Why Reliance is betting big on lingerie; influencers’ incomes on the rise

Also in this letter:

■ Social media influencers’ incomes are on the rise

■ Former Myntra CFO tipped to be new Zilingo CEO amid probe

■ Goat Brand Labs on the verge of closing $50 million funding

Reliance can’t buy enough lingerie brands. Here’s why

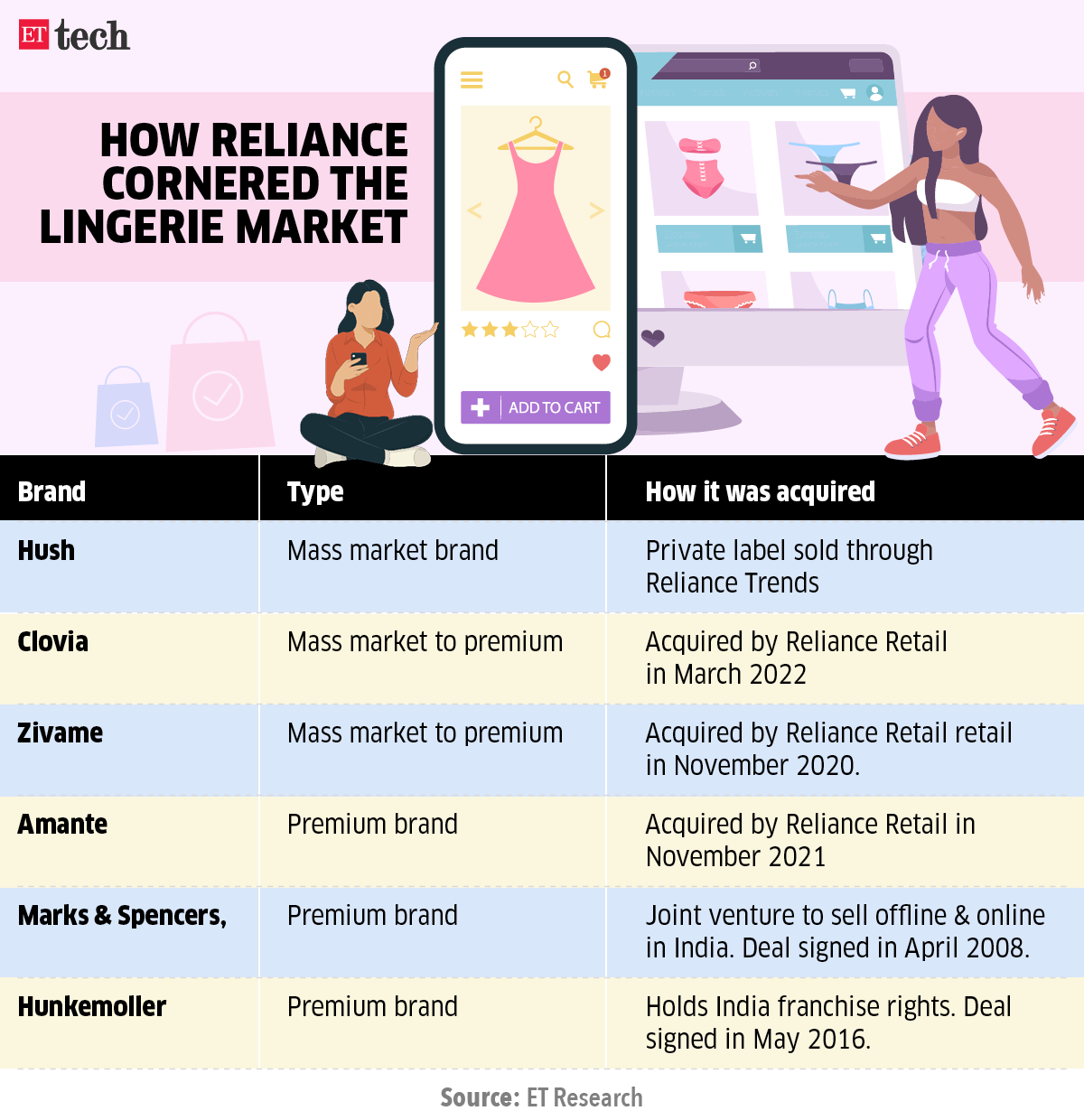

On March 20, Reliance Retail said it had acquired 89% in online lingerie retailer Clovia. That was its third acquisition in the space in the past two years, after Zivame and Amante over the last two years.

