Till debt do us part: will other startups go the PharmEasy way, and other top tech & startup stories this week

PharmEasy’s cofounder and CEO Siddharth Shah

This week’s ETtech newsbreak on PharmEasy going for a rights issue at a price 90% lower than its peak valuation of $5.6 billion to repay debt has tripped alarm bells in several startups that have taken debt financing, and are facing business challenges amid rough macroeconomic weather.

“People forget this money is not for free. Even with convertible notes, the company has to do well to raise a new round or go for an IPO. Where is that happening? Startups are still largely cutting costs and streamlining operations to ‘fix’ the business. All debt comes with covenants, and when they’re breached, there are consequences,” the entrepreneur mentioned above said.

Not Just Udaan and Dunzo, even other startups like Healthifyme, HomeLane, Infra.Market have raised capital through notes, and India’s most valued startup, Byju’s, has been in trouble with its creditors over its $1.2 billion TLB (term loan B).

With pure debt, the interest needs to be paid at a certain frequency, while with convertible notes the investor gets a discount when the debt converts to equity in the next round of funding or at the time of the IPO. That way, the startup gets to protect its valuation by not ascribing a price while taking money through notes.

“To be honest, the situation is still really tight. I have to hit certain business goals this financial year and keep investors updated about the cash flow,” a founder who has raised funds through convertible notes said. He said the notes helped him avoid a down round. “I should not let my valuation slide because of the current situation. If I can deliver the targets and raise at better terms next year, then debt is better. It comes with risks, but so does equity, and added investor pressure,” this person added.

The investor mentioned above also said that most of these companies wouldn’t have been able to raise equity capital even at a flat round given the funding drought. “Everyone underestimates how long a bad cycle can last. There is hope that this debt will let them ride out the cycle,” he said, explaining why founders opt for alternative routes of funding in tough times.

Flipkart group CEO Kalyan Krishnamurthy had predicted at the ET Startup Awards last year that we will see more ‘creative’ funding as market conditions worsen.

The big question is: how many startups will be compelled to go the PharmEasy way to live another day?

Read ETtech’s coverage on PharmEasy’s recapitalisation here:

PharmEasy plans Rs 2,400-cr rights issue at 90% discount to repay loan: Online pharmacy major PharmEasy has informed its board and investors that it plans to raise around Rs 2,400 crore ($291.5 million) through a rights issue at a 90% discount to its peak stock price, as it looks to repay a loan from Goldman Sachs.

PharmEasy value crash may not hit Velumani’s stake: Arokiaswamy Velumani — the founder of diagnostic chain Thyrocare, which was acquired by PharmEasy in 2021 — had secured anti-dilution rights ahead of his investment of Rs 1,500 crore in the online pharmacy. This will ensure he is allotted new shares to compensate for the massive erosion in the value of his holding in the company.

PharmEasy parent seeks shareholder nod to increase authorised share capital: Online drugstore PharmEasy’s parent API Holdings’ board on Thursday approved a resolution to increase the company’s authorised share capital, as per a postal ballot notice issued to shareholders, a copy of which ET reviewed.

Byju’s Updates

Byju’s promoters have sold shares worth $409 m since 2015, says report: Byju Raveendran, Divya Gokulnath, and Riju Ravindran, the promoters of Byju’s, have together sold more than $408.53 million worth of shares in the edtech firm over 40 secondary transactions since 2015, according to the research and data platform PrivateCircle.

Committee to guide Byju on governance: The troubled edtech’s CEO, Byju Raveendran, announced on Tuesday that the company will establish a Board Advisory Committee (BAC) to provide guidance and advice regarding the composition of the board and governance structure.

Shah Rukh likely to say bye to Byju’s after endorsement deal ends in Sep: Struggling to cut costs after struggling to raise funds, Byju’s is unlikely to renew its endorsement deal with superstar Shah Rukh Khan when it ends in September, people aware of the matter said.

