Delhivery files for IPO; IFF fact-checks govt on IT rules

Credit: Giphy

Also in this letter:

■ IT rules seriously undermine privacy, IFF says

■ Ola reports first operating profit ahead of potential IPO

■ India’s fintech gold rush to manifest in Paytm IPO

Delhivery files for Rs 7,460-crore IPO: the key takeaways

Delhivery filed its draft IPO papers with the markets regulator earlier today, joining a growing list of top-tier startups that have filed for IPOs after Zomato’s stellar listing in July.

Here are some key takeaways from Delhivery’s filing.

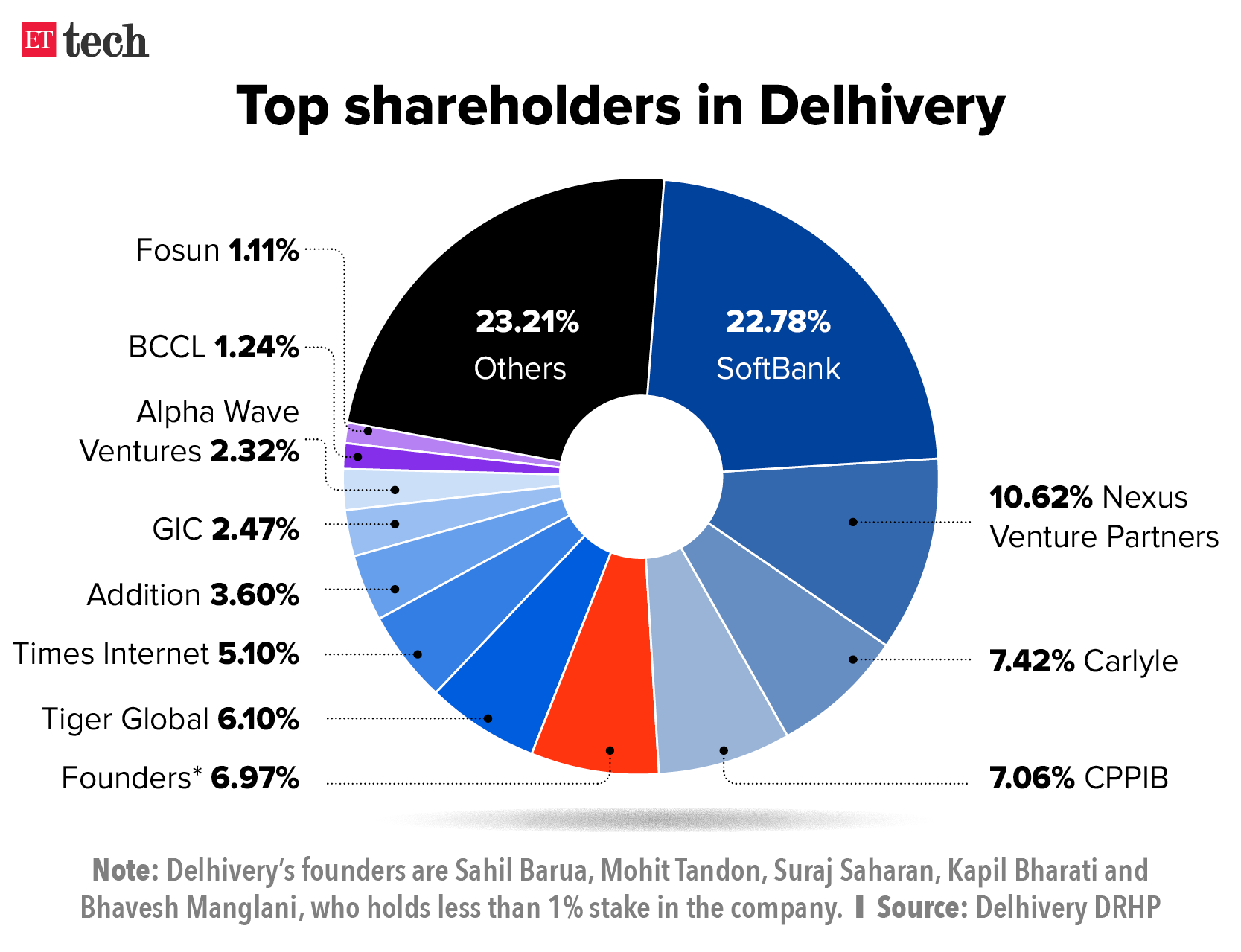

Selling shareholders: The new-age logistics company plans to raise Rs 7,460 from its IPO, including Rs 5,000 crore through fresh shares and the remaining through an offer for sale (OFS), in which Carylye, SoftBank and Times Internet others will dilute their holdings.

