Federal Reserve hikes rates 25 basis points in sign Powell is nearing end of inflation fight

The US Federal Reserve has climbed down to the lowest interest rate hike in nearly a year in a sign the world’s most influential central bank is nearing the end of its aggressive campaign to tame a historic inflation surge.

Fed chair Jerome Powell and the rest of the federal open market committee (FOMC) backed a 25 basis points increase, taking the global financial system’s anchor rate to a range of 4.5 per cent and 4.75 per cent.

It is the weakest rise since the Fed’s first hike in this current tightening cycle back in March 2022.

The announcement will likely reinforce market expectations that gathered pace ahead of the FOMC meeting that the Fed is approaching the end of this current rate hike cycle.

However, in the FOMC statement accompanying the decision, the Fed did say “ongoing increases” to the federal funds will be necessary to return inflation, running at 6.5 per cent, its lowest level in a year.

Powell said the smaller rise was designed to “better allow” the Fed to judge how steep further increases need to be. Monetary policy operates with a lag, meaning the series of tough increases last year by the FOMC are still working through the US economy.

US inflation has been coming down since last summer after it peaked at just over nine per cent, driven lower by combination of the Fed’s rate decisions and a reduction in petrol prices.

That fall has opened the door for the Fed to scale back the sharpness of increases in borrowing costs after it launched four back-to-back 75 basis points.

Cumulatively, Powell and the rest of the FOMC have bumped rates 450 basis points higher since its first rise, the most aggressive tightening cycle since former chair Paul Volcker led the charge against a historic inflation surge in the 1980s.

The move sets the stage for the Bank of England and European Central Bank tomorrow, both of which are expected to go harder than the Fed and back 50 basis point increases.

Powell, Bank governor Andrew Bailey and ECB president Christine Lagarde are trying to engineer soft landings in which they lower inflation back to their two per cent targets without tipping their respective economies into recession.

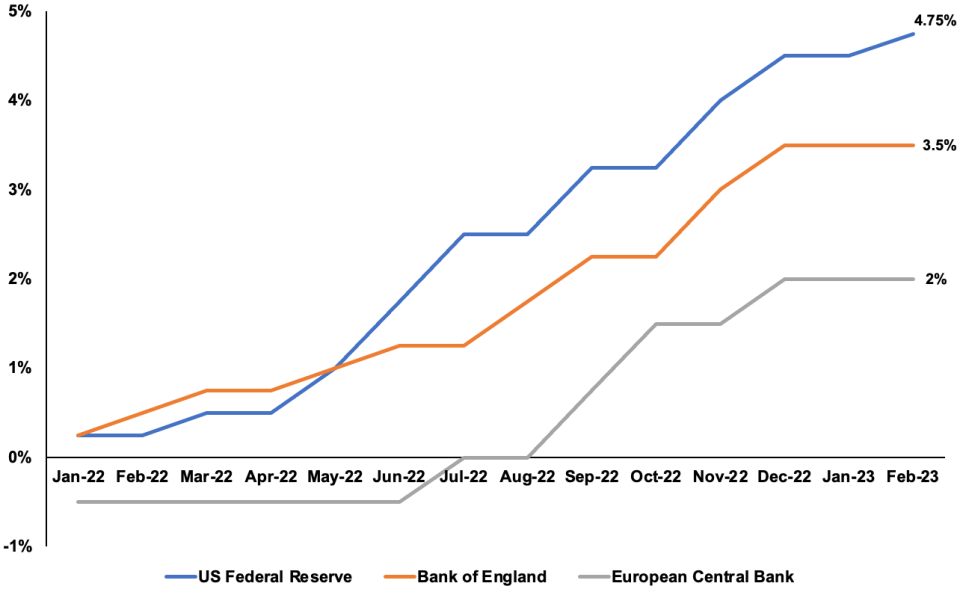

Rates have risen sharply to tame inflation

The likelihood of achieving that so-called “soft landing” is greater in the US than in the UK.

The Bank tomorrow is poised to repeat forecasts warning the country will tip into recession, albeit a much shallower and shorter one forecast back in November.

A European recession is more finely balanced. Figures out this week showed the bloc’s economy grew 0.1 per cent in the final months of last month, beating market expectations of a small contraction.

For all the latest Lifestyle News Click Here

For the latest news and updates, follow us on Google News.