Microsoft building global products in India: CEO Satya Nadella; seed funding shone in 2022

Also in this letter:

■ Seed funding outshines overall deal growth in 2022

■ Walmart, others face $1B tax bill for PhonePe’s India shift, new fundraise

■ NCLAT orders Google to deposit 10% of Rs 1,337-crore CCI penalty

Microsoft is now building global products in India: Nadella

Microsoft is making “significant investments” in India and, unlike earlier, is building global products in the country, the company’s chairman and CEO Satya Nadella said on Wednesday.

“We have the largest development centre outside the US. We have put significant capital investments in building out four large data centres…” Nadella said in an interview with ET.

Made-in-India push: Nadella, who was awarded the Padma Bhushan last October, said that historically, the company has built products elsewhere and sold them in India, but this has changed and the company is now making global products here.

Praising India’s technological progress, Nadella said it’s not just startup unicorns but also small businesses, public-sector enterprises and large multinationals that are making use of digital technology in India to create value for their users and customers.

He also lauded India’s digital public goods such as Aadhaar and the United Payments Interface (UPI).

AI is next: Widely credited with transforming the iconic software maker — now the world’s third most valuable company after Apple and Saudi Aramco — by pivoting to the cloud and mobile businesses, Nadella said artificial intelligence will be “the next big wave”. Microsoft-backed OpenAI’s platform ChatGPT will be integrated with several Microsoft products, including its search engine Bing, he added.

