1% TDS hammers crypto trading; Zomato delayed Blinkit disclosure, investors tell Sebi

Also in this letter:

■ Investors accuse Zomato of late Blinkit disclosure in letter to Sebi

■ Lenskart valued at $4.5 billion after new financing

■ Bhavish Aggarwal says special treatment for Tesla not in India’s interest: report

Crypto trading volumes crash again as 1% TDS kicks in

Spot trading volumes on crypto exchanges CoinDCX, WazirX and Zebpay fell by at least 70% from June 30 to July 3 as the 1% tax deductible at source (TDS) on all crypto transactions kicked in on July 1.

By the numbers: Volumes on WazirX were down the most at 82%, according to data sourced from crypto research and consulting firm Crebaco.

The decline was almost 70% on CoinDCX and 76% on ZebPay.

While crypto exchanges say it is too early to know the actual impact of tax deducted at source (TDS) as trading volumes are typically lower on the weekend, some experts said trading would likely remain under pressure.

Impact on traders: The 1% TDS will push day traders away from Indian exchanges and cause them to rework their playbooks, senior crypto industry executives told us.

Some day traders told us the grey market would continue to flourish in this scenario and they would try different models to see if staying on Indian exchanges was profitable.

Shounak Shetty, 28, from Mumbai said his daily assets under management were down to Rs 50 lakh from Rs 14 crore in March.

Another trader from Mumbai, who requested anonymity, said: “Whatever little trading I did on Indian exchanges, I will stop now.”

Impact on exchanges: Senior exchange executives we spoke to said the new TDS rule would lead to consolidation in volumes.

While some exchanges have enough cash to survive the current downturn, a few are also looking to diversify or explore international markets. Coinswitch Kuber is expected to launch its first financial product this year.

Second blow in months: The industry has been hammered by the new tax rules that were introduced during the union budget this year, with volumes already down 40-80% from March before the latest collapse, according to Crebaco.

Good ol’ days: Thanks to the unprecedented crypto bull run, the top five to six Indian crypto platforms clocked a combined $70-100 billion in trading volume in 2021, with WazirX alone handling about $43 billion, we reported on April 1.

Investors accuse Zomato of late Blinkit disclosure in letter to Sebi

A group of high-net-worth investors in Mumbai have complained to the Securities and Exchange Board of India (Sebi) about Zomato, saying the company didn’t disclose its purchase of Blinkit to the stock exchanges on time, sources with direct knowledge of the matter told us.

We could not ascertain the identity of the investors or verify their holdings in Zomato.

Losses: Zomato told the bourses on June 24 that its board had approved the acquisition of Blinkit for Rs 4,447 crore.

But the investors said in a June 29 letter to the Sebi chairman that news about the potential acquisition had been reported in the press and was doing the rounds on social media for more than a month before the deal was announced. Zomato, they alleged, neither confirmed nor denied the reports.

They said they had suffered losses as a result and that timely disclosure would have helped them be better prepared.

Zomato shares have plummeted 20% since it announced the deal after market hours on June 24.

What the rules say: Sebi norms require listed companies to disclose any price-sensitive information without delay. However, company boards are at liberty to decide whether a development is price-sensitive information and, if it is, when it needs to be disclosed.

Zomato responds: The company said its disclosures were made on time and in accordance with the rules.

“Zomato has complied with applicable laws and relevant Sebi guidelines and made necessary disclosures upon the approval of the transaction by the board and signing of the definitive agreements,” it said.

