Tata to infuse $2 billion into super-app Neu; tech firms slashed over 1.5 lakh jobs this year

Also in this letter:

■ ETtech Done Deals

■ By the Numbers: UPI to fuel ecommerce growth

■ Another BharatPe cofounder sues Ashneer Grover

Tata Group looks to inject $2 billion into super-app Neu

Tata Digital may receive an additional $2 billion in funding over two years from its parent as the salt-to-software conglomerate seeks to bolster its digital business, Bloomberg reported.

Details: The fresh capital is aimed at helping Tata Neu fix technical glitches and meet any new spending needs, as per the report. Deliberations are ongoing and the Tata Group could still change the size and timeline of the deal, Bloomberg added.

Muted performance: The conglomerate’s new commerce arm allows users to buy groceries and gadgets as well as reserve flight tickets and restaurants from brands under Tata. The app also comes with a membership service and offers financial products such as bill payments, loans, and insurance.

Since its launch in April last year, Neu’s overall growth has been relatively subdued.

The super app will see sales of about $4 billion in the year to March 31, compared with the $8 billion target set at the beginning of 2022, as per the report.

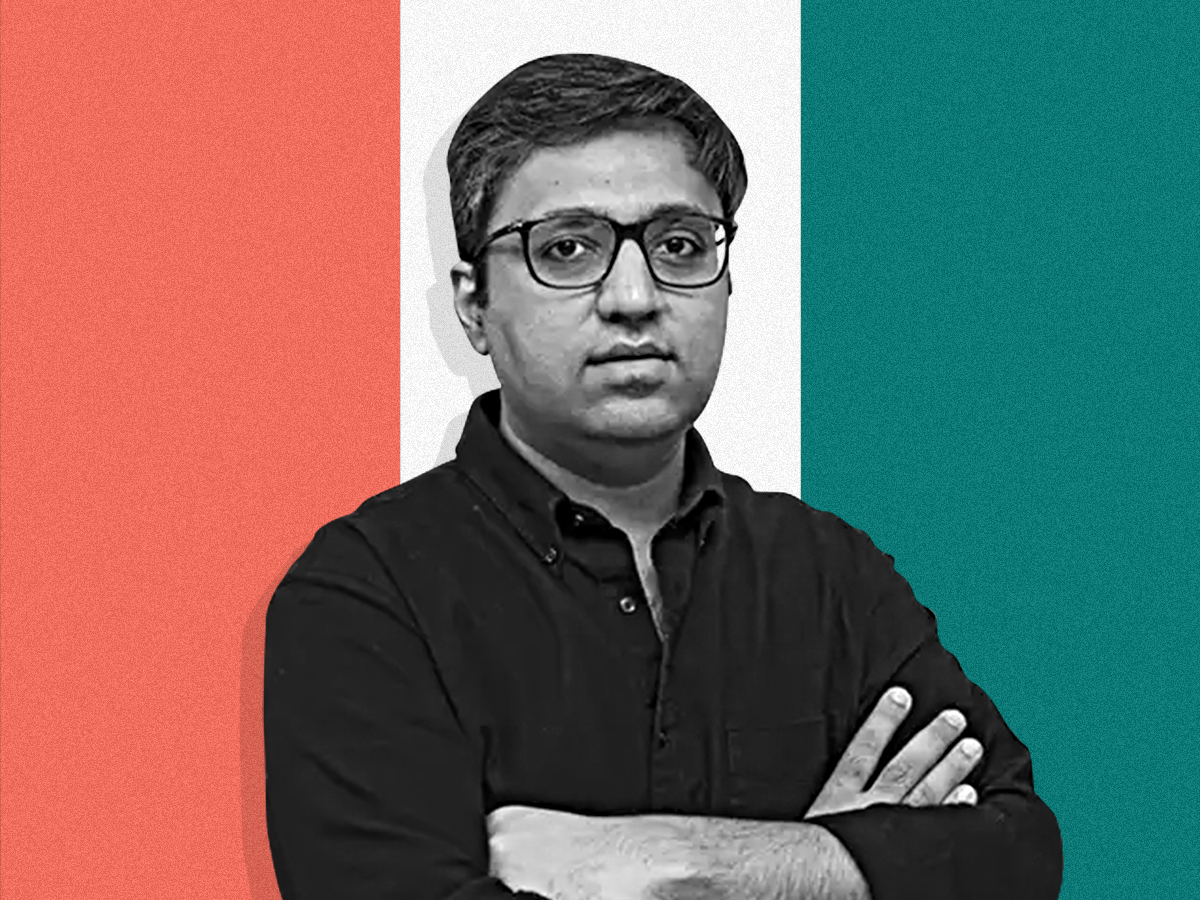

Leadership change: We reported in January that Tata Digital’s president Mukesh Bansal stepped away from day-to-day operations at Neu. Pratik Pal, the CEO of Tata Digital, now oversees all business decisions at the firm.

