Top-level executive shake-up at Nykaa; Twitter to remove legacy blue ticks from April 1

Also in this letter:

■ Disney Star eyes content deals with top multi-system operators

■ Jack Dorsey’s wealth takes $526-million hit post Hindenburg report

■ ETtech Deals Digest: weekly funding in Indian startups falls 86% YoY

Big shake-up at Nykaa as five senior-level executives exit the beauty retailer

Amid its plunging stock price and a broader rout in the listed tech pack, beauty ecommerce platform Nykaa confirmed on Friday that five executives have left the firm.

Who all have quit? Among the exits are chief commercial operations officer Manoj Gandhi, chief business officer of fashion division Gopal Asthana, and chief executive officer of wholesale business Vikas Gupta. Shuchi Pandya, vice president of Nykaa fashion division’s Owned Brands business, and Lalit Pruthi, vice president of finance at the fashion unit, have also resigned. Pandya came to Nykaa after selling her beauty accesssory startup Pipa + Bella in 2021.

Official response: A Nykaa spokesperson said, “Voluntary and involuntary exits are expected in a fast-paced, growth-focused, consumer tech organisation with over 3000 on-roll employees, like Nykaa. Over the years, Nykaa has acted as an incubator to bring together and support some of the most promising talent India has to offer. We see some of these mid-level exits as a part of the standard annual appraisal and transition process, wherein, people exit due to performance or to pursue other opportunities. Nykaa values the contributions of all its current and former employees and stays connected through a strong employee alumni network”

Stock’s under pressure: The company’s shares were listed at Rs 2,001 on the Indian bourses in November 2021, a hefty premium of 77.87% over its issue price of Rs 1,125. But Nykaa has seen its stock plunge around 68% from its all-time high since its stock market debut. The stock on Friday closed at Rs 139 a piece on the exchanges.

ET Ecommerce Index: We have been tracking new-age stock indices through three parameters – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to check the performance of these listed tech firms. Here’s how they’ve fared so far.

Company’s performance: Nykaa reported a 71% decline in consolidated net profit to Rs 8.48 crore for the quarter ended December 31. It was Rs 29.01 crore in the same period last year. The development comes at a time when the competition in the online beauty and personal care space is heating up with the launch of Reliance Retail’s Tira, as ET reported on February 19. New entrant Tata Cliq Palette, and others like Sephora, SS Beauty by Shopper’s Stop and Myntra are also doubling down on the beauty and personal care category.

Disney Star eyes content deals with multi-system operators

Disney Star is trying to close content deals with leading multi-system operators ahead of the Indian Premier League (IPL) in wake of the new tariff order which came into effect last month. Though Disney Star has signed the reference interconnect offer (RIO) agreement with multi-system operators (MSO), the commercial details are still being worked out due to disagreement over pricing, sources told us.

Jargon buster: An RIO is an offer document listing matters relating to the price, and terms and conditions, under which a carrier will permit the interconnection of another carrier to its network.

Conflicting views: Leading MSOs such as Hathway Digital, DEN Networks, and GTPL Hathway — which together have 18-20 million subscribers — are considering pulling Star India’s entertainment and sports channels from their base bouquet and bundling them in higher-priced plans. Further, Disney Star would want its channels to be in the base pack even as it seeks to maximise its subscription revenue since it has committed ₹23,575 crore for IPL TV rights, a veteran TV distribution professional told us.

Quote, unquote: “Star India is demanding an 8% hike in subscription payouts from the MSOs,” a top TV distribution executive told us. “However, the MSOs are resisting the hike since Star comprises the biggest chunk of their annual content costs. Even a small increase in the subscription payout will hurt their bottom line.”

What-if scenario: According to the veteran professional, Disney Star will be in huge trouble if their channels are kept out of the base packs since the majority of customers prefer to take the base pack

“Ultimately, both sides stand to lose. The reach of Star’s channels will take a hit while MSOs will face pressure from their local cable operator (LCO) partners,” the professional added.