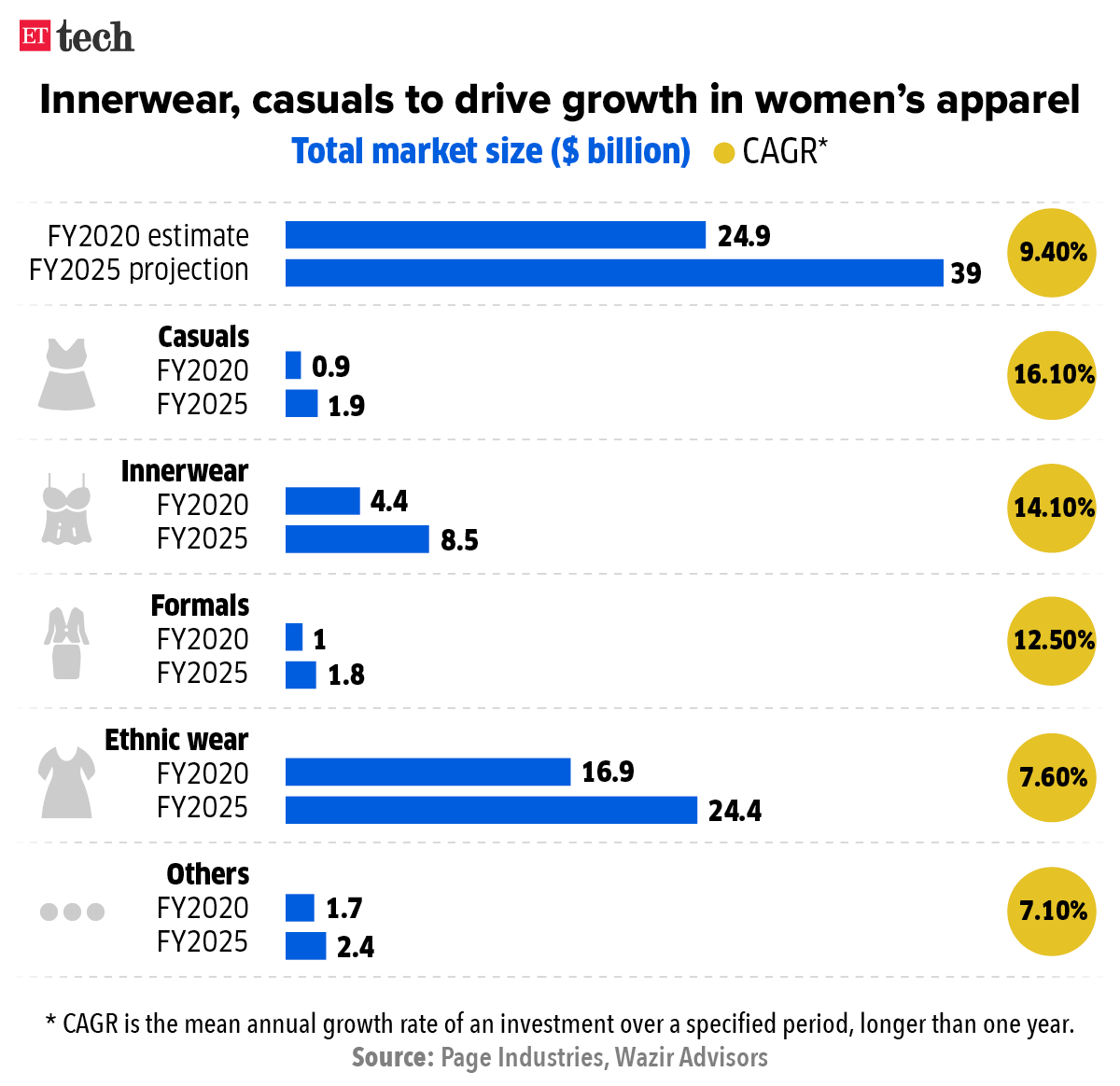

But why? Women’s apparel contributes about 37% to the overall apparel market and is expected to grow to $39 billion by FY25 from $25 billion in FY20, according to research firm Wazir Advisors. And innerwear is likely to drive this growth.

In 2021, the innerwear segment was estimated at around $4.4 billion. This is likely to reach $8.5 billion FY25, Wazir Advisors estimates.

All price points: Reliance Retail is basically looking to solve the price-point puzzle to capture a huge market opportunity, a person aware of the company’s plans told us.

From its own mass-market brand Hush, which is sold through Reliance Trends, to Marks & Spencer, the company has women’s innerwear for all income groups.

The three acquisitions – Clovia, Zivame and Amante – cater to different price points. Amante is on the higher end, while Clovia’s products are the cheapest.

And what Reliance has acquired are not just brands but ecommerce platforms.

Transformation: Ramesh Agarwala, chief financial officer and executive director of innerwear company Rupa & Co, said the industry was changing.

“Innerwear until recently was seen as a necessity, but (is) now (being seen) as creating a fashion statement,” he said.

Not everyone is convinced this is a good thing, though. “The reason we did not invest in women’s innerwear is it is more of a fashion category with a lot of SKUs (stock-keeping units),” said Sudipto Sannigrahi, principal at Matrix Partners, which has invested in men’s innerwear startup Damensch.

Social media influencers’ incomes are on the rise

Earnings of social media influencers, gamers and streamers are rising in India thanks to new formats, features, programmes and direct monetisation opportunities offered by platforms.

This has spurred many to ditch their ‘regular’ professions and pursue their passions full time.

Meta, for instance, said it has seen an over 35% year-on-year growth in the number of monetising Facebook creators and video publishers in India as of September 2021.