Also Read | Technology is a tool for inclusive growth, says Nadella

Seed funding outshines overall deal growth in 2022

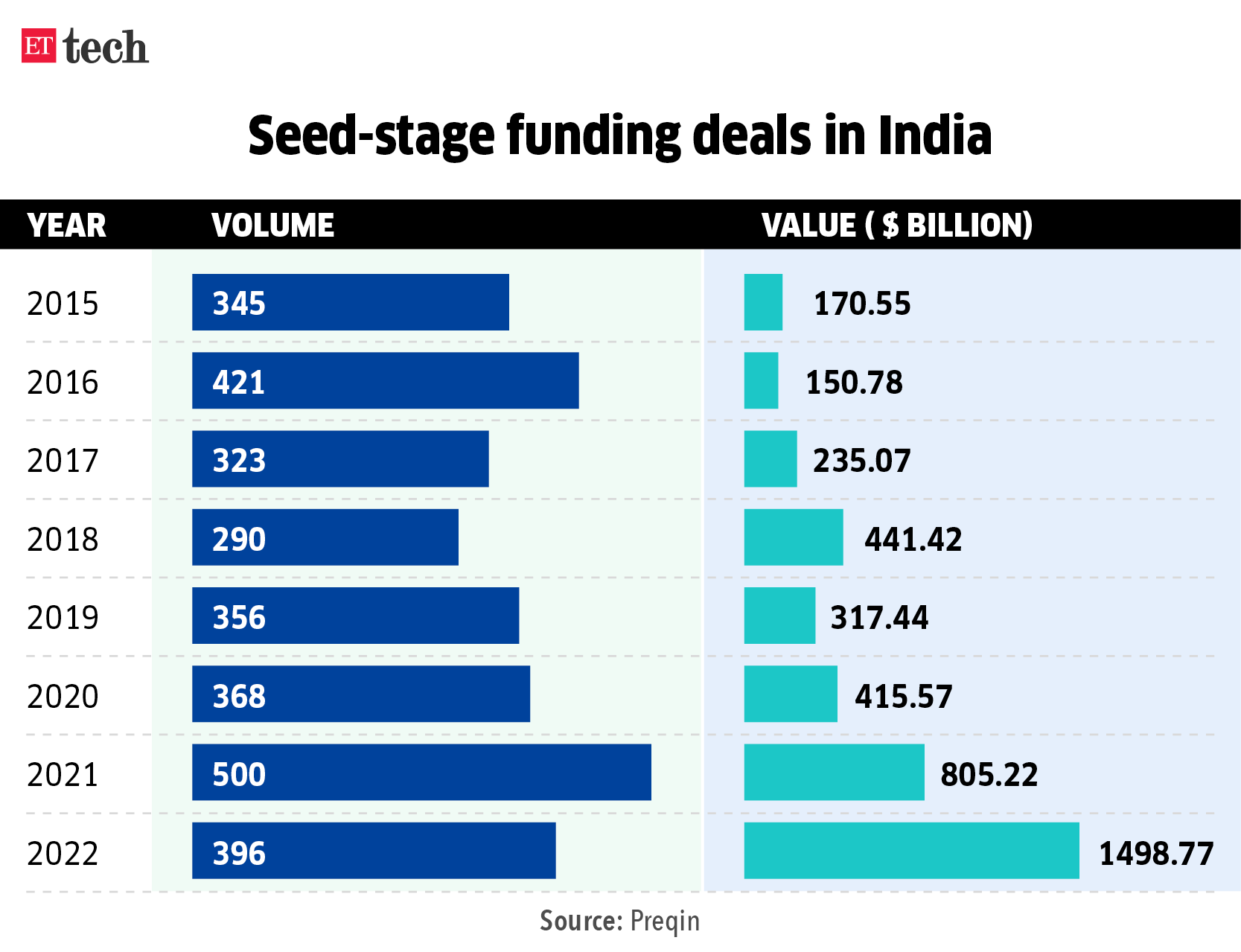

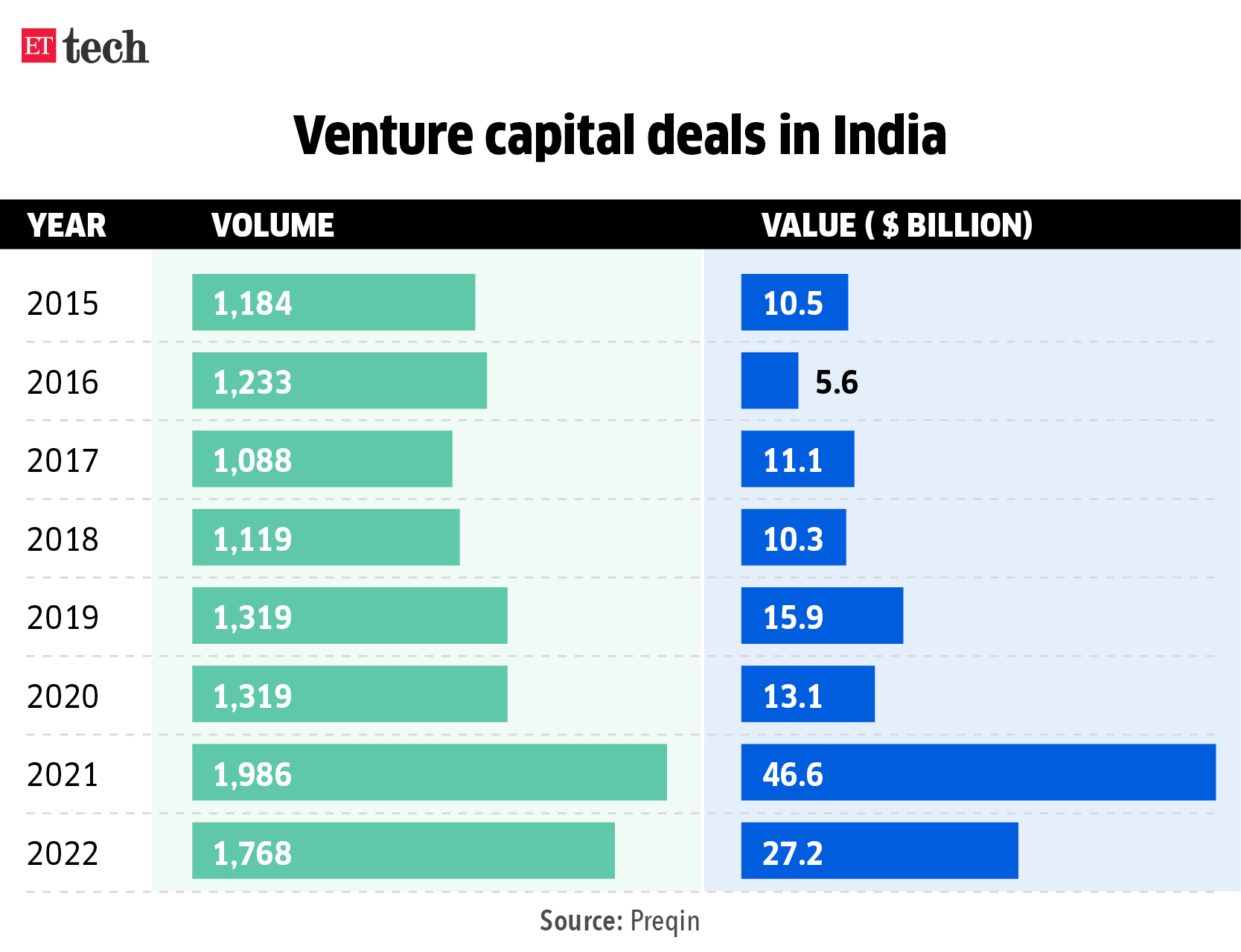

Seed-stage deals were robust in value terms last year, in line with the growth seen in 2021, according to data from London-based investment data platform Preqin, shared exclusively with ET.