ETtech Exclusives

Kalyan Krishnamurthy, CEO, Flipkart Group

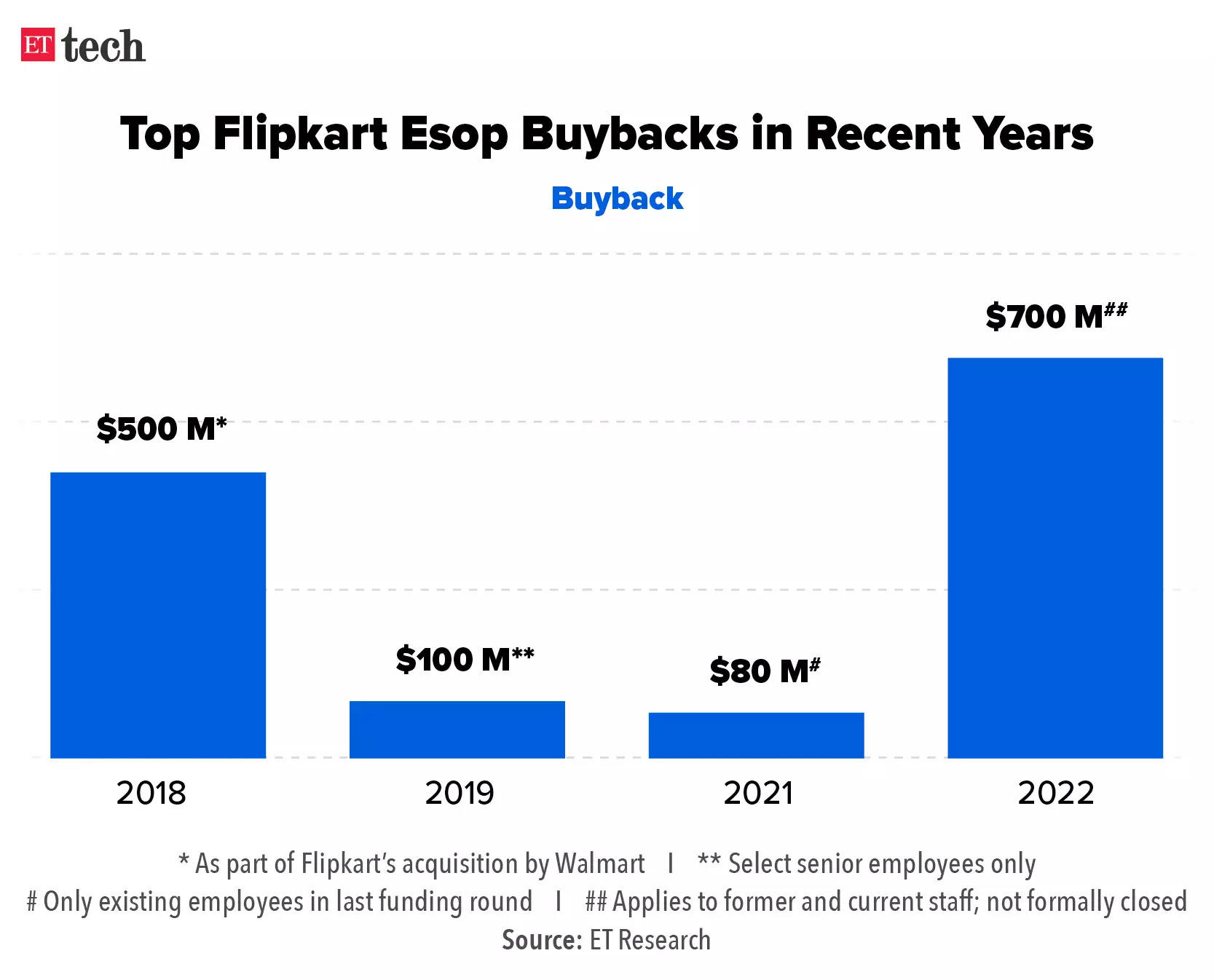

Flipkart employees to receive payout from PhonePe esop buyback: Flipkart employees will finally receive a one-time cash payout this month from a $700-million employee stock option (esop) buyback the ecommerce major is conducting as part of its separation from payments firm PhonePe.

Eligible former and current employees will receive $43.67, or about Rs 3,615 for each unit of Esop they hold in Flipkart as compensation for the loss of PhonePe’s value in the stock option as a result of its separation, the company had said in a recent internal note.

