Apple is breathing down Samsung’s neck in another key region as far as smartphone sales go

One trophy, two strong contenders

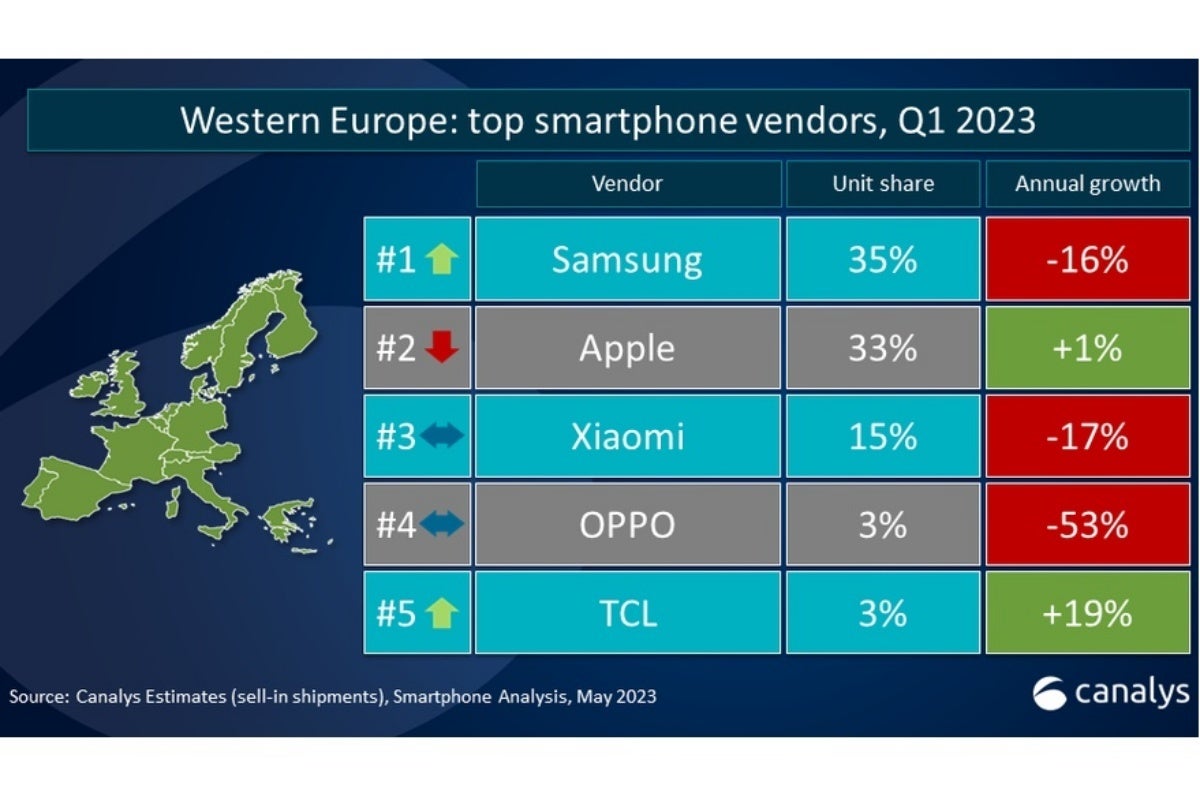

More notably, while Galaxy handset shipments declined by a worrying 16 percent from the first three months of 2022, iPhone sales stayed almost perfectly still during the same period, slightly increasing by 1 percent from around 7.7 to 7.8 million units.

