Cloud services wage price war as startups cut costs; wary IT firms may halve hiring of engineers

This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ Online gaming companies say TDS will cut rows, compliance load

■ For cloud kitchens, pandemic-driven sheen fades away

■ What the IT sector can learn from 2008 crisis?

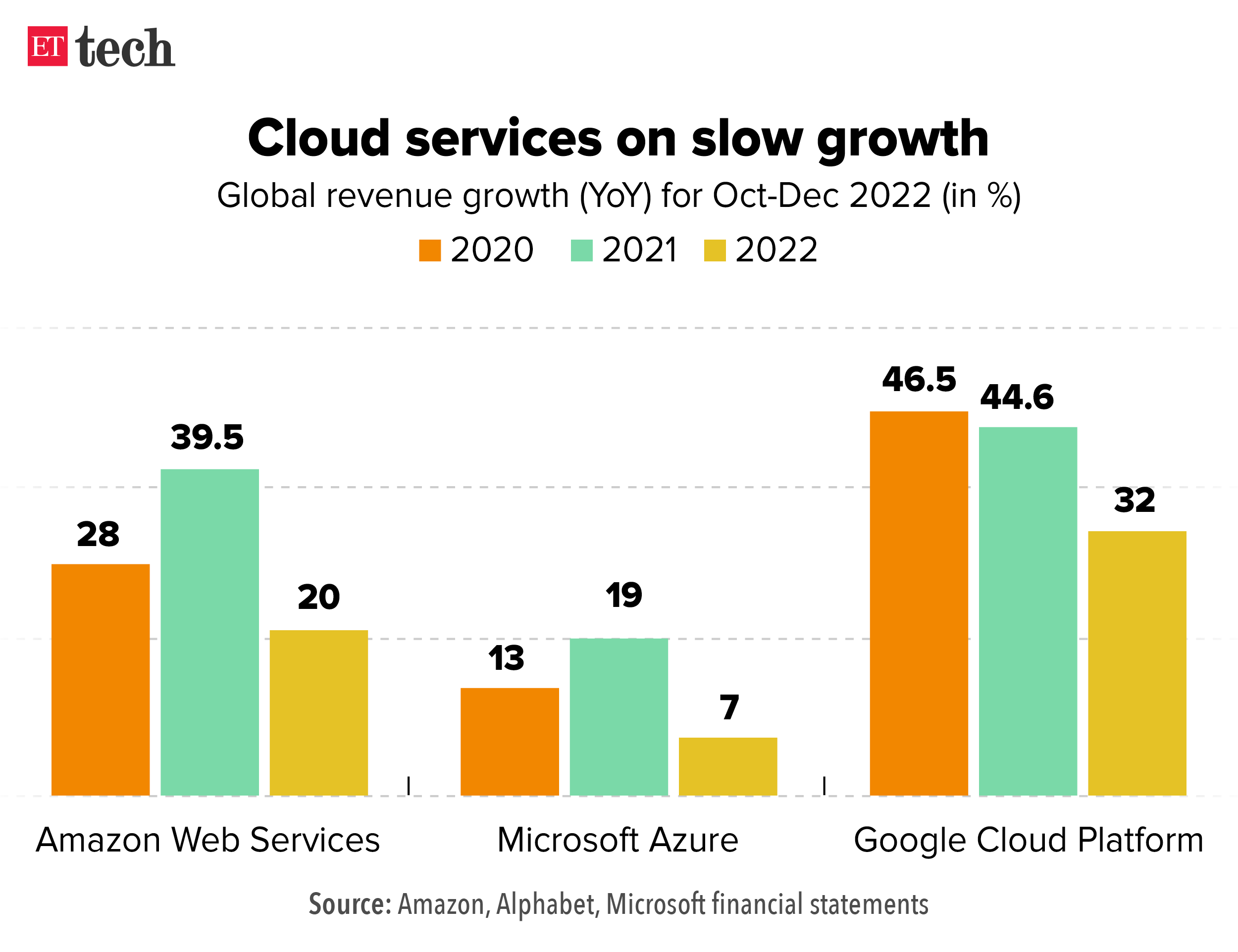

Cloud service providers see a price war as startups renegotiate contracts

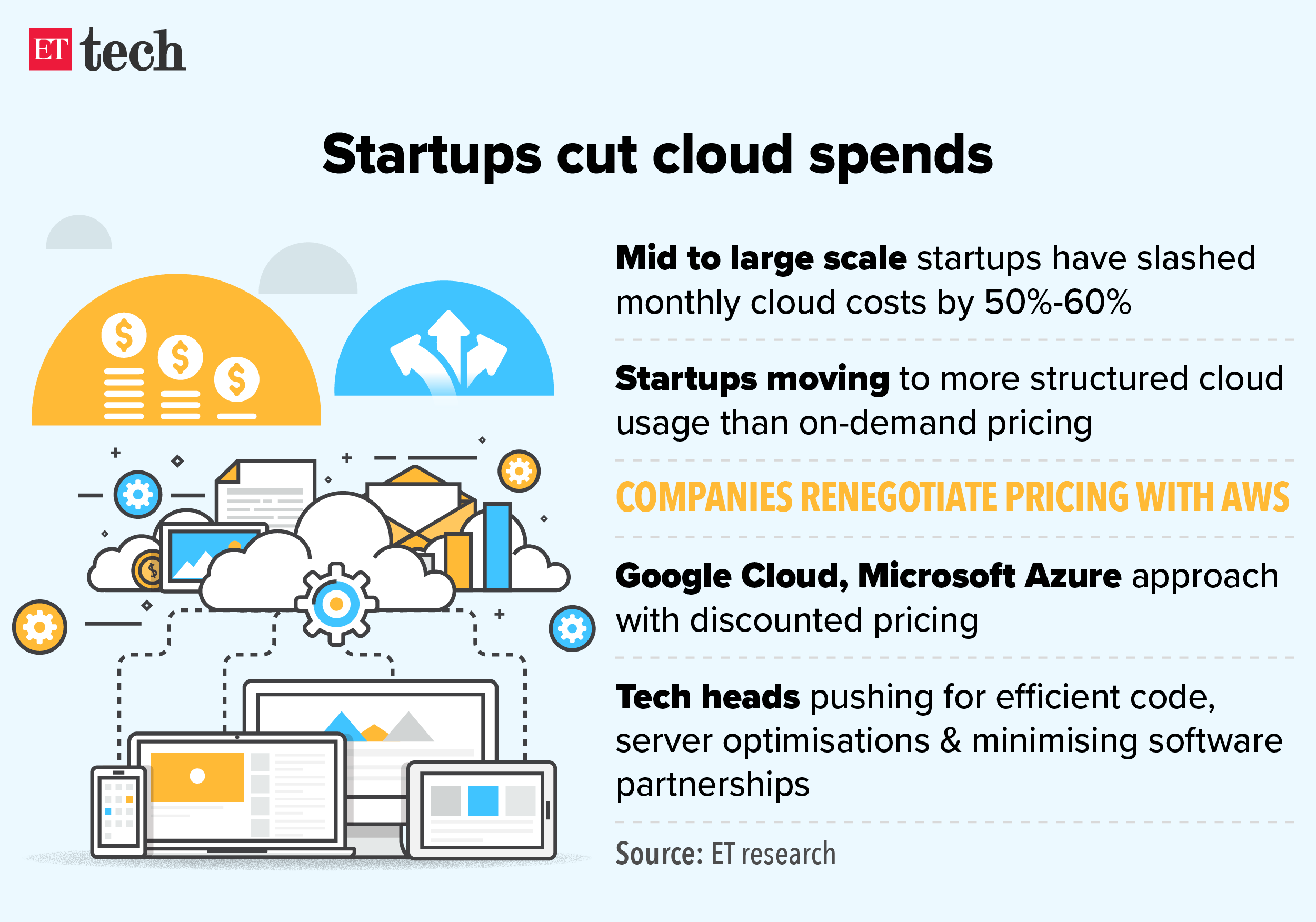

The slowdown in global macroeconomic conditions and drying up of funding have driven startups to tighter costs. Indian startups are cutting their spends on an integral part of their business – cloud storage, by renegotiating contracts with service providers like Amazon’s AWS, Microsoft Azure and Google Cloud.

Slashing costs: Founders, technology and product heads, ET spoke to said that companies across the board are cutting cloud expenses by 20%-30% while some growth-stage startups like Meesho and Dealshare have brought cloud expenses down by 50%.

Cloud wars brewing: As startups have downsized, rivals of Amazon Web Services (AWS), which is the preferred cloud service provider with new-age tech businesses, have started luring founders with deep discounts. Azure has come off as a strong choice, as it sweetens the deal by bundling cloud services with the Microsoft 365 productivity suite. But, shifting to a new primary cloud provider is time-consuming and expensive.

What’s next? Founders have been smart to take these discounted offers to AWS, and are actively renegotiating contracts. Some early stage founders have also approached AWS to extend cloud credits for a year.

Cut, cut cut: Technology heads at startups are pushing teams to drive server optimisations, deploying fewer but more efficient lines of code, minimising software tool partnerships, and moving to load capacity planning. Among other costs that startups are looking to cut are storage, monitoring, and application programming interface (API) calls.