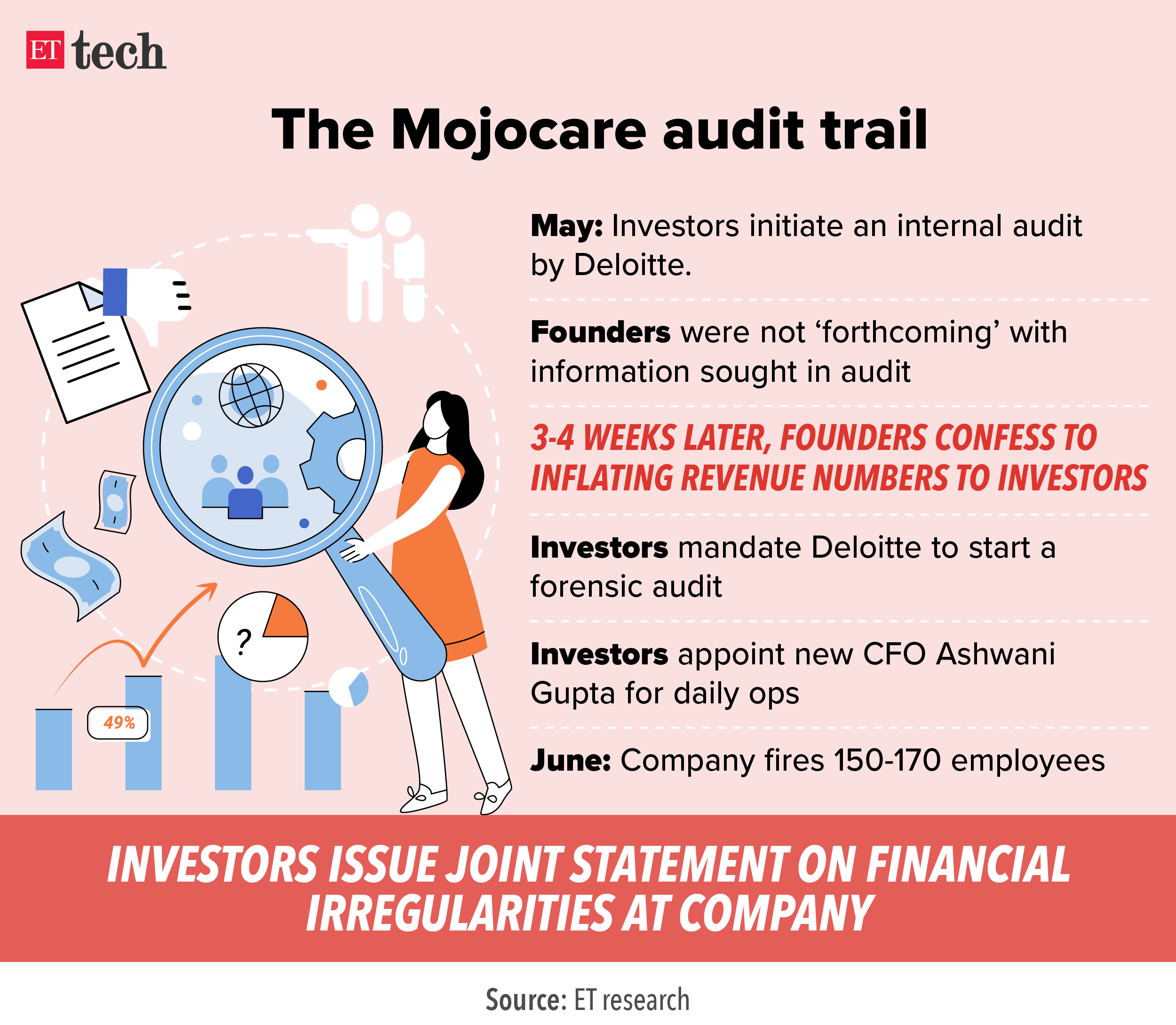

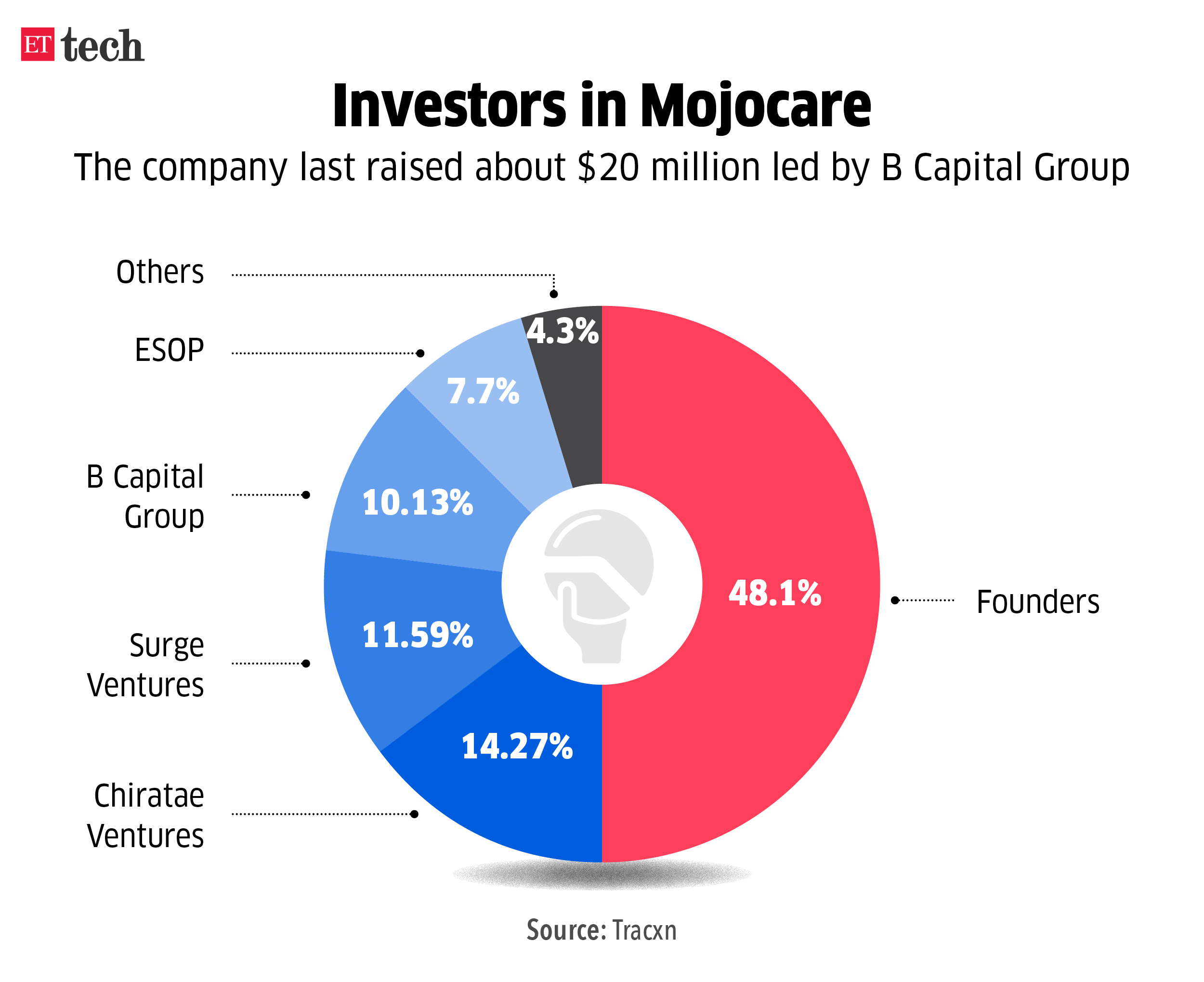

Mojocare board to decide on shutting shop, returning money to investors: The board of the troubled startup Mojocare — whose founders confessed to inflating revenues last month — is likely to meet later in July as the final audit report has been submitted by Deloitte, sources aware of the matter said.

According to people briefed on the contents of the final forensic report, the founders were found to have inflated revenues and sales figures in internal presentations to investors, and shown elevated expenses as well (to explain the losses in spite of the higher revenues).

Also read | Exclusive: Mojocare investors weigh legal action against founders

ETtech Deep Dives

Vijay Shekhar Sharma, CEO, Paytm

ETtech In-depth | Inside Paytm’s cashback offers for retailers: Fintech giant Paytm is back to offering cashbacks. This time, the money is being dangled before merchants, not consumers. And the strategy is proving to be quite a success, just as it did for consumer payments.

Paytm’s goal is to onboard as many merchants as possible and enable them to avail of and offer credit in the coming months. The hook: attractive pricing of payment terminals and transaction charges, with cashbacks as the icing on the cake, people aware of the development said.