Case in point: Mizoram-based video creator Adeline Pach claims her Instagram followers went up from 50,000 to 170,000 after she joined ‘Born on Instagram’ last year. According to its parent company Meta, Born on Instagram is a ‘central creator hub’ designed to help creators across India build a sustainable presence on the platform.

“It has helped me a lot. Before BOI, I didn’t have proper guidance or knowledge about influencers and how much they get paid, especially in terms of working with companies. The maximum that I used to take in was around Rs 15,000 in a month. After BOI, and with the help of partner managers etc, I now earn up to Rs 1 lakh or sometimes even more,” Pach said.

Big bucks: An industry insider said some big influencers are raking in lakhs through features such as Super Chats.

“More opportunities are being built on platforms for creators to make more money. One source of revenue that YouTube brought all along was ad revenue. Turns out that’s not enough. Gamers and comedians are increasingly leveraging Super Chat and could at times earn lakhs of rupees with live streams stretching for hours. Subscribers and followers can pay them directly,” he said.

TWEET OF THE DAY

Former Myntra CFO tipped to be new Zilingo CEO amid probe

Ramesh Bafna, chief financial officer at Zilingo, has emerged as one of the contenders to take over as interim CEO of the company as its board considers removing suspended CEO Ankiti Bose for good, multiple sources aware of the matter said.

Bafna, who was most recently with Myntra as its CFO and SVP, joined the Sequoia Capital-backed startup in March. He has been involved in the review of the alleged financial irregularities at the firm as well, another person privy to the talks said.

His appointment has not been finalised yet, these people said.

Tell me more: Sources told us that an existing senior employee or an investors-approved executive is likely to be the successor of Bose even as its current funding talks have stalled owing to the latest controversies.

A spokesperson for Zilingo’s board said in an emailed statement, “Any question of a change in management is speculative and premature at this stage.”