Wary IT companies may halve hiring of engineers from April: Experts

Net hiring of engineers by Indian IT companies is likely to crash by close to half in the coming fiscal starting April compared to the current year amidst cautionary sentiment among companies, hiring firms told ET. Last week, global IT giant Accenture announced 19,000 job cuts to manage cost even as it lowered revenue guidance.

Drop in hiring: Staffing firm TeamLease expects a 40% drop in FY24 headcount addition compared to FY23, based on the current outlook from companies. This comes after the companies reported record hiring and attrition numbers during fiscal year 2022 and first half of fiscal 2023.

In Quotes: “So far in FY23, there has been a net headcount addition of about 2.8 lakhs (across the IT sector) and Q4 addition is likely to remain flat. In recent quarters attrition has gone down and growth visibility has also reduced. So we would expect a 30-40% drop on FY24 headcount addition based on the current outlook,” said Sunil C, CEO, TeamLease Digital.

Online gaming companies say TDS will cut rows, compliance load

Online gaming platforms have welcomed the government’s move of making tax deducted at source (TDS) on winnings from online games applicable from April 1, instead of July 1. The original July 1 timeline was introduced in the Union Budget unveiled on February 1 this year, whereas the changes to the provisions were brought in through amendments to the Finance Bill.

Background: In the Union Budget for 2023-24, the government introduced Section 194BA and 115BBJ to tax income that users earn by winning on gaming platforms. Section 194BA deals with TDS while Section 115BBJ prescribes the 30% tax rate on winnings. Both these provisions were initially to be applicable from July.

Why the change? The industry had sought the applicability of TDS to April so that the taxation regime stays uniform for the entire financial year. Having two different tax regimes during the same year could have led to compliance burdens and tax disputes, gaming industry executives said.

Quote, unquote: “It would have been problematic if the TDS would have been applicable from July as the financial year starts from April 1, and the period from April-June would have been an exposure, and even potentially open to dispute with tax authorities”.

Tweet of the day

ETtech in-depth: Cloud kitchens change flavours as pandemic-driven sheen fades away

