Big tech’s cloud business under stress & other big stories this week

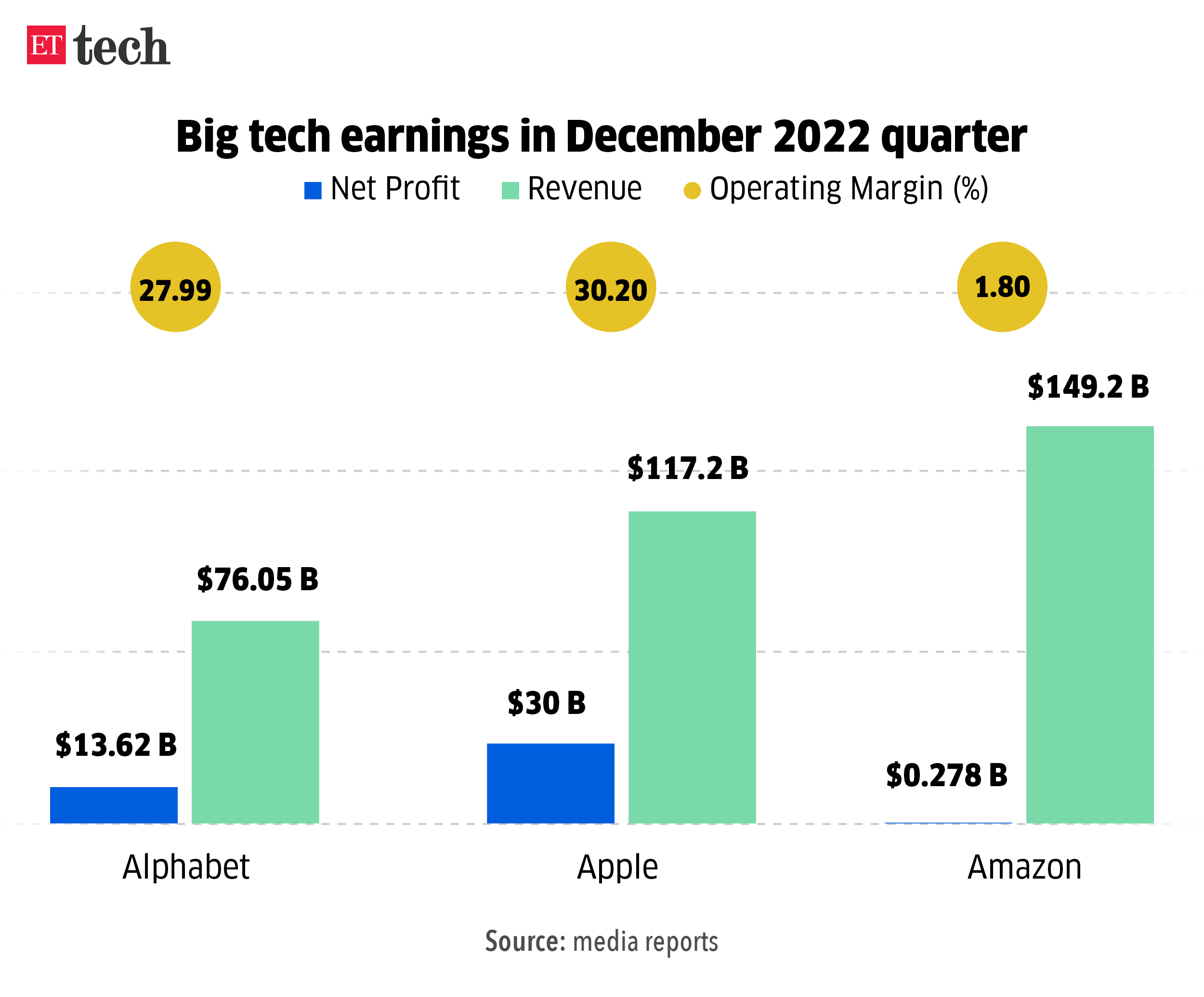

One, companies cutting down their marketing budgets reflected in the December quarter earnings of tech giants Meta, Alphabet and Snap. They took a beating as advertising revenues make a chunk of their topline.

Two, as the global economy slows, Microsoft and Amazon, which dominate the cloud services market, reported their slowest growth since they started declaring revenue breakup for this segment way back in 2015.

Numbers speak: Net sales at Amazon Web Services (AWS) grew 20% in the three-month period ended December 31 at $21.4 billion. Microsoft’s revenue in its cloud business that includes Azure rose 18% year-on-year during the quarter whereas the growth was around 50% in its cloud-computing business that it reported in every quarter of calendar year 2020.

Ads break: While Google parent Alphabet reported a slight fall in quarterly ad revenue, missing Wall Street expectations, Facebook owner Meta posted revenue decline for the third consecutive quarter (year-on-year). Snap Inc, meanwhile, said it expected current quarter revenue to decline as much as 10% due to competition for ad dollars amid challenges facing the economy.

“(Advertisers) are managing their spend very cautiously so they can react quickly to any changes in the environment,” Snap CEO Evan Spiegel said during the company’s earnings call.

What’s next: Even as the cloud gets darker, there’s a silver lining. The runaway success of OpenAI’s ChatGPT, and the follow-up play by others in the space, could set off the next boom for cloud computing revenues.

Ad revenue earners, on the other hand, would remain cautious. Meta Chief Financial Officer Susan Li said the broader economy continues to be “pretty volatile” and it was too early to tell what the year would look like.