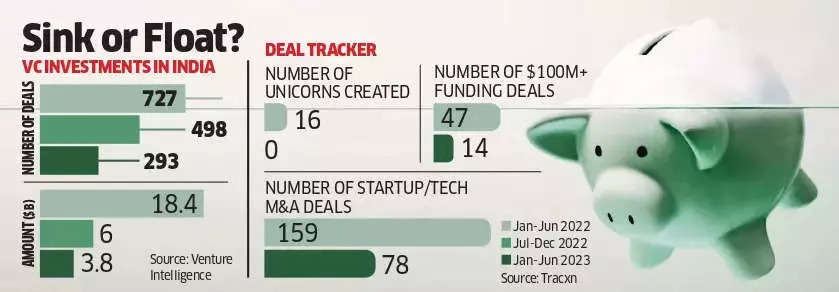

VCs keep purse strings tight despite raising more capital: Domestic and global investors, who have raised record funds over the past year have mostly held on to their unallocated capital in the first six months of 2023, when startups witnessed a substantial freeze in funding.

Future imperfect: how will FY24 pan out for Indian IT | Extended deal closure timelines, insourcing, large contract cancellations, vendor consolidation, and project ramp-downs now co-exist with large deal announcements and elevated outsourcing demand. We’re midway into the year, but the tech spend sentiment seems no better from what it was at the beginning of the year. What does the rest of the year look like?

Risqué rewards: It’s not only fans, livestream boom fetches big money | The surge of live-streaming apps that host content mostly by women — gyrating to film hits, doing their makeup, lounging around speaking about their day and sometimes enticing their audience with the promise of private time on video calls — is leading to a sharp spike in viewership for these platforms, according to industry consultants.

ETtech Interviews

Rajeev Misra, CEO, SoftBank Investment Advisers

Rajeev Misra’s $7 billion fund eyes more India play: Rajeev Misra, who stepped back from his executive role at SoftBank Vision Fund (SVF) a year ago, is open to investing in domestic companies from his new venture, One Investment Management, through debt and equity deals. Misra told ET in an interview that One IM, which currently has a corpus of $7 billion, participated in a debt issue floated by the Shapoorji Pallonji group, making it the fund’s debut in India.

Indian team behind ServiceNow’s generative AI solution, says CTO Pat Casey: Enterprise cloud computing company Servicenow’s India team accounts for almost 15% of its global workforce and has been pivotal in building its new offerings across generative artificial intelligence solutions, its chief technology officer told ET.