Kapil Bharati, Mohit Tandon and Suraj Saharan, three of Delhivery’s five founders, will also sell shares in the IPO, the DRHP said. Times Internet is part of the Times Group, which also owns ETtech. The company is seeking a valuation of around $6-6.5 billion for its listing, we reported earlier.

Pre-IPO round: In September, Lee Fixel, a former partner at New York-based investment firm Tiger Global, had invested $125 million in Delhivery through his fund Addition, partly through a secondary purchase of shares from China’s Fosun. The Chinese fund sold 1.32% of its 3.8% stake in the company, after which it was valued at $4 billion, we reported last month.

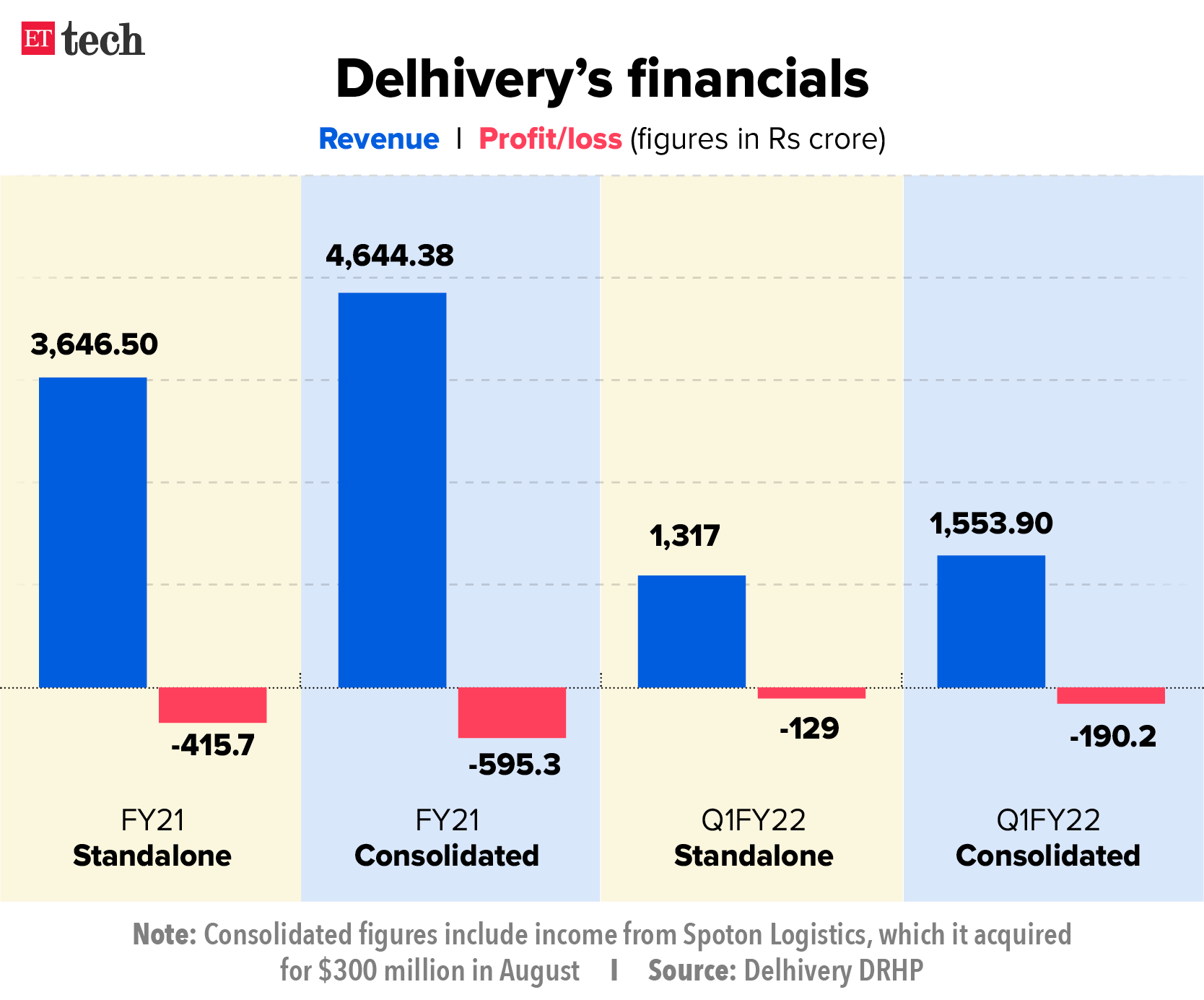

Financials: Delhivery reported consolidated revenue of Rs 4,644.38 crore and a loss of Rs 595.3 crore in FY21. These numbers include income from its subsidiary Spoton Logistics, which it acquired for $300 million in August.