Also Read: Sequoia’s Shailendra Singh leaves Zilingo board amid accounting probe

Earlier, Bloomberg reported that the board was considering permanently replacing Bose. Directors of the company have been meeting regularly in recent days to debate Bose’s and Zilingo’s futures. Bose, who is suspended until May 5, has pressured the board to clarify her situation.

End of the road? Bose has denied any wrongdoing and has hired an attorney to fight back against what she calls a “witch hunt.” She has grown frustrated with the conflicts and has begun to realise she is unlikely to return as chief executive officer.

ETtech Deals Digest

■ Goat Brand Labs, an ecommerce roll-up firm, is in the final stages of closing a $50 million funding round from new investors such as Venture Catalyst and 9Unicorns and existing investors such as Flipkart Ventures, Tiger Global and others. Sources said Goat is raising the funds through convertible share warrants, which investors will get to turn into equity shares when it closes a new round of funding.

■ Insurance startup Loop has raised $25 million as a part of a new funding round co-led by existing investors General Catalyst and Elevation Capital (formerly Saif Partners). The company said it would use the fresh funds to drive sales growth, product development and strategic hiring to scale its new health assurance delivery model.

■ Collateral-free micro, small & medium enterprise (MSME) loans provider Kinara Capital said it closed a fresh equity round of Rs 380 crore led by global investment manager Nuveen with participation from Dutch microfinance fund ASN Microkredietfonds.

■ Recur Technologies PTE, a Singapore-based financing platform, announced fundraising of $30 million in a combination of equity and debt from a clutch of Indian investors. The fintech startup operates in India through its Delhi-based subsidiary called Recur Club Technologies.

■ Fintech startup SaveIn has raised $4 million (about Rs 30 crore) as part of its seed round from existing backer Y-Combinator and others including 10X Group, Leonis VC, and Goodwater Capital. Nordstar, Rebel Fund, Pioneer Fund, Soma Capital and SCM Advisors also participated in the round.

■ Flipkart said it has acquired direct-to-consumer, software-as-a-service (SaaS) platform ANS Commerce for an undisclosed amount. The deal is yet to be completed and is expected to be closed in the second half of 2022 subject to “customary closing conditions”, the company said.

Industry wants government to fix small etail’s GST compliance problem

Industry associations IndiaTech.org, ADIF and Nasscom have urged the government to reduce the GST compliance burden on small online sellers. They have said that many micro, small and medium enterprises (MSMEs) hesitate to transition to online marketplaces due to cumbersome tax compliances under the Goods and Services Tax (GST) law.

Compliance rules: The compliance rules could inhibit sellers whose current incomes are well below the GST limits, they have said. Section 24(ix) of the CGST Act, 2017, states that “any person who supplies goods through an e-commerce operator, is required to compulsorily register under GST, irrespective of the turnover of such persons.”

Level playing field: Earlier, the Alliance of Digital India Federation (ADIF) had urged the government to level the playing field between online and offline businesses to allow startups to survive especially in the post-pandemic economy. The body also expressed concern over the increased cost of services offered online and dampening of digital growth owing to these provisions in addition to the adverse impact it could have on startups and small businesses.