By the numbers: Seed-stage deals rose to about $1.5 billion in 2022, up 86% from $805.2 million in 2021. The number of deals, however, fell to 396 in 2022 from 500 in 2021.

The average seed-stage deal in 2022 was about $3.8 million, according to Preqin.

In 2020, there were 368 seed-stage deals amounting to $415.6 million.

Moving upstream: Last year, New York-based investment firm Tiger Global, which typically funds growth and late-stage deals, entered the seed funding space with an investment in Shopflo in May.

“Funds are moving upstream to find quality over quantity-styled seed-stage companies…,” Siddarth Pai, founding partner of 3one4 Capital, told ET. “The quality of founders starting up for the first time has also improved over the years. Now you have founders with prior operator experience leaving growth and late-stage startups to found their own,” Pai added.

3one4 Capital has backed companies such as Koo, Licious and Darwinbox at the seed stage.

Outlook for 2023: Early-stage investors told us that seed- to early-stage funding will likely be the least affected segment this year as well, compared to big-ticket funding.

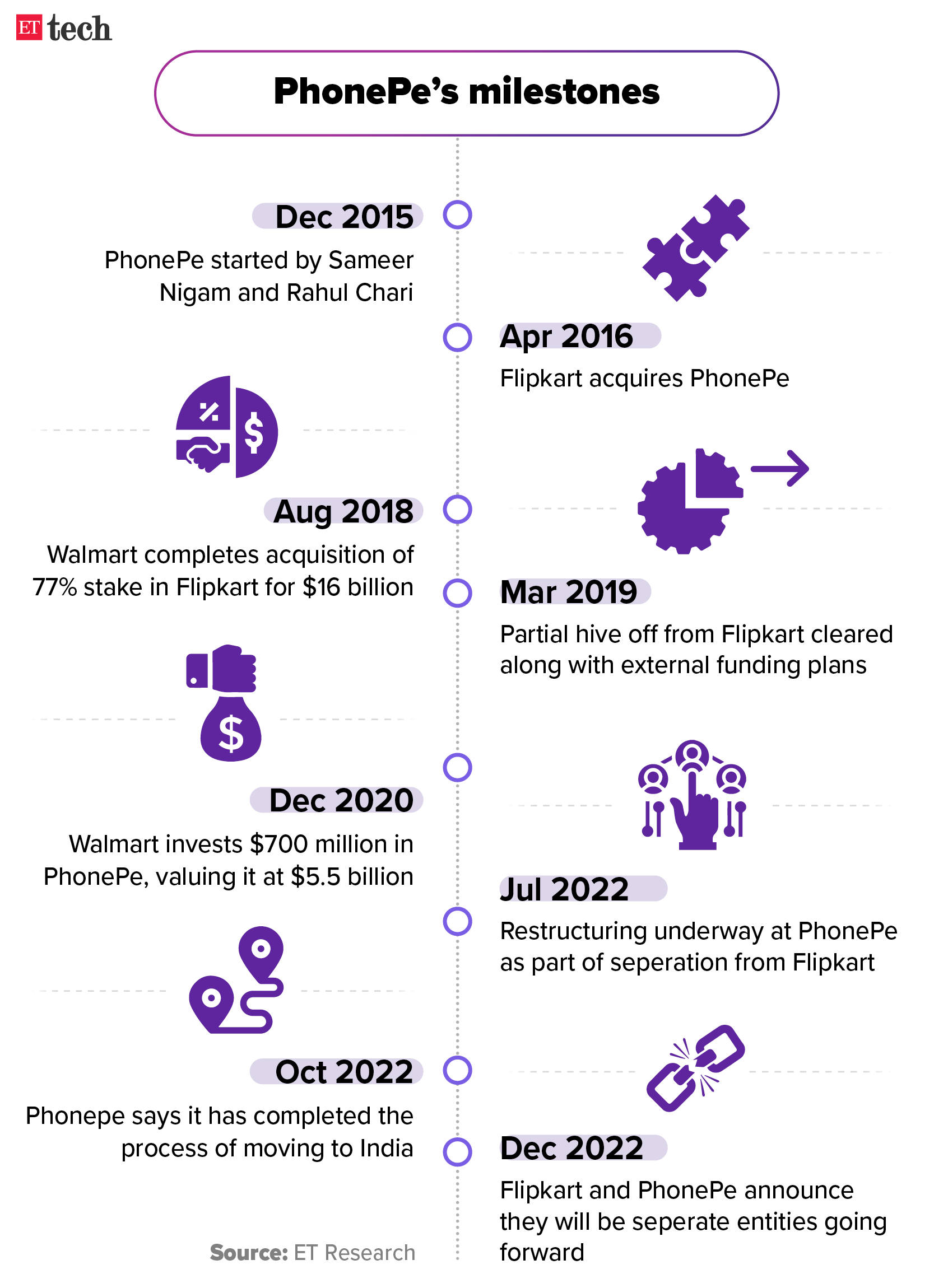

Walmart, others face $1B tax bill for PhonePe’s India shift, new fundraise

The Indian government is likely to gain as much as $1 billion in long-term capital gains tax from Walmart and other shareholders of PhonePe as part of the fintech firm’s relocation to India from Singapore and the closure of a fresh funding round, people in the know told ET.

The tax is applicable since PhonePe is raising fresh capital at a higher valuation.

Funding details: The company is in advanced talks to raise around $1 billion in primary capital at a pre-money valuation of $12 billion. It was last valued at $5.5 billion in December 2020 following a $700 million funding round from Walmart. The upcoming round will also include a significant secondary share sale, taking the total capital component to nearly $2 billion.

Jargon buster: In a secondary share sale, incoming investors, or the company itself, buys shares from existing shareholders, including holders of employee stock options.

Parting ways: In December, ET reported that Flipkart, which earlier owned 87% in PhonePe, would no longer own a stake in the restructured entity, PhonePe India. Walmart will remain PhonePe’s majority shareholder along with investors like China’s Tencent, Qatar Investment Authority, Microsoft, and Flipkart cofounder Binny Bansal.