Mukesh Bansal

Tata’s properties like Tata Cliq, Croma, AirAsia, jewellery brand Tanishq, and watch brand Titan are on the platform.

Accenture, Indeed join ever growing list of companies executing layoffs

Multinational technology consulting firm Accenture on Thursday said it will cut about 2.5% of its workforce, or 19,000 jobs, the latest sign that the worsening global economic outlook is sapping corporate spending on IT services. More than half of the layoffs will affect staff at its non-billable corporate functions, the company said.

Slowing growth: Accenture lowered its annual revenue and profit forecasts and now expects annual revenue growth to be between 8% and 10% compared to the previous projection which were slightly higher. Further, it expects earnings per share to be in the range of $10.84 to $11.06 compared to the $11.20 to $11.52 forecasted previously.

Indeed layoffs: US-based job search company Indeed on Thursday announced it will cut approximately 2,200 jobs or roughly 15% of its total workforce. Employees across teams, functions, levels, and regions at Indeed and Indeed Flex will be impacted, it said.

Other recent layoffs: After the post-Covid boom, a majority of companies across sectors have put some sort of “cost-cutting” measures in place to prepare for tougher times.

As per the latest available data from layoffs.fyi, a real-time layoff tracking platform, 517 tech companies have slashed 152,858 jobs in 2023 so far.

Also read | Layoffs in 2023: Indeed, Amazon, Disney among latest firms to cut jobs amid economic turmoil

Google, Zoom, Dell, Just Eat Takeaway, eBay, and PayPal are among the companies that have slashed thousands of jobs.

Meta, Amazon, and Disney are among companies that have announced fresh rounds of layoffs after sacking thousands before. Amazon CEO Andy Jassy said the tech major would slash another 9,000 jobs after firing over 18,000 employees in January. Similarly, Disney will fire at least 4,000 current employees in April, after sacking about 7,000 last month.

ETtech Done Deals

Travel tech startup Mystifly raises $8 million: Singapore-based travel tech startup Mystifly on Thursday announced it has raised funds from CSVP (Cornerstone Venture Partners), concluding its pre-series B funding at $8 million, which includes earlier investments from RSI Fund (a subsidiary of Recruit), Jenfi & Crusade Partners, among others. Mystifly enables online travel agencies and travel intermediaries to access the inventory of airfares (with or without commercial agreements with airlines).

HealthTech bags $4 million from W Health Ventures: Reveal HealthTech, a startup that provides cross-functional technology services to healthcare companies with its engineering, clinical, and strategic support, said it had raised $4 million in funding from W Health Ventures, a healthcare-focused venture capital firm that invests in early-stage companies.

Milkbasket cofounder’s Sorted bags $5 million: Fresh fruits and vegetable supply chain startup Sorted, founded by Milkbasket cofounder Anant Goel, raised $5 million as a part of its ongoing seed funding round. According to the company’s documents filed with MCA, venture capital firms Beenext, White Venture Capital, and NB Ventures have participated in Sorted’s ongoing fundraising.

Last week, Indian startups registered a jump in funding for the period compared to the corresponding period last year largely due to late-stage investments in omnichannel eyewear company Lenskart and Walmart-owned fintech PhonePe.