(With inputs from Reuters)

Top Stories By Our Reporters

Budget 2023 recap

Angel tax on foreign investors may muddle the maths for Indian startups: Indian startups’ popular deal structures and valuation approaches may take a hit as the Centre extends angel tax provisions to foreign investors. The move may lead to potential litigation between startups raising capital and the tax authorities over the premium in valuation at which the company will pick up fresh funds, as per industry executives and investors.

Extended tax holiday will apply to less than 1% Indian startups: The budget has proposed to extend the tax holiday offered to startups under the Startup India scheme, but industry representatives said the measures will apply to less than 1% of 84,000 startups registered with the Department for Promotion of Industry and Internal Trade (DPIIT). For startups to be eligible for availing the tax incentives, their turnover should be less than Rs 100 crore in any of the previous financial years.

Govt introduces new sections in I-T Act to tax online gaming: The government has introduced two new sections and amended one section in the Income Tax Act to separate online gaming platforms from betting and gambling activities. The government has introduced Sections 194BA and 115BBJ to tax income that users earn by winning on gaming platforms. Section 194BA deals with tax deduction at source (TDS) while Section 115BBJ prescribes the tax rate on the winnings from online games. Both sections will take effect from July 1, 2023.

ETtech Opinion | Budget will help catalyse efforts to promote digitally inclusive India, says Kalyan Krishnamurthy: The budget has proposed several steps towards boosting the economy and strengthening India’s position as a global economic power. It is in line with the vision of Atmanirbhar Bharat that empowers citizens through a democratic and transparent digital-led economy. The budget outlines the importance of startups. Allowing carry-forward of losses for longer will strengthen their books and enable focus on building the larger ecosystem. Read the full piece here

Also read | Budget 2023: Key takeaways for tech, startups from Nirmala Sitharaman’s speech

Tech policy updates

Fintechs seek clear First Loss Default Guarantee framework: Several fintechs have asked the Reserve Bank of India (RBI) for a detailed framework to allow first loss default guarantee (FLDG) arrangements to continue with banks as well as a fresh set of guidelines to better help non-regulated entities understand their scope of operations, said multiple founders and industry executives. The development comes months after the regulator notified the digital lending rules.

Govt may notify data embassy policy as part of new Data Bill: The Centre may soon notify a policy permitting countries and corporations to set up “data embassies” within India that will offer “diplomatic immunity” from local regulations for national as well as commercial digital data, top lawmakers told us. The initiative is part of a larger plan to build a trusted data storage ecosystem in India, said Rajeev Chandrasekhar, minister of state for electronics and IT.

DigiLocker set to be digital health document repository: DigiLocker, which gets a huge push in the Union Budget, is expecting to soon have another major use case by becoming a repository for digital health documents making it convenient for individuals, officials told ET. “This is going to be used as ‘a very effective container’ for all the health-related documents,” RS Sharma, told ET.

ETtech Explainer: what are the Budget proposals to expand DigiLocker’s scope?

Google vs CCI update

Google’s new billing system non-compliant, says ADIF: The Alliance of Digital India Foundation (ADIF) has claimed that the new ‘user choice billing system’ proposed by Google still did not comply with the competition watchdog’s orders. Under the proposed new system, app developers need to pay 11/26% commission to Google, the industry body said. This is not in line with the Competition Commission of India’s direction that it should not impose “any condition (including price-related condition) on app developers, which is unfair, unreasonable, discriminatory or disproportionate to the services provided,” the ADIF said in a note to startups.

App developers see scope for alternative business models: Indian app developers believe that the unbundling of the Google-controlled app ecosystem in India will help them create several new business models. “The possibilities are endless and it could even mirror the best part of China’s ecosystem wherein there are multiple OS options and app stores that thrive and users can choose from – except that in India, Google too can exist as an option,” said Rohan Verma, CEO and executive director of MapmyIndia.

Other top stories this week

PhonePe cofounders Sameer Nigam and Rahul Chari

Big payday for PhonePe founders post Flipkart Esop buyback: The cofounders of PhonePe, Sameer Nigam and Rahul Chari, are expected to receive individual cash payouts of $20-25 million by completely liquidating their stock options in erstwhile parent company Flipkart. The transactions were part of the “one-time discretionary cash payout” arising from the separation — announced on December 23 — as well as from the ongoing funding round of PhonePe, where employees of the ecommerce firm have sold their stock options.

Byju’s sacks another 1,000 employees: Byju’s has dismissed another 1,000 employees, including several senior roles in verticals such as strategy, technology, and product. Many senior vice-presidents drawing salaries of Rs 1 crore and above lost their jobs in the Bengaluru-based edtech major’s latest round of layoffs conducted over the last two weeks of January, a source said.

Meanwhile, Unacademy’s cofounder and CEO Gaurav Munjal told employees that appraisals for the financial year ended March 2023 stand cancelled. The firm will reward staffers with stock options based on individual performance, as per an internal memo reviewed by ET.

Active IT job vacancies in India plummeted 60% in January: The number of active job vacancies in India’s information technology sector plummeted by a record 60% year on year this month, data collated from LinkedIn and other popular job boards show. Job market experts said tech companies are cautious about adding to their payrolls amid worries around a gloomy global macroeconomic outlook, fears of recession in the West, and demand concerns due to the ongoing uncertainty.

Graphics and illustrations by Rahul Awasthi

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.