Fintech Corner

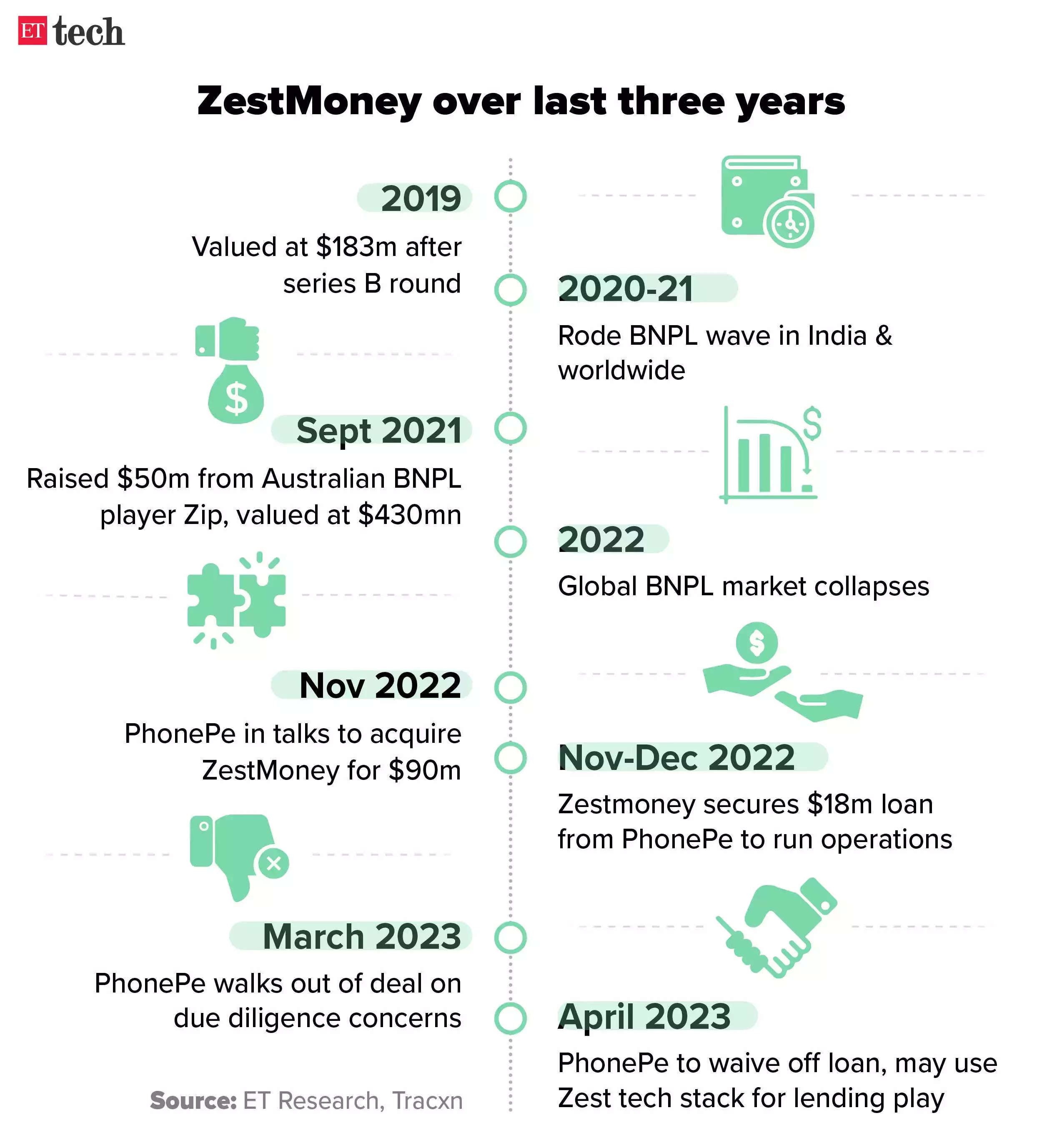

(From left) ZestMoney founders Priya Sharma, Ashish Anantharaman and Lizzie Chapman

Lifeline for ZestMoney as existing backers pump in funds: Beleaguered buy-now-pay-later finance provider ZestMoney has raised $5-7 million from a clutch of investors, including existing backer Quona Capital, according to two people aware of the matter.

“The equity infusion will help keep the company on track while it attempts to turn around after the failed acquisition bid by PhonePe,” a senior executive of a fintech company told ET, requesting not to be named.