Indian SaaS to hit $116 billion revenue by 2026: report

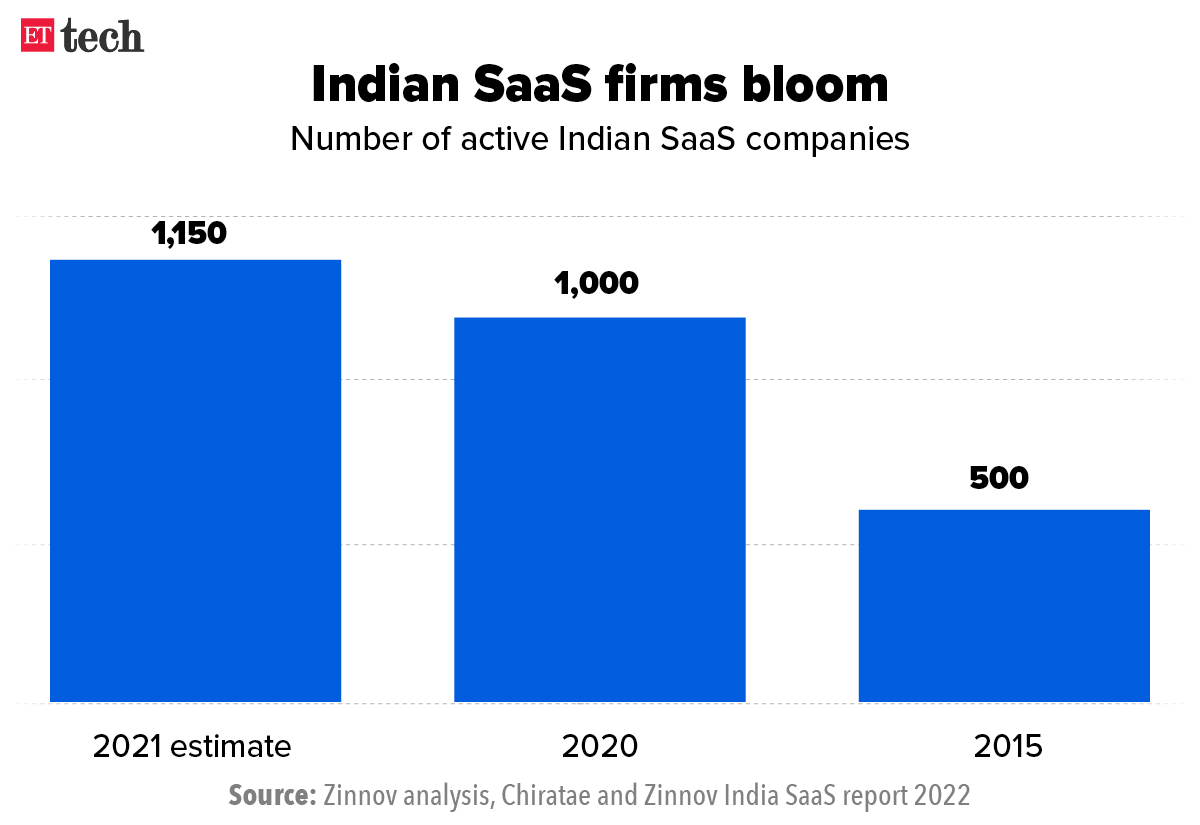

Indian software-as-a-service (SaaS) startups are expected to clock overall revenues of $116 billion by 2026, growing at a compound annual growth rate (CAGR) of 55-70%, according to the latest report from venture capital firm Chiratae and management consultancy Zinnov.

Funding to jump this year: Titled ‘India SaaS: Punching through the global pecking order’, the report said that overall funding for Indian SaaS startups is expected to touch $6.5 billion this year from $4 billion in 2021 – a 62.5% increase.

The average size of investments in Indian SaaS grew from roughly $25 million in 2020 to $56 million in 2021, the report added.

It said there are presently more than 1,150 active Indian SaaS companies.

According to data from research platform Venture Intelligence, SaaS companies raised $2 billion across 93 deals in the first quarter of 2022.