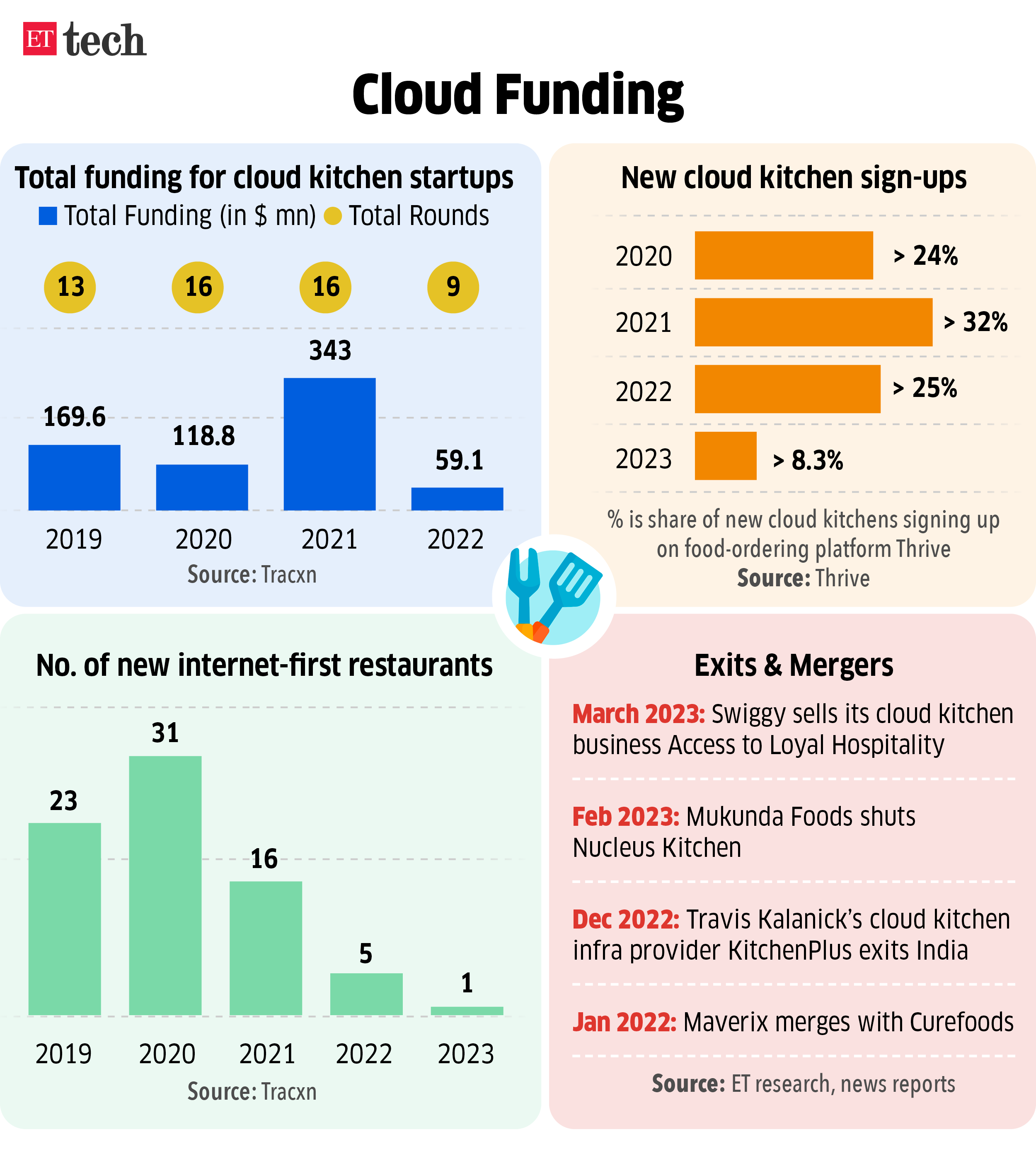

Cloud kitchens were all the rage during the pandemic when physical restaurants and eateries shuttered down. The number of cloud kitchens on Swiggy tripled between FY19 and FY21; and on Zomato they doubled between January 2020 and August 2021, ET reported in 2021.

Declining trend: The cloud kitchen boom has subsided. Food ordering platform Thrive says it has seen a decline in the number of new cloud kitchen brands signing up on it. In 2020, 24% of food brands that signed up were cloud kitchens. It jumped to 32% in 2021. In 2022, their share fell to 25%. As of March 2023, just 8.3% of its new merchant sign-ups were cloud kitchens.

Shutdowns, exits, mergers: The slide was visible even last November when food delivery platform Swiggy wound down its delivery-only brand, The Bowl Company, in Delhi-NCR as it did not perform well in the region. It is not just delivery-only food brands that have been hit. There has been a spate of shutdowns, exits and mergers of startups providing space and infrastructure to dark kitchens. Early March, Swiggy sold Access, which rented out kitchen spaces, to Loyal Hospitality. Last month, Zomato-backed Mukunda Foods shut down Nucleus Kitchen, which offered automated kitchen spaces to brands.

Lessons from the past: what the IT sector can learn from 2008 crisis?

The banking turmoil that’s hit North America and Europe over the past two weeks has got the Indian IT sector worried. But current and former industry executives say that the going is unlikely to get as tough for India’s tech companies as it was in FY2008-9 when the global financial crisis struck.

Collapse and chaos: Over the past few weeks, the US has seen its second and third largest banking failures in history with Silicon Valley Bank and Signature Bank, both taken over by the Federal Depositors Insurance Corporation (FDIC). First Republic has been teetering, with JP Morgan heading talks on a rescue plan. Across the Atlantic, Swiss bank UBS has had to take over a failing Credit Suisse. On Thursday, Software services behemoth Accenture said it will cut around 19,000 jobs giving in to macroeconomic concerns.

Companies with exposure to troubled banks: Companies like Tata Consultancy Services, Infosys, Wipro, LTIMindtree, Cognizant and Mphasis are vendors to banks at the centre of the turmoil such as Silicon Valley Bank, Signature Bank and Credit Suisse. Exposure to regional banks in the US is the highest for Cognizant, followed by Infosys and TCS. Tech Mahindra and HCLTech have low exposure to US regional banks.

Other top stories by our reporters

Paytm wins regulator extension for payment aggregator licence application: One97 Communications (OCL) said its subsidiary Paytm Payments Services Ltd (PPSL) has received an extension from the Reserve Bank of India to resubmit its application for a payment aggregator (PA) licence. The banking regulator had in November last year asked Paytm to reapply for the licence within 120 days and stopped it from signing up new online merchants for the platform.

Pocket FM plans a global audio series platform: Audio streaming platform Pocket FM is planning to increase its global presence, after the ‘great traction’ it is seeing in the US. The Gurgaon-based company made its foray into the market in November last year. “As a format, audio is way more engaging and monetizable than audiobooks and podcasts,” Rohan Nayak, co-founder at Pocket FM, told ET.

Global picks we are reading:

11 Tips to Take Your ChatGPT Prompts to the Next Level (Wired)

ChatGPT started a new kind of AI race — and made text boxes cool again (The Verge)

At Apple, Rare Dissent Over a New Product: Interactive Goggles (New York Times)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.