Also Read: ETtech IPO Watch: A decade of Delhivery

Proceeds of the issue: According to its DRHP, Delhivery will spend around Rs 2,500 crore to fund organic growth initiatives and Rs 1,250 crore to fund inorganic growth through acquisitions and other strategic initiatives. It will use the remaining amount for general corporate purposes, the draft prospectus said.

IPO coverage:

Policybazaar parent’s IPO fully subscribed on Day 2

IT rules seriously undermine privacy, IFF says in rebuttal to govt’s FAQs

On Monday, the ministry of electronics and information technology (MeitY) released a document that it said was meant to “bring clarity” on Part II of the IT Rules, 2021. Earlier today the Internet Freedom Foundation (IFF) published a 12-point fact-check of the government’s “FAQs”.

Catch up quick: The rules themselves were notified in February and came into effect on May 26. Part II of the rules deals with the due diligence required by intermediaries and the government’s grievance redressal mechanism. The government released the FAQs on Monday, saying the aim was to bring clarity and to “explain the nuances of the due diligence” that intermediaries must follow.

Yes, but: IFF said many claims were presented as facts in the document.

On public consultation: The first of these was MeitY’s claim that it had invited public comments on the draft rules in December 2018, and adopted the rules based on the comments and suggestions it received. IFF said that while there was indeed a public consultation in 2018, the IT Rules, 2021 are “drastically different” from the draft that was released back then. “No public consultation was held for this version of the rules,” it said.

On privacy: IFF also said the government’s claim that the rules “focus on protecting online privacy of individuals and are consistent with the fundamental right to privacy” was incorrect. It said the rules are not consistent with the right to privacy and in fact seriously undermine the right to privacy. “In particular, Rule 4(2) considerably weakens end-to-end encryption, which has now become the privacy standard for mobile-based messaging platforms,” IFF said. Rule 4(2) says messaging platforms such as WhatsApp, Facebook Messenger and Telegram “shall enable the identification of the first originator of the information on its computer resource as may be required by a judicial order passed by a competent court or authority”.

On traceability: IFF countered the government’s claim that intermediaries only have to be able to trace the first originator of a message or post when it directs them to do so. Instead, it said, such services would have to enable first-originator traceability for all texts, all the time, “since it is impossible to predict which message may receive an order against it for tracing of the first originator”.

Legal challenges to IT rules: The new IT rules have been challenged in various courts since they came into effect earlier this year. Two high courts—Bombay and Madras—have stayed portions of the rules that seek to regulate digital news publishers and OTT platforms that have a physical presence in India or “conduct systematic business activity of making content available in India”.

Ola reports first operating profit ahead of potential IPO

Ola CEO Bhavish Aggarwal

Ola, which is backed by Japan’s Softbank Group, has recorded its first-ever operating profit since it was founded a decade ago, company documents showed.

The numbers: The company reported a standalone operating profit or earnings before interest, tax, depreciation and amortisation (Ebitda) of Rs 89.82 crore for FY21, versus a loss of Rs 610 crore in the previous fiscal.

Though revenue was down 65% from the previous year owing to the pandemic and lockdowns, Ola turned profitable on the back of aggressive cost-cutting and workforce reduction, according to its filing with the government.

IPO plans: As we reported earlier, Ola is exploring a public offering early next year, aiming to raise at least $1.5-2 billion at a valuation of $12-14 billion. It plans to raise half this sum by issuing fresh shares and half through an offer for sale (OFS), in which a few early backers will sell some or all their shares.

Last month, we reported that two top executives at the ride-hailing firm had quit amid preparations for the IPO. Ola’s chief operating officer Gaurav Porwal and chief financial officer Swayam Saurabh left the Bengaluru-based firm.

- Porwal had joined the Bengaluru-based company in 2019. He handled various assignments including roles in Ola Delivery and Ola Foods before he took over as COO last November.

- Saurabh, a veteran finance hand with more than two decades of experience, took charge as CFO in April. He was previously the CFO for Hindustan Zinc, Philips and has had stints at Asian Paints and L&T. He will be moving on to pursue other opportunities in mid-December, the mail said.