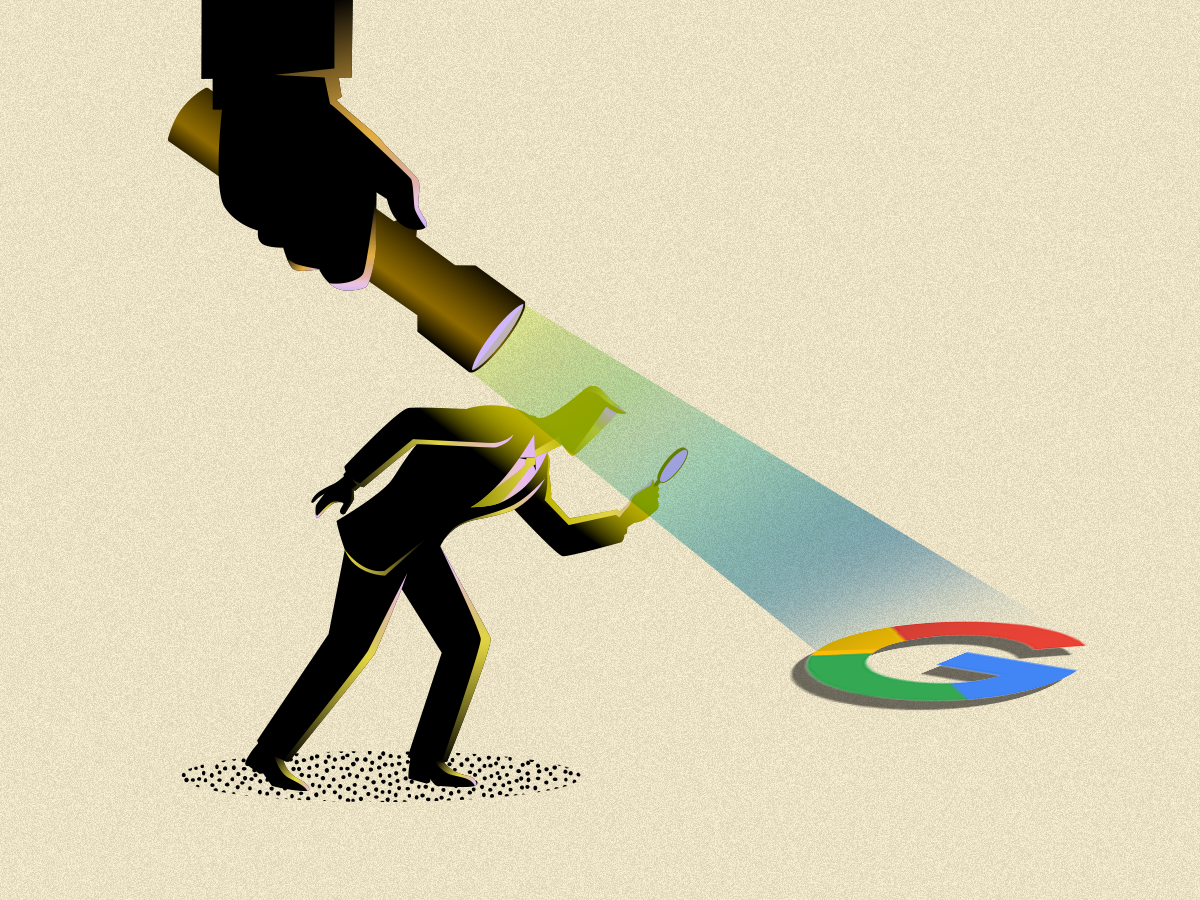

NCLAT orders Google to deposit 10% of Rs 1,337-crore CCI penalty

NCLAT on Wednesday asked Google India to deposit 10% of the Rs 1,337 crore penalty imposed on it by the Competition Commission of India (CCI) for abuse of dominance, while refusing to grant a stay on the entire fine.

Lack of urgency: While refusing to stay the penalty imposed by the CCI, the Tribunal observed that the penalty order had been passed by the competition regulator on October 20 whereas an appeal had been filed by Google only on December 20, which indicated a “lack of urgency” on the part of the company.

Catch up quick: On October 20, 2022, the CCI fined Google Rs 1,337 crore abusing Android’s dominant position in the mobile operating system market. On October 25, the anti-trust regulator imposed another fine of Rs 936.44 crore on the company for abusing its dominant position with respect to its Play Store policies.

Copy-paste charge: We reported on Wednesday morning that Google had alleged in its challenge to the CCI order that the competition watchdog had “copy-pasted” paragraphs from a similar order by the European Commission. Google also brought this up during Wednesday’s hearing.

US likely to hike H-1B visa fees to deal with backlog

The United States may increase fees for certain visa categories to better manage immigration operations and deal with the global backlog in visa processing.

The move, if approved, is likely to result in a substantial rise in filing fees for H-1B visas, which will affect both American and Indian technology companies.

Massive hike: The US Citizenship and Immigration Services (USCIS) published a Notice of Proposed Rulemaking (NPRM), which seeks to hike the pre-registration fees for H-1B visas from $10 to $215. The actual petition fees would also increase by 70%, while fees for an L1 visa, for intra-company transfer, would increase by 201%.

Why it matters: Indian nationals are the biggest beneficiaries of the non-immigrant employment petitions like the H-1B and the I-140. There is also a proposed $600 ‘Asylum Program Fee’ to be paid by employers filing a Form I-129. The form is required for a visa petition under the two categories. Technology companies often sponsor the residency permits of those employees who have been in the country on an H-1B visa once its six-year validity expires.

Other Top Stories By Our Reporters

Snapdeal losses jump 4x to Rs 510 crore: Ecommerce company Snapdeal’s revenue from operations rose more than 14% to Rs 539 crore in FY22, from Rs 471 crore in FY21, but losses surged 4x to Rs 510 crore as expenses such as employee benefits and advertisements rose, according to the company’s financials sourced from Tofler.

Mamaearth cofounder denies IPO valuation rumours: Responding to social media rumours and news reports on the company’s valuation for its initial public offering (IPO), Mamaearth cofounder Ghazal Alagh said the firm has neither quoted nor subscribed to the valuation numbers doing the rounds. “Valuation discovery is a process which will take place over time as we get into deeper conversations with the investor community,” Alagh wrote on LinkedIn.

Global Picks We Are Reading

■ Hacker lexicon: what Is a pig butchering scam? (Wired)

■ Meta fined more than $400 million for serving ads based on online activity (WSJ)

■ Why TikTok’s future has never been so cloudy (The Verge)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.