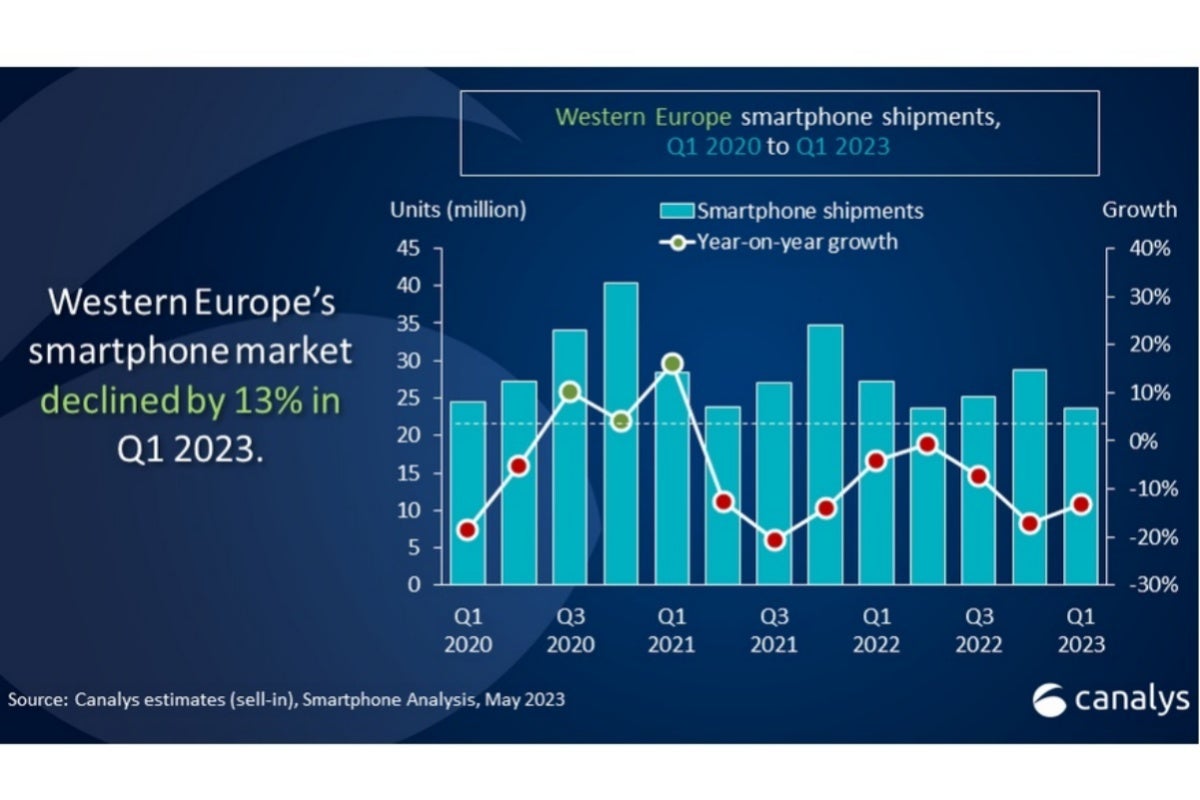

Apple’s unflinching figures in the face of “challenging economic conditions” are made that much more impressive by the 13 percent slump of the Western Europe smartphone market in its entirety between Q1 2022 and the opening quarter of this year.

But Oppo and TCL’s positions among the top five smartphone vendors in Western Europe could well be threatened in the very near future by the likes of Google, Motorola, Honor, and HMD Global (aka Nokia).

Pricier is better

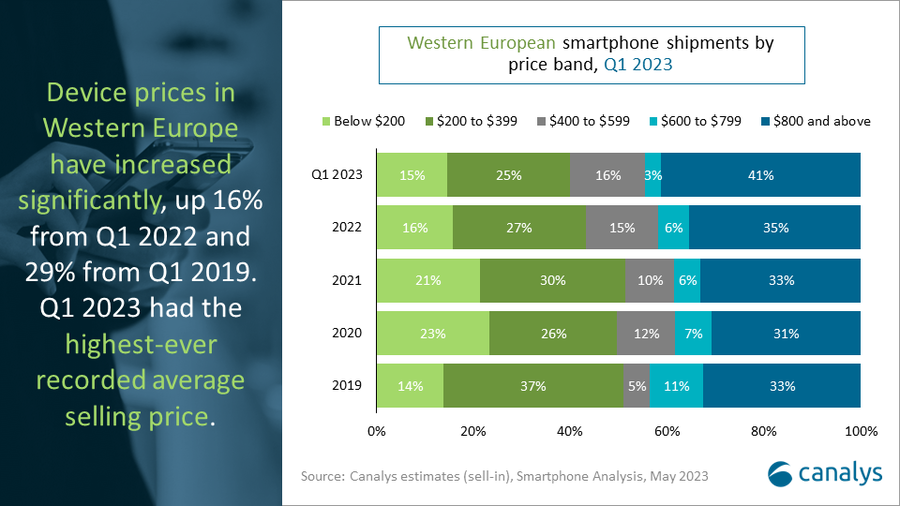

Apple and Samsung are also mainly responsible for the progress of the premium (or mid-to-high-end) segment, which now accounts for an impressive 41 percent of the market compared to an also solid 35 percent back in Q1 2022.

That’s right, there are almost as many $800+ phones being sold in Western Europe than devices under that price point these days, which represents a stark contrast with the current situation in markets like India, China, and basically the rest of the old continent.

It’s no wonder therefore that Samsung is apparently investing more heavily than ever in “brand and product advertising” around those parts, shifting its focus from the once hugely popular Galaxy A line of low to mid-end handsets almost entirely to high-priced (and high-profit-generating) flagships. And that, our dear friends and readers, is also called the “Apple strategy.”

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.