Growing footprint: Ola, has a majority share of India’s ride-hailing market, where it competes with Uber. It also has a growing presence in several global markets such as Australia and the UK.

Tweet of the day

India’s fintech gold rush to manifest in Paytm IPO next week

China’s transformation from a financial-technology backwater into a $46 trillion-a-year leader in digital payments left most international investors watching in awe from the sidelines. Now India is undergoing its own fintech revolution, and the race is on to grab a piece of the action.

Time for India to shine: As online payments and digital loans in the second-most populous country soar at some of the fastest rates worldwide, money is pouring into India’s fintech sector at an unprecedented pace. The sector’s sharp ascent will be on show this month as Paytm seeks a valuation of about $20 billion in what would be India’s largest-ever initial public offering (IPO).

A win-win: Some foreign players in India are poised to see payoffs. Berkshire Hathaway, which invested $300 million in Paytm in 2018 for a nearly 3% holding, could see the value of its stake rise about 70% at a $20 billion valuation, while Paytm’s other international backers would also profit. Investment banks including Goldman Sachs — which is working on the Paytm IPO — have been bolstering their teams in the country and are benefiting from the spate of deals and the flurry of fundraising.

The digital payments era: Digital retail payments on India’s Unified Payments Interface — the much-lauded national fintech system that connects more than 230 banks and 20 third-party apps — have risen nearly fivefold over the last two years to Rs 41 lakh crore ($546 billion).

China’s loss is India’s gain: Meanwhile, China’s ongoing fintech crackdown is only adding to India’s appeal among investors. Venture capital and private equity firms have invested $6.4 billion so far this year in Indian fintech companies, triple the amount their Chinese counterparts drew, according to researcher Tracxn.

Quote: “What the government has done with the common fintech network in the form of the UPI is phenomenal,” Raghav Maliah, vice chairman of global investment banking at Goldman Sachs said. “It’s the equivalent of the creation of the National Highway System in the US and leads us to be very bullish on possible opportunities in India.”

Indian fintech firms are likely to attract an additional $3 billion to $4 billion of investment over the next 18 months due to tighter Chinese regulations, according to Anuj Kapoor, MD for investment banking in UBS Group AG’s India business.

Paytm IPO: One97 Communications, which operates under the Paytm brand name, will launch India’s biggest initial public offering (IPO) on November 8 valuing the firm in the range of $19.5 billion to $20 billion.

The IPO — which will close for subscription on November 10 — comprises issuance of fresh equity shares worth Rs 8,300 crore and an offer for sale by existing shareholders to the tune of Rs 10,000 crore.

Offloading stakes: Paytm founder Vijay Shekhar Sharma will offload stock worth up to Rs 402.65 crore while Antfin (Netherlands) Holdings will sell shares to the tune of Rs 4,704.43 crore in the offer for sale. Besides, Alibaba.com Singapore E-Commerce will sell shares worth up to Rs 784.82 crore, Elevation Capital V FII Holdings (Rs 75.02 crore), Elevation Capital V Ltd (Rs 64.01 crore), Saif III Mauritius (Rs 1,327.65 crore), Saif Partners (Rs 563.63 crore), SVF Partners (Rs 1,689.03 crore) and International Holdings (Rs 301.77 crore), according to the offer document.

Coinbase acquires Agara to further India push

Coinbase Global, the largest cryptocurrency exchange in the US, has acquired Agara, an artificial intelligence-powered support platform, to further its India push.

The Nasdaq-listed firm plans to leverage the platform’s deep learning and conversational AI technology to automate and enhance its customer experience tools, according to a company blog post.

Quote: “The acquisition reinforces our commitment to delivering world-class support for customers, and brings Agara’s deep expertise in machine learning and natural language processing to Coinbase’s engineering team,” Manish Gupta, executive vice president (engineering) at Coinbase Global, said.

Focus on India: Coinbase began hiring in India this year and expanding to build a high-quality tech hub. Pankaj Gupta, VP of engineering and site lead, India, had said in July that the company was on the lookout for acquisitions in India given the growth in crypto talent in the country.

- “To support our ambitious growth plans in India, we are also exploring startup acquisitions and acquihires. Founders who might be interested in joining Coinbase’s journey and mission, please contact me,” he had said.

In July, Brian Armstrong, cofounder and CEO, announced that the company was building an office and setting up a team in India.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.