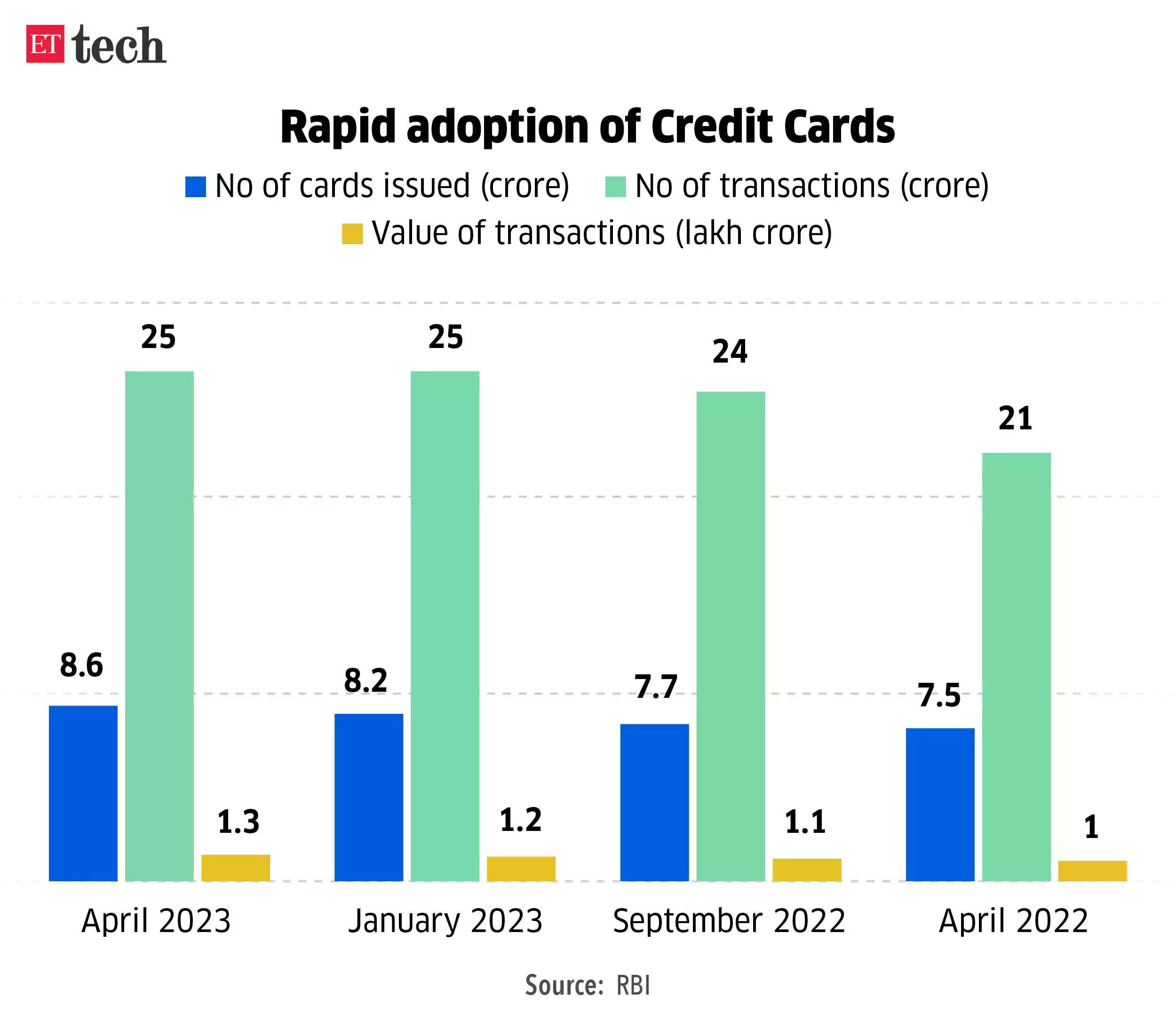

Swiggy joins co-branded credit card rush: Softbank-backed Swiggy is relying on discounts and special offers on its hyper local delivery services to make the card attractive to users, sources told ET, adding that it could also offer additional discounts on Dineout and its restaurant bill payment service.

Groww rolling out UPI payments: The platform is using unified payments interface (UPI) to enable users to make peer-to-peer payments, as well as to pay merchants by scanning their QR codes.

Tech Policy

Cabinet approves Digital Personal Data Bill: The union vabinet on Wednesday approved the Digital Personal Data Protection bill (DPDP), paving the way for voluntary disclosures of data breaches by companies, while also providing an alternative dispute resolution mechanism, senior officials said.

Google accuses CCI of protecting Amazon in Android probe: Google has told the Supreme Court that the Competition Commission of India (CCI) relied on “unreliable and uncorroborated” statements from Amazon to pass orders against it for abuse of dominance in the Android market space.

Meanwhile, Google’s fight with Indian startups continues. ET reported last week that four more companies — streaming player Altt, audiobook portal Pratilipi, art and design platform Crafto, and Tamil publisher Ananda Vikatan — have approached the Madras High Court seeking relief against Google’s payment policy.

Online gaming companies plan to discuss rules with states: Online gaming companies are planning to reach out to state governments about their concerns over the implementation of gaming rules that were notified by the centre earlier this year. These bodies plan to approach the governments of Tamil Nadu, Odisha, Assam, and Telangana over the issue.

Social Media Rush

Meta launches ‘Twitter killer’ Threads app: Meta’s Mark Zuckerberg landed a blow on Elon Musk on Wednesday night as the battle of the billionaires went live with the launch of Instagram’s much-anticipated Threads app, a clone of Twitter.

Twitter clone Threads sees 30 million signups within a day: More than 30 million people signed up for Meta’s Threads within a day of its launch. “Wow, 30 million signups as of this morning. Feels like the beginning of something special, but we’ve got a lot of work ahead to build out the app,” the Meta boss posted on his Threads profile.

Also read | Will Meta’s Threads unwind Twitter in India? Opinions vary

Twitter threatens to sue Meta over Threads: In a letter sent to the Meta CEO Zuckerberg by Twitter lawyer Alex Spiro, the latter has threatened to sue Meta over its new Threads app.

SpaceTech

ISRO chairman S Somanath

Chandrayaan 3 to aim for the moon on July 14: Chandrayaan-3, India’s third lunar mission, will be launched on July 14 at 2.35 pm, Indian Space Research Organisation (ISRO) chairman S Somanath said.

Revival of space FDI policy in the works: IN-SPACe Chairman Pawan Goenka: Revival of the space Foreign Direct Investment (FDI) policy is currently in the works and will be released soon, said Pawan Goenka, Chairman, Indian National Space Promotion and Authorization Center (IN-SPACe).