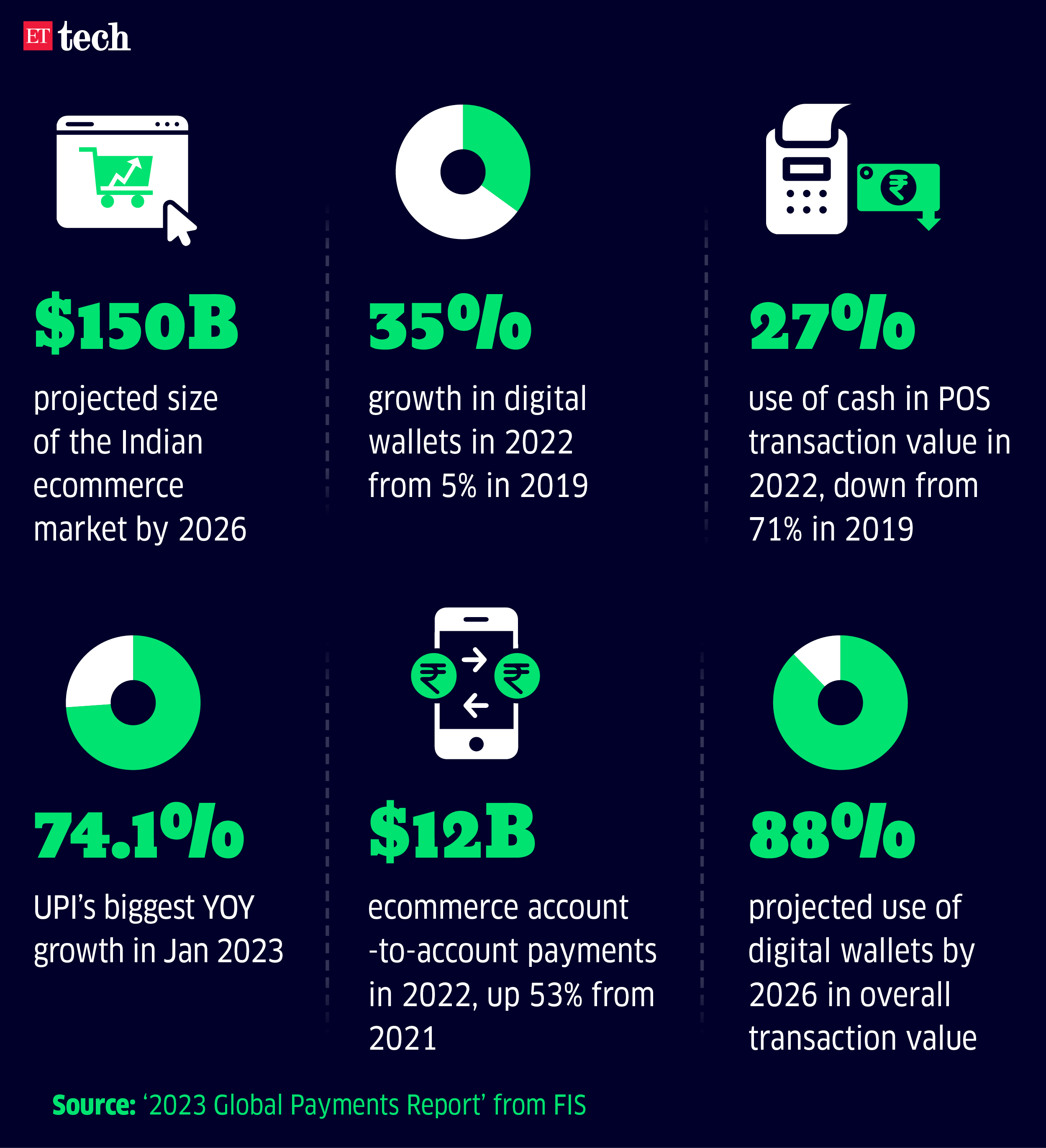

By the numbers: UPI to fuel India’s ecommerce growth to $150 billion by 2026

As unified payments interface (UPI)-based transactions continue to clock new records, India’s ecommerce market is projected to grow from $83 billion in 2022 to $150 billion in 2026, as cash transactions decline further, suggests a report titled ‘2023 Global Payments Report’ from global financial technology leader FIS.

According to the report, UPI recorded the biggest year-on-year growth of 74.1% in transaction volume as of January 2023 and digital wallets grew from 5% in 2019 to 35% of the point of sale (POS) value in 2022 stimulated by UPI.

UPI has helped ecommerce account-to-account (A2A) payments grow to $12 billion in 2022, up 53% from 2021.

With cash use declining from 71% of POS transaction value in 2019 to just 27% in 2022, India has emerged as a global leader in payments with the development of its next-generation real-time payments (RTP) infrastructure.

BharatPe cofounder Shashvat Nakrani sues Ashneer Grover over unpaid shares

Two months after BharatPe’s original cofounder Bhavik Koladiya sued now-ousted founder Ashneer Grover in January this year to reclaim his shares in Resilient Innovations another cofounder Shashvat Nakrani has sued Grover as well. Resilient is the parent entity which runs BharatPe.

What’s the case? Koladiya founded BharatPe in 2017 with Nakrani. In 2018, while looking for a chief executive for the company, they joined hands with Grover. Post joining the firm as the third cofounder, Grover bought the shares from Koladiya and Nakrani and was to pay the other cofounders.

In the fresh suit, Nakrani is now demanding his shares back, said a person aware of the discussion.

Case after case: Over the past few months, Grover and his wife Madhuri Jain Grover, who was also the former head of controls at the fintech firm, have been slapped with multiple legal suits by the company and its founders.

Apart from filing civil and criminal suits in the high court against Grover and the others, BharatPe also approached the Singapore International Arbitration Centre seeking to claw back Grover’s restricted shareholding in the company in December.

During the last hearing in the case on March 13, the Delhi High Court granted more time to the Grovers and their family members to file additional responses to the notices issued on a lawsuit.

Today’s ETtech Top 5 newsletter was curated by Gaurab Dasgupta in Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.