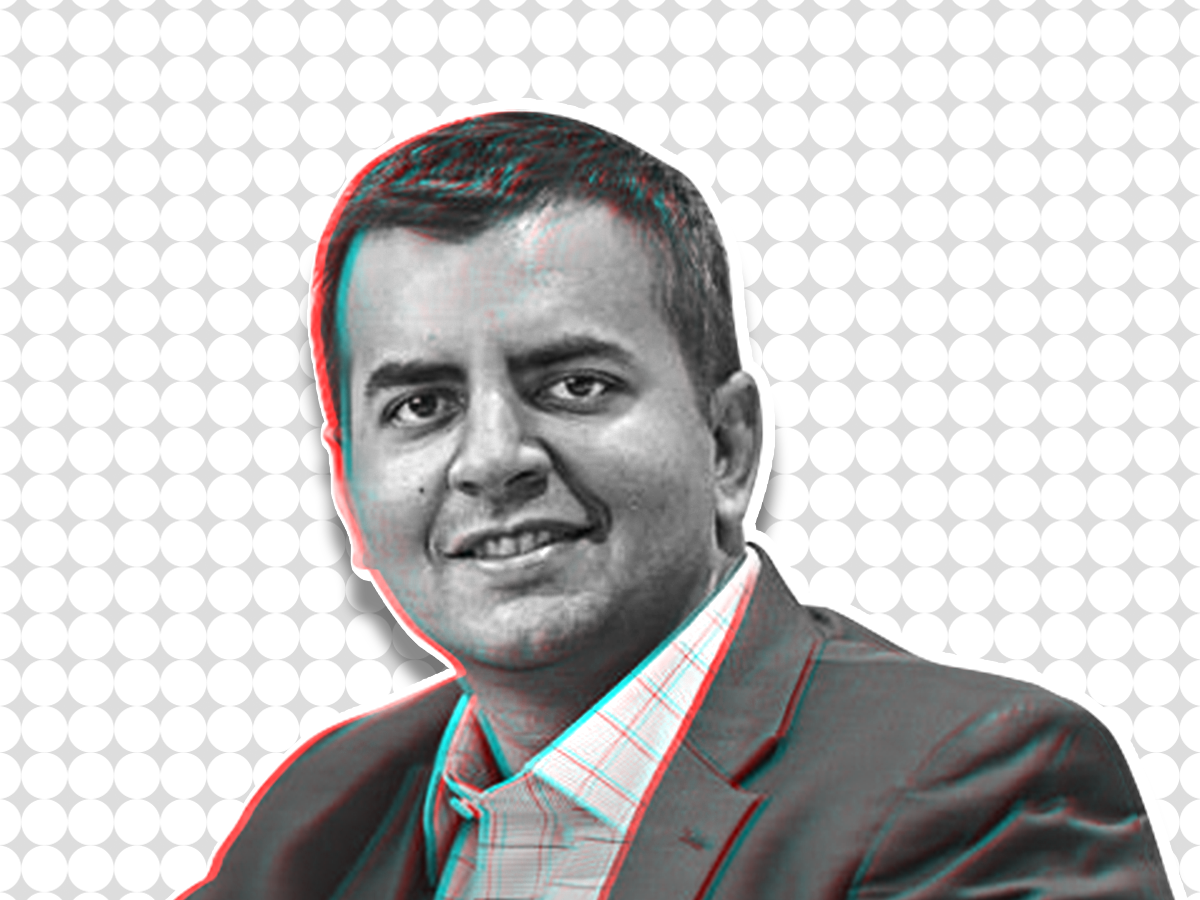

Lenskart valued at $4.5 billion after new financing

Lenskart founder Peyush Bansal

Omnichannel eyewear brand Lenskart has been valued at $4.5 billion in a new $200 million investment led by Alpha Wave Global (previously Falcon Edge), a person briefed on the matter told us.

This is an 80% expansion in value for the company, which was last valued at $ 2.5 billion following the close of a $315 million round in July 2021 that was led by Singapore’s Temasek.

Other existing investors such as Temasek, Epiq Capital, Avendus Future Leaders Fund II also participated in this round, with the funds being released in tranches, sources said.

We had reported on April 13 that Lenskart was in the final stages of closing a new round and that it could be valued at $4.5-5 billion.

With this, the eyewear platform, which was started in 2010, has raised a total of around $1 billion, including secondary share sales.

On June 30, Lenskart closed the $400 million acquisition of Japan’s Owndays to create one of the largest eyewear businesses in Asia.

Ola’s Bhavish Aggarwal says special treatment for Tesla not in India’s interest: report

Ola Electric CEO Bhavish Aggarwal

Granting special incentives to encourage US electric car major Tesla to come to India will not be in the best interests of the country, Ola Electric CEO Bhavish Aggarwal has said.

“Tesla is free to come in and put up a shop here and sell its cars,” Aggarwal told the London-based business publication Financial Times. “They just want to be treated differently from others, which I believe is not in the interests of India.”

The Elon Musk run-company had a keen interest in entering the Indian market, but its demand for a cut in import duties, which can go up to 100% of the cost of the vehicle, has led to a tussle with the government, which is pushing for local manufacturing of vehicles. This has led to Tesla halting its plans to enter the Indian market.

Tesla wants to import and sell in India first before manufacturing. The company is known to lobby governments around the world for special incentives.

In China, for example, Tesla has been able to start operations without having to partner with a local company, which has been the law in the country for many years.

TWEET OF THE DAY

Shopsy brings in about 25% of Flipkart’s new customers

About a quarter of new customers for the entire Flipkart group have come from its one-year-old social commerce app Shopsy, a senior executive at the ecommerce firm said.

The group has several apps, including the Flipkart app, Myntra, payments app PhonePe and travel service app Cleartrip.

“We had set an audacious target of 100 million users to be on the platform by the end of the year and we are well on course to achieve that,” Prakash Sikaria, Flipkart’s senior vice president (growth and monetisation), told ET.

Shopsy, which is involved in a heated competition with Meesho on a zero-commission model and is targeted at value-conscious customers, started off by having all of Flipkart’s sellers on it last year.

But Sikaria said Shopsy’s rise had not resulted in the cannibalisation of Flipkart’s business in any manner, as 70% of Shopsy’s sales came from its unique sellers.

Flipkart chief executive Kalyan Krishnamurthy in an interview in January told ET that scaling the grocery and Shopsy would be the priority for the company this year.

Other Top Stories By Our Reporters

Cloud service providers eye huge opportunities in India: According to the International Data Corporation (IDC), the Indian public cloud services market is expected to touch $13.5 billion by 2026 from $4.6 billion in 2021, growing at a Compounded Annual Growth Rate (CAGR) of 24% in five years.

Deutsche Bank to ramp up tech hiring in India: Deutsche Bank will be increasing its technology workforce in India, given the German financial services company’s focus on strengthening its engineering and IT capabilities inhouse and doing more strategic technology research internally.

Global Picks We Are Reading

■ ‘Hostage-taking laws’ seem to be fueling a Twitter crackdown in India (Rest of World)

■ Bill to grant crypto firms access to Federal Reserve alarms experts (The Washington Post)

■ Tesla’s run of record quarterly deliveries comes to an end thanks to China’s covid shutdowns (The Verge)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.