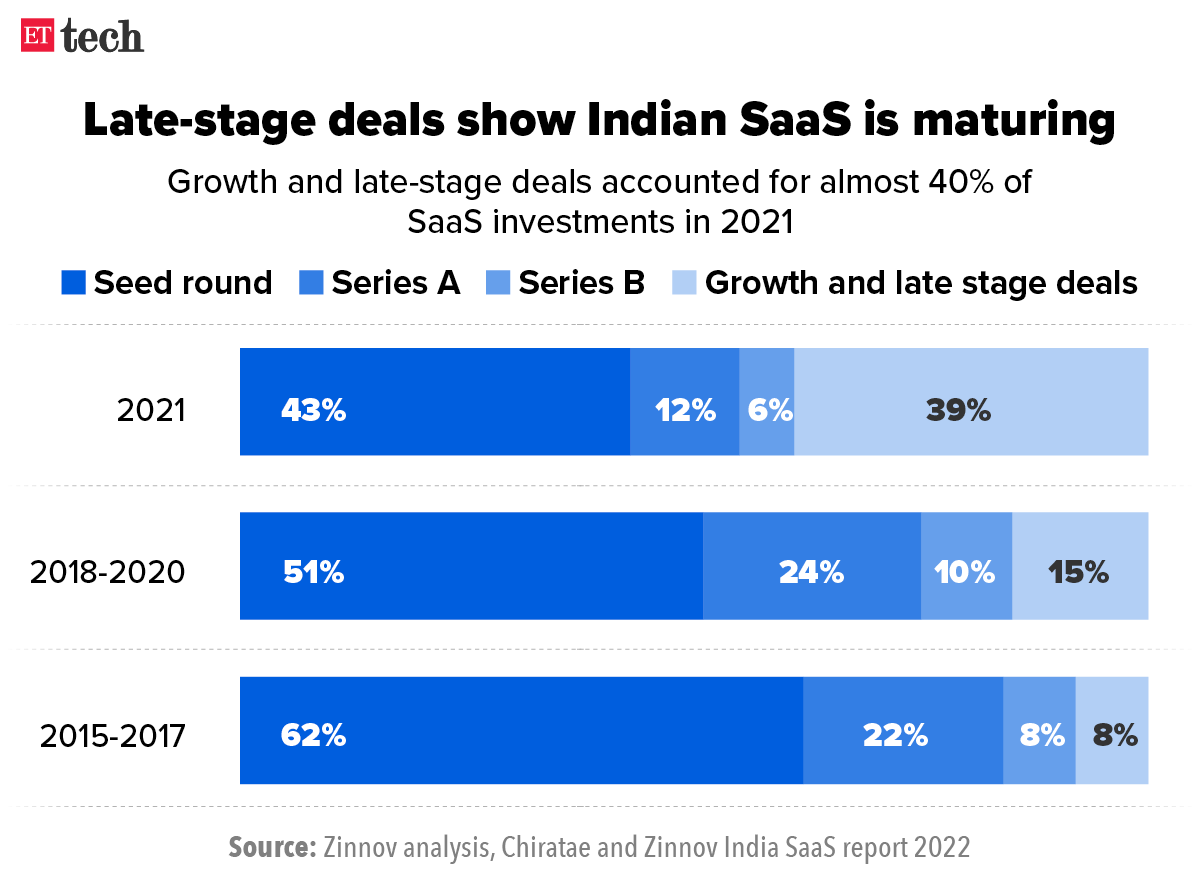

Sector maturing: In 2021, almost 40% of overall funding invested in Indian SaaS was in growth to late-stage rounds, compared to just 15% between 2018 and 2020.

Unicorn factory: With investors continuing to back Indian SaaS startups for their predictable revenues and growth outcomes amidst the global downturn, the report said as many as eight SaaS startups could become unicorns in 2022.

Other Top Stories By Our Reporters

Karnataka unveils new data centre policy: Karnataka has unveiled a data centre policy that promises a slew of attractive incentives and concessions for investments in these units. The state government aims to attract investments worth about Rs 10,000 crore for the emerging sector over the next five years, as per the policy.

Lightspeed promotes three execs to partner level: Shuvi Shrivastava, Pinn Lawjindakul, and Rahul Taneja have been promoted to partner roles in Lightspeed Venture Partners’ early-stage investment advisory team. Lightspeed Venture Partners has funded businesses such as Byju’s, Sharechat, and Udaan.

Global Picks We Are Reading

■ The tech bubble that never burst (NYT)

■ Ukraine forms ‘Internet Army’ to pressure Western firms in Russia (WSJ)

■ Downing Street and Foreign Office networks targeted with Pegasus, says group (BBC)

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.