ETtech Done Deals

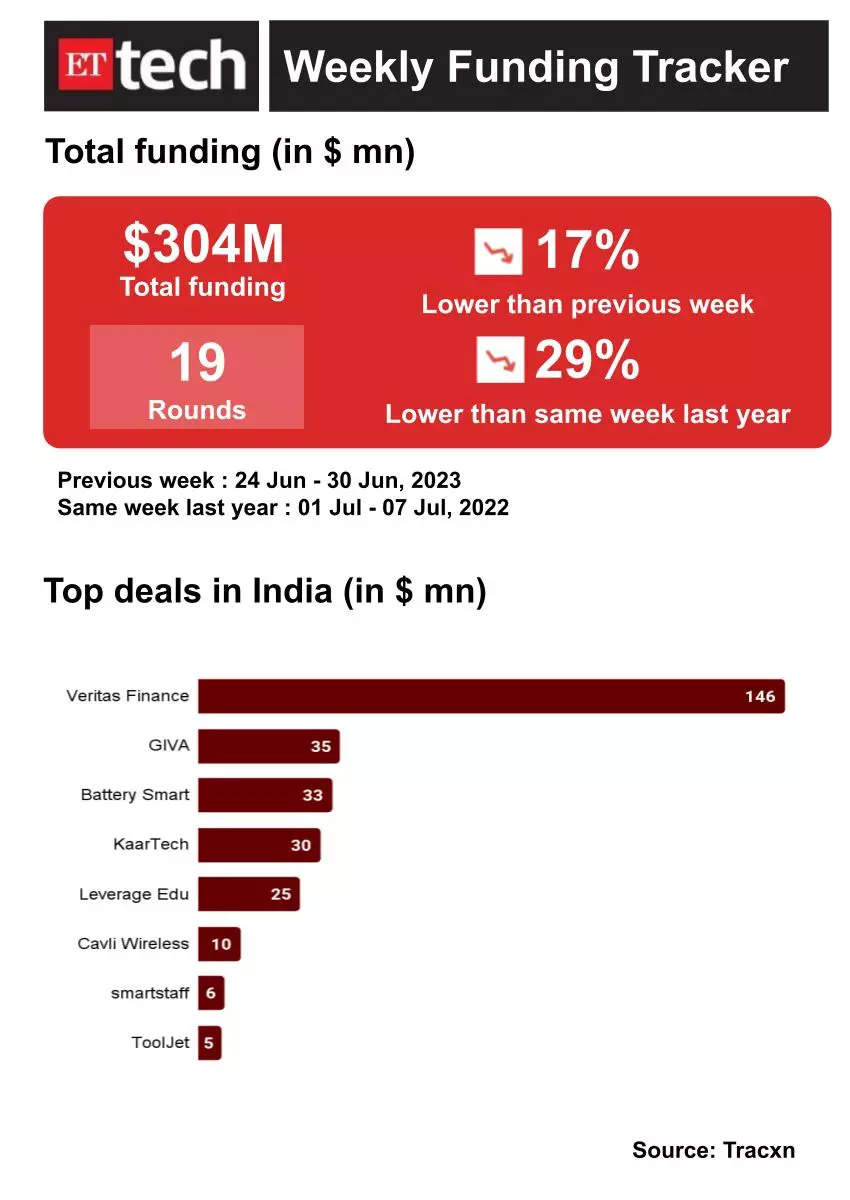

The funding landscape for Indian startups continues to remain bleak, with new-age companies managing to raise only $304 million across 19 rounds this week. This is a 29% decline from the same period last year, when investments poured in at a much faster clip, with a total of $427 million coming in from 77 rounds.

Sequentially, funding activity dipped 17%, compared to $366 million raised across 31 rounds last week.

Of the total funding raised this week, late-stage funding accounted for $171 million, making up 59% of overall funding. Early-stage investments constituted over a third of the investments, with $104 million injected into the startup ecosystem. Seed-funding accounted for $18.6 million, representing 6% of the total funding activity.

Other Top Stories This Week

Amazon set to cross $8 billion mark in India exports: Ecommerce major Amazon is set to surpass $8 billion in cumulative exports from India by the end of 2023, the firm said in a statement on Wednesday.

ETS leads funding round in global study-abroad company Leverage Edu: Global education testing and assessment organisation Educational Testing Service (ETS) has led a new funding round in study-abroad platform Leverage Edu, at least three sources told ET.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.