Also read | End of HBO deal may take some shine off Disney+Hotstar

Starting April 1, Twitter to remove legacy blue ticks

Microblogging platform Twitter announced on Friday it will remove all legacy verified badges for users and organisations from April 1. Only accounts actively subscribed to Twitter Blue will be eligible to receive the blue checkmark. This is the latest measure from new CEO Elon Musk in his monetisation push.

Twitter’s statement: “Starting April 1, we’ll be winding down our legacy Verification program and accounts that were verified under the previous criteria (active, notable, and authentic) will not retain a blue checkmark unless they are subscribed to Twitter Blue,” the social media platform said.

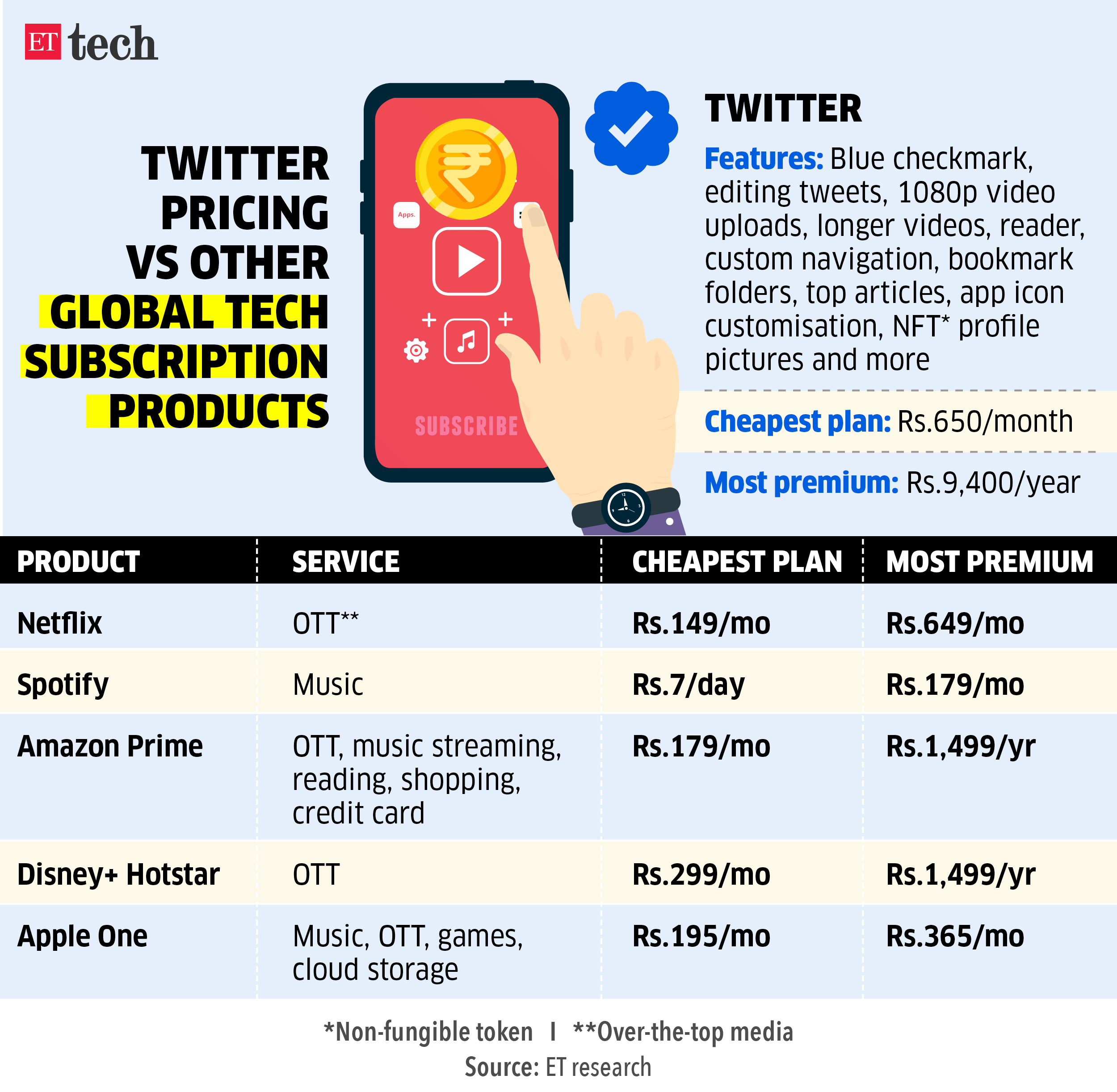

Pricing details: In India, Blue is available for a monthly fee of Rs 650 on the web and Rs 900 on mobile devices. The microblogging platform also offers a discounted annual plan of Rs 6,800 per year, which comes to Rs 566.67 per month on web.

Users subscribing to Blue on the mobile app can get the annual plan at a nearly 13% discount for Rs 9,400. Individual Twitter users have to pay $8 a month via the web and $11 a month through in-app payments on iOS and Android in the US.

Musk on OpenAI: Musk said on Friday that Microsoft was given exclusive and complete access to OpenAI’s codebase as part of its investment in the generative AI firm. Microsoft, an early backer of OpenAI, has reportedly invested another $10 billion in it.

“ChatGPT is entirely housed within Microsoft Azure. When push comes to shove, they have everything, including the model weights,” he tweeted.

In recent months, Musk has criticised the firm for generating profits from OpenAI, which was founded as a non-profit.

Also read | Elon Musk hiring AI researchers to develop OpenAI rival: report

ETtech Deals Digest: weekly funding in Indian startups falls 86% YoY with no late-stage fundraises

