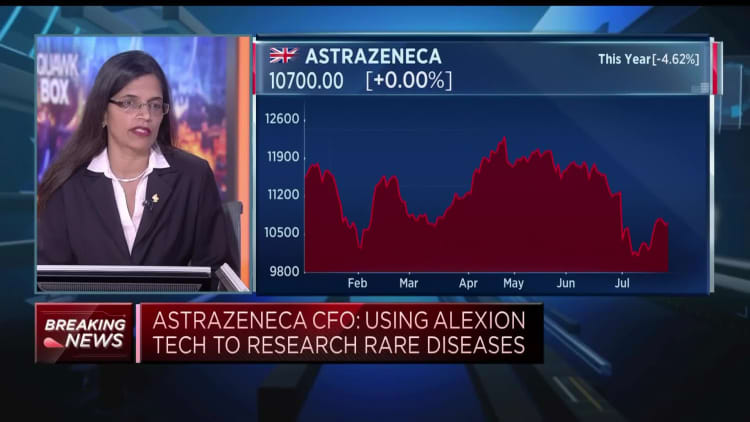

AstraZeneca CFO denies geopolitics impacts the company’s China business after spinoff rumors

AstraZeneca’s chief financial officer on Friday said that geopolitical tensions are not impacting the company’s China operations, following a report that the pharma giant is considering spinning off its business in the country.

“We’re in an industry that is producing life-saving medicines, that is helping China and actually citizens all across the globe in improving their health in reducing costs overall for healthcare systems. So I think we’re just in a very unique space and we don’t really see geopolitics playing a role in doing business in China,” Aradhana Sarin told CNBC’s “Squawk Box Europe.”

related investing news

The Financial Times reported on June 18 that AstraZeneca had drawn up plans to spin off its China business and potentially list it in Hong Kong, in order to shield it from China’s strained relationship with the U.S. and Europe. The same report noted that the plans were not a certainty, and that a Shanghai listing was another possibility.

Sarin said she would not comment on “rumors” regarding a potential China breakaway.

She added that AstraZeneca has been operating in China for a decade and is its largest pharmaceutical company.

“China has actually been a great business for us,” Sarin said, observing that the company’s China branch had recorded four successive quarters of growth.

“But what’s really interesting about China is not just the commercial business, which is doing really well, but actually all the innovation that is coming out of China when we run our…global clinical studies. And a lot of the studies are also running in China,” she said.

“There’s also the ability to tap into local innovation. And it’s not just us, even many of our peers have done licencing deals with really innovative biotech companies in China,” she added. “So it’s really not just commercial [interest], but being able to tap into that innovation.”

AstraZeneca earnings on Friday showed revenue growth ahead of estimates at 6% in the second quarter, following 1% growth in the first half. Core earnings per share rose by 25% to $2.15.

The company’s China revenues expanded by 7%, slightly above the 6% recorded in Europe, but below the 10% growth in the U.S., including Covid-related figures.

For all the latest World News Click Here

For the latest news and updates, follow us on Google News.