‘growth-alive’ as they move into the more traditional public market. This balance isn’t easy to strike but that’s what startups will need to work towards, writes Samidha Sharma.

How creators and NFTs are fuelling the Digital Renaissance: Just like the Medicis of the Renaissance era, “Superfans” will happily spend lakhs of rupees to own or support the work of their favourite creators, writes A Junior VC’s founder Aviral Bhatnagar. Those who give creators the shovels for their careers will be part of the “creator economy”. The gold that the creators will find with these shovels will very likely be in the form of NFTs.

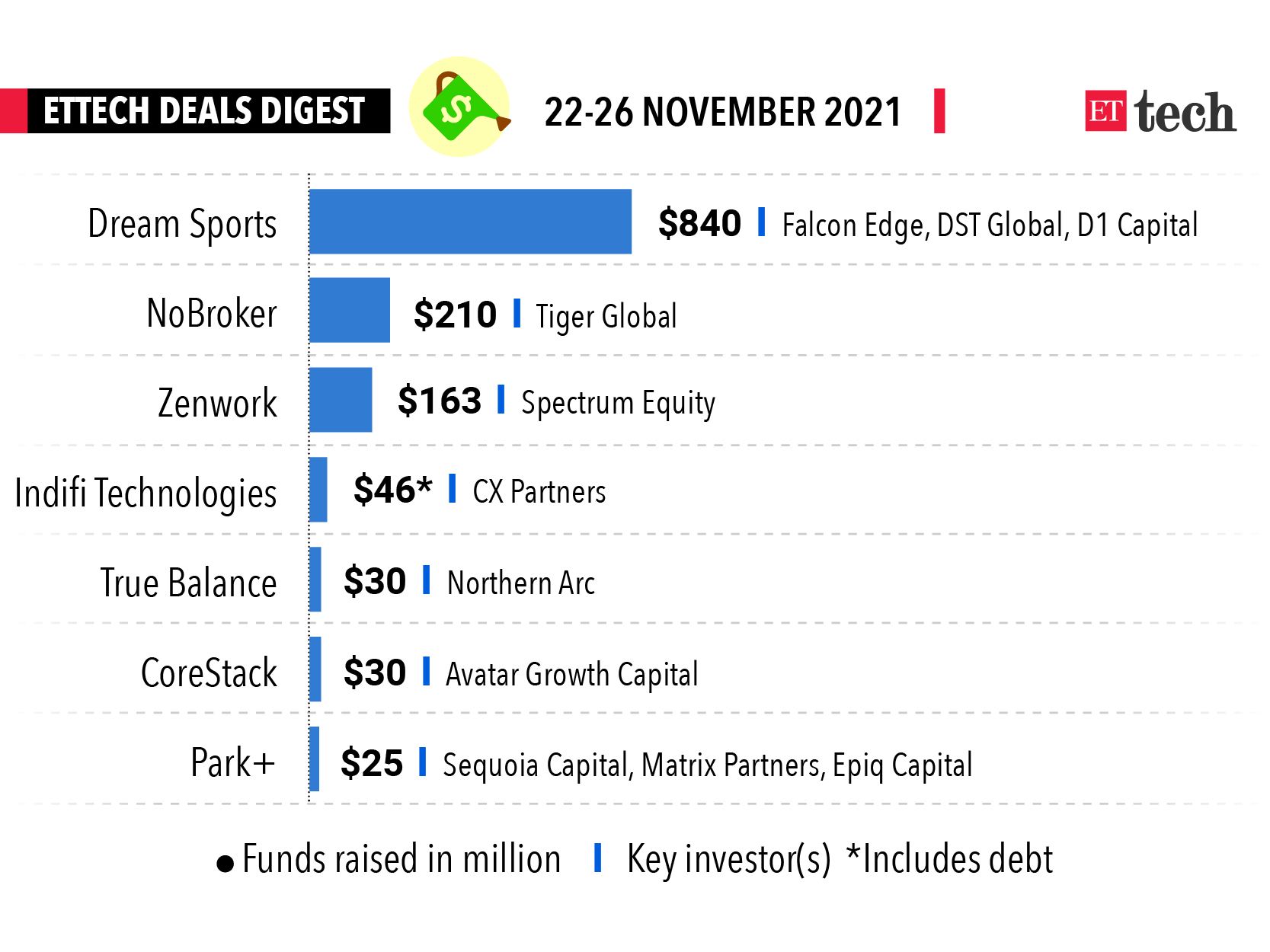

ETtech Deals Digest

MORE TOP STORIES

Amazon gets Cloudtail’s replacement for electronics retail: The Salarpuria-Sattva Group, one of the largest real estate developers in South India, has incorporated Dawntech Electronics to take over the entire consumer electronics business of Cloudtail India, currently the largest seller on Amazon India.

Swiggy’s food delivery revenue grew 56% in H1 FY22, Prosus says: Swiggy is doing 1.59 million orders per day, and its GMV for April-September 2021 was up 69% year-on-year to $984 million on the back of higher average order values compared to pre-pandemic levels and higher revenues, Prosus says.

Ola delays deliveries of its electric scooters yet again: Ola had until recently maintained that it would begin deliveries of its electric scooters later in November. This was already a month behind the delivery schedule that it had indicated to buyers when bookings opened in mid-September.

MoS Electronics & IT Rajeev Chandrasekhar.

Equal opportunities for all Internet firms, Rajeev Chandrasekhar says: The government will provide equal opportunities as per law to all internet companies, both foreign-owned and Indian, and is taking a professional approach in dealing with any outstanding issues, said Union Minister of State for IT and Electronics Rajeev Chandrasekhar.

Startups conduct ESOPs buybacks worth Rs 3,200 crore in 17 months: Nearly 40 Indian startups have bought back Rs 3,200 crore worth of shares since July 2020 from employees who had been given stock options, according to data compiled by ESOP Direct.

India’s tech startups step up campus hiring: Hiring from campuses will help startups nurture young talent and create more stickiness among them, amid record high attrition rates in the wider technology industry. They are also offering attractive pay cheques and growth opportunities to youngsters in a hyper-competitive talent market.

That’s all from us this week. Stay safe and get that jab.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.