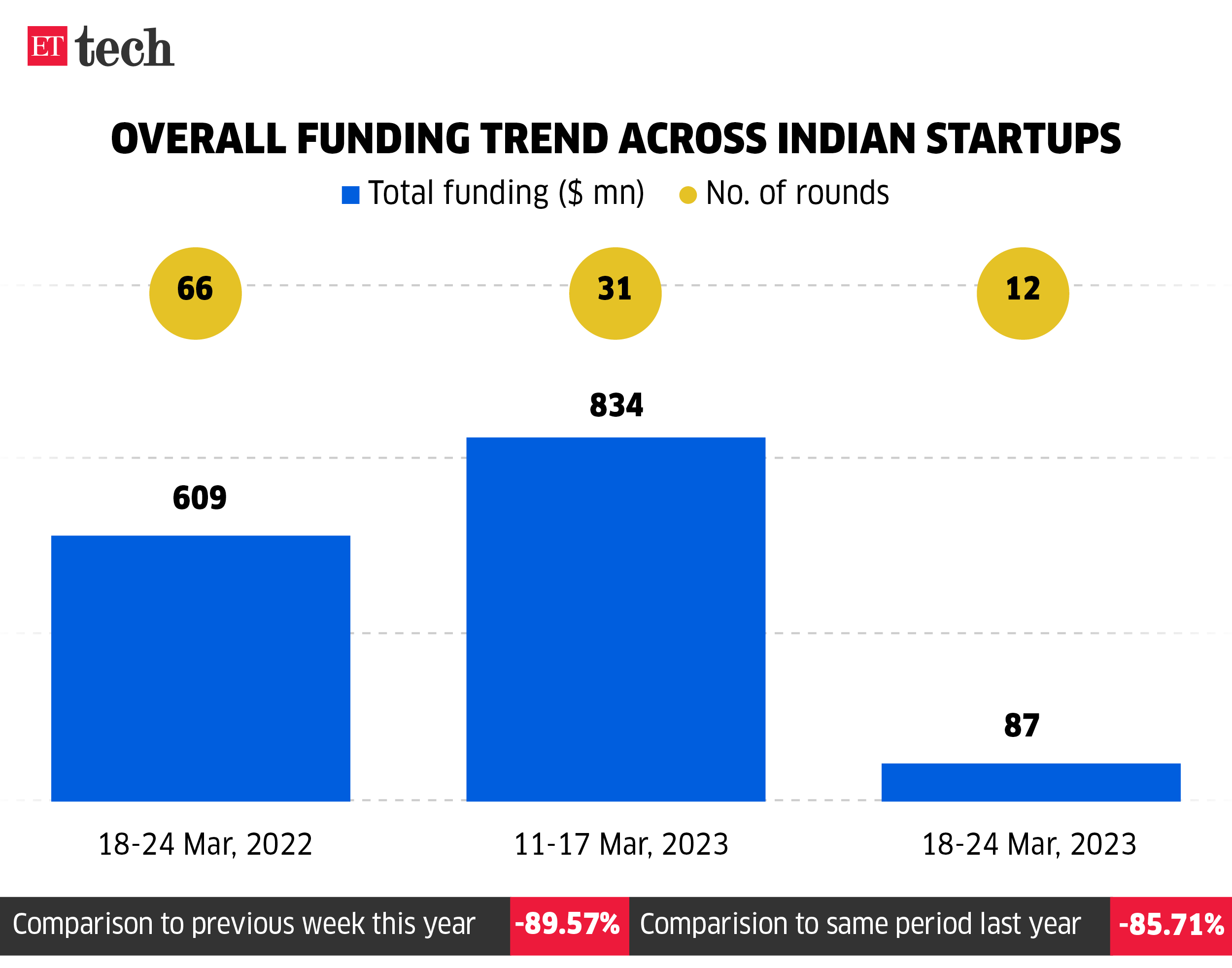

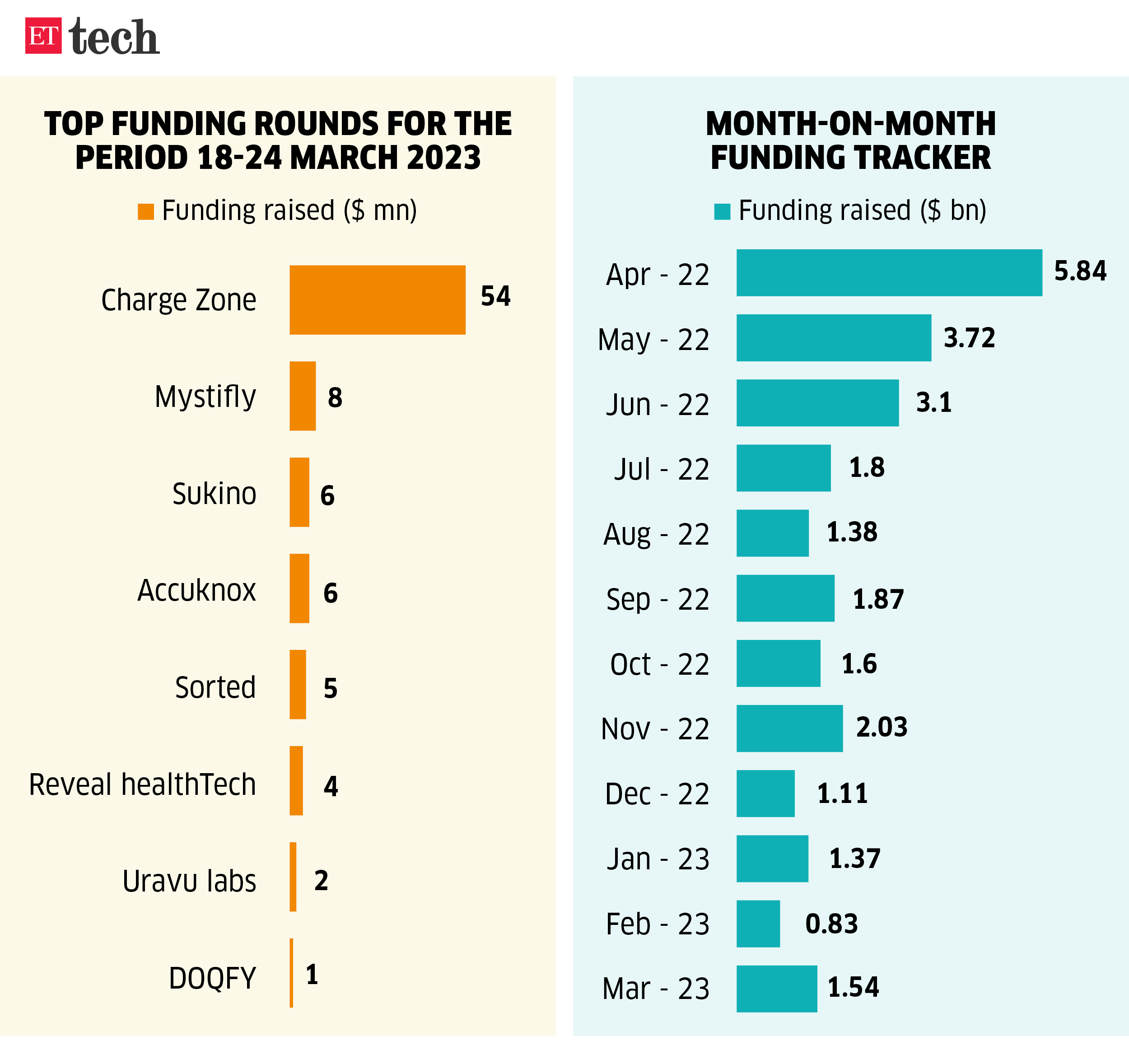

Funding activity in the Indian startup ecosystem saw another muted week. A total of $87 million was raised across 12 rounds between March 18 and March 24, according to data provided by market intelligence firm Tracxn.

This represents an 86% dip in the amount of funding, compared to the same period last year, when $609 million were poured into startups.

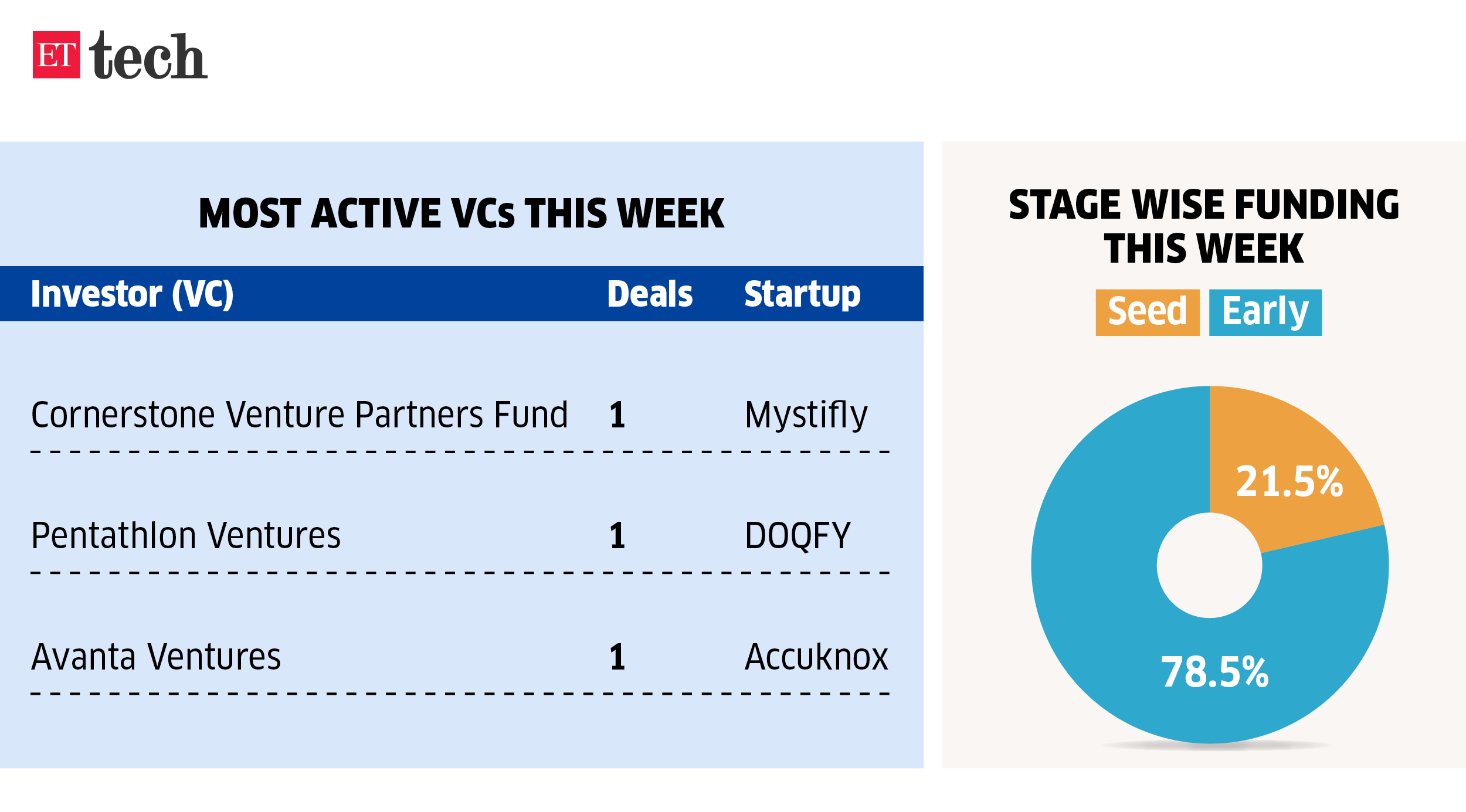

According to Tracxn data, no late-stage startups received funding this week, with early-stage startups picking up $68.2 million. This represented 78.5% of the overall weekly funding, while seed-stage companies racked up at $18.63 million, making up for the remaining 21.5%.

Here are the startups that got funded this week

Jack Dorsey’s wealth takes $526-million hit post Hindenburg short

Block Inc. cofounder Jack Dorsey’s fortune plunged by $526 million after US investment group Hindenburg Research disclosed short positions.

Net worth slides: As per the Bloomberg Billionaires Index, the Twitter founder is now worth $4.4 billion after the 11% drop. Block share price fell as much as 22% on Thursday, before closing down 15%.

The Bloomberg wealth index estimates Dorse’s stake in the firm worth $3 billion, while his position in Twitter is valued at $388 million.

Block, founded by former Twitter boss Dorsey in 2009, was called Square before being renamed in late 2021. The tech company operates financial transactions, ranging from payments to merchants to payments between individuals.

Allegations against Block: Hindenburg report said Block has overstated its user numbers and understated its customer acquisition costs. Hindenburg said Block “obfuscates” how many individuals are on the Cash App platform by reporting misleading “transacting active” metrics filled with fake and duplicate accounts.

The report also accused the firm’s Indian-origin CFO Amrita Ahuja of liquidating millions of dollars in equities during the pandemic as the firm’s price climbed on the strength of its facilitation of fraud.

Also read | Who is Amrita Ahuja, the Indian-origin CFO of Block named in Hindenburg report?

The short seller added that cofounders Dorsey and James McKelvey collectively sold over $1 billion of stock during the pandemic.

Responding to the short seller, Block said its report on Cash App business was “factually inaccurate and misleading report” and it was exploring “legal action”.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.